Summary:

- Affirm’s FY2023 Q4 earnings report exceeded expectations, with accelerated GMV growth and positive operating cash flow.

- High interest rates have negatively impacted Affirm’s business, leading to slower growth and decreased profitability.

- Despite the challenges, Affirm has demonstrated strong execution, expanded its network of merchants, and achieved profitability, making it a promising growth stock in the BNPL sector.

Marut Khobtakhob/iStock via Getty Images

Investment Thesis

The BNPL sector is projected to experience rapid growth over the next decade; Affirm (NASDAQ:AFRM) stands out as one of the most promising growth stocks for the upcoming years in this sector due to its expanding network of merchants and consumers, its robust underwriting algorithm that withstands the test of high-interest rates, and the potential success of its Affirm card.

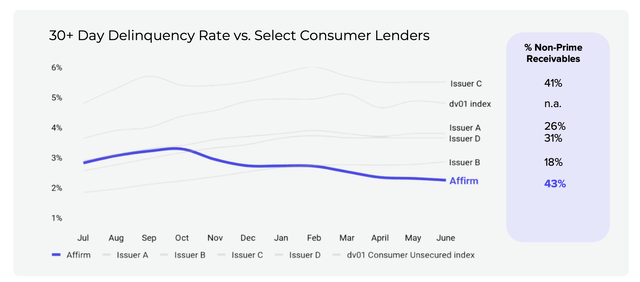

Affirm’s recent FY2023 Q4 earnings report has further strengthened our confidence in this thesis for several reasons. Firstly, its GMV growth has accelerated to 25%. Secondly, its operating cash flow has turned positive. Lastly, its 30+ days delinquency rate remains well below 3%.

Additionally, Affirm achieved these results against a high-interest-rate environment. The trajectory of this stock’s story is starting to bear resemblance to Amazon’s early days in 2000 when the internet was just gaining prominence. Amazon managed to generate positive cash flow after the market crash in 2002, and today, it stands as the foremost e-commerce giant.

How high interest rates affect Affirm’s business

Affirm makes its BNPL service convenient for customers by integrating with e-commerce platforms. For example, it has partnered with Amazon (AMZN), Walmart (WMT), and Shopify (SHOP), and there is a checkout button directly integrated with these platforms. Customers can choose to pay for goods using BNPL by clicking on Affirm’s checkout button. However, BNPL is a short-term loan, and when the Fed raises interest rates, the cost of borrowing for Affirm’s customers increases. This makes Affirm’s BNPL products less affordable, which could lead to fewer consumers using Affirm to shop online. This would dim the outlook for Affirm’s revenue growth. We can clearly see this trend from Affirm’s latest earnings report, its GMV growth rate has dropped from 74% in Q4 FY2022 to just 25% in Q4 FY2023. The decelerating growth trend in Affirm’s business does not necessarily mean that customers are using Affirm less. It is more likely that the high interest rate environment is making it difficult for Affirm to grow its business.

The high interest rate environment not only affects customer spending, but it also affects Affirm’s cost of doing business. Affirm is not a bank, so it does not have customer deposits to fund its BNPL loans. Instead, it partners with banks or issues bonds to raise capital. When interest rates rise, the cost of capital for Affirm increases, which makes it more expensive for the company to make BNPL loans. The higher funding costs that Affirm is facing are already evident in its latest Q4 FY2023 report. While its GMV grew 25% year-over-year to $5.5 billion, its RLTC (revenue less transaction costs) declined 1% year-over-year to $182 million. RLTC, or revenue less transaction costs, is a key metric for BNPL providers like Affirm. It measures the profitability of the BNPL business by subtracting the cost of funding loans from the revenue generated from BNPL transactions. The decline in RLTC is an ominous sign that the higher interest rates are negatively impacting the profitability of Affirm’s business.

To make matters worse, if the high interest rates persist for longer, the two factors mentioned above could create a vicious business cycle for Affirm. For example, in order to stop losing money in the high interest rate environment, Affirm will have to keep raising interest rates on its products. This will further dampen consumer spending on its platform. There are signs that this vicious business cycle is already developing. In Affirm’s Q3 2023 earnings report, we saw the following pricing initiatives, which are a big jump compared to the APRs from the year earlier:

Our team made good progress implementing the new APR cap, with 55% of interest-bearing GMV offered at up to a 36% APR as of the end of March, up from 23% at the end of December and 10% at the end of September.

