Summary:

- Affirm being branded a short idea by equity research outfit Hedgeye runs counter to strong US economic figures and its positive operational momentum.

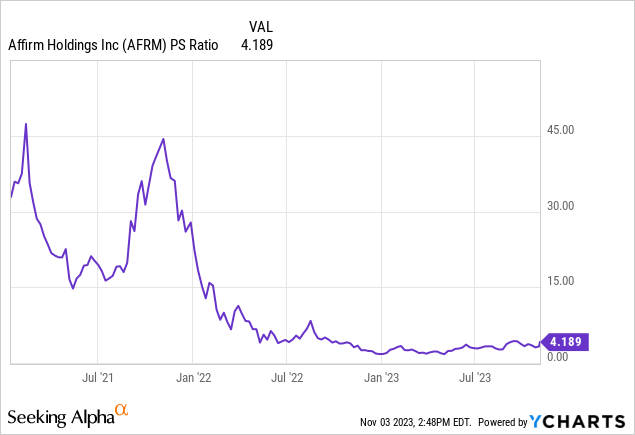

- The buy now, pay later firm is currently trading hands for a 4.19x price-to-sales multiple, amongst its lowest level in more than three years.

- Growth across its core financial metrics was strong during its fiscal 2023 fourth quarter with allowance for credit losses also trending lower.

hapabapa

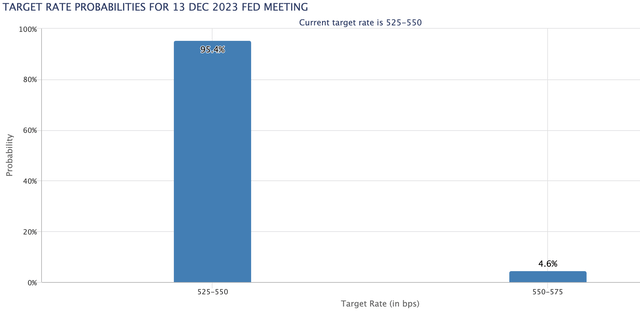

When I last covered Affirm (NASDAQ:AFRM) in the spring of 2023, the banking crisis sparked by the collapse of SVB Financial Group had sparked a selloff that saw the common shares of the buy now, pay later firm fall to new lows. The ticker is up significantly since then, 148% year-to-date as we head into its fiscal 2024 first-quarter earnings ending 30 September. This will be released after market close next week Wednesday on 8 November. I’m excited as seemingly moribund animal spirits have been revitalized over the last few days since the November Federal Open Market Committee meeting saw a second consecutive rate pause and October nonfarm payrolls underperformed consensus. These have set a Goldilocks backdrop for the Fed to pause rates again in December and for a potential full dovish pivot early next calendar year.

To be clear, a small beat could see shares realize extreme volatility against a 20% short interest. One in five of Affirm’s common shares are being sold short against a market that’s seeing sentiment rapidly recover as investors look towards the light at the end of a tunnel formed by interest rates being hiked to a 22-year high at 5.25% to 5.50%. The bears are relentless even with Affirm’s price-to-sales multiple currently amidst lows from a three-year viewpoint. Hedgeye added the ticker as a new short idea. The categorization by the research outfit raises the stakes of $6.3 billion Affirm going into its first-quarter earnings but I remain bullish.

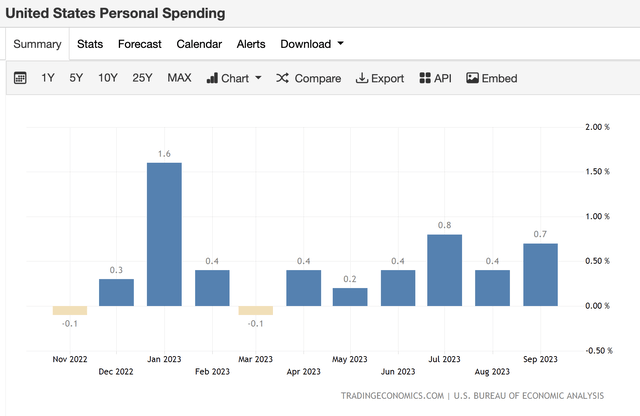

Affirm Is Currently Not A Clear Short Against Healthy Economic Figures

Hedgeye flags an end of ZIRP as driving a new paradigm for Affirm. However, this new paradigm is being built on product innovation and healthy revenue growth set against the backdrop of expanding gross merchandise volume and resilient consumer spending. Personal spending by US consumers rose 0.7% in September, above the consensus of a 0.5% advance, and accelerating from growth of 0.4% in August with $42.5 billion spent on goods during the month. Affirm is seeing broad growth across all its core financial metrics with this momentum set to continue going into the first quarter of its fiscal 2024.

