Summary:

- AMD’s Q3 earnings report on October 29th is crucial, especially after ASML’s disappointing results, which impacted the semiconductor market.

- Despite ASML’s challenges, AMD’s role as a chip designer and its diversified revenue base set it apart, suggesting different growth prospects.

- AMD is expected to show healthy growth with EPS up 30% YoY and revenues up 15.72% YoY, making it a potentially attractive buy.

- AMD remains well-priced with strong growth prospects, making it a good long-term hold despite recent market volatility and ASML’s issues.

sidewaysdesign/iStock via Getty Images

Thesis Summary

Advanced Micro Devices (NASDAQ:AMD) is set to report Q3 earnings on October 29th and this is going to be a very important release.

Just last week, ASML Holding (ASML) released its earnings and investors were not pleased. The stock tanked over 10% and dragged the semiconductor market with it.

With AMD reporting soon, we may get the answer to many of the pressing questions the ASML debacle has raised.

- Is the AI mania over?

- Is ASML an exception, or the canary in the mine?

- Will AMD’s results help turn the stock around?

In my opinion, AMD is one of the few companies that can realistically take market share from NVIDIA (NVDA).

Though ASML is also in the semiconductor industry, it plays a very different role from AMD, and their poor guidance may not actually be reflective of the broader demand for chips.

In my last article on AMD, I highlighted the stock was cheap for an AI company, and that continues to be the case today as the price has not moved much. The doubt cast by ASML gives us a chance to pick up more stock at a discount.

What happened to ASML?

It’s worth having a quick look at the ASML earnings, which the market punished so brutally. There were three factors coming together that catalyzed the sell-off.

