Summary:

- The Healthcare sector has seen a modest bid since mid-July compared to the S&P 500, with a reach for perceived safety.

- Agilent Technologies is a leading supplier in the Life Sciences Tools and Services industry.

- Agilent’s earnings and valuation outlooks are mixed, with weak near-term growth but potential for improvement in the future.

- I highlight key price levels to watch – with one important support zone being penetrated today.

Sean Anthony Eddy

The Healthcare sector has caught a modest relative bid compared to the S&P 500 since mid-July. As the dollar, rates, and oil have all risen, a reach for some perceived safety has ensued. But not all Healthcare stocks are created equal from a risk perspective. The Life Sciences Tools and Services niche can be volatile – particularly for firms with heavy exposure to emerging markets.

I have a buy rating on Agilent (NYSE:A) for its growth-at-a-reasonable price status. While EPS trends may be soft in the short term, better bottom-line growth is expected in out years. I do see trouble lurking on the chart, however.

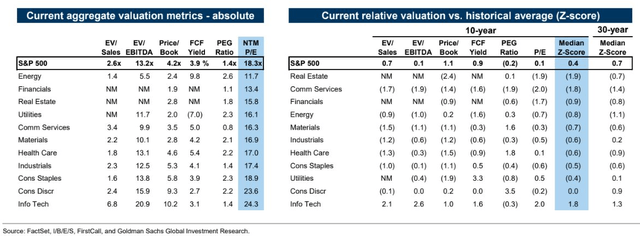

S&P 500 Sector Valuations: Healthcare Middle of the Pack

According to Bank of America Global Research, Agilent Technologies is a leading supplier of analytical instrumentation and consumable products, which are used mainly for research and quality assurance applications by customers in the life sciences, chemical analysis, and diagnostics industries. The company is known for being a leader in the Life Sciences industry, with a long history of innovation and geographical expansion.

The California-based $33 billion market cap Life Sciences Tools and Services industry company within the Healthcare sector trades at a high 29.3 trailing 12-month GAAP price-to-earnings ratio and pays a modest 0.8% forward dividend yield. Ahead of earnings in November, shares trade with low implied volatility at 24% while short interest is also modest at just 1.4%.

Back in August, Agilent continued its EPS-beat winning streak (to nine). The firm issued operating earnings of $1.43 (a 66% annual decline), which was a 6-cent beat while revenues fell 3% year-on-year to $1.67 billion – modestly topping estimates. Unfortunately, the management team cut its FY 2023 earnings forecast (Agilent cuts fiscal 2023 guidance citing softer economy) citing macroeconomic weakness and softness in China. Full-year revenue is now seen in the $6.8-$6.85 billion range compared to the previous range of $6.93B to $7.03B. Operating EPS is now estimated to be $5.40-$5.43 versus $5.60-$5.65 prior.

On the conference call, tough times in China were the reason for pharma-sector sales weakness (down 30%). Other segments showed varying results. Agilent Cross Labs, on the other hand, saw an impressive +11% growth, and Diagnostics & Genomics grew by +3%. Still, the firm managed to increase its adjusted operating margin by 180 basis points compared to a year earlier. The team was downbeat in the near term, but more optimistic when looking at the second half of 2024. Furthermore, the company highlighted the introduction of new products and workflows to enhance data quality and productivity, and Morgan Stanley says that diagnostics will be a top priority for AI/ML investments, with Agilent being a possible major player.

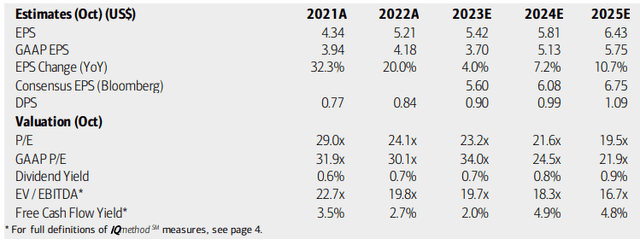

On valuation, analysts at BofA see earnings rising just 4% this year. That climb comes after strong profitability trends seen during and post-Covid. Going forward, EPS should rise to above $6 by 2025 at an accelerating pace. The Bloomberg consensus forecast is a bit more sanguine compared with BofA’s projection. That per-share profit growth would lead to improved earnings multiples, but the dividend isn’t expected to grow rapidly. With an EV/EBITDA ratio that is above the market’s average, Agilent is free cash flow positive with a nearly 5% FCF yield expected in 2024.

Agilent: Earnings, Valuation, Free Cash Flow, and Dividend Outlooks

If we assume $5.80 of 2024 operating EPS and apply a 22 multiple, then shares should be near $128. My reasoning for that P/E is the reality that EPS growth is not very strong over the next two years – it’s simply near the S&P 500’s average. If anything, I might be generous on the multiple, but the stock has historically traded at quite a premium to the SPX.

