Summary:

- Affirm provides a “buy now, pay later” service with no hidden fees and 0% interest.

- The stock price of Affirm has had a volatile year, but currently presents a 1-year return of 187%.

- The increasing demand for BNPL services and partnerships-led growth position Affirm for price upside in FY 2024, in my opinion.

Charday Penn/E+ via Getty Images

Affirm (NASDAQ:AFRM) provides a “buy now, pay later” / BNPL service that lets you split purchases into installments with no hidden fees and also 0% interest. It was founded in 2012 by Max Levchin, who also co-founded the well-known online payment platform, PayPal.

Since going public in 2021 at a price per share of $117, AFRM has had a rough ride. It briefly reached its all-time high of $164 in November 2021, but then tumbled down to mid-teens for most of 2023. There’s a recent positive sentiment in the stock in December 2023, when the share price briefly jumped to $51. However, the share price has normalized since then, with AFRM currently trading at $39, presenting a staggering 1-year return of 187%.

I initiate my coverage with a buy rating. My price target of $43.6 implies the stock achieving a 16% upside at the end of its FY 2024 in June.

Financial Reviews

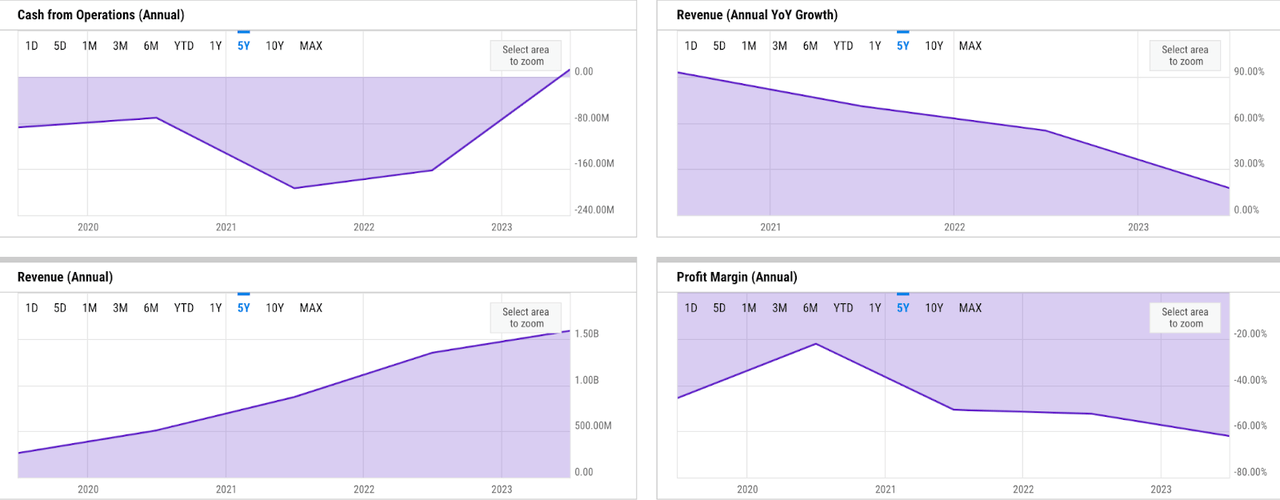

ycharts

I believe AFRM has mixed, yet significantly improving fundamentals. Over the past five years, AFRM’s revenue growth has declined from the low 90s in 2021 to around 17% in FY 2023 (FY ending in June 2023). However, revenue growth has rebounded since. In the first two quarters of FY 2024, AFRM delivered impressive revenue growth of 37% and 47%.

Operating cash flow / OCF, which had mostly been in the red, reached break-even in FY 2023. AFRM has not only maintained OCF generation over the next two quarters but also considerably improved it. AFRM delivered $99 million and $72 million of OCFs in Q1 and Q2 2024 consecutively.

