Summary:

- Ford’s stock price has declined recently, but strong sales of hybrids and SUVs, along with a low P/E ratio, suggest undervaluation.

- Despite industry risks and debt, the Company’s dividend yield of 5.5% appears sustainable, with potential for future growth as the market stabilizes.

- F’s long-term competitiveness hinges on efficiency and margin improvements while maintaining a competitive cost structure and managing credit risks.

- With positive sales trends and a solid earnings outlook, I rate Ford a buy, though cautious due to uncertainties in the automobile industry.

Vera Tikhonova

Back in 2014, one of the first articles I wrote for Seeking Alpha was about Ford Motor Company (NYSE:F), and I recommended the company both for its strong P/E ratio, and the prospect of the dividend growing in the years to come.

Fast-forward a decade, and the stock has gone down a bit from the price I first recommended it at. At the same time, the dividend has continued, and even increased somewhat.

Today I’d like to take another look at Ford, and see how the company looks now, whether it remains a long-standing value play, and how the prospect of returning value to investors in the form of dividends appears going forward.

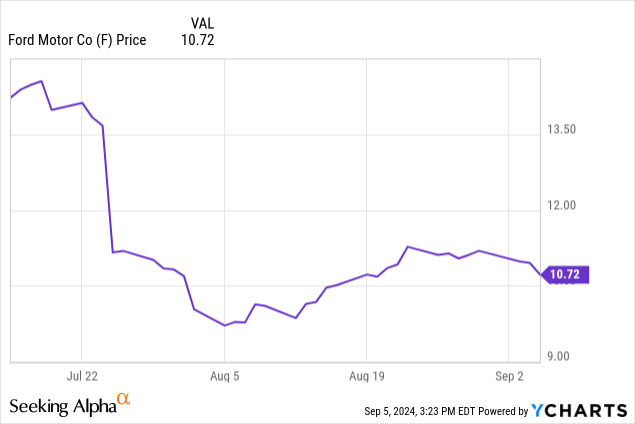

Ford’s price has declined in the last couple of months, largely after they missed earnings estimates in the second quarter and over concerns about warranty issues the company may face going forward.

At the same time, August vehicle sales for the company are reported up 13.4% year over year. The demand for hybrids is helping that increase in sales, and Explorer SUVs and Ranger pick-ups are leading the pack for strong sales.

Ford has recently been emphasizing plans to prioritize hybrid models as the automobile industry is undergoing a substantial transition to more fuel-efficient vehicles. Every company has their own plans in this regard, and in my opinion, Ford has a pretty good history of adapting as the market changes.

Consolidated Balance Sheet

|

Cash and Equivalents |

$19.9 billion |

|

Total Current Assets |

$120 billion |

|

Total Assets |

$277 billion |

|

Total Current Liabilities |

$101 billion |

|

Total Liabilities |

$230 billion |

|

Total Shareholder Equity |

$42.8 billion |

(source: most recent 10-Q from SEC)

Ford is a huge company, and as a result, they have a fair amount of debt. That’s not terribly unmanageable for the company given the current earnings, and the Current Ratio at the very least is 1.19, not exceptional but not dreadful either.

What really interests me here is that the company is trading at a price/book ratio of 0.98, which is quite a bit below the sector median of 2.15. This suggests that the company may be undervalued.

The Risks

The automobile industry is undergoing big changes right now, and that understandably puts Ford at risk. There are other possible problems that investors should be aware of.

Long-term competitiveness of Ford depends heavily on the Ford+ plan, which focuses on company efficiency and eyes future growth. The hope also is to improve margins.

One of the constant risks faced by Ford is the need to maintain a competitive cost structure. Keeping union wages competitive but not excessive, and preventing any major labor issues, would be important for them to accomplish this.

Bottom-line results for Ford depend heavily on the sales of larger and more profitable vehicles. That’s important, as potentially the market for vehicles in the future could skew more toward smaller vehicles that generate worse margins.

Ford Credit also carries some risks. Like a lot of automakers, Ford has its own credit wing, and while that has been profitable, there is also a risk it could expose the company to higher credit losses in the future.

Auto sales are also affected by the overall economic condition. A recession could always lead to an overall decrease in industry sale volume, as consumers put off buying new vehicles. I don’t expect an imminent recession, but sooner or later, that is something the company will have to navigate.

Statement of Operations – Expectations of Strong Future Profits

|

2021 |

2022 |

2023 |

2024 (1H) |

|

|

Total Revenue |

$136 billion |

$158 billion |

$176 billion |

$90.6 billion |

|

Operating Income |

$4.5 billion |

$6.3 billion |

$5.5 billion |

$3.1 billion |

|

Net Income |

$17.9 billion |

($2.1 billion) |

$4.3 billion |

$3.17 billion |

|

Diluted EPS |

$4.45 |

(49¢) |

$1.08 |

79¢ |

(source: most recent 10-K and 10-Q from SEC)

A company that has been around for generations, Ford, unsurprisingly, isn’t a huge growth company that is experiencing massive sales increases year over year. At the same time, the company is continuing to grow at a rate appropriate for a mature company. The thing I really like about them is the earnings, which are impressive for the current market environment.

Estimates are that for the rest of the year, Ford will see revenue of $174.6 billion, and a profit of $1.90 per share. That gives them a P/E ratio of 5.76, which absolutely puts this in a strong value range. The next two years should be much the same, with revenues going up to $176.3 billion and then $181.2 billion, while the earnings per share is gradually increasing to $1.94 and ultimately $2.11 in 2026.

Dividend Growth

When I wrote Ford up in 2014, I was talking a lot about the possibility of the company increasing its quarterly dividend payments. As expected, that has continued over the last decade, and the company is now paying 15¢ per quarter.

That’s a yield of about 5.5%, and in my opinion it looks very sustainable. Immediate growth is not likely, even if the earnings do suggest it could be supported, as the current uncertainty surrounding the automobile industry may force Ford to conserve more money to adapt to market changes. I would also like to see them pay down their sizable debt. Either way, this is a good income stock at these levels, and better than the sector median by quite a considerable amount.

Conclusion

With the economy rolling at a pretty good clip, I’m surprised to see Ford trading at such low levels, near the bottom of their 52-week range. The company was punished based on an earnings miss in Q2, but quarterly earnings have not been trending generally downward, and with positive news on sales I’d expect the third quarter to look a fair bit better.

At these prices, I’m rating Ford a buy, with a bias toward strong buy that I’m only withholding because I still am not totally certain about the future of the automobile industry. The industry is seeing a lot of big changes, and while I believe Ford will come out of all of this in a good position, there is still reason to be cautious with any company in the industry, even one that is plainly quite a bargain at these levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.