Summary:

- Affirm stock has recovered strongly after crashing during the tech stock bubble burst.

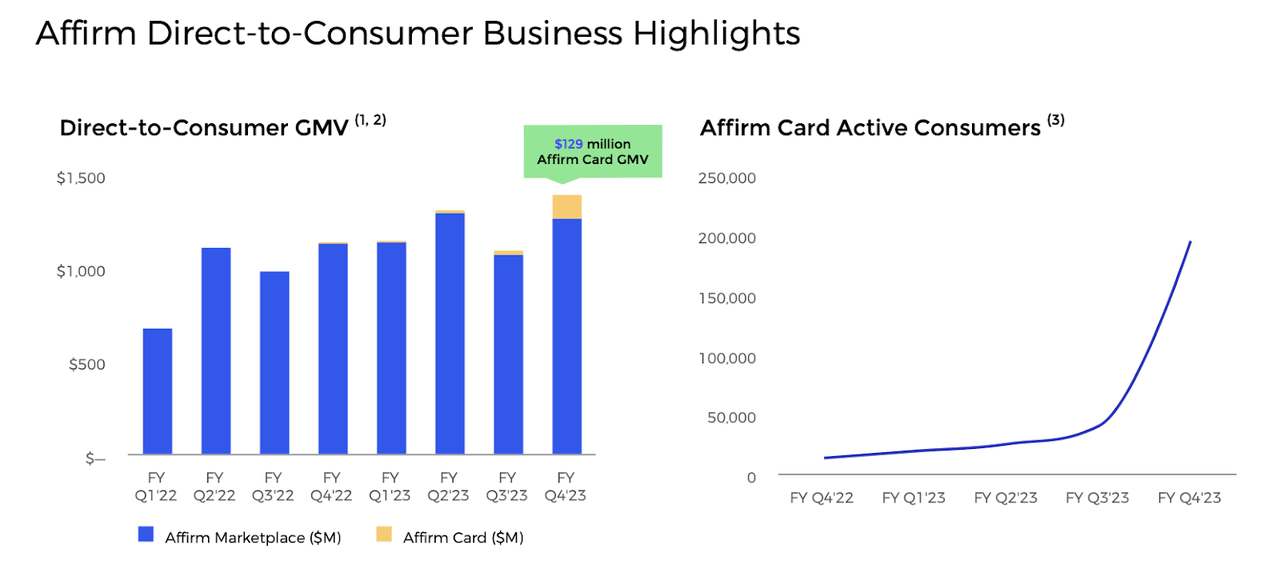

- The Affirm Card has reinvigorated revenue growth rates.