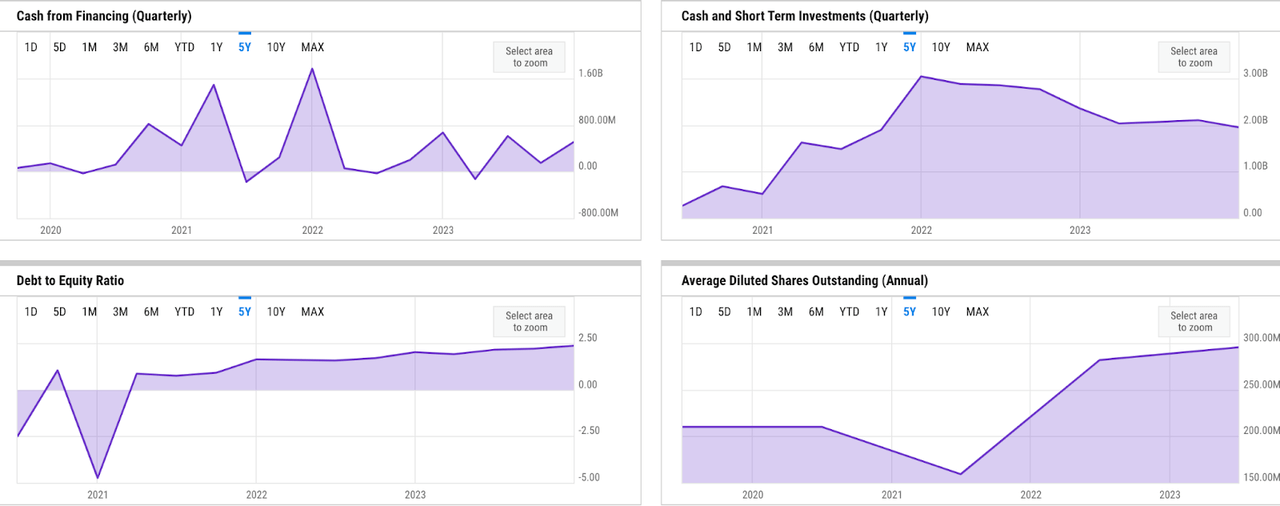

key metrics (ycharts)

AFRM has historically relied on the liquidity from debt and equity issuance, including at IPO. Cash and short-term investments reached over $3 billion upon IPO but saw a gradual decline to $1.9 billion as of Q2 2024. AFRM has also raised capital from debt issuances in 2023 to support its liquidity, effectively driving up the debt-to-equity / DE ratio to 2.3x.

Catalyst

I believe the increasing demand for BNPL services should help AFRM maintain its overall growth performance in 2024. In my view, this demand is driven by the shifting preference towards alternative financial services products with more manageable and predictable payment terms.

