Summary:

- Affirm Holdings shows potential with robust revenue growth but faces risks from high delinquency rates and regulatory changes impacting the BNPL market.

- AFRM’s business model relies on interest income and merchant fees, and it has lower consumer costs and delinquency rates than most traditional credit cards.

- Competitive pressures and economic scale advantages could make BNPL a “winner-take-all” market, with Affirm and Klarna leading the charge with no clear leader.

- Affirm’s valuation is reasonable, given a 3X sales growth level over the coming years as the BNPL market matures.

- Competition, regulation, or the rise in unemployment are all key risk factors facing Affirm.

Duncan_Andison

With the sharp rise in consumer prices, many people have opted for “Buy now, pay later” short-term financing options on retail purchases. The market for “BNPL” grew from ~$33B in 2019 to $300B last year, with the industry expected to grow $570B by 2026. According to the Boston Fed, BNPL is most common with individuals with FICO scores in the 600-650 range but is nearly as popular for those in 650-699. It is more common in those who’ve gone bankrupt and those with incomes below $75K. The Fed found that low FICO scores are the most significant predictor of BNPL usage.

Interestingly, the leading BNPL provider, Affirm Holdings (NASDAQ:AFRM), does not account for FICO scores. As noted in its 10-K,

We consider data beyond traditional credit scores, such as transaction history and credit usage, to predict repayment ability, and leverage this with real-time response data.

This is an interesting approach, though it also creates risk assessment issues for investors as it does not publish traditional credit metrics of its borrowers. I think it is fair to say that the traditional credit-scoring system has flaws. However, I’d argue those flaws led to the widespread artificial increase in credit scores after 2020 due to government stimulus efforts, resulting in significant credit card debt growth and savings declines over the past three years.

Affirm’s business model is interesting, as only around half of its usual sales come from interest, given that many of its loans are interest-free. Most other sources are fees paid by merchants, servicing income, and gains on loan sales. However, despite significant sales growth, it has not yet had consistent positive operating income.

AFRM has not performed well, losing around two-thirds of its IPO value. Short interest has risen to 7.2%, implying a growing number of speculators are betting against it. On the other hand, many see it as a value opportunity, particularly given its robust revenue growth trend. Accordingly, I believe the stock deserves closer inspection, particularly regarding its macroeconomic credit risk factors.

Affirm’s Shifting Toward Traditional Lending

In 2023 (which for Affirm is Q3 2022- Q2 2023), Affirm’s total sales were $1.58B, of which $685M was from interest and $626M from “network revenue” (merchant fees). In 2024 (mid-23 to Q2 of this year), it had $2.32B in sales, of which $1.2B was from interest and $828M from network revenue. Thus, we see a notable shift toward higher interest income as a portion of sales. As noted in its annual report (ending Q2),

This increase (interest income) was partially due to an increase in the volume of interest bearing loans originated, which increased to 74% of total GMV for the year ended June 30, 2024, compared to 68% of total GMV in the same period in 2023, in addition to recent pricing initiatives, including the increase of the maximum APR and merchant-subsidized low APR loans replacing previously non-interest bearing loans.

Delinquency rates on Affirm loans are somewhat high. About 5% of its loans were over four days past due in June, compared to 4.1% in June 2023. That is well below typical credit card delinquency rates but higher than household debt in general. Affirm does not charge late fees, and many of its loans are interest-free, so it faces added risk compared to credit card lenders in the event of delinquency.

Over the past year (ending Q2), it had a $460M provision for credit loss, about 8% of its total loans ($5.6B) and above the total number of delinquent loans. The company has consistently had positive gains from loan sales, indicating potential overestimation of credit risk. However, it is more likely that Affirm’s credit risk assessment will, on average, be correct, given that delinquencies should spike well above 8% in a negative credit cycle.

The company also offers the “Affirm card, ” a debit card linked to one’s bank, allowing users to convert eligible debit transactions into installment loans. Data from this income source is accounted for in the above metrics. In my view, this card is interesting as it acts like a hybrid between a credit card and a debit card. Affirm is also working on a money-market account, offering FDIC-insured high-yield savings. Since these accounts operate through a different bank, it does not publish data regarding deposits, as Affirm is not an FDIC-insured bank.

Affirm’s operating “funding cost” expense was $344M TTM, while its total liabilities were $6.78B. It would be interesting to see if it could borrow more affordably if it acted like a traditional consumer credit bank, similar to American Express (AXP) or Discover (DFS), but that may not offset the associated regulatory requirements.

BNPL Likely Superior to Credit Card Model

Affirm faces some risks associated with the Consumer Financial Protection Bureau’s new rule applying credit card protections to the BNPL market. Realistically, these rules will increase Affirm’s operating costs by mandating regular billing statements, investigating customer disputes, and offering refunds. Affirm, Klarna, Block (SQ), and PayPal (PYPL) are all impacted by this rule and the related lawsuit. In my view, the financial impact of this rule would largely be pushed onto consumers and merchants because the costs would rise for all BNPL companies, potentially lowering the market’s growth rate.

Still, I do not believe that BNPL is inherently predatory or exposes Affirm to excess risk. Although, as an analyst, I’d prefer to see FICO scores on its loans, the company seems to adequately assess credit risk in proportion to interest rates on its loans. The rise in delinquencies over the past year is notable, but it is consistent with the general economic pattern.