-

Revenues below expectations

-

Poor guidance

-

Export controls

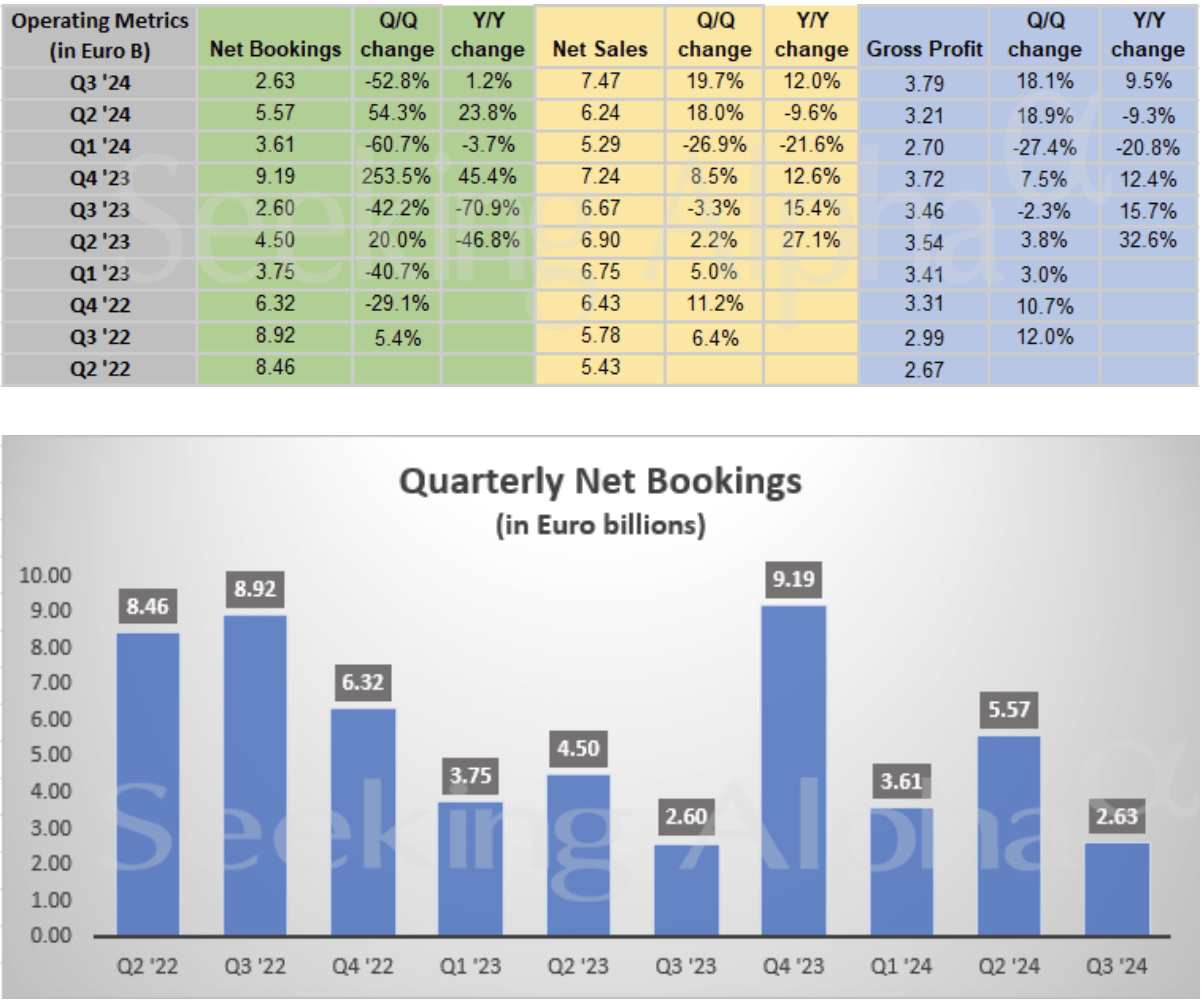

ASML in charts (SA)

Net bookings were very weak, down 52% QoQ. While ASML’s earnings have come up in the last year, there’s certainly been a lot of volatility, and growth has not been explosive like with NVIDIA.

Meanwhile, guidance was lowered, which probably ties into the new restrictions by the Dutch government.

The Dutch government will be requiring chip companies to apply for permits in order to export their products, and China is ASML’s largest client.

Could AMD face the same fate?

But that’s old news now. The next big chip company to report will be AMD. Could we see a big sell-off in this stock too?

Before we get into the earnings preview, it’s important to highlight the similarities and differences between AMD and ASML.