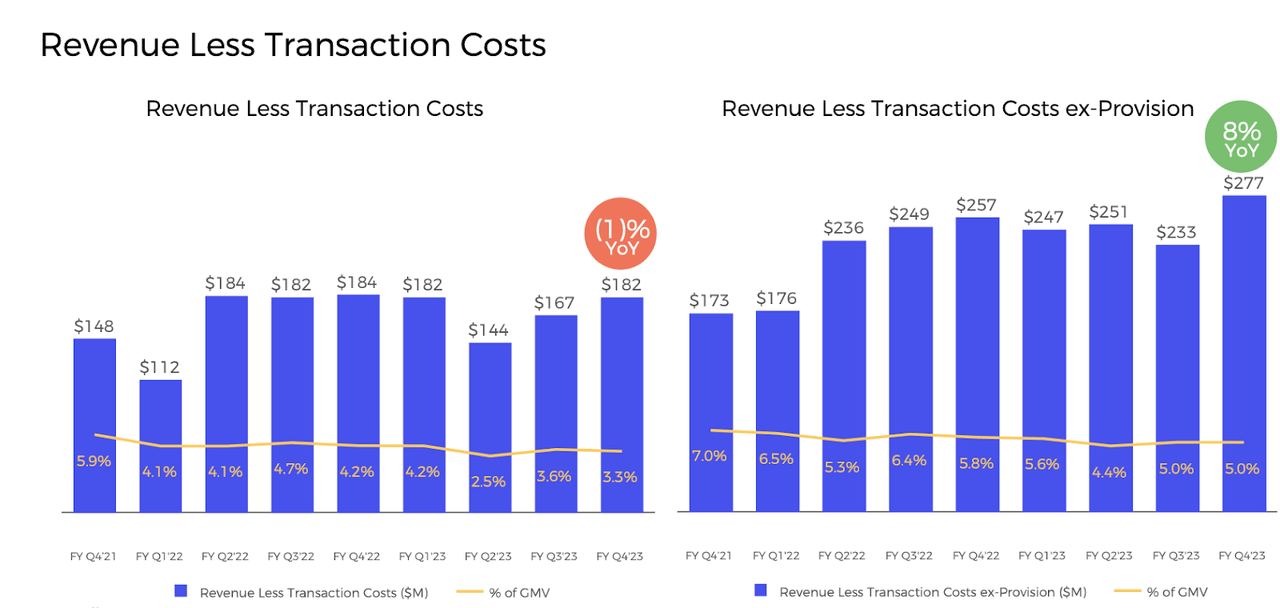

- Higher interest rates have caused revenue less transaction costs to grow significantly slower than revenues.

- I am downgrading the stock in light of the valuation and elevated risk profile.

Kevin Dietsch

Affirm (NASDAQ:AFRM) has been a strong performer over the past year but that is mainly due to the stock having been crushed amidst the bursting of the tech stock bubble. The higher interest rate environment and elevating risks of recession have posed considerable headwinds to unit-level margins. Even so, the company hopes to accelerate top-line growth on the backs of its Affirm Card and is projecting sustainable non-GAAP profitability moving forward. The company may see further acceleration as more and more of its merchants adopt its higher APR thresholds, but it is clear that higher interest rates have taken its toll on the growth story. I am downgrading the stock from “buy” to “hold” as the risk-reward proposition is no longer favorable.

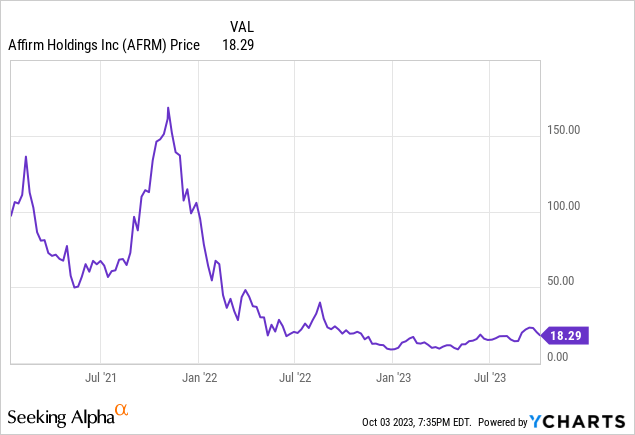

AFRM Stock Price

It is easy to forget that AFRM at one point traded into the triple-digits. The stock crashed as much as 95% to the single-digits, but has since recovered strongly.

I last covered AFRM in June where I rated the stock a buy on its inclusion in Amazon Pay (AMZN). At the time, I noted that the undervaluation was only modest unless one assumed a significant acceleration in revenue growth rates. With the stock up double-digits since this report, I am now moving to the sidelines.