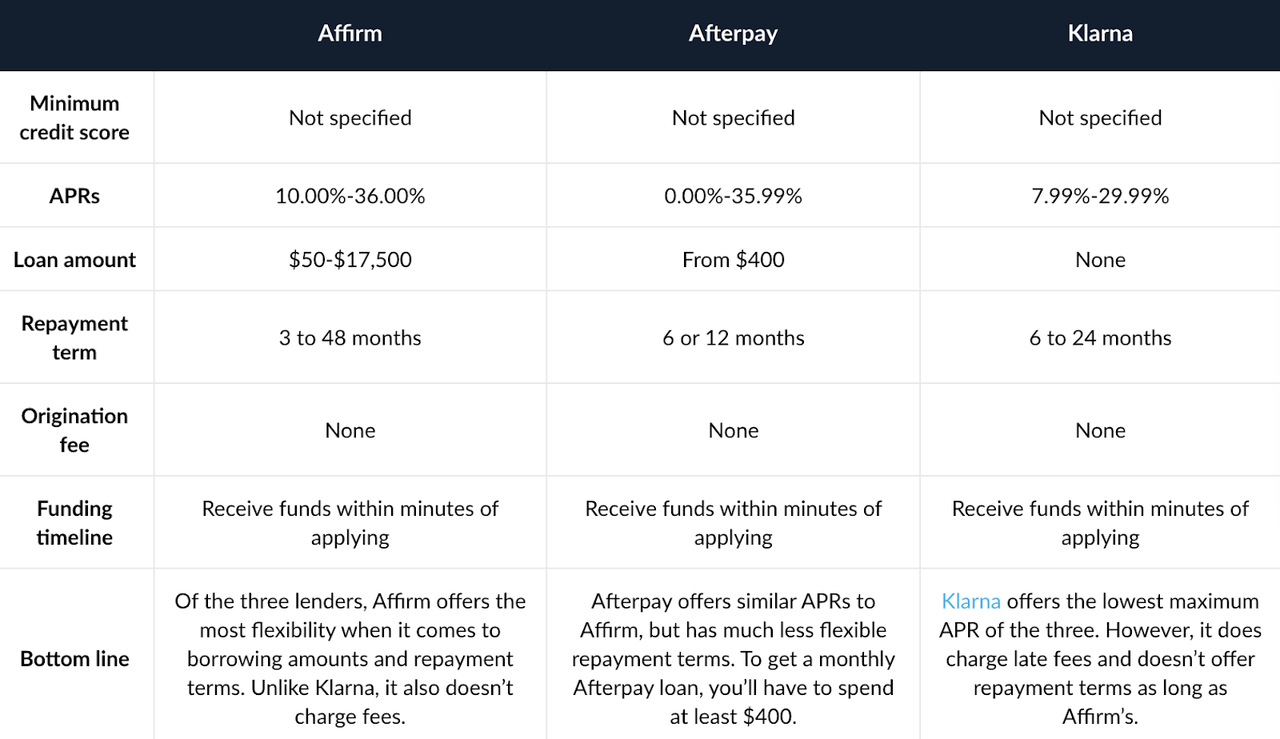

comparison (LendingTree)

I believe AFRM is in a good position to benefit from the growth opportunity, due to the strength of its products and deep merchant networks. AFRM’s BNPL and its interest-bearing core loan options offer more predictable monthly payments and transparency with no fees, making them attractive for budgeting and managing finances. As per the LendingTree’s review of the platform, AFRM has the most flexible repayment and borrowing terms among its competitors, Afterpay and Klarna.

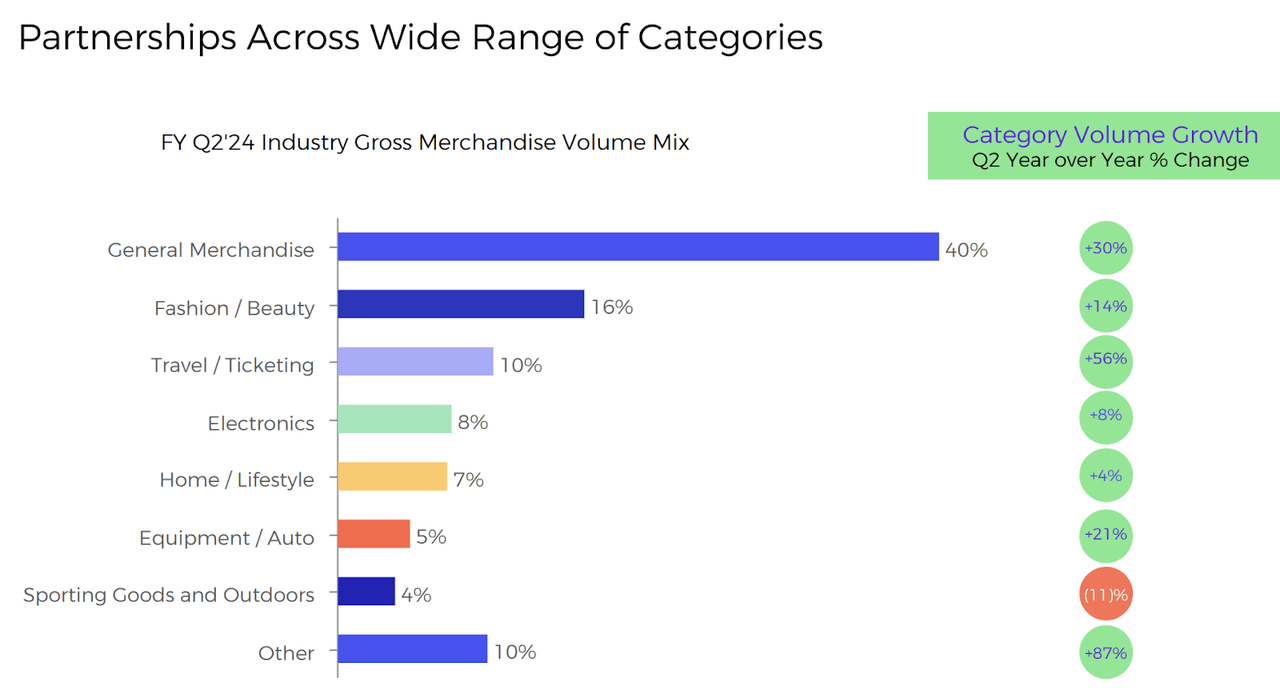

partnerships (company presentation)

AFRM also has a deep merchant network, in my opinion, which enables it to deliver revenue growth from the transactions in the network. As AFRM continues to strengthen this network through various strategic initiatives, such as partnerships, I would expect AFRM to continue seeing a positive impact on revenue growth in 2024.