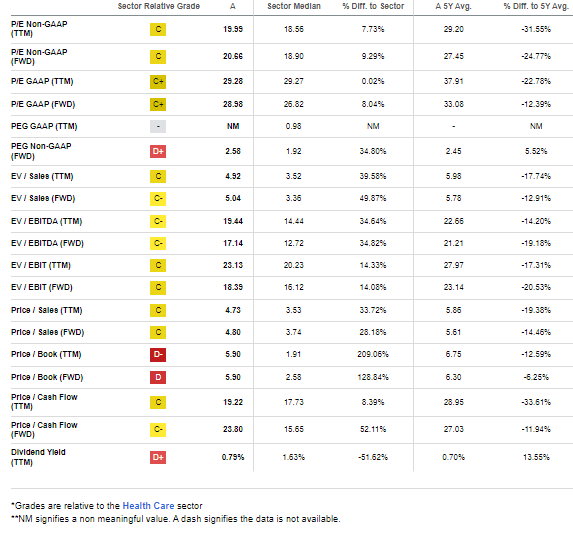

Agilent: High Multiples, But Growth Rate Inflecting Higher

Seeking Alpha

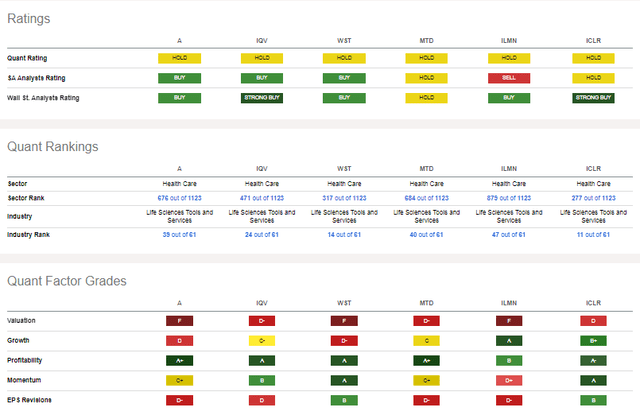

Compared to its peers, the valuation rating is actually about in line as the industry often carries a premium price. Growth may appear weak, but the firm is also near a trough in EPS growth currently. More broadly, profitability is very strong, but momentum is quite soft (which I will highlight later). EPS revisions following the somewhat weak quarter have been poor, too.

Competitor Analysis

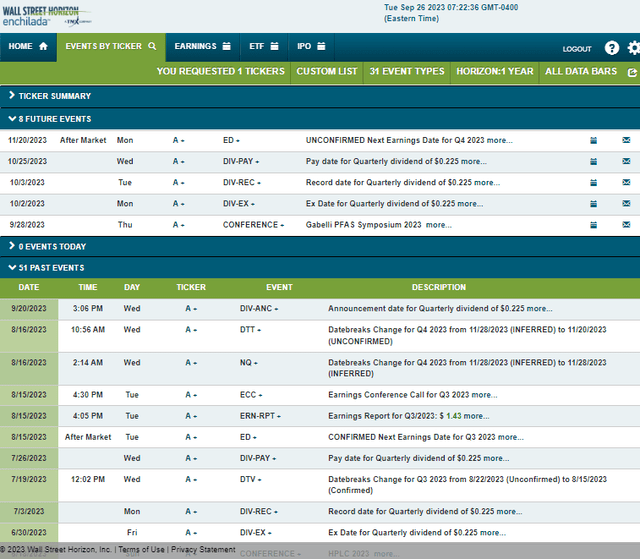

Looking ahead, there could be some share price volatility on Thursday of this week as the management team is slated to present at the Gabelli PFAS Symposium 2023 in New York. Beyond that, Agilent has an unconfirmed Q4 2023 earnings date of Monday, November 20 with an ex-dividend date of Monday, October 2.

Corporate Event Risk Calendar

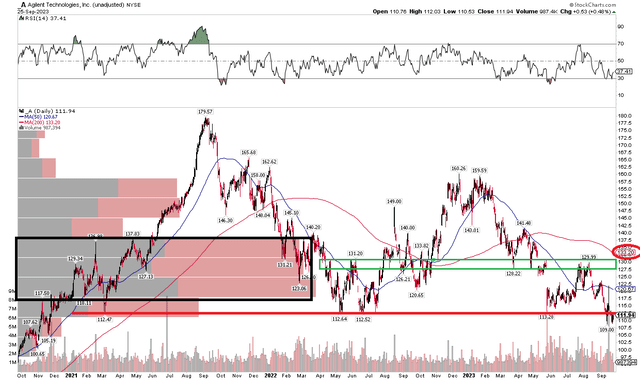

The Technical Take

Agilent is trading at a precarious spot on the chart. Notice in the graph below that shares are below a key horizontal trendline that has been a key pivot point in the past. The $112 to $113 area is crucial for the bulls to get back above. After probing under $110, I fear the downside may have been penetrated. Next support, in my view, is not until the $90 to $93 area.

Upside resistance is seen in the $128 to $130 zone. Bigger picture, the long-term trend is bearish, evidenced by the falling 200-day moving average. Moreover, the shorter-term 50dma is under the 200dma and the stock price is below both of those indicators. With high volume by price from $115 to $140, the bulls have their work cut out for them on any rally attempts.

Overall, it is a bearish chart, and the bulls must defend key support at the current level.

Agilent: Shares Probing Under Critical Support

The Bottom Line

I have a buy rating on Agilent. I see the stock as undervalued following a nearly 40% decline and with improving EPS trends ahead. The technicals are concerning, however, and adding to the stock in the low $90s could also work. For now, I will be watching $112 for support.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.