AFRM Stock Key Metrics

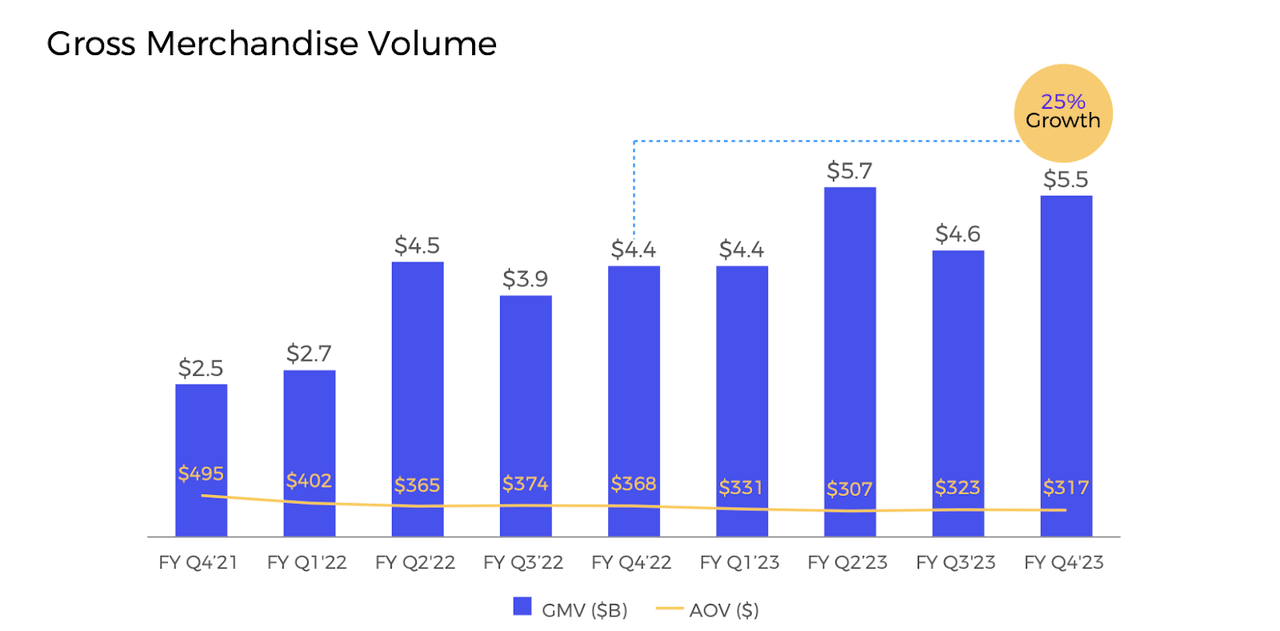

In its most recent quarter, AFRM delivered $5.5 billion in GMV, coming ahead of guidance for up to $5.35 billion. I note that the Affirm Card did not make up a significant part of that GMV.

