Summary:

- Affirm is a leading Buy Now, Pay Later company benefiting from growing product adoption and revenue growth.

- Despite not being profitable yet, Affirm has long-term potential with a moderate risk profile for investors.

- Affirm’s valuation appears high when compared to other Fintech companies like Block and PayPal.

- Operating income and GAAP profitability would be inflection points and could trigger a rating upgrade.

Cn0ra

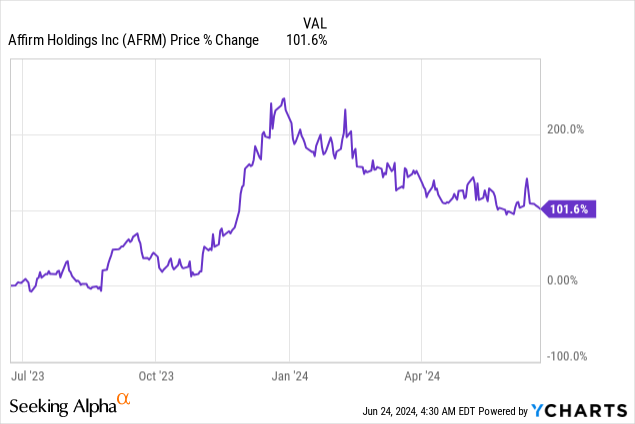

Affirm (NASDAQ:AFRM) focuses on offering customers tailored, short-term financing solutions with a high degree of transparency. The Fintech is a leading Buy Now, Pay Later (BNPL) company in the industry and benefits from growing product adoption, especially in the Millennial and Gen Z customer cohorts, and is seeing strong revenue and transaction per account growth as a result. Although Affirm is not yet profitable on either an operating income or net income basis, I believe the Fintech has long-term potential. Shares are not especially cheap, however, and since the Federal Reserve recently walked back earlier comments of up to three rate cuts in FY 2024, I believe Affirm is a solid hold here!

Growing customer base, tailwinds for product adoption and rising transactions per account

Affirm provides short-term financings solutions to consumers on an installment base. Consumers buy products online, or in store, and can opt for a straightforward, installment plan that lays out exactly how much they are going to pay for an instant purchase. The value proposition for Affirm especially is that it provides a transparent financing solution to consumers. Buy Now, Pay Later has surged as a leading source of new credit origination in the last couple of years, with the pandemic providing crucial tailwinds and fostering product acceptance.

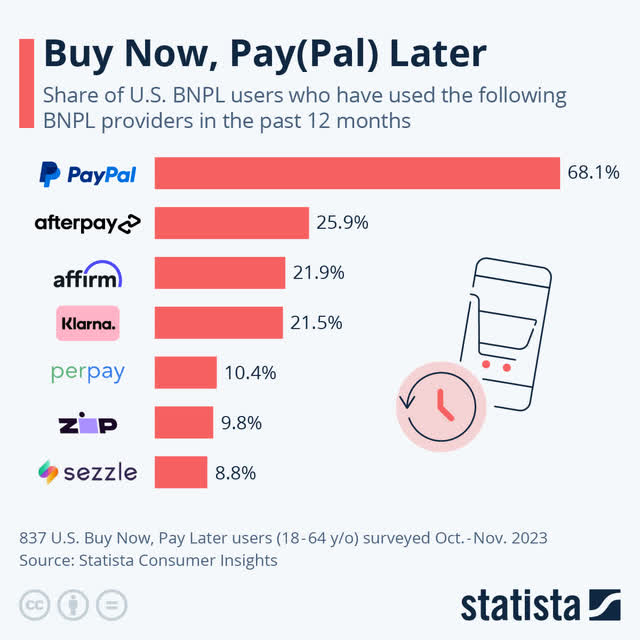

PayPal (PYPL) is most heavily associated with BNPL products, interestingly, which likely relates to the wide availability of the network’s payment processing capabilities. Affirm, Klarna and Afterpay — which was acquired by Fintech Block in FY 2022 — are other big players in the BNPL market.