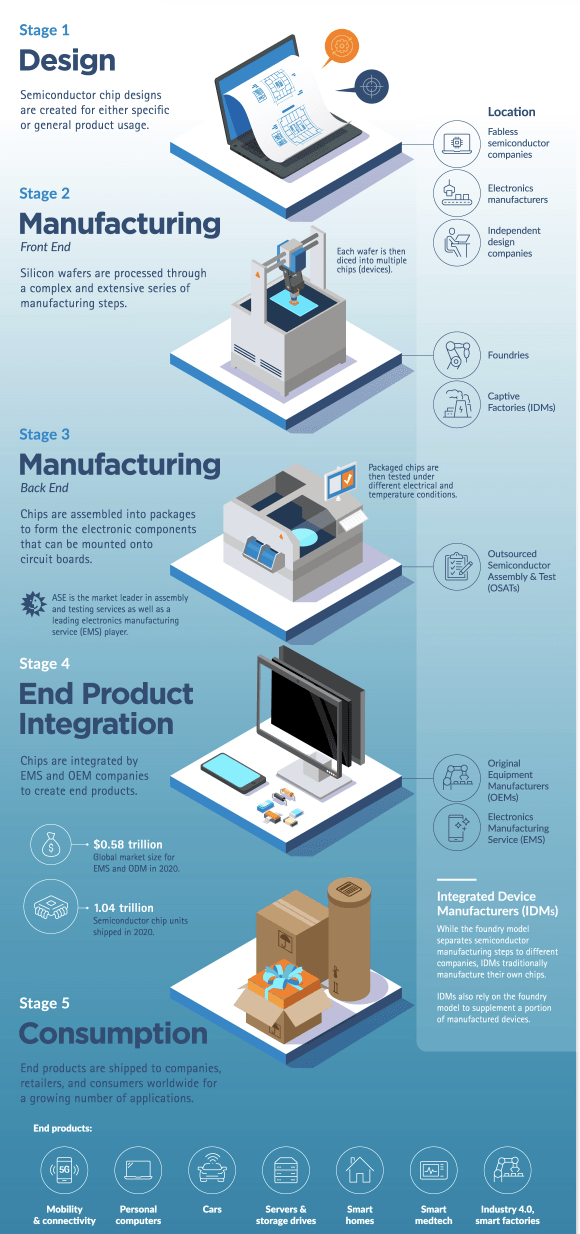

Semiconductor Market (Visual Capitalist)

AMD, like NVIDIA, is a chip designer. They are essentially coming up with the technological designs that are used to build semiconductors.

On the other end, we have Taiwan Semiconductor (TSM), which is a fab company that assembles the chips.

Somewhere in the middle, there’s ASML, which sells the equipment necessary for the manufacturing of said chips, focusing on lithography.

This is to say that not all chip companies are created equal. While ASML is an important company in the space, its particular challenges, revenues and margins are quite different from chip designers like AMD and NVIDIA.

Specifically, I would argue that while we have seen ASML do well in the last year, its revenue growth hasn’t been equal to that of other companies in the sector. We can’t simply extrapolate from the company’s earnings what the whole semi-industry will look like.

We must dive into the specifics of each company, which we will do below with AMD.

Q3 Earnings Preview

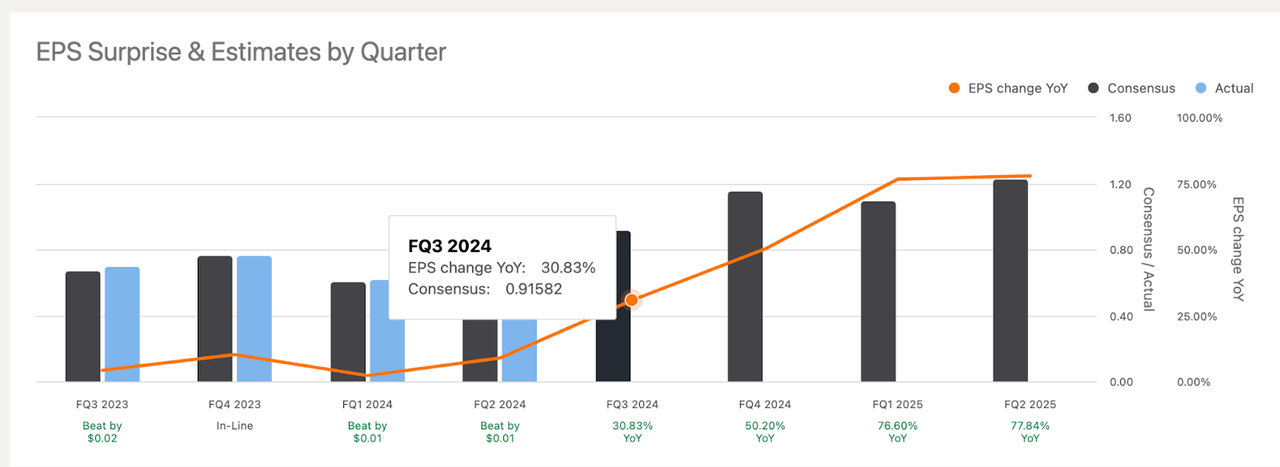

AMD will report earnings next week. Here’s what we can expect.

-

EPS of $0.91, up 30% YoY

-

Revenues of $6.71 billion, up 15.72% YoY

-

Non-GAAP gross margin of around 53.5%, 53% in the prior quarter.

Overall, AMD is still expected to show healthy growth in earnings.

As we can see, the company has narrowly beat estimates in the last four quarters, and investors will be expecting nothing less.

It’s interesting to note that earnings are expected to climb significantly too in Q4, so guidance will be a very important factor in these earnings.