There could be many ways AFRM’s products can benefit from deeper partnership activities. For instance, within a partnership with Shopify (SHOP) alone, I would imagine AFRM unlocking new growth potential as the partnership activities evolve into other channels. This implies not only an expansion of AFRM’s products into the partner’s new categories, but also brands, customer segments, or geographies. The management’s comment in the Q2 earnings call also provides an insight into the untapped potential of the partnership with Shopify:

But the program at Shopify grew twice the speed of the overall Affirm growth on the GMV side of things. They have aspirations off-line that they’re going after quite strongly and there’s still a lot of synergies and what we’re doing now there. We have a whole host of programs we’re contemplating going forward. So lots of with the job feeling very good. The fact that it’s accelerating suggests that there’s just more growth to be had for both of us.

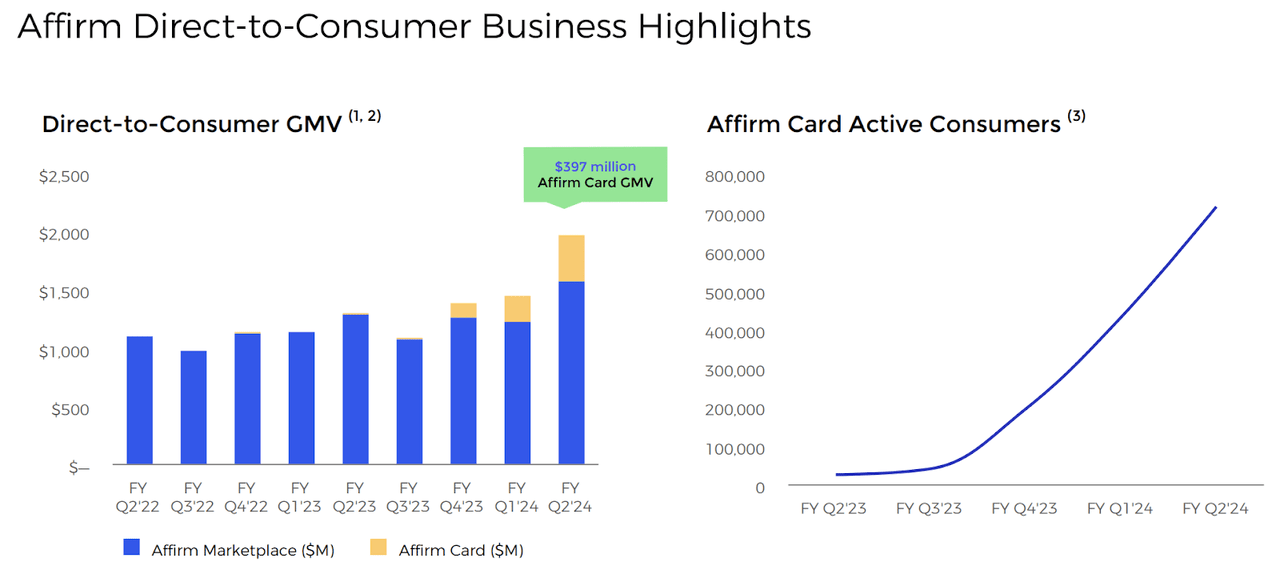

Direct to consumer business (company presentation)

I also see AFRM’s card business as a long-term catalyst. Despite still being in the early stage, the card business holds attractive potential due to its access to broader offline merchant networks:

In order to accelerate our ubiquity, we facilitate the issuance of virtual cards directly to consumers through our app, allowing them to shop with merchants that may not yet be fully integrated with Affirm. Similarly, we also facilitate the issuance of the Affirm Card, a debit card that can be used physically or virtually and which allows consumers to link a bank account to pay in full, or pay later by accessing credit through the Affirm App. When these cards are used over established card networks, we earn a portion of the interchange fee from the transaction.

Source: 10Q.