Affirm borrowers do not have great credit, but the same is largely true for those who are consistently behind on credit cards. Affirm utilizes technology to reduce some risks at the product SKU level, which cannot be done with traditional credit cards. Further, a large portion of its income comes from merchants.

Although it’s trending toward more significant interest income, some are merchant-paid interest. Thus, for a lower-income borrower, I think Affirm’s model is less predatory than traditional credit card lending, while it has shown the ability to manage the associated credit risks. I believe BNPL is technologically superior to credit card lending, likely creating better outcomes for lenders, borrowers, and merchants. That said, that depends in part on BNPL’s lower regulatory burdens. Still, I expect BNPL growth to continue steadily as more people opt for BNPL instead of credit card debt, given its typically lower interest rates and fees.

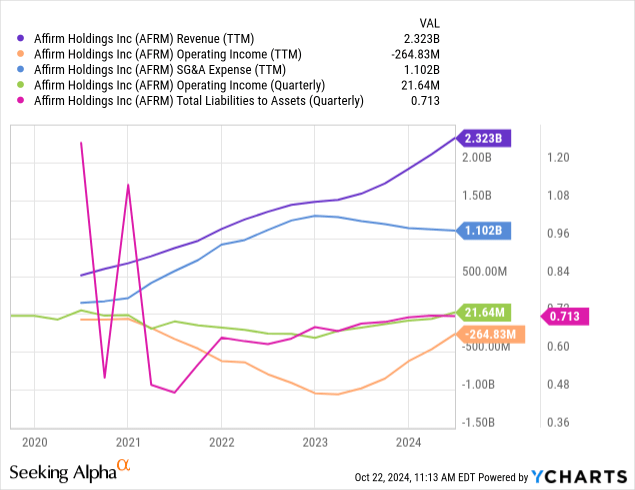

Although Affirm has not had positive TTM operating income, but had positive operating income last quarter. Its sales are growing very quickly as the BNPL market continues to expand. Some operating costs will rise proportionally to its sales, but about $1.6B should be roughly constant. The largest of these is its SG&A expense, which has declined since 2023 despite a sharp rise in revenue. See below:

Affirm’s leverage is also not problematically high, with liabilities-to-assets of 71%. Since it is not a bank, we should not expect bank-like figures of ~90%, which usually require stable deposits. However, Affirm still faces risk if its delinquency rate spikes significantly beyond its expected levels. Affirm’s “technology and data analytics” operating expense was ~$502M TTM, down from $615M in 2023. Thus, I estimate that its fixed overhead is around $1.6B. In comparison, its more variable operating costs were ~$1.3B TTM (provision for credit loss, funding costs, processing, and loss on loan purchase commitments). Although Affirm does not publish a “gross margin” figure, I estimate it is around 40-45% if we look at those more variable operating costs. Thus, we should expect Affirm to see significant EPS growth over the next two years if it can continue its current growth rate.

Valuation and Competition are a Concern

BNPLs, unlike credit cards, do not have market protection from customers and loyalty. Most often, merchants opt for BNPL providers with the lowest rates, encouraging sales and reducing merchant fees. This provides immense economic scale advantages to BNPL providers.

Affirm is the largest pure-play publicly traded BNPL company. It had $26.6B in GMV and $2.3B in revenue TTM. Klarna, a private Swedish firm, reported SEK 13.2B in revenue at SEK 523M during H1 2024. Annualized and converted to USD equates to a GMV of ~$100B and ~$2.5B in revenue. Thus, Klarna has a higher GMV, but their revenue is very similar. As a US publicly traded company, Affirm may have more significant growth potential through access to capital and transparency of public markets.

I expect competitive factors to become more critical as the BNPL market grows. Due to economic scale benefits, there is a notable risk that BNPL will be a ” winner-take-all ” market. It is likely most similar to Visa (V) and Mastercard (MA), where it tends toward duopoly due to the regulatory issues of monopoly power. Of course, Block (Square) and PayPal are also involved in BNPL. Still, I do not think they’ll gain an edge, given both Klarna and Affirm are on the verge of consistent operating profitability, potentially allowing them to lower merchant or consumer costs to accelerate growth.

Analysts do not expect Affirm to earn a positive income until ~2027. Given the data I’ve seen, barring a consumer-driven recession, I think it may be profitable in 2025. That said, I do not believe it is undervalued. AFRM’s price-to-book is a high 4.9X. If it can triple its sales to $7B and earn a 40% “gross profit” (based on my estimates of variable vs. fixed costs) less ~$1.6B in fixed costs, I estimate its foreseeable operating income potential at ~$1.2B ($7B*40% – $1.6B), or around $800M in after-tax profits.

That would give it a forward “P/E” of ~17X today, which may be reasonable only if we assume continued growth after that, stable overhead, and a lack of significant competitive pressures. A consumer-driven recession would also prolong and alter its path toward such profitability.

The Bottom Line

I believe AFRM is fairly valued today, giving me a neutral outlook. Its valuation is higher than its book value and depends mainly on significant continued sales growth, prudent operating spending, and maintaining a competitive edge. AFRM also faces regulatory and recession risks. That said, I believe its interest income is high enough to offset a feasible increase in defaults.

I would likely become bullish on AFRM if it falls below $30. In the long run, I think the BNPL model may prove superior to the traditional credit card lending model because it has a technological advantage by lending at the product level, allowing for lower risk and lower rates for consumers and merchants. I’d prefer to buy AFRM after it faces a consumer spending slowdown or recession, as its ability to handle a significant and sustained (unlike 2020) unemployment spike remains untested.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.