Statista

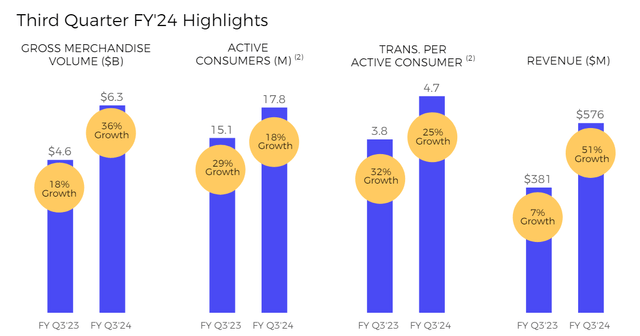

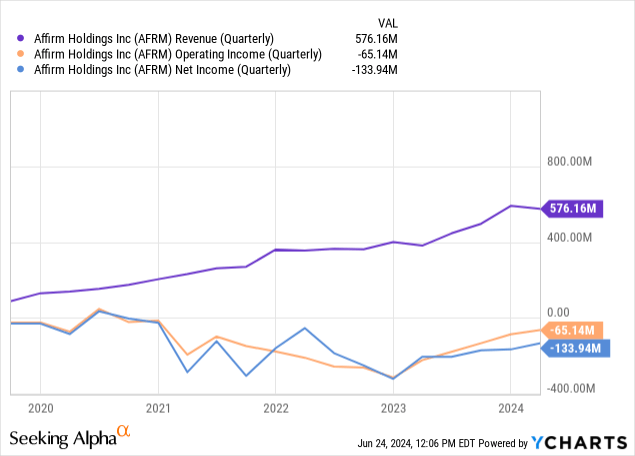

Affirm has seen a bit of slowdown in its business after the pandemic, but the Fintech is still growing quickly. In the third fiscal quarter (which is the March quarter), Affirm generated revenues of $576M, showing 51% year-over-year growth. This growth has been driven by two factors: 1) More customers are using the company’s Buy Now, Pay Later product, and 2) Customers tend to increase their transactions over time.

According to Affirm’s third fiscal earnings report, 17.8M customers were classified as active — meaning they conducted at least one transaction in the last twelve months — showing 18% year-over-year growth. More importantly, transactions per active customer increased 25% year over year to 4.7M. These two trends, growing customers and higher average transaction volumes per account are driving Affirm’s revenue growth.

Affirm

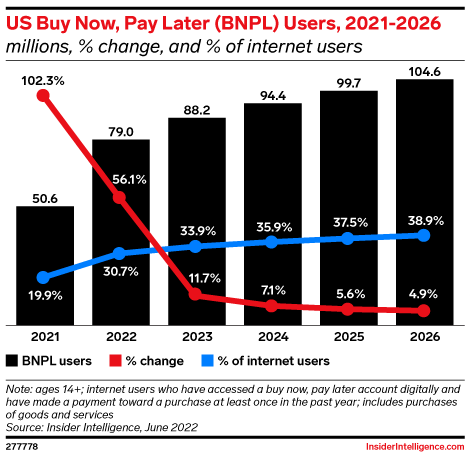

The amount of BNPL users is expected to grow in the future, with Millennials and Gen Z being especially open to give Buy Now, Pay Later products a shot. While the overall growth in the BNPL market is expected to slow, due to saturation and increasing competition of Fintechs that are competing for a piece of the BNPL pie, the BNPL user count is projected to surpass 100M in the near future (FY 2026).

eMarketer

Despite this solid growth in the top line, the Fintech is not yet profitable, which is something that I feel would be necessary to justify a buy rating here. Affirm is not profitable on an operating income or net income basis. In Q1’24, the Fintech lost $134M, which translates to about 23 cent lost for every dollar brought in terms of revenues.

These metrics would have to improve considerably before I would be comfortable with an upgrade to buy. According to Seeking Alpha-provided consensus estimates, the Fintech is not expected to be profitable in the next three years. What could potentially accelerate the company’s path to profitability is a fast decline in the Federal Funds rate (which is not very likely, in my opinion). The Federal Reserve only recently walked back its comments from last year when it said that it was evaluating to cut the Federal Funds rate up to three times in FY 2024. Lower Federal Funds rates would likely be a catalyst for stronger demand for BNPL-like, short-term credit offers and therefore help Affirm’s top line growth.