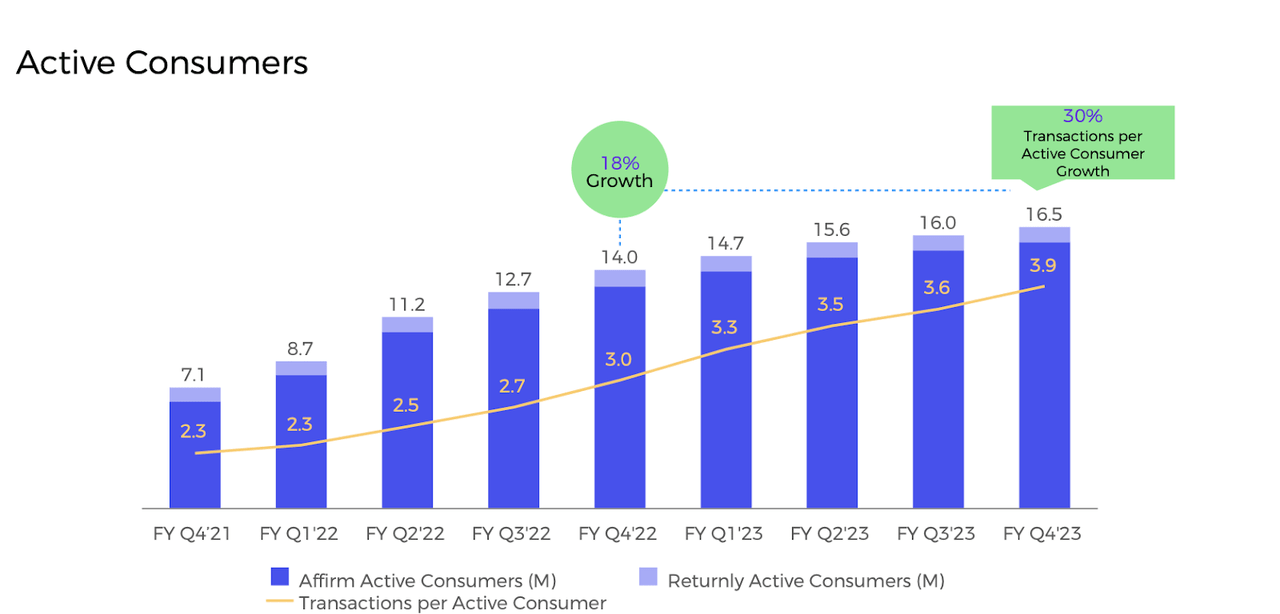

AFRM delivered 18% YoY growth in active consumers as well as 30% growth in transactions per active consumer. I suspect that this growth (and the implied smaller basket size) may be due to the company growing further into the Amazon ecosystem.

AFRM has seen its Affirm Card grow rapidly since its launch just several quarters ago. The Affirm Card totaled $129 million in GMV in this past quarter and the consumer base has seen exponential growth.

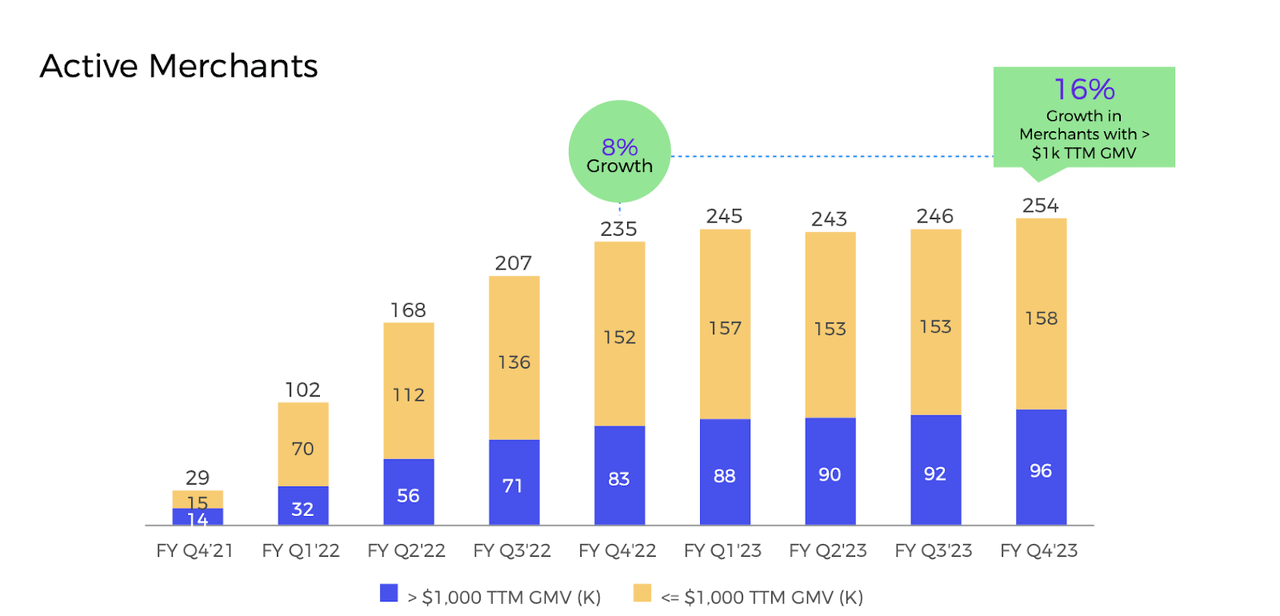

After seeing active merchant growth stall for two quarters, AFRM saw active merchants grow by 8% YoY.

