Summary:

- Affirm Holdings Inc. offers a unique value proposition in the buy-now-pay-later market, with a recent partnership with Amazon expected to boost transaction volume and revenue growth.

- AFRM faces challenges from competitors and inconsistent financial performance, but its commitment to customer service and innovation may help it navigate these obstacles.

- Affirm’s stock may be a promising addition to investors’ portfolios looking for exposure to the rapidly growing fintech sector, but its ability to turn growth strategy into sustainable profitability will be crucial for long-term success.

I going to make a greatest artwork as I can, by my head, my hand and by my mind.

Introduction

Affirm Holdings Inc. (NASDAQ:AFRM) is a financial technology company that offers a platform for consumers to pay for items in fixed monthly installments. The company has recently made headlines due to many key developments that could potentially drive its stock price higher. The company’s unique value proposition, coupled with positive analyst ratings, makes it a compelling buy in the burgeoning buy-now-pay-later market. The partnership with Amazon, a global e-commerce giant, is expected to significantly boost Affirm’s transaction volume, driving revenue growth and potentially leading to a surge in its stock price.

While the competitive landscape and the company’s inconsistent financial performance pose certain risks, Affirm’s continuous innovation and commitment to superior customer service are key strengths that could help it navigate these challenges. Investors looking for exposure to the rapidly growing fintech sector may find Affirm’s stock a promising addition to their portfolio.

Yahoo Finance

Company Overview

Affirm was founded in 2012 by Max Levchin, a co-founder of PayPal. The company’s mission is to provide honest financial products that improve lives. Affirm allows consumers to pay for purchases over time with simple, transparent terms and no hidden fees. As of 2023, the company has partnerships with over 6,500 merchants, including major players like Walmart and Shopify.

Industry Overview

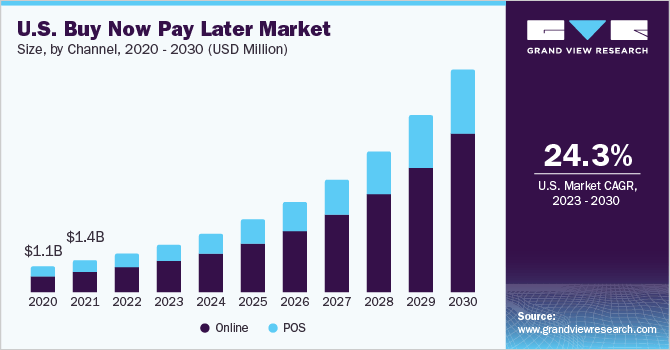

The buy now, pay later (BNPL) industry, where Affirm operates, is rapidly expanding. The industry’s expansion has been spurred by a shift in customer preferences away from traditional credit cards and toward more flexible payment methods, particularly among younger consumers. The global BNPL market is estimated to be worth $3.9 trillion by 2028, expanding at a 24.3% CAGR from 2021.

Grand View Research

Competitive Analysis

While the competitive BNPL scene presents difficulties with competitors such as Afterpay and Klarna innovating and forging alliances, and traditional financial institutions mulling entry into the BNPL industry, Affirm distinguishes itself in the crowded BNPL market by committing to transparency and a customer-centric approach. Unlike many competitors, Affirm does not impose late fees and gives upfront payment certainty, which appeals to consumers who are afraid of hidden fees. Furthermore, Affirm provides flexible payment schedules, letting clients choose terms that fit their budget, making it more appealing to individuals who need to spread the expense of large purchases.

Financials

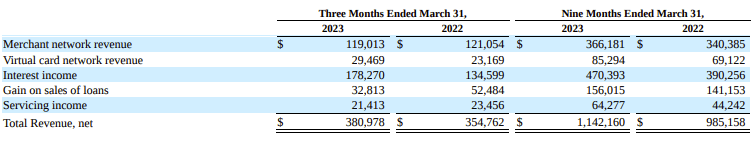

As of the end of the third quarter of fiscal year 2023, Affirm reported total assets of $7.51 billion and equity of $2.51 billion. The liabilities of the corporation totaled $4.99 billion. In terms of earnings, Affirm earned $380.98 million in sales for the quarter. The company did, however, report a net loss of$205.67 million, indicating the difficulties of operating in the competitive BNPL area. The company’s operational expenses were $691.01 million, well exceeding its revenues. According to Affirm’s cash flow statement, the company had a net cash outflow of $483.3 million during the quarter, with significant withdrawals from both investing and financing activities. These financials reflect the company’s ambitious growth investment, which has yet to result in profitability.

Affirm Holdings Inc. 10-Q

Key Catalyst

The expansion of Affirm’s partnership with Amazon presents several key catalysts that could drive the company’s growth and stock price. Firstly, the partnership provides Affirm with access to a wealth of consumer data. This data can be leveraged to refine Affirm’s credit risk models and offer personalized services, potentially reducing default rates and increasing customer satisfaction.