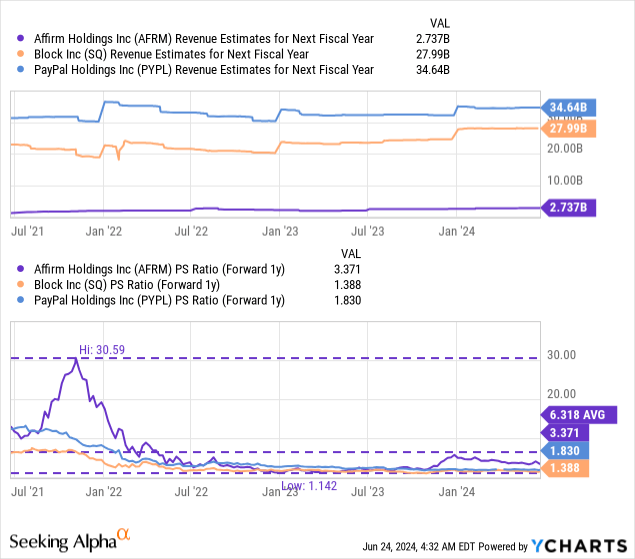

Affirm’s valuation

Affirm is currently valued at a price-to-revenue ratio of 3.4X, based off of FY 2025 revenues. The Fintech is widely expected to grow its revenues in the double-digits next year (+20%) as the Fed’s rate pivot should provide some tailwinds for Affirm’s credit demand. Affirm may be compared against other Fintechs, like Block — which acquired Afterpay in FY 2022 for $29B. Klarna, a Swedish Fintech company, is not publicly-traded and PayPal has moved into the BNPL space as well lately and is as reasonable rival to consider for valuation comparison purposes.

Block is trading at a P/S ratio of 1.40X and is not that highly valued in comparison, although the Fintech has had quite a bit of success with its Cash App and its Cash App card (not coincidentally, this growth is also driven by Millennials and Gen Z). PayPal has a P/S ratio of 1.8X and provides deep value, in my opinion, mainly because the Fintech, is enormously free cash flow-profitable, despite dealing with account retention issues.

Affirm may have good prospects for top line growth in a falling-rate world, but currently, given today’s business setup, shares are not that appealing from a valuation or risk profile point of view, in my opinion. While shares of Affirm have been more highly valued in the past — Affirm has a 3-year average P/S ratio of 6.3X — I believe only when the Fintech has improved its profitability situation, are shares worthy of a 3.3X P/S ratio.

I would be willing to pay 2.5X forward revenues for Affirm, given its long-term potential in the BNPL market and because Affirm struck a partnership with Amazon (AMZN) last year that allowed the Fintech to bring its BNPL offer to the Amazon Business’ checkout page. This deal will not only add transactions to Affirm’s business, but also make the Fintech’s brand name more recognizable over time. With a 2.5X P/S ratio, Affirm has a fair value in the neighborhood of $25, but I would be willing to revisit this number under the condition that the Fintech achieves GAAP profitability.

Risks with Affirm

Affirm is an interest rate-sensitive Fintech that has a much higher chance of making money when interest rates are lower and consumers are demanding more credit. In a high-rate world, it is harder for Affirm to make money. The current trajectory of persistent net losses is a concern to me, but I would be willing to change my opinion on Affirm and my rating on the shares if the Fintech were to achieve a crucial inflection point: GAAP profitability.

Final thoughts

The Fintech’s shares are a hold here, chiefly because of the long-term growth opportunity in the BNPL market. Rising product acceptance and BNPL adoption are driven mainly by Millennials and Gen Z. The Federal Reserve is not lowering its Federal Funds rate much in the near term. Therefore, investors may have to wait a couple of quarters until the Fed finally pivots and provides a catalyst for accelerating top line growth for Affirm. The Fintech is not profitable yet, but I would be willing to reconsider my rating on Affirm if the Fintech achieves milestone events, such as reaching operating income or GAAP profitability. Right now, I believe shares are slightly overvalued, but I have decided on a hold rating given the attractive prospects for BNPL market expansion in the next couple of years!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, SQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.