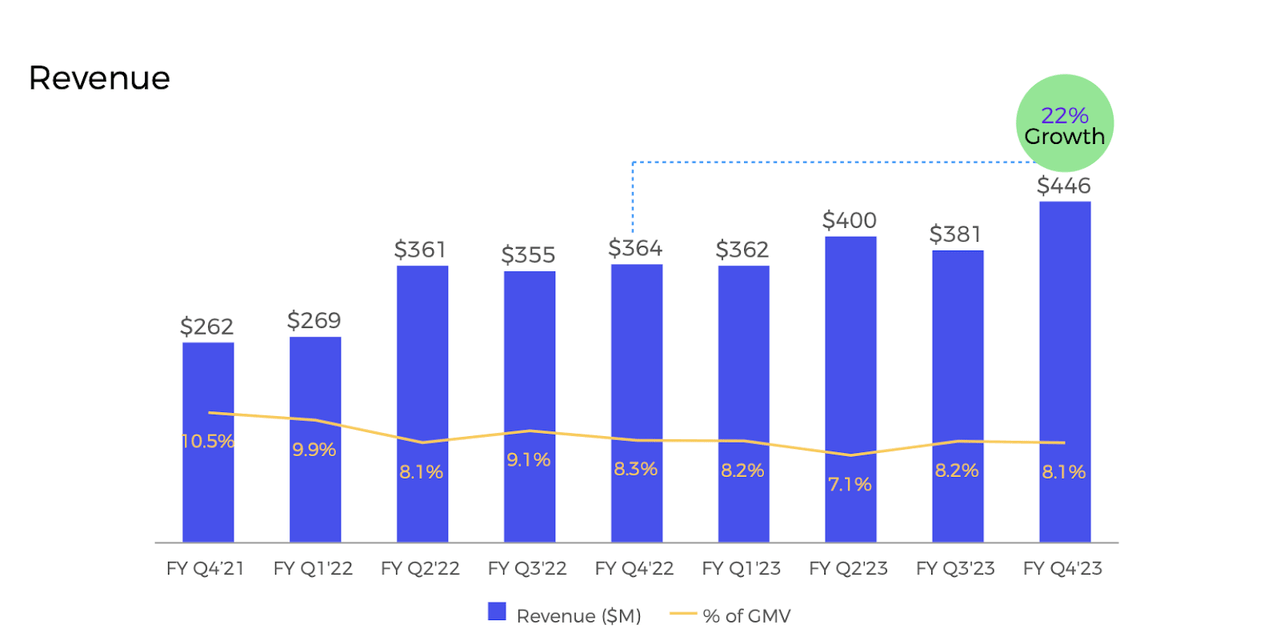

Revenue came in at $446 million, representing 22% YoY growth and coming ahead of guidance for up to $415 million. While growth rates are much slower than pandemic levels, it is still impressive that management is once again back to beating guidance.

Revenue less transactions costs (‘RLTC’), which I consider to be “gross profits” for the company, grew by only 8% as the company felt the impact from both higher financing costs as well as lower take rates from AMZN and Shopify (SHOP). I note that $277 million in RLTC came well ahead of guidance for $160 million.

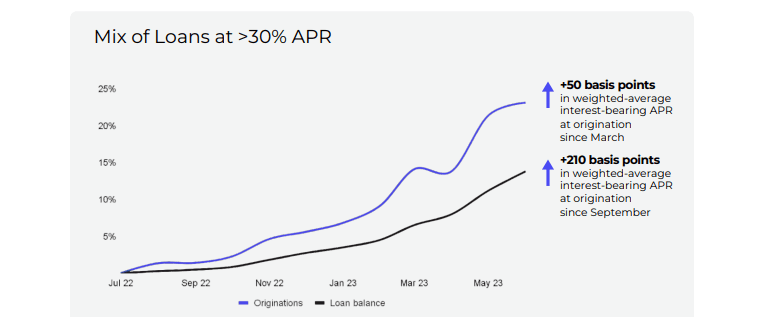

AFRM has struggled to adapt to the higher interest rate environment in part due to its interest income rates not rising in tandem with financing costs. AFRM has seen some steady progress in recent quarters in getting more merchants to allow for APRs in excess of 30%. As more merchants adopt the looser thresholds, I expect AFRM to see RLTC growth come more in-line with revenue growth (and potentially exceed it at some point when easy comps become tailwinds).

