Summary:

- Affirm exceeded revenue and earnings growth expectations in Q2 FY24, driven by strong growth in adding new merchants while deepening adoption of the Affirm Card among consumers.

- The company aims to reach $50B in GMV by FY28 through strategies such as deeper adoption of the Affirm Card, unlocking new merchants and segments and expanding internationally.

- Although Affirm faces risks from exposure to interest rates and a competitive landscape, I believe the stock is attractively priced to drive significant long-term returns.

Fokusiert

Introduction & Investment Thesis

Affirm (NASDAQ:NASDAQ:AFRM) is a “buy now, pay later” (BNPL) platform that has severely underperformed the S&P 500 and Nasdaq 100 YTD. The company reported its Q2 FY24 earnings in February, where revenue and earnings beat expectations, growing 48% and 250% YoY, respectively, as it saw strong growth with small and medium-sized businesses as well as deepening adoption of its Affirm Card.

Moving forward, Affirm has set forth the target of growing to $50B in GMV in the medium-term, growing at 20% annually. While I am impressed by the company’s product innovation and execution thus far, as it has rapidly expanded its profitability YoY, I am on guard when it comes to the risks posed by the company’s exposure to interest rates, where the longer interest rates remain high, the higher the probability of loan delinquencies. At the same time, it also operates in a highly competitive landscape, which may dampen the company’s growth prospects.

Assessing both the “good” and the “bad”, and taking into account both the “bull” and the “bear” scenarios of the long-term financial model provided by the management in their Investor Day presentation, I believe that the stock is attractively priced at current levels from a risk-reward standpoint, where it can drive sizable returns over a 5-year time period, making it a “buy”.

About Affirm

Affirm is a BNPL platform that makes it easier for consumers to spend responsibly and for merchants to convert and grow sales more effectively. The platform comprises three core offerings that include point-of-sale payment solutions for consumers, merchant commerce solutions, and a consumer-focused app.

The point-of-sale solution enables consumers to pay for purchases in fixed amounts without deferred interest and late fees through their Pay-in-4 payment plan as well as Core loans that include interest-bearing installments and 0% APR installment loans, thus increasing their purchasing power. On the merchant side, they offer solutions that enable merchants to effectively promote and sell their products while also providing data and insights to inform their strategies. Finally, their consumer app allows consumers to apply for the Affirm Card, which, upon approval, enables consumers to transact both digitally and in-store, as well as manage pre- and post-purchase features that convert eligible transactions into an installment loan. At the same time, consumers can open a high-yield savings account and get access to Affirm Marketplace on the app, which provides tailored offers from merchants based on consumers’ unique preferences.

In terms of their business model, they generate revenue by charging a fee from merchants on the platform upon conversion of a sale based on the arrangement between Affirm, the merchant, and the terms of the consumer’s payment plan. On the consumer front, Affirm generates revenue from earning interest income on interest-bearing loans that originate on the platform. In FY23, interest-bearing loans amounted to 57% of the total GMV that originated on the platform. Furthermore, Affirm earns a portion of the interchange fee when consumers transact using the Affirm Card.

The good: Strong revenue growth driven by merchant growth and Affirm Card, Expanding Margins a possible path to $50B in GMV

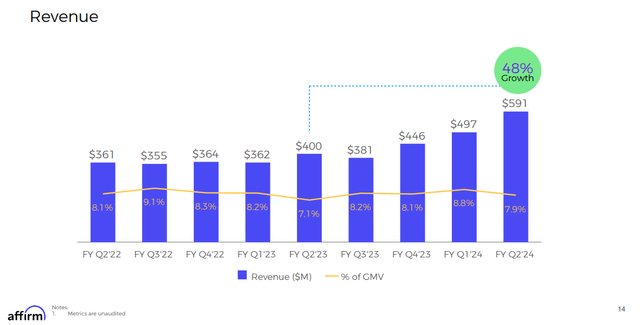

The company generated total revenue of $591M in Q2 FY24, which grew 48% YoY. Revenue as a percentage of GMV increased to 7.9%, vs. 7.1% in Q2 FY23, as overall revenue grew faster than GMV, which totaled $7.5B, growing 32% YoY. Out of $591M, network revenue contributed 38.5% to Total Revenue, growing 40% YoY. Meanwhile, interest income also contributed 38.5% of Total Revenue, growing at 85% YoY. The remaining 23% of the revenue, which consists of the sale of loans and servicing income, declined YoY as a higher benchmark interest rate proved to be a headwind.