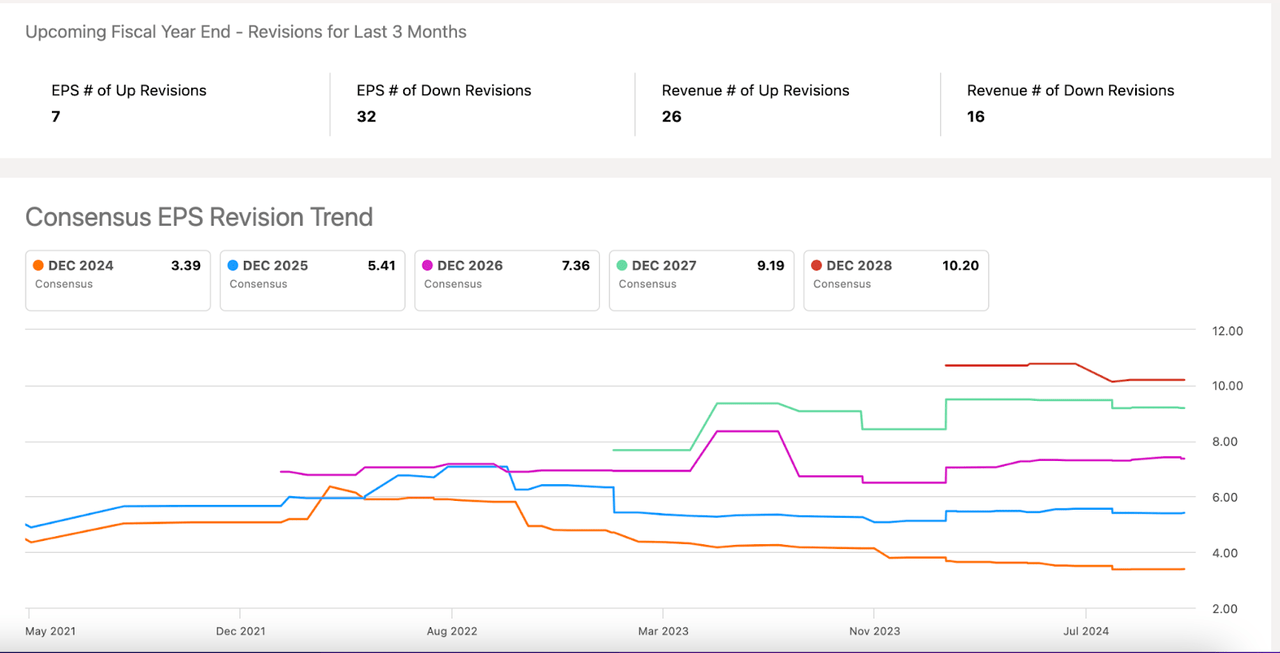

We can also see that there have been a lot more downward revisions in EPS over the last three months than up revisions. Interestingly, it seems to be the opposite for revenues.

Perhaps the strong monthly numbers that TSM has been posting have increased analysts’ expectations, but clearly there’s some idea that margins may not do as well as once expected.

My 2 Cents

The way I see it, a lot of the bad news seems to have been priced in here for AMD, and there’s room for a nice surprise at earnings.

