Summary:

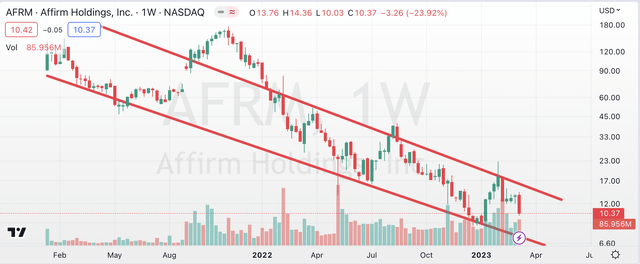

- Affirm shares have declined over 70%.

- Financials have deteriorated along with lowered guidance.

- The valuation just simply isn’t cheap enough, but it’s likely coming.

Kevin Dietsch/Getty Images News

Over the past year Affirm (NASDAQ:AFRM) stock has collapsed over 70%. While not entirely the company’s fault that the market bid shares of Affirm up to an elevated valuation, the result of rate hikes has deteriorated discretionary spending and therefore had a huge drag on Affirm’s results.

Deteriorating Financials

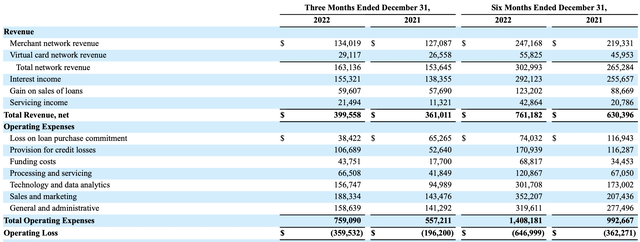

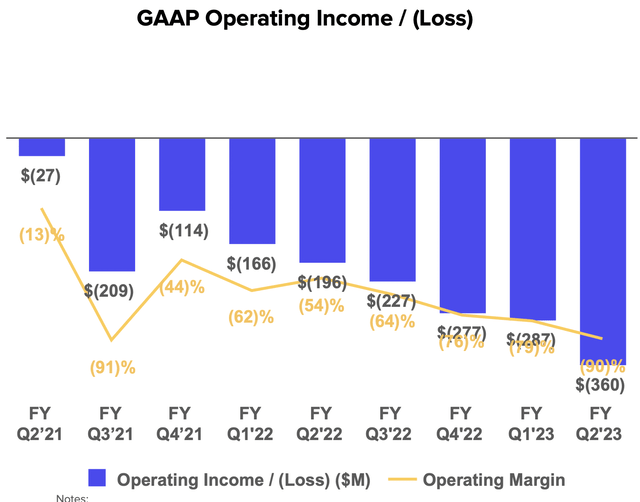

During a key holiday shopping season Affirm racked up nearly $360M in operating losses which was an acceleration of the $196M it lost in 2021 and almost equal to the losses tailed through 6 months in 2021.

On the revenue side, the company grew just 10% Y/Y which was promptly offset by operating expenses increasing 36%. The most alarming increase are the provisions for credit losses which accelerated over 102% over the past year on a quarterly basis.

The company is responding by initiating some job cuts expected to save the company $77M – $83M annually once fully baked in. However, ~$20M in quarterly expense reductions will barely move the needle on a company on a $700M+ quarterly burn rate.

Investors would be wise to wonder where the operating leverage is going to come from. As interest rates have steadily climbed in 2022, Affirm’s results only got worse. The company also guided down from a revenue range of $1.60B-$1.675B to $1.475B-$1.550B.

The company has very little ability to expand margin through price increases and as interest rates have climbed, it both reduces the demand for the company’s product (hence the revenue downgrade) and increases the amount of losses the company needs to provision for.

Looking forward, Wall Street analysts recognize the headwinds with revenue estimates being pulled down to just single digit growth Y/Y for the next two quarters. However, its anticipated revenues reaccelerate towards the back half of 2023.

No Moat

Affirm has a nice product, anecdotally I’ve used it before on occasion to score a 0% “buy now pay later” (BNPL) offer on Peloton (PTON) and for some Super Bowl tickets. However, there’s nothing proprietary about Affirm.

Apple (AAPL) already has a similar service where consumers can stretch a purchase of an Apple product out over 12 months with zero interest or fees. However the rumor is Apple will be rolling out a version of BNPL that will apply to purchases of other non-Apple items. It seems that Apple might actually be underwriting these financing charges on its own, whereas with Apple Card it’s used Goldman Sachs (GS).

Other retail giants appear to be jumping on board too. Walmart (WMT) is likely introducing a version of BNPL through a majority owned fintech. This obviously goes along with other BNPL providers like PayPal (PYPL), Block (SQ), Klarna, and credit cards offer similar services such as Chase (JPM).

Certainly some tailwinds can emerge for Affirm in the coming 12-month stretch with the Federal Reserve possibly pausing (or even reducing) interest rates, but some (if not all) of that benefit could be chewed up by competitors coming on board.

Valuation

Most traditional ways to value a stock doesn’t work with Affirm. No positive EPS is anticipated out to calendar year 2025 by Wall Street analysts. Operating cash flows are bolstered up by large amounts of stock-based compensation and the fact the company can add-back provisions for credit losses. Even if you want to analyze the company this way, through 6-months the company generated just $22.7M in operating cash flow… not exactly impressive for a company worth just north of $3B.

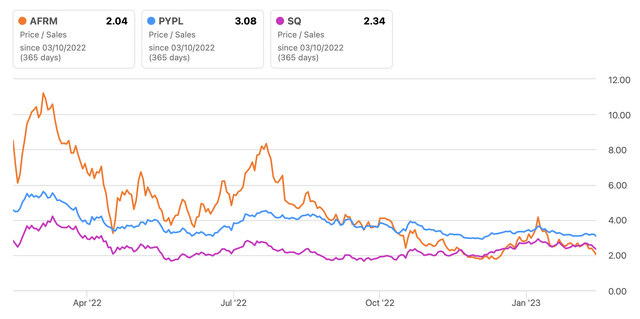

The only clean way you can analyze this company is from a sales perspective. While not entirely comparable, Affirm essentially wants to become a version of PayPal and Block at some point. As it stands now, investors are paying a comparable price for Affirm sales (2x) versus rivals that are already where Affirm wants to be.

It’s simply just not exciting to pay a similar valuation for a stock that has an uphill battle just to equal peers, let alone surpass them. There is a real risk Affirm never achieves the scale need to achieve profitability, therefore a far greater risk/reward valuation premium is needed.

Wait For Distress

Yes, Affirm shares have tanked over the past 12 months, but it’s really just brought the valuation in-line with peers operating a similar business model. The argument that the Federal Reserve will pause or cut rates (which would likely boost Affirm’s outlook) is valid – but the amount of stocks that benefit in this scenario is so wide an investor actually doesn’t gain much by taking the risk to buy Affirm now over a large basket of stocks.

A wiser investor waits for distress. If we don’t see a pause/cut in rates, that distress will likely materialize in shares of Affirm. In that scenario Affirm becomes a buyout candidate from a larger financial institution, which creates a floor underneath the shares and the upside is greater than just simply a broad basket of stocks.

For well over a year shares of Affirm have been locked in a downward trend and the path of least resistance is back down towards the 52-week low under $9 per share and potentially new lows at the bottom of the channel closer to $7 per share. That’s the area from a technical and valuation perspective the risk reward in Affirm is attractive.

Disclosure: I/we have a beneficial long position in the shares of JPM, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.