Summary:

- Affirm’s Q3 earnings showed revenue growth of 51% YoY and earnings turning positive with a margin of 14%, driven by operational efficiencies.

- During Q3, the company saw its active cardholders cross 1M, up 30% YoY, while active merchants grew 19% YoY as it drives innovation in its core products to improve conversion rates.

- The company set a target to reach $50B in GMV in the medium term by driving adoption of its Affirm Card, helping merchants win at checkout and expanding internationally.

- Although rising credit card delinquencies can spill over to the BNPL market, coupled with regulation risks, I believe the downside is likely priced in, making it a “buy”.

Sviatlana Zyhmantovich

Introduction & Investment Thesis

I initiated a “buy” rating on Affirm (NASDAQ:AFRM) on April 6th, where my investment thesis was predicated on my belief that the stock was attractively priced from a risk-reward perspective, given the management’s $50B Gross Merchandise Value (GMV) target in the medium term and its progress in scaling the adoption of its Affirm Card while onboarding new merchants on the platform through continuous product innovation and financial discipline.

Although the stock has declined another 7% since the time of my writing, underperforming the S&P 500, I maintain my “buy” thesis after analyzing its Q3 FY24 earnings report, where revenue grew 51% YoY and earnings turned positive from -$6M to $79M driven by operational efficiencies. For the full year FY24, the company expects to grow its revenues by 41% YoY to $2.25B while expanding its margins to 14.5%.

Although rising credit card delinquencies in the US can spill over to the BNPL market, which can adversely affect Affirm, especially if the US labor market further weakens, coupled with the possibility of growing regulation, I believe that long-term, the company is well positioned to drive growth towards its $50B GMV target given its ongoing progress in its strategic initiatives of deepening adoption of its Affirm card, helping merchants win at checkout, and expanding internationally.

Revisiting my valuation, I believe that the risk-reward remains attractive after the Q3 earnings report, given both the “bull” and the “bear” scenarios based on the management’s long-term operating model. As a result, I will maintain my “buy” rating at the moment, given the stock’s significant upside potential over a 4-5 year investment horizon.

The good: Affirm Cardholders crossed 1M users, Robust innovation to help merchants win at checkout, Expanding profitability

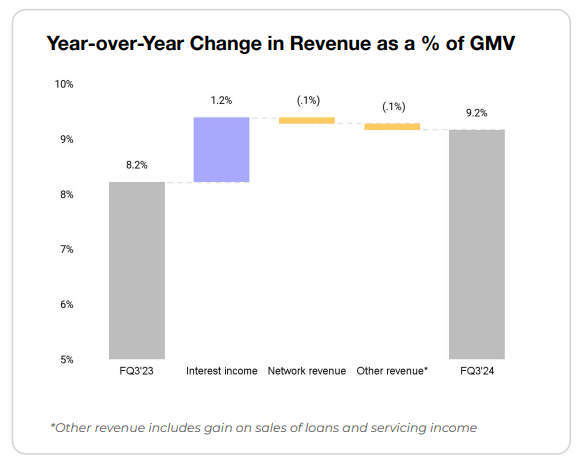

Affirm is a Buy Now, Pay Later (BNPL) platform that makes it easier for consumers to spend responsibly by offering the flexibility of payment options that include Pay Now, Pay in 4 and interest-bearing loans, while enabling merchants to convert and grow sales more effectively. The company reported its Q3 FY24 earnings, where it generated $576M in revenue, growing 51% YoY. During the quarter, GMV accelerated to $6.3B, with general merchandise and travel categories driving superior growth, leading to Revenue as a percentage of GMV growing 100 basis points YoY to 9.2%. However, this increase was entirely driven by a 120 basis point improvement in interest income as a result of higher interest rates and pricing initiatives.

Q3 FY24 Shareholder Letter: Revenue as a percentage of GMV by segments

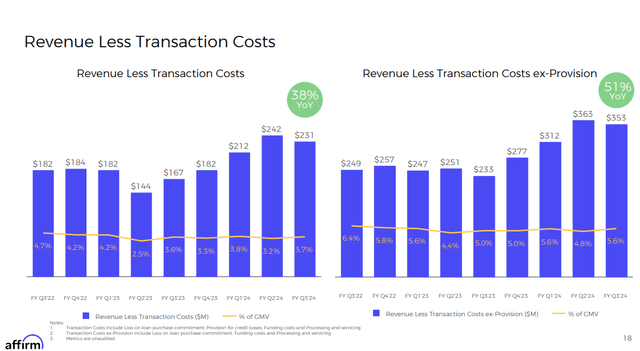

Meanwhile, Revenue Less Transaction Costs (RLTC) grew 38% YoY to $231M, as transaction costs increased by 90 basis points as a percentage of GMV due to higher funding costs and provisions for credit losses. The management is focused on anchoring its RLTC as a percentage of GMV between 3-4%, which I believe will be possible as the average cost of funds is stable with the majority of the funding debt already having absorbed the increase in the federal funds rate, assuming that the federal funds rate has peaked.

