Summary:

- In 1Q25, AFRM continues to expand its market share to 34% and post strong revenue growth (+41% y/y). Additionally, the company estimated that overall GMV increased by 36% y/y.

- AFRM is making meaningful progress towards profitability. As a percentage of revenues, RLTC ex-provisions have improved substantially, while major expenses have declined.

- Valuation analysis based on price-to-sales and revenue growth suggests that the company is overvalued by more than 30%, making AFRM unattractive at this stage.

- Ultimately, AFRM is a highly volatile company (90% annualized volatility) with an extremely elevated beta of more than 3. Hence, investors should exercise caution and wait for a better entry point.

B4LLS

Introduction

Based on my analysis, Affirm (NASDAQ:AFRM) will continue to expand its market share and make meaningful progress towards profitability. However, my valuation analysis suggests that the company’s price is overvalued; there is a possibility that the company may correct in the short term. Moreover, this is a highly volatile company with high beta. In this report, I will demonstrate why investors should exercise caution and wait for a better entry point for AFRM.

Company Overview

AFRM is the largest buy now, pay later (“BNPL”) company in the United States. The company was founded in 2012 by Max Levchin, one of PayPal’s co-founder. Currently, the company employs around 2 thousand employees and has more than 19.5 million users and process more than $26 billion in transaction value per year.

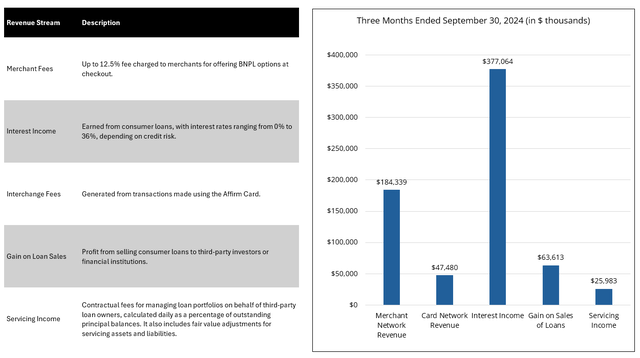

AFRM Business Model (Company Filings)

AFRM generates revenue through multiples streams. Currently, the company reports its revenue through the following segments: (1) Merchant Network Revenue, (2) Card Network Revenue, (3) Interest Income, (4) Gain on Sales of Loans, and (5) Servicing Income.

Latest Developments

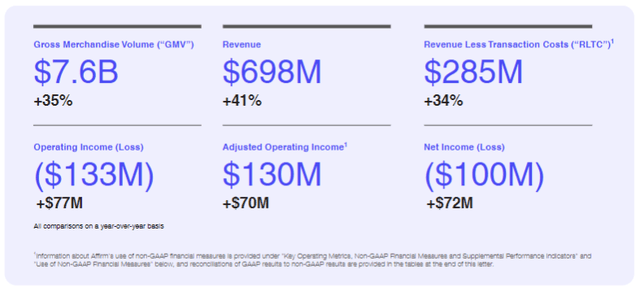

In 1Q25, AFRM process around $7.6 billion in gross merchandise volume, representing an increase of 35% year-on-year. The company posted strong revenue growth across all revenue streams; total net revenues came in at $698 million, up by 41% year-on-year. Overall margins improved due to relatively lower expenses. 1Q25 operating expenses as percentage of revenue improved to 118.97% as compared to 142.21% in the same period last year; net loss margin improved to -14.35% from -34.59% in the same period last year. AFRM expects to reach operating income profitability by 4Q25.

Performance Snapshot (Shareholder Letter)

AFRM Is Well Position To Continue Capitalizing On The Expanding Pay Later Market

Based on a recent study, the BNPL market continues to expand and gain popularity in the United States. According to Capital One, it is estimated that there are 93.3 million US consumers using BNPL, representing close to 28% of the country’s population. Each user is reported to have borrowed around $2,085 across all of their BNPL related purchase, while more than 50% of the users have more than three purchases under BNPL. Interestingly, the heaviest users of BNPL are those who are earning more than $75k per annum.