FY23 Q4 Presentation

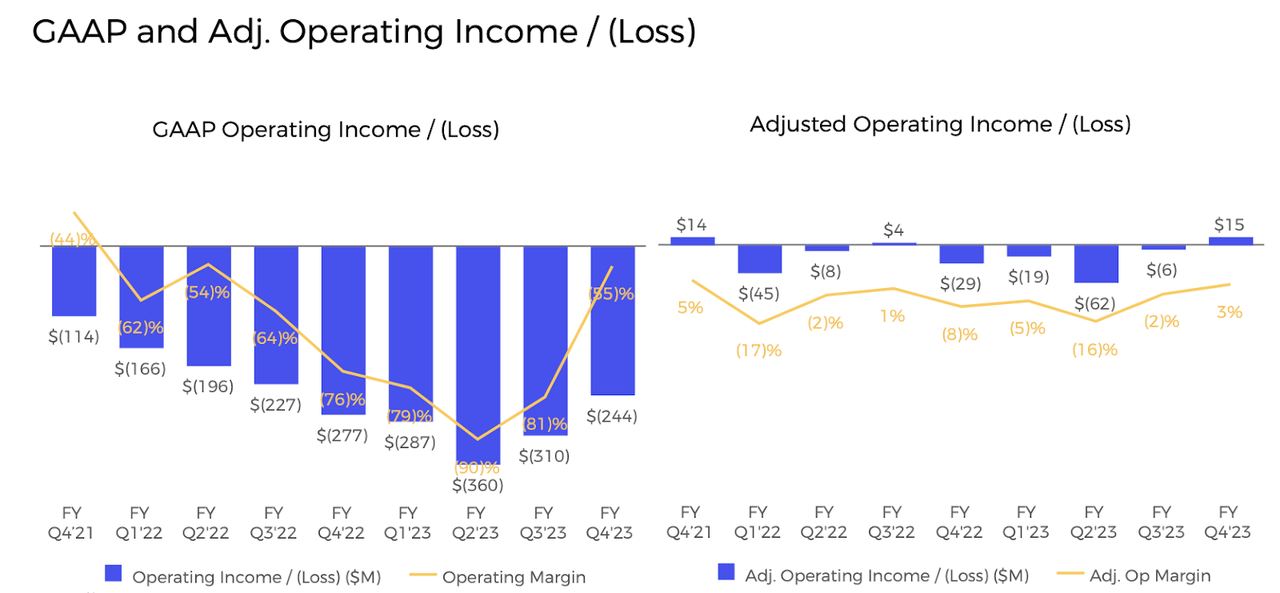

AFRM is not yet GAAP profitable but did deliver $15 million in positive non-GAAP operating income – coming ahead of guidance for a 1% margin loss. On the conference call, management reiterated expectations for positive non-GAAP profitability in the next fiscal year and in the years thereafter.