If the high interest rates persist, Affirm may have to raise interest rates even further, which could lead to even lower consumer spending on its platform. This would create a vicious cycle that could be difficult for Affirm to break.

The market clearly sees these risks that Affirm faces in the high interest rate environment. As a result, investors have been selling Affirm’s stock, and the stock price has dropped a whopping 90% from its pandemic high.

Having discussed how high interest rates affected its business, it’s worth noting that Affirm has actually defied the challenging interest rate environment and achieved profitable and accelerated growth in FY2023Q4.

Affirm delivered a strong Q4 earnings report and what does that mean to investors

Affirm’s earnings report has exceeded the analyst consensus on nearly every metric, and the company is forecasting its 2024 GMV to exceed 24 billion, indicating another double-digit growth from FY2023. Let’s delve into its financial reports in greater detail.

The GMV grew 25% YoY to $5.5 billion, while revenue increased by 22% to $446 million. Additionally, its adjusted operating income for FY2023Q4 was $15 million. The growth rate has accelerated against FY2023Q2.

The number of active merchants witnessed an 8% YoY growth, reaching 250 thousand, while the active customer base expanded by 18% to 16.5 million. Moreover, the delinquency rate continues to remain comfortably below 3%.

The company’s capacity to drive and accelerate revenue growth stems from its management’s exceptional execution

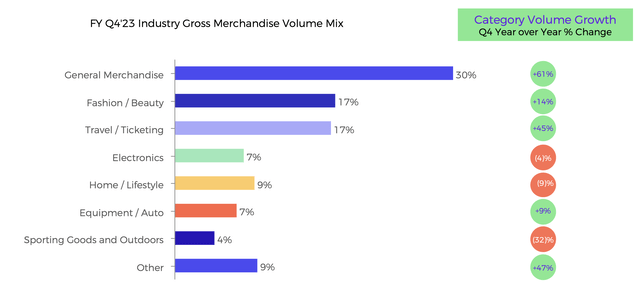

Firstly, the company is diligently working to broaden its product reach and onboard a greater number of merchants. For instance, in FY2023Q4, they successfully integrated selfbook, Cathay Pacific, Amazon Pay, and Worldpay from FIS into their platform. They have established partnerships with a diverse array of merchants, with particularly prominent ones including Amazon, Shopify, Target, and Walmart. As a result, their growth isn’t confined to a single sector of the U.S. economy; rather, it spans across various consumer spaces.

Affirm FY2023Q4 Earnings Report

Secondly, they foster a deeper level of engagement with both their merchants and customers in comparison to their competitors. For instance, let’s consider my recent quest for a purple mattress. I was genuinely impressed by the granular promotion efforts Affirm undertakes in collaboration with Purple. They provide their customers with offerings of 0% interest and low ARP rates. In their earnings call, Affirm reiterated several times that they continue to extend this remarkable 0% offering to their customers even within the context of a high-interest rate environment, managing to generate revenue on top of it. This ability is likely a key reason why merchants and consumers remain loyal to Affirm; the company aids them in driving demand and discovering favorable deals for consumers. This sets them apart from their competitors. Notably, in the case of the purple mattress, they have even expanded their SKU-based promotional activities to encompass their retail stores.

Affirm achieved a positive adjusted earnings report

This is indeed exciting for a couple of reasons. Firstly, Affirm can now achieve profitable growth and self-fund its expansion moving forward. Secondly, this achievement underscores their superior underwriting algorithm and validates the viability of their short-term consumer loan business model.