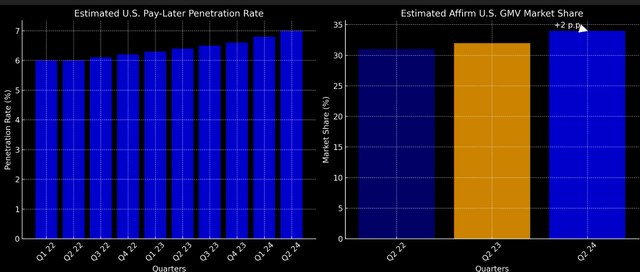

BNPL Penetration Rate & Market Share (AFRM Shareholder Letter)

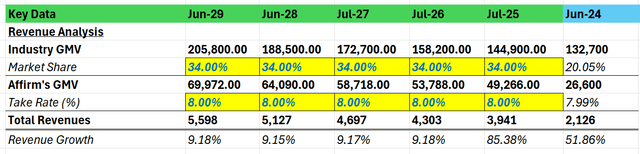

According to AFRM, the industry’s GMV as a percentage of e-commerce has increased by 1% to 7.4% for 2Q24. The company estimates that AFRM’s GMV accounts for around 34% of the industry’s entire GMV and half of the industry’s revenues. Looking ahead, Capital One expects Payment volume to continue surging; by 2029 the total GMV is estimated to expand to around $205.8 billion from $132 billion in 2024. Assuming that FY2025’s GMV is around $144.9 billion and AFRM is able to maintain its current market share of 34% and revenue take rate of about 8%, that would imply that for FY2025, the company’s revenue expands by close to 85%.

Revenue Analysis (Author’s Projections, Capital One)

Given that AFRM has recently launched multiple initiatives, there is a very strong likelihood that we will see revenues surprise us towards the upside. Recently, AFRM’s BNPL service went live on Apple Pay, allowing Apple users to spread their payment. Apart from that, the company launched it service across another 20k merchants, providing more choices for consumers to pay later. Moreover, AFRM had also expanded into the UK market. Although all of these initiatives are still in the early stages, they are poised to contribute to the company’s topline over time.

AFRM Is Demonstrating Progress Towards Achieving Profitability

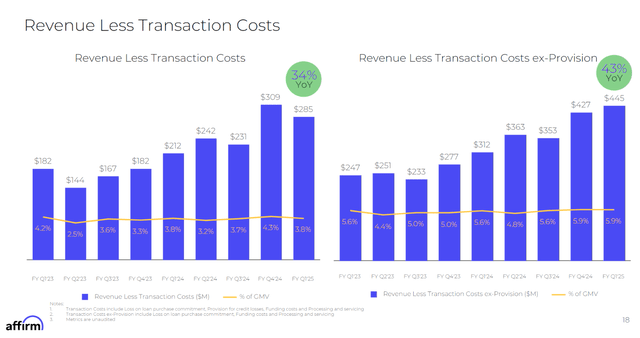

Overall, AFRM is making strong progress in improving its margins. Revenue Less Transaction Costs ex-Provision (RLTC ex-Provision) continue inching towards the upside. For 1Q25, RLTC ex-Provision stands at 5.9% as compared to 5.6% in the same period last year; from an absolute perspective, RLTC ex-Provision surged by 43% year-on-year. All of these suggest that AFRM has a stronger bargaining position, accelerating its path towards profitability.

Revenue Less Transaction Costs (Earnings Presentation)

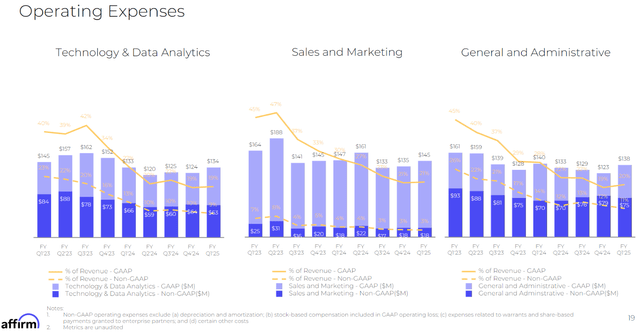

AFRM is not only improving its RLTC; in fact, AFRM is showing meaningful progress in its operating efficiency, expanding its operating margin. From a non-GAAP basis, all major operating expense items have declined as a percentage of revenues. As compared to a year ago, technology & data analytics spending and sales & marketing spending have declined by 100 bps. General & administrative spending declined by 300 bps from 14% to 11%. AFRM posted a 19% operating margin for 1Q25, as compared to 12% in 1Q24. Looking forward, AFRM expects to achieve operating income profitability by 4Q25 on a GAAP basis. Currently, AFRM’s management believes that there are still more operating leverage and is confident to further grow their margins.

