Summary:

- AFRM’s exclusive BNPL partnership with AMZN is ending soon by January 2023, with no extension announced yet.

- It is also possible that WMT may launch its fintech venture, One, as a new competitor in the overly crowded BNPL space.

- While AFRM may still hold the leading US market share, the company remains unprofitable with massive SBC expenses and stock warrants.

- With market analysts expecting AFRM to deliver EPS of -$1.75 by FY2025, it is unsurprising that the stock continues to boast an elevated short interest of 14.14%.

nicolas_/E+ via Getty Images

Affirm May Lose Its Leading Market Share Soon

Affirm Holdings (NASDAQ:AFRM) may have announced its partnership with Amazon (AMZN) with a big bang in August 2021, especially boosted by the upgrade to an exclusive BNPL service provider through January 2023. The former’s payment platform has been similarly embedded in Amazon Pay’s US digital wallet since then, suggesting its massive exposure to the e-commerce giant’s Prime members.

This matters, since AMZN remains the leading player in the US e-commerce market, with 37.8% of the market share in June 2022. Notably, the company boasts 163.5M of US Prime members as of 2022, with a subscription fee of $14.99 monthly or $139 annually. Despite the supposed tightened discretionary spending over the past few quarters, more US consumers were choosing Amazon Prime at a rate of 77% by mid-2022, compared to 68% in 2021, and 69% prefer browsing the e-commerce platform over only 54% in 2021. 90% of its consumer stickiness is also attributed to the company’s attractive Prime Day discounts and free two-day shipping facilities.

With AFRM looking to aggressively expand its user base and Gross Merchandise Volume [GMV], it is no wonder that it has been generous with AMZN, giving the latter two tranches of warrants. To date, $281M of expenses had been recorded attributed to the e-commerce giant. Interestingly, the BNPL company expects to realize up to $133.5M of economic benefit over the 3.2-years of the commercial agreement. Assuming so, we are looking at an approximate partnership expiry by the end of 2024, if not further extended.

Based on these terms, AFRM may likely remain a long-term BNPL partner to the e-commerce giant, though it remains to be seen if the exclusivity may be extended from January 2023 onwards. Assuming not, we may see a notable headwind in its forward growth and consumer onboarding, despite its early successes thus far.

In the meantime, AFRM’s partnership with Walmart (WMT) looks shaky as well, with the latter’s fintech venture, One, reportedly offering a similar BNPL service through the retailer by 2023 onwards. This is on top of the previous banking accounts offered to the retailer’s 1.7M employees since October 2022. For now, WMT only reports a minimal ~12% e-commerce contribution to the US-based revenues of $412.1B over the LTM. However, the number has been notably growing by leaps and bounds compared to the ~5% reported in 2019. In addition, since AFRM users spent the most at WMT and AMZN during the recent Black Friday/Cyber Monday in 2022, it is evident that One’s BNPL may cannibalize AFRM’s business moving forward.

Meanwhile, since the announcement of AFRM’s multiple partnerships, including Peloton (PTON), Shopify (SHOP), Booking (BKNG), among others, the company has recorded excellent growth in GMV by 62% YoY to $4.38B in FQ1’23. Active consumers have naturally increased by 69% YoY to 14.7M at the same time, with an average transaction growth per active consumer of 43.4% YoY to 3.3, respectively.

Therefore, it is unsurprising that AFRM’s quarterly revenues have also expanded by 34.2% YoY to $362M in the latest quarter, suggesting tremendous tailwinds in consumer onboarding and spending. We reckon part of the success is attributed to AMZN, WMT, and SHOP, which reported excellent sales/GMV of $502.1B, $600.1B, and $190.4B over the last twelve months, respectively.

In addition, market analysts note that AFRM remains the most frequently used BNPL app in the US for eight consecutive months as of October 2022. The platform averages 2.9M monthly active users, growing by 81.2% YoY, partly attributed to the growing app downloads of 30% in Q3’22, against 25% in Q2’22. Notably, its direct competitor, Klarna (KLAR), recorded a contrasting decline from 40.6% in Q2’22 to 27.5% in Q3’22. It is apparent that the former’s aggressive market grab has been a great success.