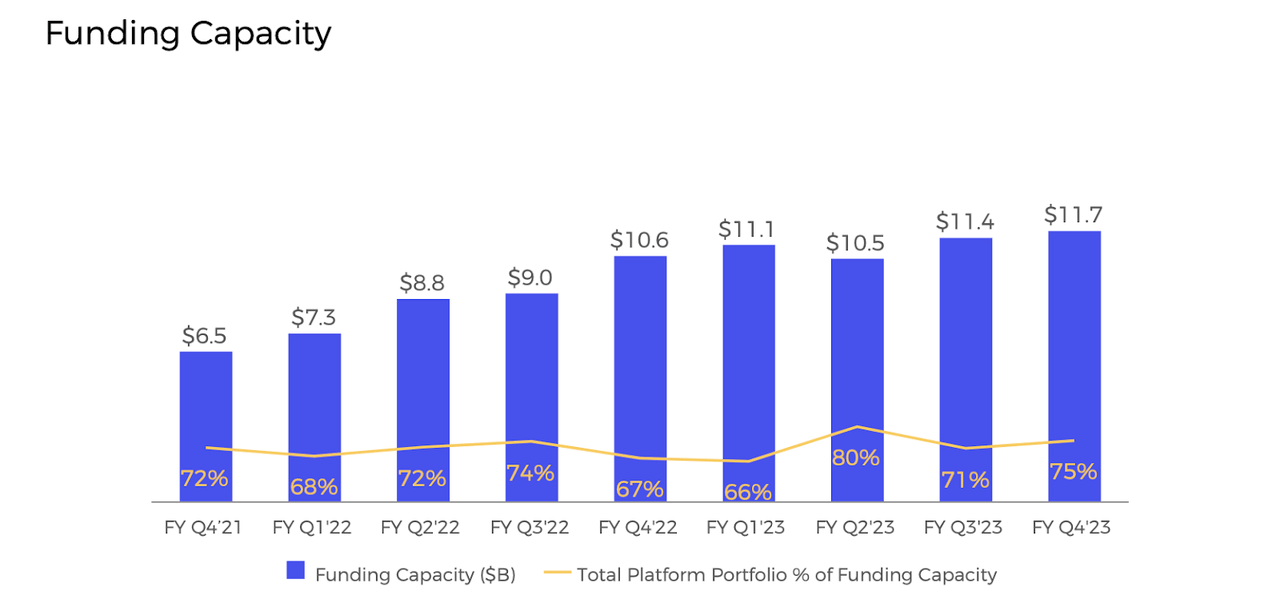

The higher interest rate environment has negatively impacted many other former-high-flyers by constraining funding sources. In AFRM’s case, the company continues to have ample access to funding – perhaps the main differentiator is that buy now, pay later (‘BNPL’) loans tend to have short durations in nature.

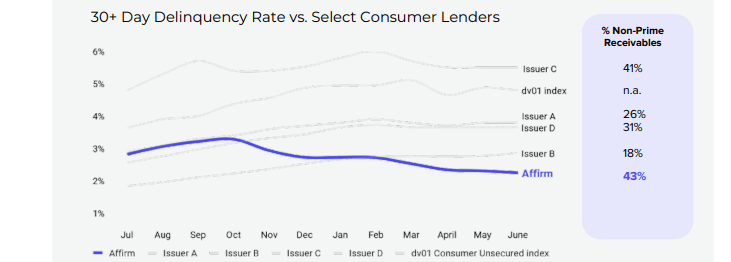

Amidst rising fears of recession, AFRM has seen its credit quality improve over the past year, in stark contrast with conventional credit card companies. That said, it is still unclear how the company will perform in the event of an actual recession, and I doubt that Wall Street will ease their fears so easily.

FY23 Q4 Presentation

AFRM ended the quarter with $2.1 billion of cash and investment securities versus $1.4 billion in convertible notes. There were also $4.2 billion in loans held for investment versus $4 billion in funding-related debt. The net cash balance sheet is a source of strength that may prove invaluable under tougher macro conditions.