Q3 FY24 Earnings Supplement: Revenue Less Transaction Costs

In the previous post, I discussed the management’s medium-term goal of reaching $50B in GMV by driving 1) deeper adoption of its Affirm Card, 2) winning at checkout, and 3) expanding internationally. In this post, I will discuss the progress made by Affirm so far in its first two strategic priorities.

During its 2023 Investor Presentation, Affirm estimated its US total addressable market (TAM) at 240M credit card users. As of Q3, active Affirm cardholders have crossed 1M, up 30% YoY, with recent cohorts spending at a higher annual spend rate than user cohorts from the previous year, which I believe demonstrates improved engagement as Affirm continues to leverage its existing merchant partnerships to offer exclusive deals to more users while expanding the number of active merchants on its platform to 292,000, growing 19% YoY. One of the interesting trends was that Pay Now accounted for 10% of Affirm Card GMV, up from 5% in Q1 FY24, indicating that consumers are increasingly using the card for smaller-ticket, everyday purchases.

When it comes to its second strategy of “winning at checkout,” the company continues to attract new merchants given its superior underwriting, user experience, and product options, which leads to higher order values and repeat rates per customer. In fact, during the earnings call, the management discussed its innovations in some of its core products, which include Purchasing Power and Adaptive Checkout, which I believe will help drive GMV growth by improving checkout conversion coupled with improving underwriting capabilities based on consumers’ financial preferences and repayment trends.

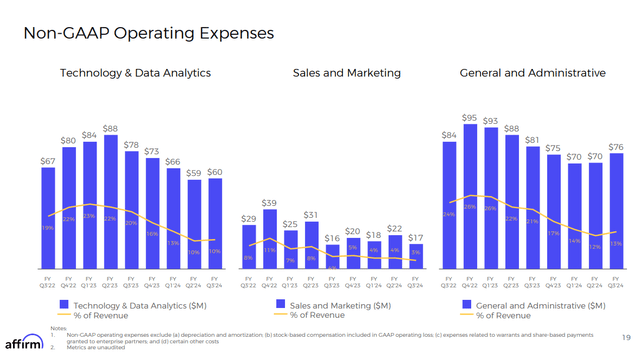

Shifting gears to profitability, Affirm generated $79M in Adjusted Operating income in Q3 FY24, up from a loss of -$6M in Q3 FY23, with a margin improvement of 1600 basis points YoY to 14%. This was driven by a YoY reduction of $85M in operating expenses excluding RLTC and a $64M increase in RLTC on a GAAP basis. Within operating expenses, we saw Affirm streamlining its spend on restructuring efforts, technology & data analytics and sales & marketing. In fact, the largest decline in operating expenses was observed in Technology & Data Analytics, where spending was reduced from 42% to 21% of Total Revenue, coupled with Sales & Marketing which also declined from 36% to 22% of Total Revenue. During the earnings call, the management also discussed some of the early results from testing their customer support AI assistant, where over 60% of customers served by the AI assistant did not require further human assistance, and I believe that as Affirm rolls it out more broadly, it will unlock operational efficiencies and improve the user experience by optimizing the time to solve customer queries on its platform.

Q3 FY24 Earnings Supplement: Improving operational efficiencies

The bad: Rising credit card delinquencies may spill over to the BNPL market, Increasing regulations may hamper the pace of product innovations

Although Affirm’s credit quality is stable as a result of their ongoing improvements in their underwriting process that have enabled them to reduce the charge-off rates for Pay in 4 loans, there is a risk that delinquencies can pick up, especially the longer the interest rates remain high coupled with a weakening in the US labor market. As per the Federal Reserve Bank of New York, credit card delinquencies have been rising above pre-pandemic levels, especially as interest payments on credit card loans grew steadily with the share of maxed-out credit card borrowers continuing to climb. Should we see a continuing weakening of the labor market, there is a probability that it will spill over into the BNPL market, thus putting pressure on Affirm’s mid-term GMV target of $50B, as well as higher costs in the form of write-offs and higher credit loss provisions.