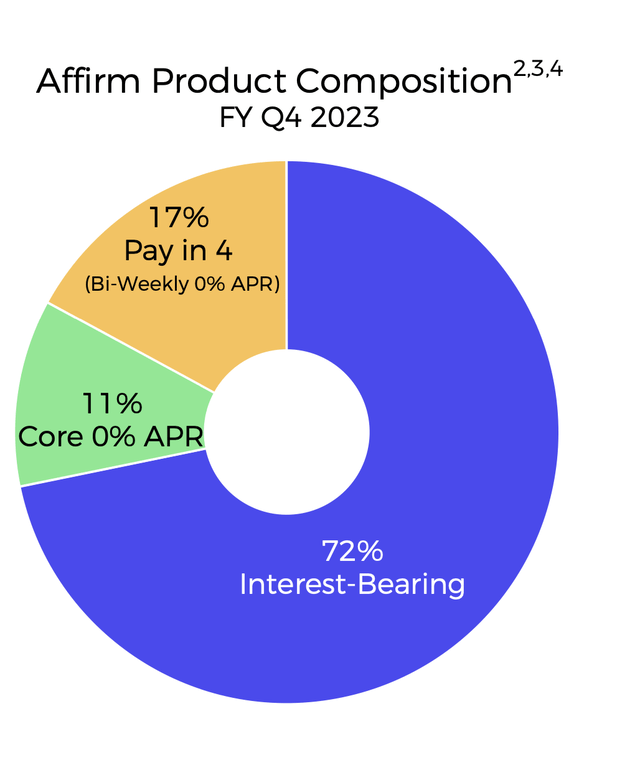

Affirm FY2023Q4 Earnings Report

Affirm’s origin was as a “pay in 4” business, but it has continually innovated and introduced a range of financial products over its journey. Currently, approximately 72% of their products involve interest, yet their delinquency rate for payments exceeding 30 days remains consistently below 3%. This signifies the presence of a highly disciplined underwriting model that has proven resilient even in a challenging high-interest rate environment. It’s worth noting that these earnings have been generated amid historically high funding costs. As the Federal Reserve begins to reduce interest rates once again, Affirm stands to benefit from increased cash flow due to the lowered cost of funding.

Affirm FY2023Q4 Earnings Report

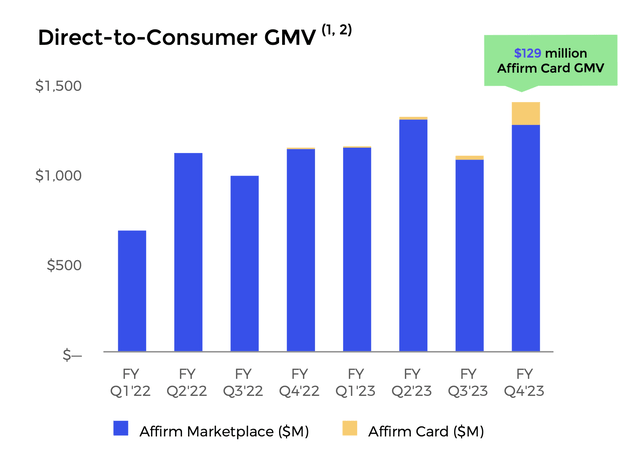

There has been a significant increase in the Affirm card business for the very first time

Affirm FY2023Q4 Earnings Report

This is very exciting, as Affirm has been talking about the Affirm card for more than a year and we are now witnessing its adoption by consumers. The potential success of the Affirm card will immediately expand its network reach to almost anywhere. This financial product is still in its early stages. The company has introduced the card to a limited number of customers, using this phase for continuous improvement and refining the design before a full-scale release. Notably, there is a waitlist of 1 million customers eager to experience this product. let’s hear the latest development from its management team from the latest earnings call.

The Affirm Card has a very full development roadmap ahead, but we like the early metrics. We have been adding approximately 75,000 active cardholders per month since late May, and we have over 300,000 active cardholders as of mid-August. Affirm Card GMV was over $70 million in July. Affirm Card consumers already transact three times more often than the Affirm average.

How much will Affirm be valued in the future

We can explore two valuation methods for Affirm: First, valuing Affirm by looking at how the market values its competitors during the low interest rate environment. Second, valuing Affirm using EV/Sales method.

Valuing Affirm by looking at how the market values its competitors

|

Competitor |

Valuation |

FY2022 Revenue |

P/S |

|

Klarna |

$15 billion (Valuation reported in Aug 2022 June) |

$1.85 billion |

8.1 |

|

Afterpay |

$29 billion (Valuation reported in Aug 2021) |

$1.18 billion |

24.5 |

We can use the valuation of Klarna and Afterpay as a reference to value Affirm’s market value. Taking a median P/S value of 16 and Affirm’s annual revenue of 1.3 billion in FY2022, we arrive at a valuation of around $20 billion. However, Affirm’s current market valuation is $5 billion, which represents a 4X return if investors purchase Affirm’s stock today.