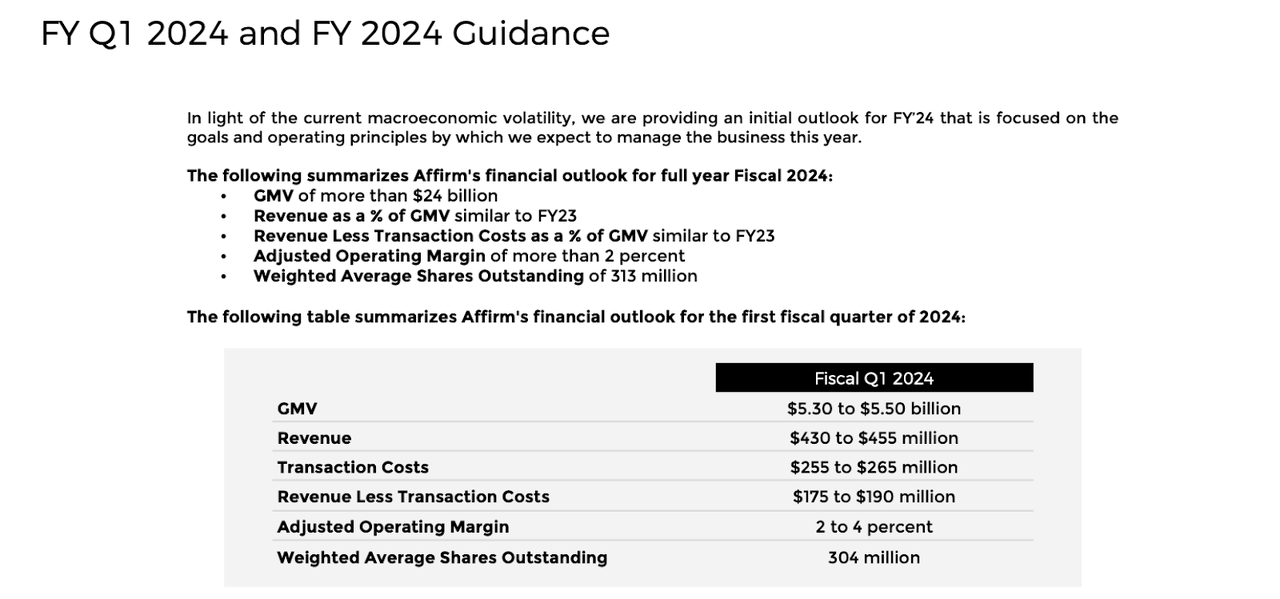

Looking forward, management is guiding for at least 18.8% YoY GMV growth to $24 billion, with RLTC continuing to be pressured from the higher rate environment. I note that RLTC might grow faster in the next fiscal year due to the easier comparables. Management is guiding for at least 2% in adjusted operating margin for the year. For the first quarter, management is guiding for up to $455 million in revenue, representing 25.7% YoY growth, and $190 million in RLTC, representing only 4.4% YoY growth. Given management’s guidance for up to 4% adjusted operating margin, I suspect that the full-year margin target may prove conservative.

On the call, management outlined expectations for RLTC as a percentage of GMV to stabilize in the second quarter due to their ongoing rollout of pricing initiatives. While reiterating expectations for positive adjusted operating profitability moving forward, management noted that they have “earned … the right to return to a more aggressive pace of network growth while maintaining discipline.” I agree with the sentiment and note that it is impressive that the company was able to pivot so rapidly under undesirable macro conditions.

Management stressed that their guidance for $24 billion in full-year GMV is a “floor,” and I remind readers that AFRM was once a leader in “beating and raising” on expectations. AFRM will be lapping a full year of higher interest rates, offering potentially easier comparables. It was in the second quarter of this past year that the company had tightened its credit box (effectively stunting growth), so investors should expect stronger results in the second quarter of this year and thereafter.

Management did note that they had been increasing the use of their balance sheet to hold loans in order to earn greater interest income. I suspect that this is not necessarily by choice – AFRM is a frequent participant in the asset backed securities (‘ABS’) market and the rapidly changing interest rate environment may pose difficult headwinds to monetizing loan investments.

Regarding the Affirm Card, management expressed the ultimate goal as being to deepen their relationship with consumers, noting that the average consumer uses Affirm just 4 times a year. Management stated that whereas they have “more or less conquered the bicycle and couch space,” they are now trying to get their “unfair share of doughnuts and coffee.”

Is AFRM Stock A Buy, Sell, or Hold?

After the rally from the lows, AFRM is no longer trading at “deep value” valuations. The stock is now trading at around 3x sales and 8x gross profits.

In my last report, I assumed 15% to 20% revenue growth, 30% long term net margins (based on gross profits), and a 1.5x price to earnings growth ratio (‘PEG ratio’). That implied a valuation of 6.75x to 9x gross profits. With the stock trading at the upper end of that range, I must withdraw my buy rating as this stock is not yet of blue chip quality.

That said, I should mention again that AFRM is a founder-led company with CEO Max Levchin owning 29 million shares in the company as well as being paid a very modest base salary. AFRM does face intense competition from the likes of Apple (AAPL), PayPal (PYPL), AfterPay (SQ), and Klarna among others, but the company appears to be led by a highly incentivized management team focused specifically on the BNPL market. My rating downgrade is instead due primarily to valuation though I may lift my fair value estimates if the company continues to execute on operating margin expansion and accelerating top-line growth rates.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, PYPL, SQ, AFRM, SHOP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!