Summary:

- Affirm has lost more than 50% of its value in just over a month.

- The buy now, pay later firm reported strong growth across its core operating metrics for its last reported fiscal 2023 second quarter.

- Concerns from bears around net losses and cash flows are yet to be addressed but recent cost cuts should drive this down.

We Are

Affirm (NASDAQ:AFRM) is down by more than 50% from a near-term peak over the last 38 days as the market once again embraces angst and fear over rising Fed Funds rate and the potential contagion impacts of the SVB Financial Group (SIVB) collapse. It’s important to spell out this macro picture as returns this year will be dominated by inflation and the Fed Funds rate dynamic that has already eviscerated the valuation of the buy now, pay later firm. Affirm currently trades on a $3 billion market capitalization, a more than $40 billion negative difference from its November 2021 peak.

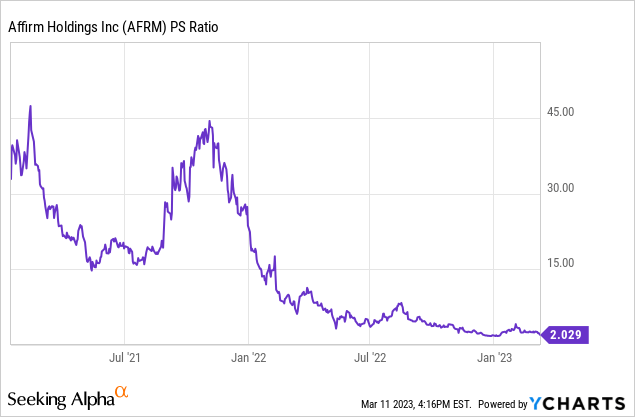

The long-term play here is that the valuation multiple as highlighted by a 2x trialling-12-month price-to-revenue ratio incorrectly and insufficiently reflects the core business operations of Affirm. Even against the gloom, bulls should still be happy about current growth with buy now, pay later demand strong against high inflation and its pressure on wages. My expectation is that the current near record-low PS ratio will recover once the torrid macroeconomic environment we’re in stabilizes.

Indeed, I won’t be paying more than 2x sales for a loss-making business facing interest rate risk. But, and perhaps my most critical point, the current sales multiple is cognizant of inherently temporary macro-level risks. Is Powell still going to be talking about potentially pushing a 50 basis points interest rate hike two years from now? Perhaps. But it’s unlikely. To be clear, assuming zero revenue growth for the next two years, Affirm’s common shares should see a recovery of their value from $10.37 per share. However, a core part of being a bull is awareness of the bearish perspective. Affirm has 20.5% of its share float being sold short with bears flagging competition and rising cumulative net losses as reasons to go short.

Net Losses Ramp Up

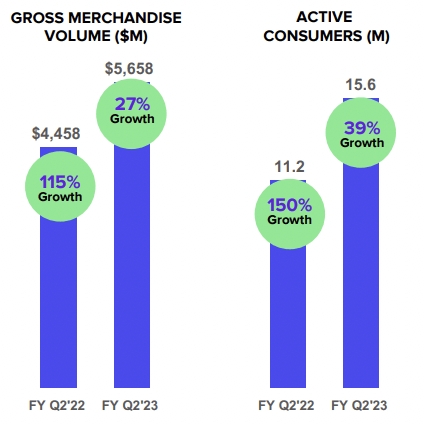

Affirm recently reported fiscal 2023 second quarter earnings that saw revenue come in at $400 million, a 10.8% increase over the year-ago comp but a miss by $16.33 million on consensus estimates. Growth was driven by a 27% year-over-year increase in gross merchandise volume to $5.66 billion from $4.46 billion. The company also added 4.4 million new active consumers to increase its total active consumers to 15.6 million.

Affirm

Gross profit during the quarter came in at $144.2 million, down from $183.6 million as the gross profit margin declined from 50.85% to 36.09%. This decline in profitability offset the revenue gains and meant the company recorded a net loss during the quarter of $322.4 million. This was up from $160 million in the year-ago quarter. Affirm makes its money from merchant fees and interest charged on what’s effectively the loans issued to active consumers.

Affirm

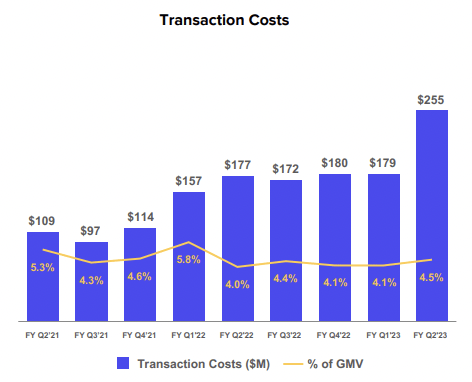

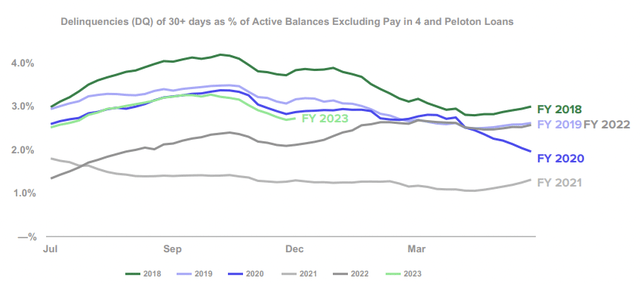

The company faces higher funding costs with transactions costs as a per cent of GMV creeping up to 4.5% during the quarter, up 40 basis points from the prior first quarter. Hence, underlying profitability could worsen against what’s a slowing of GMV growth momentum. This is especially acute as fiscal 2023 year-to-date delinquency rates are tracking higher than the prior two years.

Affirm

Competition Is Getting Heavier

The financials leave more to be desired with cash burn from operations as of the end of the second quarter coming in at $28.5 million. However, this was a decline from $440 million in the year-ago comp with the headline net loss mainly comprised of non-cash items including stock-based compensation of $120 million.

Apple’s (AAPL) imminent entry into the buy now, pay later industry with Apple Pay Later complicates the longer-term play. Apple’s new service will allow millions of Apple Pay users to split the cost of their purchase into four equal payments spread across six weeks and with no interest or fees charged to them. No one wants to compete against Apple and Affirm could find itself in a position where its overall pricing power is somewhat eroded as per its ability to push higher merchant fees and charge higher APR rates. The risk here is that revenue goes into decline as net losses ramp up and cash burn remains entrenched. In this negative growth scenario, the price-to-sales multiple might actually decline further.

With cash and equivalents of $1.6 billion as of the end of the second quarter, Affirm has enough liquidity against its current quarterly burn rate to maintain operations for years. This is critical against capital markets starved of liquidity by a hawkish Fed and the specter of a recession. The company is also pushing through with laying off 19% of its employee base. Affirm needs to improve core profitability against what could be a further slowdown in revenue growth. I think the most likely near-term move for its common shares will be driven by contagion fears around the Silicon Valley Bank collapse and the potential second and third order consequences. I remain long against all this chaos with a view that net losses will be addressed and the current near-record low sentiment will eventually recover even against future earnings still showing net losses.

Disclosure: I/we have a beneficial long position in the shares of AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.