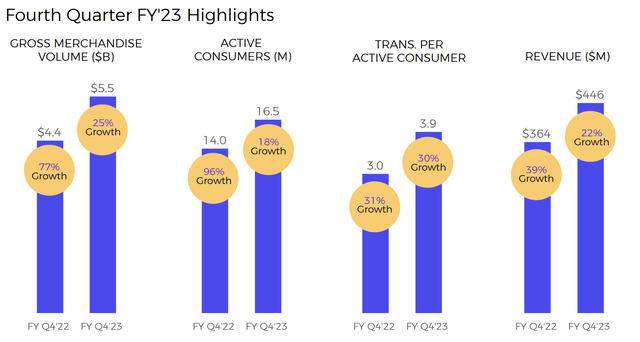

Affirm Holdings Fiscal 2023 Fourth Quarter Supplemental

GMV for the fourth quarter at $5.5 billion grew by 25% over its year-ago comp with revenue of $446 million during the quarter growing by 22% year-over-year. Critically, the company continues to notch new partnerships and chase growth. It’s expanding its partnership with Magnificent Seven company Amazon (AMZN) to offer a pay-over-time option at checkout on Amazon Business, a business-to-business store. Amazon CEO Andy Jassy stated in his shareholder letter discussing the 2022 fiscal year that this division recorded revenue of roughly $35 billion. Critically, Affirm is set to be the first buy now, pay later firm listed on Amazon Business, an incredible moat for future GMV and revenue generation.

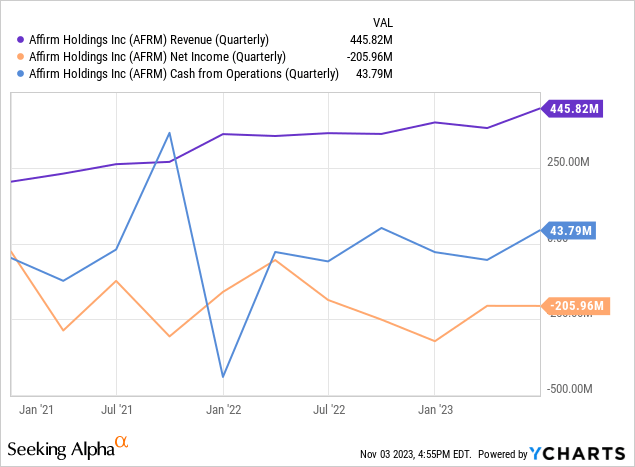

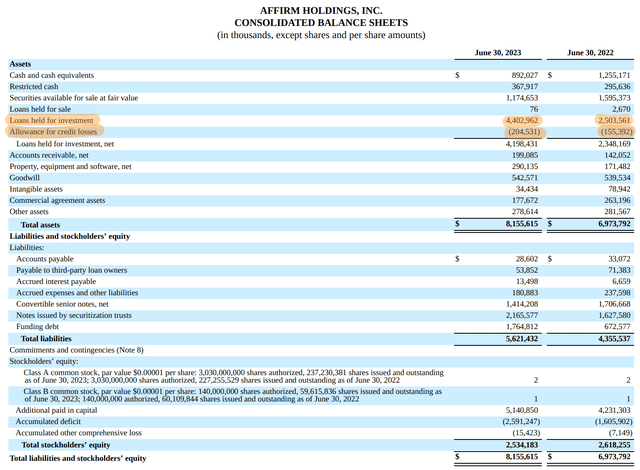

Whilst Affirm is loss-making with material stock-based compensation expenses driving this, the company’s underlying cash position is not as deteriorated as implied by its losses. Affirm’s stock-based compensation is high with the company recording a $103.3 million expense on this item during its fourth quarter with the trailing 12-month figure at $451.7 million. Cash flow from operations came in at $43.8 million after adjusting net loss for stock-based compensation and other non-cash items. Affirm’s net loss was $205.96 million with cash and equivalents of $892 million at the end of the quarter.

Stock Market Sentiment At The Cusp Of Total Change

The risk-off sentiment that drove most of the selloff in loss-making but high growth payment and technology firms like Affirm is on the cusp of ending as the market prices in yet another pause of the Fed fund’s rate at the upcoming 13 December FOMC meeting. Expectations for a 25 basis points hike currently stand at just 4.6% with a third consecutive pause now the base expectation.

Affirm Holdings Fiscal 2023 Form 10-K

This comes as active consumers hit 16.5 million, growing by 18% over its year-ago comp and with transactions per active consumer of 3.9 being driven higher by a terrific 30% over its year-ago comp. We’re not currently in a recession, the Fed is about to fully pivot to a dovish stance, and strong consumer spending aggregated with its partnership with Amazon is set to deliver incremental gains with GMV and revenue. The company’s allowance for credit losses of $204.53 million as a percent of loans held for investment at 4.6% was also a full 160 basis point decline from its year-ago comp of 6.2%. Fundamentally, this implies higher underwriting standards and instills a strong level of confidence that the company’s growth is being chased sustainably. Affirm remains a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AFRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.