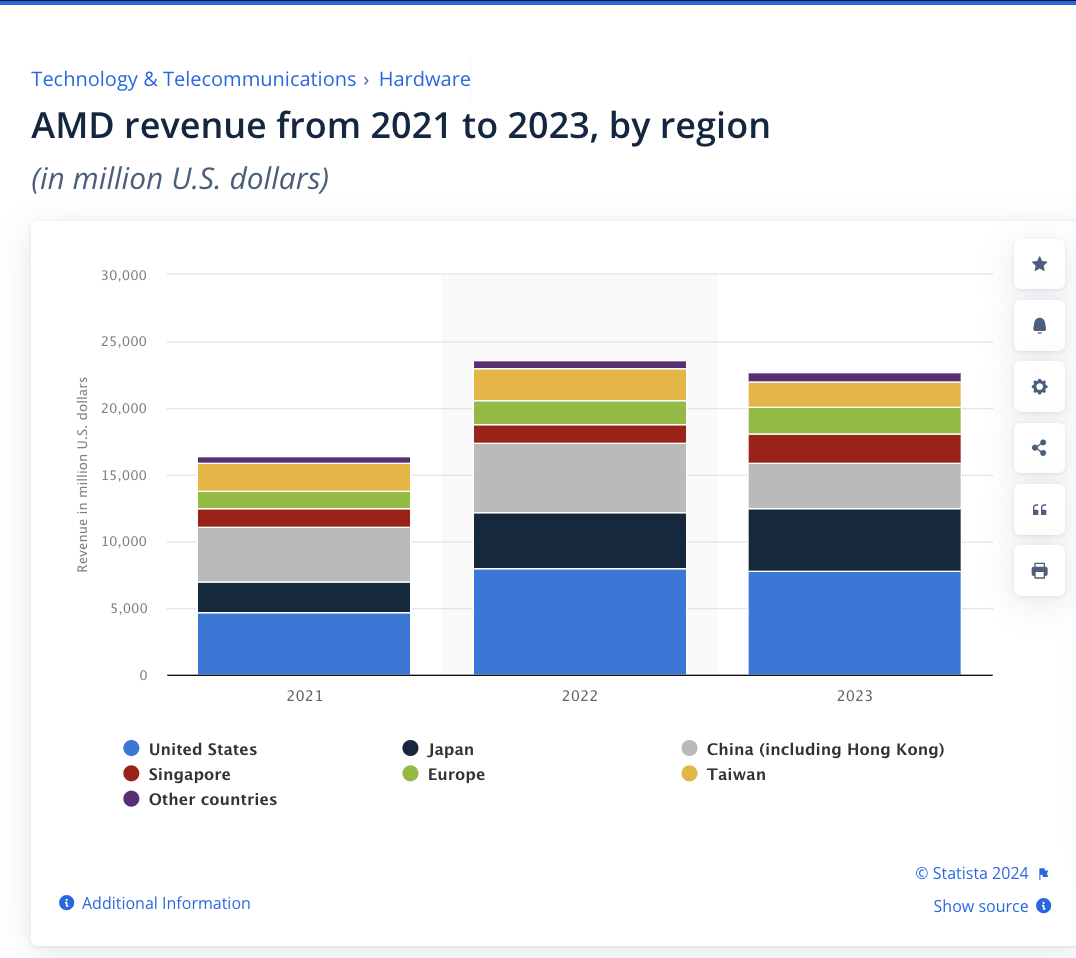

First off, there are strong differences between ASML and AMD. The former is much more dependent on foreign clients, while AMD’s revenues are more evenly distributed geographically.

AMD revenues by country (Statista)

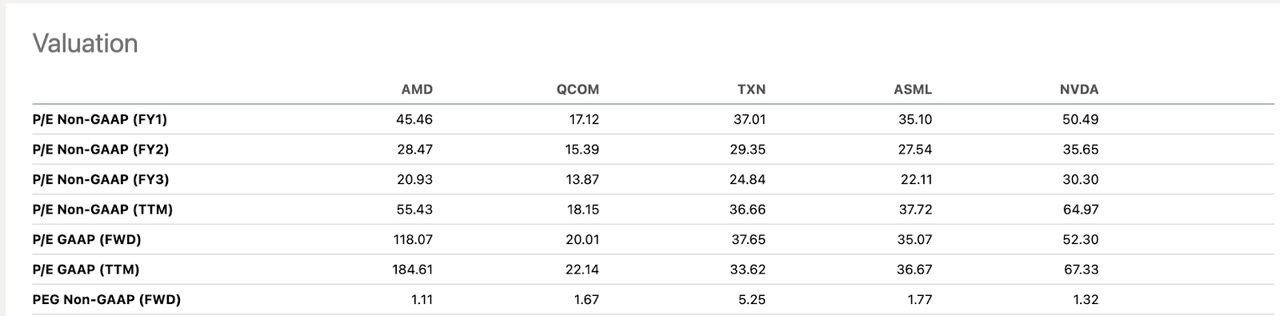

On the other hand, AMD has enjoyed strong growth in earnings, and if we look at valuations, it’s actually well-priced.