Valuing Affirm using EV/Sales method

The BNPL sector is still in its early stage, and no BNPL company has yet achieved positive net income, EBITDA, or free cash flow consistently. As a result, we will use the EV/Sales method to calculate future value.

According to a research cited by Mastercard, the BNPL’s transactions are expected to grow by 374% by 2027. Affirm is a leader in the BNPL space, so we believe it will grow even faster than the market as a whole. We therefore assume that Affirm’s transactions will grow 500% by 2027.

Affirm’s current annual revenue is expected to be $1.53 billion in fiscal year (FY) 2023. If Affirm’s revenue grows by 500% by 2027, its revenue by then would be $7.65 billion. The BNPL sector has an average enterprise value (EV) to sales multiple of 3 (The enterprise value (EV) to sales multiple is referenced from the Seeking Alpha valuation metrics as of August 3, 2023). This would give Affirm an enterprise value of $23 billion. Assuming Affirm’s debt and cash structure remains the same, this would lead to a market capitalization of $17 billion. Affirm’s current market capitalization is $5 billion, so this implies that Affirm has the potential to increase in value by 3.4 times from its current level.

Risk

Competition

The BNPL sector is still in its early stages, and competition is fierce. Affirm is the leading BNPL player in the United States, but competition is still the biggest risk factor for this investment. Affirm not only needs to compete with existing BNPL players, but also with new entrants. For example, banks are starting to offer BNPL services to their customers, such as Wells Fargo (WFC), Bank of America (BAC), and Chase (JPM). PayPal(PYPL) has also started offering BNPL, and even Apple (AAPL) jumped into the fray with its own BNPL service.

Affirm’s key advantage is its integration into the e-commerce system as a checkout button. This makes it very convenient for consumers to use Affirm as a payment option, which is something that its competitors lack. However, Affirm’s partnerships with e-commerce retailers are not exclusive. This means that merchants can choose to partner with Affirm’s competitors if Affirm stops offering a compelling value proposition. Investors should pay attention to Affirm’s integration with the e-commerce system. Any slowdown or mis-execution by management could break Affirm’s growth potential and invalidate our valuation model.

When analyzing competitive industries, execution emerges as a pivotal factor in the battle for supremacy. Affirm’s performance in FY2023Q4 eloquently demonstrated their management’s adeptness in navigating challenging environments. Over time, they’ve consistently showcased a higher caliber of execution, evident in their broader network coverage and deeper engagement with merchants and consumers alike. Simultaneously, there are indications that their competitors might be lagging in their execution strategies. A case in point is Dorsey’s acquisition of Afterpay, which led to a shift in focus towards integrating Cash App’s payment functionality with Afterpay’s e-commerce offerings. While Dorsey’s approach centers on synergy, Affirm has remained actively engaged in expanding its network, procuring exceptional deals for customers, and aiding merchants in generating demand and pioneering new financial solutions for their clientele.

Dorsey said Block’s longer-term strategy was focused on linking the Cash App with its payment business, Square. He argued having these two ecosystems was Block’s super power, and that Afterpay had a critical role in bringing together these two parts of the company.

High interest rate environment

While Affirm managed to achieve robust Q4 earnings despite a challenging interest rate environment, it’s important to acknowledge that a consistently high interest rate environment remains a significant challenge for its operations. This situation could potentially push the economy towards a recession, posing a threat to their short-term loan business. However, Affirm does possess a total liquidity of $2.1 billion, providing them with the means to weather a potential short-term economic downturn.

Conclusion

We are very excited after Affirm reported its FY2023Q4 report. The resilience of its robust underwriting algorithm in the face of high-interest rates is commendable, and the potential success of the Affirm card offers further promising prospects for its business. Crucially, the ability to achieve profitable growth is a significant milestone. Given the anticipated rapid expansion of the BNPL sector in the coming decade, we possess a high level of confidence in Affirm’s capability to spearhead its growth trajectory.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.