Plus, given the rapid increase in BNPL loans, the Consumer Financial Protection Bureau declared on May 22nd that BNPL providers are required to provide consumers with legal protections and rights that apply to conventional credit cards that include the right to dispute charges and demand a refund from the lender after returning a product purchased with a BNPL loan, which I believe will bring consistency to the market. Although Affirm complies with refund and dispute requirements, I believe that greater regulation in the BNPL industry can curb the pace of innovation and market penetration of companies like Affirm to a certain extent.

Revisiting my valuation: Affirm’s risk-reward has further improved and the stock remains a “buy”

Looking forward, the company is expected to generate $6.75-$6.95B in Q4, or a total of $26.25B in FY24, which would represent a growth rate of 29% YoY, with revenue projected to grow 41% YoY to $2.25B. The management expects RLTC to remain at 3.7% of GMV while projecting to produce an Adjusted Operating Income of approximately $327M in FY24 with a margin of 14.5%, an improvement of over 1800 basis points YoY. I believe that Affirm will be able to achieve its target, led by growth across both network and interest income revenue, as Affirm continues to add net new cardholders and merchants on the platform while leveraging its product innovation to engage its customer cohorts and lead to higher conversion rates at checkout and order volumes for merchants.

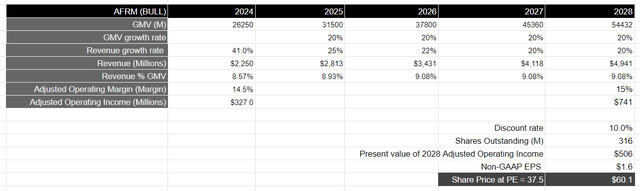

Over a longer time period, the management has set a GMV target of $50B, and assuming it can grow its GMV annually by 20% while maintaining a Revenue to GMV ratio of 8-9% (slightly higher than the management’s estimate of 6-8%), as Affirm sees the continued success of BNPL market penetration with more cardholders, merchants, and funders joining the network, coupled with international expansion, it should generate a total revenue of $4.9B by FY28. Assuming that the margins remain more or less anchored at current levels during this period of time, the company should generate approximately $740M in Adjusted Operating Income or an equivalent present value of $506M when discounted at 10%. Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period with a price-to-earnings ratio of 15–18, I believe that Affirm should trade at 2.5 times the multiple given the growth of its earnings during this period of time. This will result in a PE ratio of 37.5, or a price target of $60, which represents an upside of 100%.

Author’s Valuation Model: The bull case

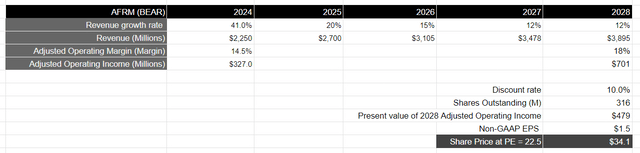

On the other hand, if Affirm comes under pressure from a weakening US economy leading to increasing delinquencies on its loans, coupled with rising regulation curbing the pace of innovation, it may not be able to reach its $50B GMV target, as cardholders will be attributing, the pace of adding new merchants will decline, and funding costs may increase. In this scenario, assuming that revenue grows at a slower pace in the mid- to high teens range, it should generate a total revenue of $3.8B by FY28, coupled with an Adjusted Operating Income of at least $700M, which would be equivalent to a present value of $479M when discounted at 10%. Assuming a PE ratio of 22, which is 1.5 times the multiple of the S&P 500, we arrive at a price target of $34, which represents an upside of 13%.

Author’s Valuation Model: The bear case

While there could be short-term volatility given the high beta nature of Affirm, especially with the PE ratio of the S&P 500 extended from its 5- and 10-year averages of 19.1 and 17.7, respectively, which could induce a sizable pullback in the index, I believe the risk-reward looks attractive to initiate a position in the company with a net upside of 87% over a 5-year investment horizon, making it a “buy”.

Conclusion

Despite the possibility of near-term volatility, I remain optimistic about the long-term prospects and positioning of Affirm in the BNPL market. I believe the company will continue to grow its user base of Affirm cardholders and increase the frequency of use of its BNPL products with continuous product innovation, while onboarding new merchants, partners, and funders on the network and further streamlining its operating expenses to unlock profitability. Given the risk-reward of the stock, I believe that it has the potential to drive long-term returns for investors, making it a “buy”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AFRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.