Secondly, Amazon has a vast product range that caters to a wide variety of consumer needs, from books and electronics to groceries and clothing. This extensive product range allows Affirm to cater to a diverse customer base, including those making large purchases.

Thirdly, the partnership with Amazon, a globally recognized brand, could enhance Affirm’s reputation and competitive standing. This endorsement could deter other e-commerce giants from developing their own BNPL services, thereby securing Affirm’s market share in the foreseeable future.

The potential for data-driven innovation, market expansion, and enhanced competitive advantage presents significant growth opportunities for Affirm. These factors, combined with Affirm’s ongoing efforts to manage costs and improve operational efficiency, as seen by the 19% layoff in February, could drive further upside for investors and propel the company’s stock price higher.

Valuation

Affirm’s valuation presents a complex picture. The corporation has a market capitalization of almost $5 billion as of June 2023. Given its current revenue run rate, this suggests a P/S ratio of about 20x, which is high in comparison to traditional financial institutions but not uncommon for fast-growing fintech firms.

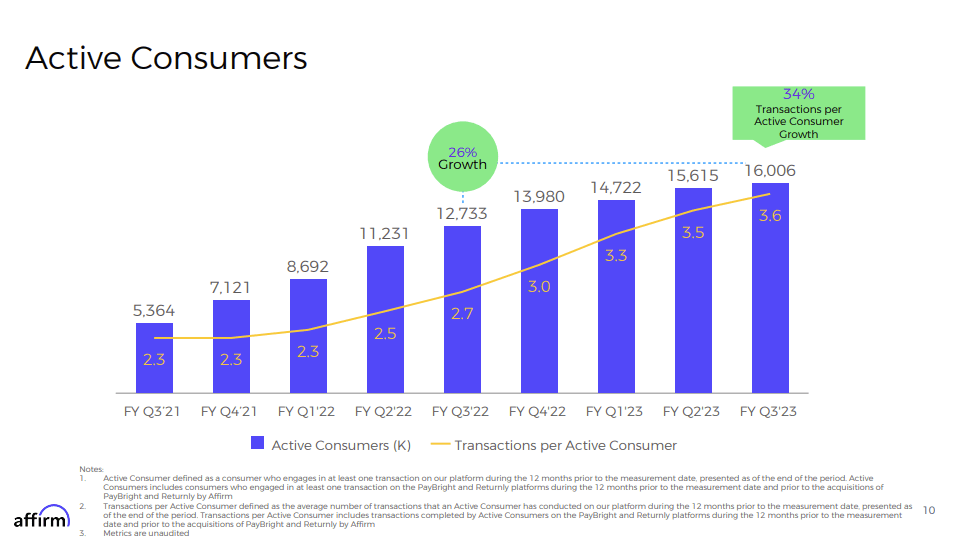

However, it is vital to note that Affirm is not yet profitable, therefore valuation metrics such as the P/E ratio are inapplicable. Instead, investors should look at growth measures. The company’s consumer base has been rapidly increasing, with a growth rate of 34% since Q3 2022.

Affirm FY Q3 2023 Presentation

ESG

Affirm is partnering with CodeGreen, a comprehensive sustainability initiative, to evaluate its carbon footprint and set ambitious targets to lessen its environmental impact. Affirm gathers carbon emissions data in order to establish a baseline of its impact and find areas for improvement. In addition, the company provides events and volunteer opportunities to involve its employees in its sustainability efforts.

Risks

To begin with, the BNPL business is highly competitive, with several participants, like Afterpay, Klarna, and traditional credit card firms, potentially introducing their own services. The capacity of Affirm to keep its competitive edge is critical to its success. Second, Affirm’s business strategy is based on consumer spending, which is susceptible to economic downturns. During a recession, consumers may reduce their spending, resulting in a fall in the company’s sales. Third, regulatory concerns are a major issue. Because the BNPL business is still in its early stages, it may face more scrutiny and regulation. Any changes in laws or regulations affecting Affirm’s operations can have a detrimental impact on the company. Finally, creating alliances with retailers is part of the company’s growth plan. Affirm’s growth may be hampered if it is unable to maintain existing partnerships or form new ones.

Conclusion

In conclusion, Affirm Holdings Inc. represents an appealing investment opportunity in the fast expanding BNPL industry. With its extended collaboration with Amazon, commitment to customer transparency, and flexible payment alternatives, the company is well positioned to profit on the shift in consumer preferences away from traditional credit cards. However, the company’s current financial performance and the competitive nature of the BNPL industry pose significant challenges. Affirm’s ability to navigate these challenges and turn its aggressive growth strategy into sustainable profitability will be key to its long-term success.

Analyst Recommendation By: Tiancheng Hu

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.