Since Q4 2023, GMV from the card business has grown substantially, driven by the growth of active card consumers. I believe AFRM’s card business enables a new way to unlock more growth potential, even beyond the existing ecosystem. As of Q2 2024, 77% of transactions done by AFRM users already occurred at retail POS / Point of Sale channels outside AFRM’s mobile app, website, or card channel.

Risk

Risk remains minimal to moderate, in my view. Though the management acknowledged its potential to improve RLTC / Revenue Less Transaction Cost in the Q2 earnings call, a lower interest rate environment can still be a mixed bag for AFRM, in my opinion. While they potentially boost revenue and lower costs by encouraging borrowing, the wider availability of low-interest loans across lenders, including its competitors, could potentially weaken the appeal of AFRM’s transparent 0% APR offer.

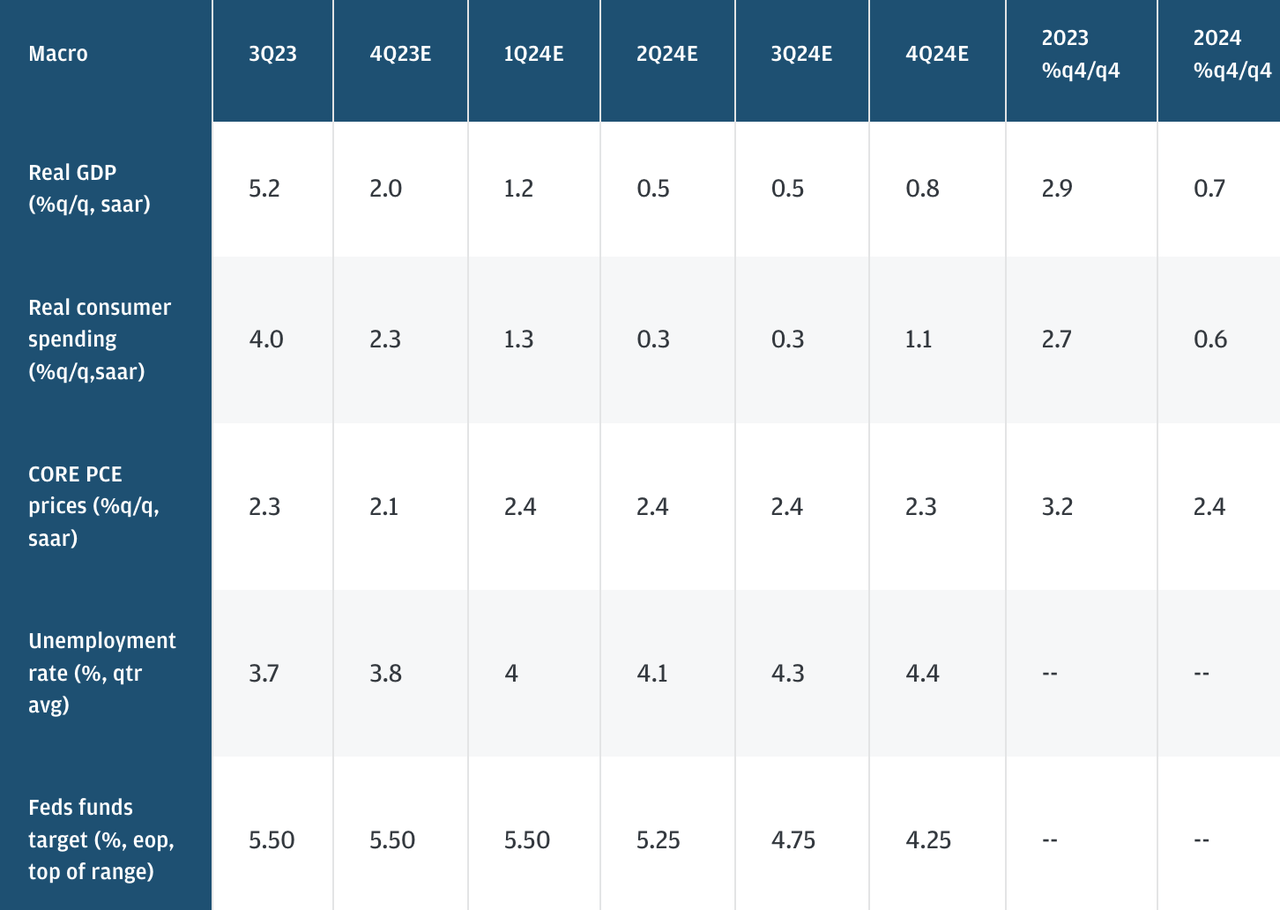

economic outlook 2024 (JPM)

Furthermore, I believe the potential slowdown in consumer spending in 2024 compared to 2023, according to JPM / JPMorgan’s report, could impact AFRM’s overall growth outlook. In my opinion, the negative impact could manifest in lower card usage and affiliate merchant transactions, effectively creating a more subdued outlook for Merchant and Card network revenues. In FY 2023, both businesses made up over 38% of AFRM’s revenue.

