Summary:

- Affirm reported impressive 48% revenue growth in FQ4 and recorded adjusted operating income of $150 million.

- The company has substantial catalysts in FY25 with digital wallets like Apple Pay and the expansion of use of the Affirm Card.

- The company aims for GAAP profitability by FQ4’25, a shift that may hinder stock performance due to market focus on meager GAAP metrics.

- Despite strong growth, Affirm’s stock may face valuation challenges, trading at 20x adjusted operating income but potentially viewed as expensive.

Ratana21/iStock via Getty Images

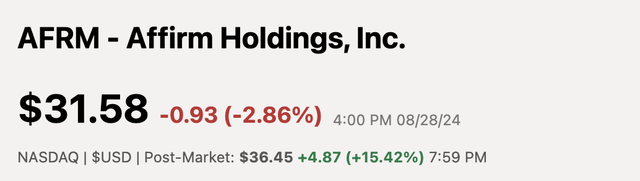

Affirm Holdings, Inc. (NASDAQ:AFRM) has always been an intriguing fintech due to the well known CEO in a crowded space. The biggest issue has always been paying the correct price for the opportunity in the buy now, pay later space. My investment thesis is more Neutral on the stock after the big jump in after-hours trading on excitement over earnings.

Source: Seeking Alpha

Impressive Growth

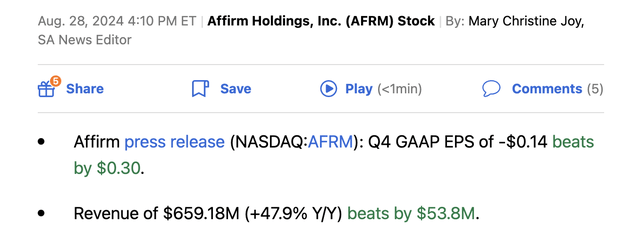

Affirm has really turned the business around with the fintech reporting a strong FQ4 as follows:

Source: Seeking Alpha

The company reported revenue surged past estimates hitting 48% growth in the quarter. Affirm has taken the BNPL concept to new heights and signed up digital wallets like Apple (AAPL) Pay to drive future growth due to the ability of Affirm to correctly price the simple, yet complex transactions.

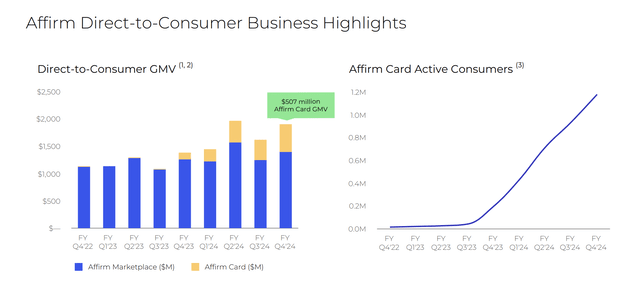

Apple had originally planned to offer their own product, but the tech giant quickly realized the best way to offer a BNPL solution was via the leading provider. In addition to the digital wallet business set to ramp up in FY25, the Affirm Card has long term growth potential with CEO Max Levchin targeting the average customer to ramp spending over time as presented on the FQ4’24 earnings call:

So the fact that we are driving this outsized gain just means that there’s a lot of work to do like the way we think about what’s going to happen to be a Affirm card, for example, right now, we’re on the order of $3,000 of annual spend. The right number from my point of view is $7,500 at least and on the order of 20 million active cards.

While not really sure whether 20 million consumers want an Affirm Card for a fintech tied to a BNPL product, Levchin clearly sees substantial upside to this business line. The CEO is predicting a 50% upside to the average card spend of 1.2 million active cards along with a more than 15x upside in the active card accounts.

Source: Affirm FQ4’24 presentation

For this reason, the company appears set to easily top the analyst estimates for revenues of $2.76 billion in FY25 for growth of 19%. The guidance is for GMV to hit $33.5 billion, up 26% from $26.6 billion.

The guidance is for revenue as a percentage of GMV to rise 10 bps from the 8.7% last year to reach 8.8%. Revenues would reach $2.95 billion, substantially above the consensus estimates heading into earnings while Levchin was clear these targets are a baseline with an easy hurdle, in part due to not factoring in material amounts for several digital wallet partnerships, like Apple Pay, yet to start.

GAAP Earnings Mistake

Affirm has spent the last couple of years pushing towards the company producing adjusted income in a very positive move for the fintech. Yet, the BNPL company has now turned around and wants investors to focus on turning GAAP profitable.

In our view, Affirm is making the same mistake as SoFi Technologies (SOFI) in allowing the market to focus on a different metric in a move that likely sets the stock back now. Management should most definitely have a goal of producing GAAP profits in as much as the number requires higher adjusted operating income.

In the shareholder letter to investors, Levchin immediately pointed out this goal shift to GAAP profits as follows:

It is therefore only appropriate that we set another public goal today: we intend and expect to be profitable on a GAAP basis in our fourth fiscal quarter, and plan to operate the business while maintaining GAAP profitability thereafter.

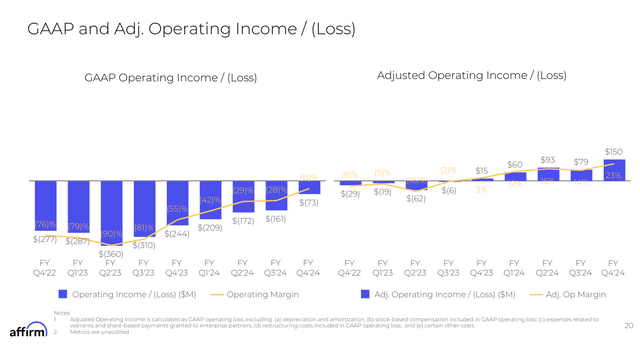

Affirm reported FQ4’24 operating income of $150 million and reached $381 million for FY24. The fintech guided towards adjusted opening income margins of nearly 20% in FY25 amounting to income of nearly $600 million based on revenue in the range of $3 billion.

Source: Affirm FQ4’24 presentation

In the case of SoFi, the fintech started pushing the GAAP profits goal in early 2023. The stock started the year at close to $7 and still trades in that range roughly 18 months later despite growing revenues consistently. The digital bank has even promoted a huge boost to GAAP EPS with a goal to reach $0.55 to $0.80 in 2026.

The mistake is that the market starts valuing the company based on GAAP earnings not adjusted earnings, which the company doesn’t even forecast until the end of FY25. In essence, Affirm won’t have a chance to reach annual GAAP profits until FY26 and the stock will have a premium PE multiple based on any EPS target below $0.36 (AH price) amounting to a 100x multiple.

Affirm only has an $11.5 billion market cap based on the after-hours close. The stock trades at 20x adjusted operating income, but the market is unfortunately going to shift to the GAAP profits metric and the stock is unlikely to rally further.

Takeaway

The key investor takeaway is that Affirm reported another strong quarter and the company is forecasting a very strong FY25 ahead. Unfortunately, the fintech shifted the market’s focus to GAAP profits and now a lot of market pundits will view Affirm as expensive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end August, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.