Particularly if we look at forward PEG, AMD is the cheapest out of its peer group. The key here is for AMD to deliver on these lofty earnings expectations. So far, the company hasn’t done anything to make me doubt them.

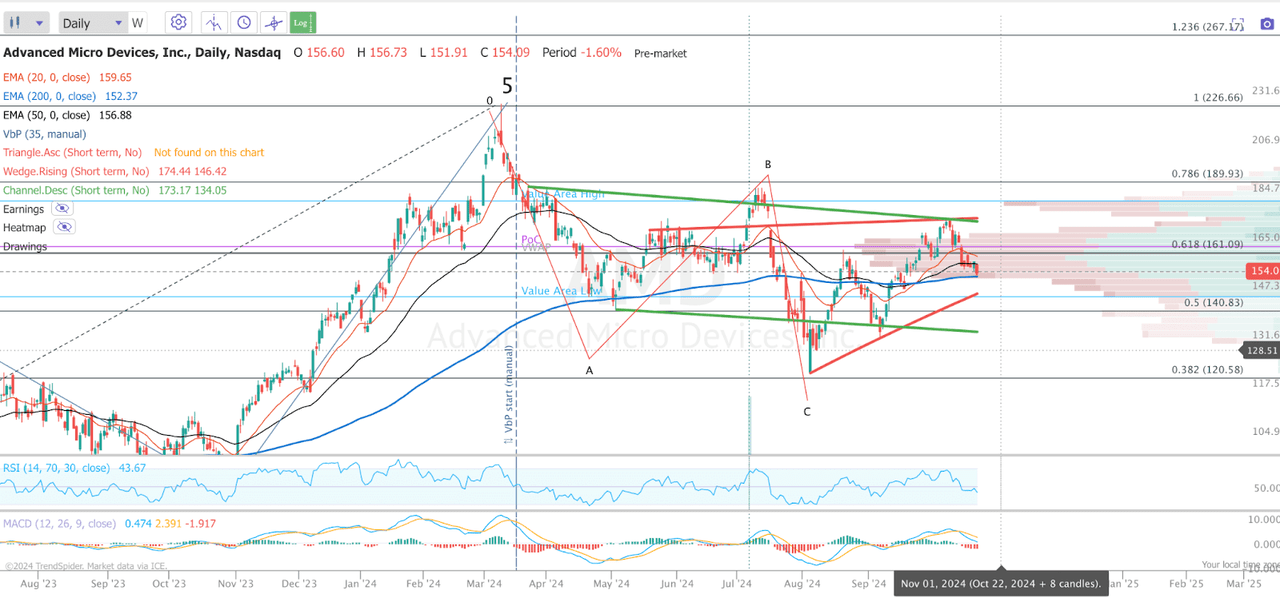

Finally, if we look at the price chart, technical analysis shows this could be a decent place to buy.

After rallying to over $220, AMD has come down significantly. It actually almost tapped the 61.8% retracement back in August. Since then, we have been grinding up, and now we are finding support at the 200 EMA.

The way I see it, this is a key level to hold, but we also have strong support at $147 and then $130 as shown by the two trend lines.

Below that, we could revisit $120, but this would be such an attractive price I don’t think we will get there.

Takeaway

All in all, I think AMD is still a good long-term hold. The ASML earnings have not changed my view. AMD is still cheaply valued and has good growth prospects. Earnings moves are very hard to predict, but I think we have a good chance of heading higher next week.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is a high-risk/high-reward opportunity, which is exactly what I look for in my YOLO portfolio.

Joint the Pragmatic Investor today to get insight into stocks with high return potential.

You will also get:

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video