Q2 FY24 Earnings Slides: Affirm’s Revenue Growth

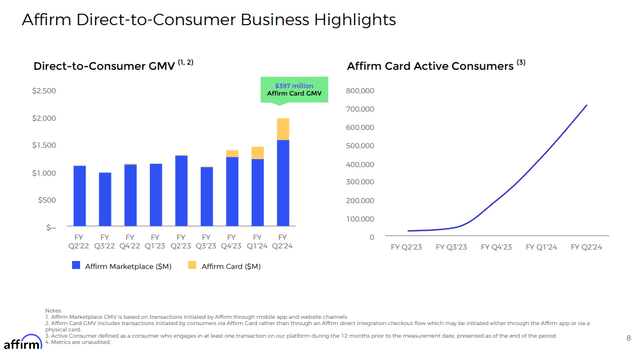

Focusing our attention on network revenue, it was driven by strong growth with small and medium-sized businesses as well as success with the adoption of the Affirm Card, both of which led to strong growth in overall GMV. Active Merchants on the platform grew 15% YoY to 279,000, while merchants with $1K or above in GMV grew 21% YoY. Meanwhile, Affirm Card generated $397M in GMV, with over 700,000 active consumers by the end of Q2 FY24, compared to just $11M in GMV and less than 50,000 active consumers during the same period in the prior year. Out of the $397M in Affirm Card GMV, 90% of it came from interest-bearing loans, while the remaining was split between Pay Now and Pay-in-4 payment terms.

Q2 FY24 Earnings Slides: Growth in Affirm Card

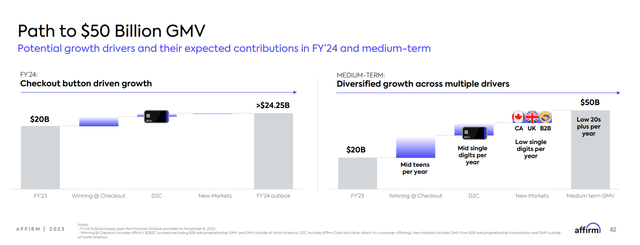

During the company’s Investor Day Presentation, the management set a lofty goal of reaching $50B in GMV in the medium term, by growing in the low-twenties range annually. This would mean that even if it grows its GMV by 20% annually, it should reach $50B by FY28. The company believes it can reach its goal by focusing on three growth strategies: 1) driving deeper adoption of its Affirm card; 2) winning at checkout; and 3) entering new markets. In this post, I am going to go into deeper details about how the first two growth drivers will enable Affirm to continue its growth trajectory to the $50B GMV mark.

2023 Investor Presentation: Path to $50B in GMV

When it comes to the Affirm Card, I believe the company will continue to see deeper penetration, especially given the large total addressable market (TAM) estimated at 240M credit card users. While I don’t believe that the credit card market is ready to be fully disrupted, the large TAM allows for companies such as Affirm to continue to innovate in order to enhance the commerce experience for both consumers and merchants by leveraging existing merchant partnerships to offer personalized deals to consumers and further encourage transaction frequency with products such as Pay-in-6, which should boost engagement and customer retention.

As to the “Winning at Checkout” strategy, I believe that Affirm can continue to drive growth by expanding the number of merchants across industry segments on its platform, as merchants get access to a powerful network of shoppers that leads to higher conversion rates and Average Order values (AOV). At the same time, Affirm is also looking to scale its reach through distribution partnerships that include e-commerce platforms to enable SMB’s selling online to seamlessly add Affirm as a payment method, PSP platforms that would embed Affirm within merchants’ payment product suites, as well as wallets and browsers so that shoppers can easily transact with merchants using wallet integrations and browser extensions.

