Summary:

- Affirm Holdings, Inc.’s business model has improved, leading to a surge in stock value, but the market is too bullish.

- The company has announced big deals in the Buy Now, Pay Later space, but investors should be cautious as large retailers don’t like to give up profits.

- Affirm Holdings’ revenue less transaction costs is expected to slump in the December quarter, and the company faces challenges in matching gross revenue growth with bottom line numbers.

- Affirm stock is too expensive at over 15x net revenues considering the limited profits.

Mohd Azrin/iStock via Getty Images

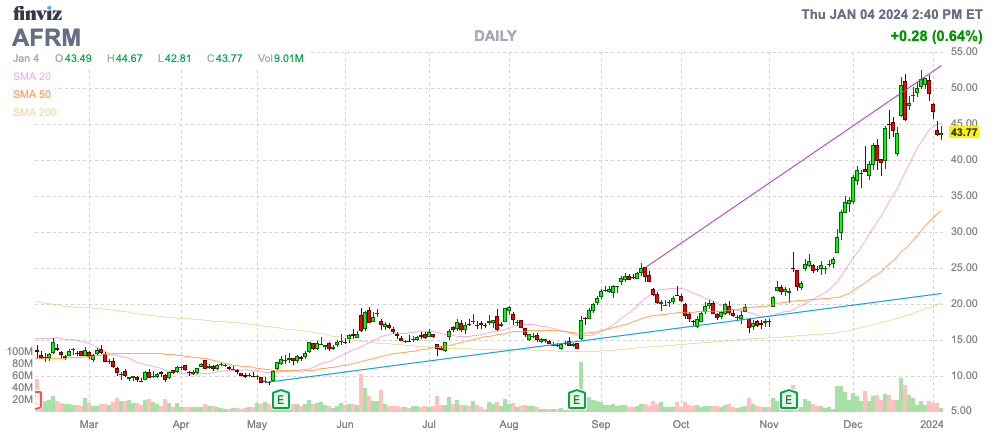

Affirm Holdings, Inc. (NASDAQ:AFRM) has seen the business model improving heading into the stock surge during the last couple of months of 2023. The market appears to have gotten far too bullish on the investment story due to the addition of a new large retailer. My investment thesis is more Bearish on the stock following the surge to over $40 now.

Source: Finviz

Big Deals

Affirm has announced some big deals in the buy now, pay later (“BNPL”) space, but investors should always have raised eyebrows on these deals. Large retailers like Amazon.com, Inc. (AMZN) and Walmart Inc. (WMT) don’t necessarily choose partners in order to watch profits walk out the door.

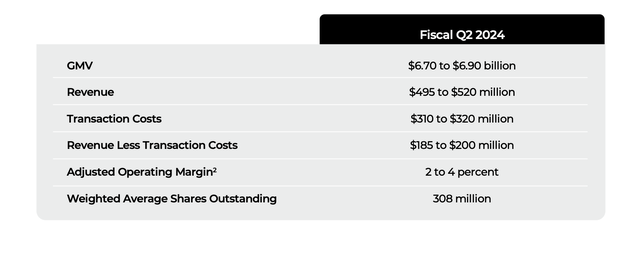

The fintech guided to FQ2’24 revenue in the $500+ million range for strong growth approaching 30%, with consensus estimates up at $518 million. The problem is that revenue less transaction costs (RLTC) are expected to slump to $200 million, or below, in the December quarter.

Source: Affirm FQ2’24 shareholder letter

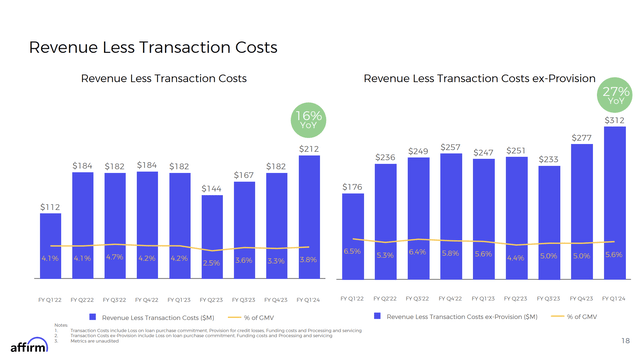

The problem facing Affirm is that this key category isn’t exactly growing to match the gross revenues. Affirm posted quarterly RLTC of ~$182 million for the last 2 years, and the current guidance has FQ2 headed back in that direction.

Source: Affirm FQ1’24 presentation

A big part of the problem is the ~$100 million in provisions costs in FQ1 due somewhat to the initial CECL charge. The provision charges are surging, with higher GMV leading to the net revenue metrics basically flatlining.

Affirm reported FQ1’24 RLTC of just 3.8% of GMV, down from 4.2% in the prior FQ1. The higher hidden transaction costs from funding to provisions aren’t reflected in the stock surging due to headline revenue growth.

Since announcing the FQ1’24 earnings report in early November, Affirm has announced expanded plans with self-checkout at Walmart stores and teamed up with Google Pay for more flexible options for shoppers. The fintech had just announced the additional BNPL option for business customers on Amazon prior to the quarterly report.

The company expects GMV to jump to $50 billion in the near term from a rate in the $25 billion range now. The stock appears to already factor in such growth.

Priced For GMV Growth

Affirm only has $800 million in RLTC with the stock now worth $13 billion. If the company hits the GMV target, the RLTC amount only hits up to $1.5 billion for a stock worth $13 billion already.

The fintech moving more into Walmart self-checkout could face higher delinquencies in the year ahead. The biggest risk is that more customers will be stretched in 2024, and a push into more BNPL transactions aren’t necessarily good for business.

The company only guided to a less than 5% adjusted operating margin for FQ2. With Affirm approaching $7 billion in GMV for the December quarter, the company is no longer a small operation with unlimited growth ahead. Affirm needs to start generating profits and prove the Amazon and Walmart deals are financially rewarding, not just positive for gross revenues.

Affirm has guided to FY24 shares outstanding of 311 million, with stock-based compensation expenses topping $112 million in FQ1 alone. The company won’t have an adjusted profit without excluding SBC.

In essence, Affirm isn’t profitable enough to cover non-cash compensation and, of course, risks exist for higher provision expenses in an actual recession. The BNPL business is more complicated than purely signing up new payment platforms driving growth. The dynamics of new deals may not be favorable to the company, and the costs might rise in order to acquire new customers leading to the current position where RLTC isn’t growing at a clip to match gross revenues.

Takeaway

The key investor takeaway is that Affirm Holdings, Inc. shares are not accurately priced based on the net revenues, which include substantial costs for funding BNPL loans and provisions for credit losses. The fintech still has a very small adjusted operating margin and investors should’ve used the recent rally to $50 to unload a stock once trading below $10 during 2023.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market starting 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.