However, we remain concerned about AFRM’s minimal profitability, despite its improving gross margins. By FQ1’23, the company reported excellent gross margins of 50.4%, growing by 8.8 percentage points YoY. However, its operating margins have also declined by -17.9 points YoY to -79.5%. Notably, it is partly attributed to the elevated Stock-Based Compensation of $417.61M over the LTM, growing by 10% sequentially. Naturally, IPO investors would have also been diluted by 24.6% since January 2021, further exacerbated by the multiple warrants issued to AMZN and SHOP.

With market analysts expecting AFRM to deliver EPS of -$1.75 by FY2025, it is no wonder the stock continues to boast an elevated short interest of 14.14%, despite the catastrophic plunge of -93.1% since November 2021.

So, Is AFRM Stock A Buy, Sell, or Hold?

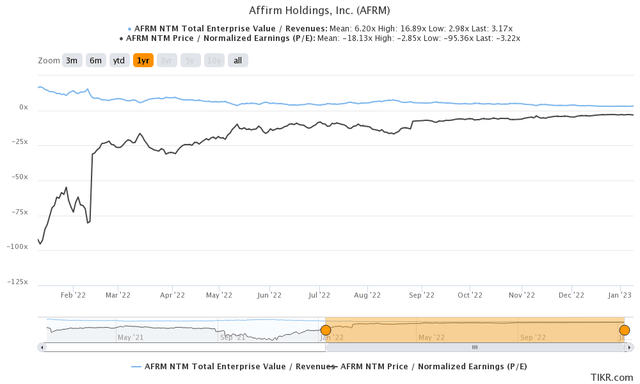

AFRM 1Y EV/Revenue and P/E Valuations

AFRM is currently trading at an EV/NTM Revenue of 3.17x and NTM P/E of -3.22x, lower than its 2Y mean of 14.44x and -67.01x, respectively. While its GMV and consumer base may grow organically, it remains to be seen how the company may cope if its existing partnerships with AMZN and WMT are disrupted from 2023 onwards.

Only time will tell, since AFRM’s consumer base is also reportedly more likely to default with supposedly lower credit scores of >550 being accepted, against SoFi’s (SOFI) stricter score of >650. It is unsurprising then, that the former reported up to $191.5M/7.1% of its loans as past due in the latest quarter, against the latter’s weighted average of 5%. We think the outperformance has contributed to SOFI’s eye-watering NTM P/E of -53.26x indeed, despite the peak recessionary fears.

However, we must also highlight that the BNPL space remains speculative, since it primarily targets consumers with lower credit scores. There is a reason why the Bank of America generally requires a score of >750 for the application of credit cards, since it is directly attributed to the consumers’ capability in repaying their loans.

Even regulators, Consumer Financial Protection Bureau [CFPB], are growingly concerned about BNPL’s massive penetration, since it is a “potential for debt accumulation and overextension.” This explains why late payments and fees are increasingly common for BNPL consumers at 42% in 2022, against 10.5% in 2021 and 7.8% in 2020.

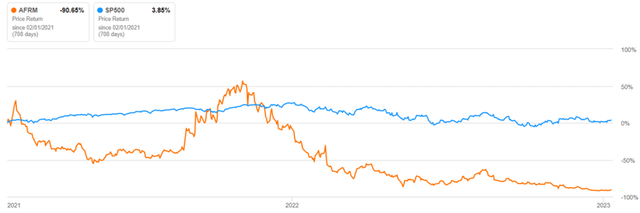

AFRM 2Y Stock Price

Due to AFRM’s lack of profitability through FY2025, it is naturally difficult to place a price target on the stock. There are also minimal tailwinds for recovery, with the Fed’s recent meeting minutes suggesting raised terminal rates of above 5% by mid-2023. Lastly, a pivot may only happen from 2024 onwards. As a result, the prolonged interest pains may further affect the challenging funding environment and bearish market sentiment in the short term.

Due to the minimal profitability, elevated SBC expenses, and lack of moat, the AFRM stock may continue declining through 2023, unfortunately. Therefore, we prefer to rate the stock as a Hold, since there is a minimal margin of safety here in our view.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.