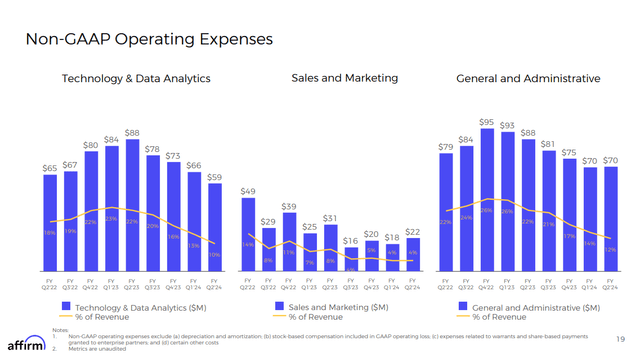

Shifting gears to profitability, Affirm generated $93M in Adjusted Operating Income in Q2 FY24, with a margin of 16%, compared to -$62M in Q2 FY23. This is a huge improvement on a YoY basis. This was driven by strong growth in Revenue Less Transaction Costs (RLTC), which grew 68% YoY to $242M, accounting for 3.2% of GMV compared to 2.5% of GMV in the previous year. While transaction costs increased, driven by higher funding costs along with provisions for credit losses, overall revenue growth was much stronger than the increase in transaction costs. According to the Shareholder Letter, approximately two-thirds of the YoY increase in adjusted operating income was driven by the increase in RLTC. Meanwhile, the company also managed to streamline operating expenses, which declined 27% YoY, allowing Affirm to expand its margins.

Q2 FY24 Earnings Slides: Affirm’s improving operating expenses

The bad: Exposure to interest rate risk and a fiercely competitive landscape can dampen Affirm’s growth prospects.

While Affirm is positioned to benefit from the secular trend in adoption of BNPL, which is expected to grow into a $143B market by 2026, growing at a compounded annual growth rate (OTC:CAGR) of 15% as per Insider Intelligence Data, I am concerned about how a macroeconomic slowdown will impact the growth trajectory of Affirm. The US economy continues to remain resilient with a strong labor market and inflation that is stubbornly over the Fed’s target rate of 2.2%. As a result, the Fed is hesitant to cut rates any time soon. At the same time, over the last couple of years, consumers have heavily tapped into credit card debt, which sits at an all-time high of $1.03T. With interest payments on credit card debt remaining high, the longer the Fed holds its rates steady, the greater the chances of large-scale delinquencies, especially if the labor market weakens. This will undeniably impact Affirm as well. In Q2 FY24 earnings, the company stated that its 30+ day delinquencies for monthly installment loans are flat YoY; however, I believe that we may see a sharp increase in this figure should a macroeconomic slowdown, or worse, a recession, take place. Under that event, I believe that RLTC would decline sharply, as funding costs and provisions for credit losses would rise, while revenue growth would fall, along with headwinds to the company’s $50B GMV projection, as fewer merchants would sign up, with customers possibly attriting from the company’s Affirm Card, leading to a decline in both network revenue and interest income.

Coupled with concerns of a macroeconomic slowdown, I believe there could be exces optimism baked into the projected 20% annual growth rate in GMV on the path to $50B in GMV by FY28, as the competitive landscape is fierce with legacy players, such as debit and credit cards provided by Visa (NYSE:V) and Mastercard (NYSE:MA), mobile wallets such as PayPal (NASDAQ:PYPL) and Apple (NASDAQ:AAPL), as well as other BNPL solution providers that include Block (NYSE:SQ) and Klarna. Given that merchant checkouts don’t usually have exclusive agreements with payment solution providers, Affirm has to differentiate its offerings to a great extent in order to compete for consumers’ preferred method of payment.

Tying it together: Affirm is a “buy.”