Though AFRM might have baked this into its seemingly conservative guidance upon a very strong Q2 beat, another thing that could also affect consumer spending levels is the Fed’s reluctance to cut rates in 2024. The news about the Fed being cautious around cutting rates came out just over a week ago, a few months after the JPM’s report, potentially in response to the seemingly sticky inflation in the US, AFRM’s main market. This means the JPM’s projection of lowered rates across the remainder of 2024 still appears a bit optimistic.

Valuation / Pricing

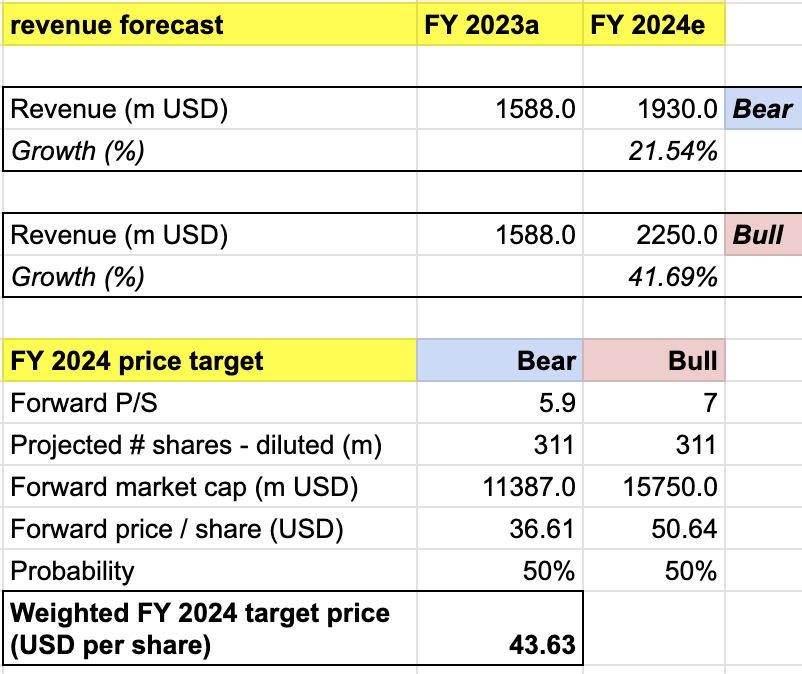

My target price for AFRM is driven by the following assumptions for the bull vs bear scenarios of the FY 2024 (year ending in June 2024) projection:

-

Bull scenario (50% probability) assumptions – AFRM to achieve FY 2024 revenue of $2.25 billion, a 42% growth, at the high end of the market’s guidance. I assign AFRM a forward P/S of 7x, an expansion from the current level. In this scenario, I expect AFRM to beat guidance in the next two quarters, with increased revenue growth due to more channel expansions.

-

Bear scenario (50% probability) assumptions – AFRM to deliver FY 2024 revenue of $1.93 billion, a 21.54% growth, lower than the market’s estimate. In this scenario, I would expect AFRM to see subdued revenue growth due to weaker consumer spending level, as a result of sticky inflation with no Fed rate cuts until June. I expect P/S to remain at 5.9x, which still factors in revenue growth acceleration from prior year with 21.5% growth, but also implies a slight correction or minimal price action from the current level.

price target (own analysis)

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of $43.6 per share, presenting a potential upside of 16% from the current level. I give the stock a buy rating.

Conclusion

AFRM, a “buy now, pay later” pioneer, offers a transparent and potentially interest-free alternative to credit cards. Despite a volatile past year, recent positive sentiment suggests growth potential. My buy rating with $43.6 price target is based on factors like strong customer retention, a promising new business segment, and stronger partnership development.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.