Operating Expenses (Earnings Presentation)

Other Related Risks

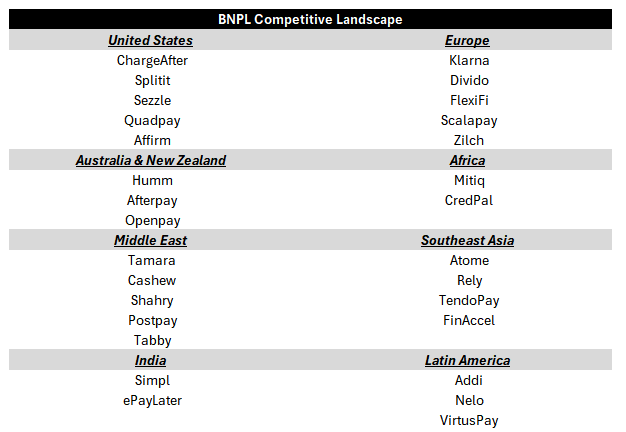

It is important to note that the BNPL is an extremely competitive market. Although AFRM is trying to expand internationally, there are already a lot of players around the world. Many of these players have already established market dominance locally; hence, there is a possibility that AFRM face a lot of challenges in relation to its international ambitions. I fear that AFRM’s path to profitability may be affected if its UK expansion requires substantial customer acquisition related expenses.

Other Competitors (Author’s Illustration)

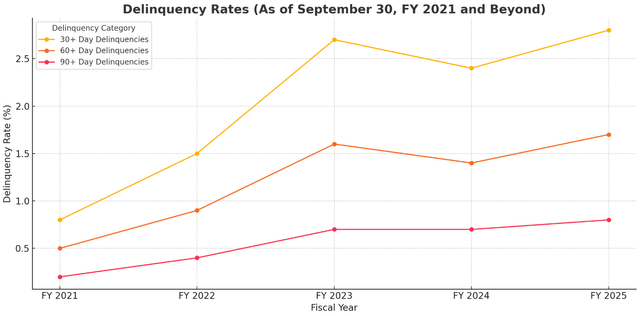

Investors should also know that the company’s delinquencies have been showing slight signs of deterioration. This is not surprising as consumer’s sentiment remains relatively deteriorated. However, there might be other consumer related headwinds in 2025, such as the potential inflationary effects from Trump’s tariffs. If consumers are further pressured, there is a likelihood that these delinquency rates will increase as well.

Delinquency Rates (Earnings Presentation)

Valuation Analysis Suggests That AFRM’s Potential Has Been Priced In

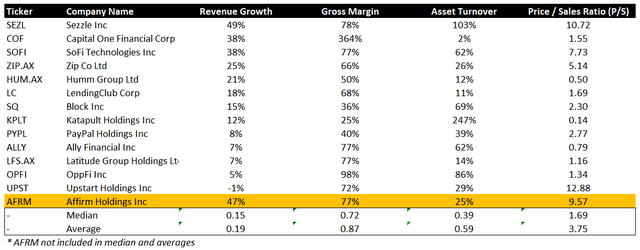

Since AFRM is still posting operating losses on a GAAP basis, we can only use price-to-sales to value the company. AFRM is trading at a price-to-sales ratio of 9.57x, which is relatively high as compared to the entire industry. However, that is still justifiable given that the company’s revenue growth outperformed almost all of the other companies in the set.

Comps Analysis (Company Filings, ValueInvesting.io)

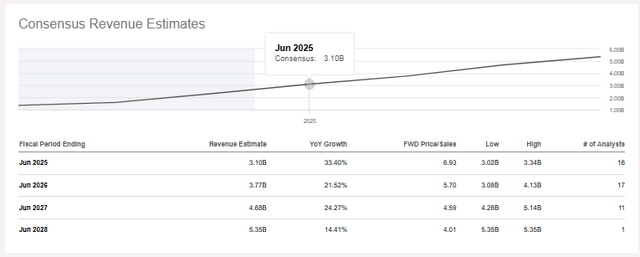

Based on the current data, for every 1% of revenue growth, the market is pricing in an average price-to-sales multiple of 0.16x. Since market participants are expecting AFRM to post $3.1 billion in revenues for FY2025, that will represent an expected year-on-year growth of 33.40%; Hence, a price-to-sales multiple of 5.34x (33.40 * 0.16x) will be reasonable. Unfortunately, utilizing a 5.34x multiple on the AFRM’s revenue of $3.1 billion suggests that the company’s market capitalization should be approximately $16.55 billion. Currently, AFRM’s market cap is $22.46, indicating that the company is overvalued by more than 30%.

Consensus Estimates (Seeking Alpha)

Closing Remarks

It is clear that AFRM is firing on all cylinders. I have no doubt that the company will be able to achieve profitability on time. Unfortunately, at this time, it seems that market participants have already priced in the company’s potential. Based on my valuation analysis, the company is overvalued by more than 30%, making it an unattractive investment. Moreover, AFRM is an extremely highly volatile company. It currently has an annualized volatility of more than 90% and a beta of more than 3x. Hence, there is a very high chance that investors can find a better entry point. At this stage, investors should exercise caution and wait for a correction before jumping onto AFRM.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AFRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.