Looking forward, the management has guided GMV to grow 25% YoY to $25.25B, while Revenue as a percentage of GMV is projected to increase 65 basis points to 8.55%, translating to $2.16B, or a growth rate of 36% YoY. Meanwhile, the company is also expected to generate Adjusted Operating Income of $237M, at a margin of 11%. I believe this will be achievable, as long as the US economy stays resilient.

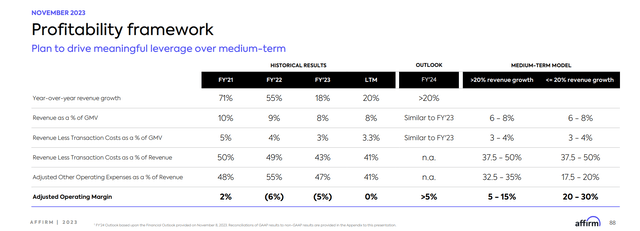

During the Investor Day Presentation, the management also provided a long-term financial model, where it has provided two scenarios; one where revenue is projected to grow over 20% in the medium term with Adjusted Operating Margin in the range of 5–15%, and the second scenario where revenue is expected to grow less than 20% with Adjusted Operating Margin expanding between 20-30%.

2023 Investor presentation: Affirm’s long-term financial model

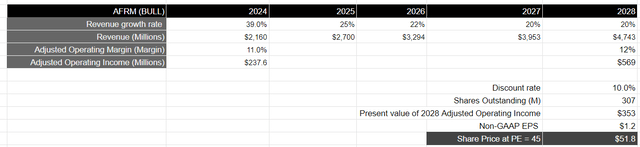

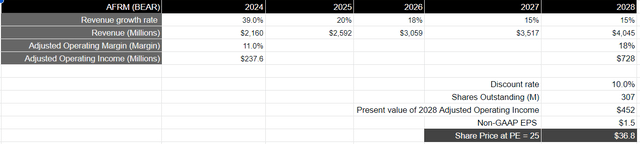

As a result, I have conducted a valuation on both the bear and bull projections to better assess the fair value, given how the overall context of the global economy and competitive landscape may evolve over the coming years.

In the Bull Valuation, I have assumed that the company will reach and surpass its $50B GMV target, as it would grow its GMV at least 20% annually until FY28. This would mean that revenue would grow at a slightly higher pace, with Revenue as a percentage of GMV of 8% to $4.7B by FY28. With an Adjusted Operating Margin of 12% in FY28, it would translate to an Adjusted Operating Income of $569M, which equates to a present value of $353M, when discounted at 10%. Taking a forward price-to-earnings ratio of 45, which is approximately 2.5x the price-to-earnings ratio of the S&P 500 of 15–18, where its companies grow their earnings on average by 8% over a 10-year period, it would translate to a price target of $52, or an upside of 60% from its current levels.

Author’s Bull Valuation Model

On the other hand, should the US and the global economy slow down and Affirm see growing transaction costs and slowing revenue, I believe it will not be able to reach its $50B in GMV target. As per my estimates, I believe it should still be able to grow in the mid-teens range until FY28, which would translate to a total revenue of $4B, and assuming Adjusted Operating Income expands to 18%, which is lower than the projections of the long-term financial model, Affirm should be able to generate $728M in Adjusted Operating Income by FY28, which is equivalent to a present value of $450M, when discounted at 10%. Assuming a PE ratio of 25, which is 1.5x the PE ratio of the S&P 500, the fair price target would be $37, an upside of 15% from its current levels.

Author’s Bear Valuation Model

Assuming a 50/50 chance that either of the scenarios work out, the weighted average return would be approximately 38%, which I believe is strong enough to make the stock a “buy”.

Conclusion

Affirm has strong growth prospects ahead when it comes to driving GMV growth on its platform as it onboards new merchants and expands its scale through partnerships, while continuing to deepen the adoption of its marketplace and Affirm Card among consumers. I am also impressed thus far by the management’s focus on driving long-term profitability, as it streamlines operating expenses and optimizes transaction costs. While an economic slowdown in the US and globally will lead to short-term volatility in the stock, I believe that there is sizable upside for the stock for a long-term investor at its current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AFRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.