Summary:

- Agilent Technologies is a major player in the diagnostics and research industry, with a focus on laboratory-focused solutions.

- The company has shown resilience and strong growth potential, with a positive outlook for future earnings and long-term growth.

- However, there are concerns about the company’s valuation and potential market volatility, as well as geopolitical risks in China.

Govind Oza

Introduction

One of my favorite industries is the diagnostics & research industry, part of the healthcare sector. In this sector, I own the Danaher Corporation (DHR). I have bought Thermo Fisher Scientific (TMO) for family accounts and have IDEXX Laboratories (IDXX) on my watchlist.

In this case, I listed the biggest, second-biggest-and fourth-biggest players in this industry, respectively.

The third-biggest player is Agilent Technologies (NYSE:A), which I started covering last year in July using the title “Agilent Technologies – A Wealth Compounder 30% Below Its Highs.”

Interestingly enough, the stock has returned 29% since then.

My most recent article on the company was written on December 23, when I discussed its fantastic 4Q23 earnings:

After a tough start to the year, Agilent Technologies emerges as a standout performer in the healthcare sector.

[…] The company’s resilience in a challenging market, strategic dividend hikes, and an optimistic outlook for 2024 and beyond underscore its long-term potential.

While I’m cautious about market risks after the recent rally, the prospect of sustained growth, especially in the service business, makes Agilent a stock worth watching for future opportunities.

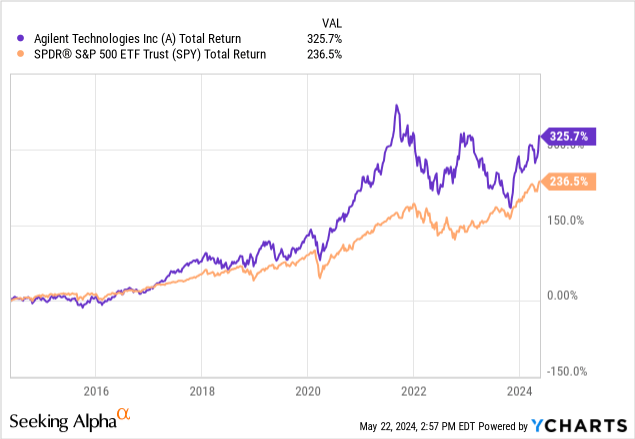

After two tough post-pandemic years, the company is back on track. Over the past ten years, the A ticker has returned 326%, beating the S&P 500 by roughly 90 points.

Since November 2003, the stock has returned 11.3% annually.

As the company is expected to report its earnings on May 29, I’m going to use this opportunity to assess how attractive the company is and what we need to look for when management presents us with a wave of new data and comments.

So, let’s get to it!

A Laboratory-Focused Innovator

Founded in 1999, Agilent has become one of the largest companies in its industry, as I just briefly mentioned.

The company has become a leader in life sciences, diagnostics, and applied chemical markets, where it focuses on “application-focused solutions” tailored to the entire workflow in laboratories.

Essentially, this includes advanced instruments, software, consumables, and a whole range of services.

All of these operations are offered through three major segments:

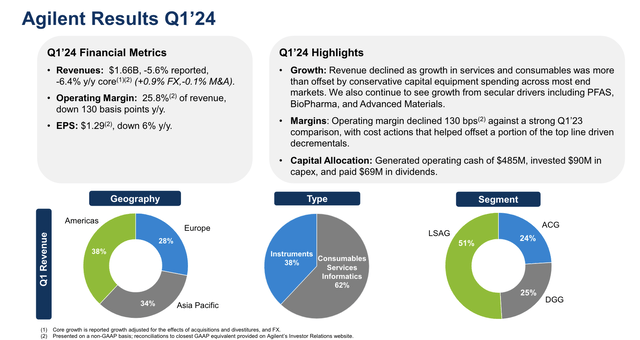

- Life Sciences and Applied Markets: This segment includes instruments, consumables, and software to allow customers to identify, quantify, and analyze the physical and biological properties of substances and products. Using the overview below, we see this segment accounted for 51% of revenues in 1Q24.

- Diagnostics and Genomics: This segment provides active pharmaceutical ingredients (APIs) for oligo-based therapeutics and a wide range of solutions like reagents, instruments, software, and consumables.

- Agilent Crosslab: This segment focuses on making laboratory workflows more effective.

To use simpler terms, Agilent provides essential products and services for laboratory research, which it supports using very efficient operations through its order fulfillment and supply chain organization (“OFS”).

At the end of last year, the company was named “global lighthouse” by the World Economic Forum for its manufacturing innovations (emphasis added).

The recognition showcases Agilent’s Waldbronn facility as a model of smart manufacturing enabled by Fourth Industrial Revolution (4IR) technologies, such as artificial intelligence and machine learning, robotics, data analytics, and the industrial internet of things (IIoT).

Only 153 manufacturing facilities worldwide have received the Lighthouse distinction from WEF, and Agilent is the sole analytical and clinical laboratory technology company among them. It is the second Agilent facility to be named a Lighthouse, after Agilent’s Singapore site in 2022.

While I am not a huge fan of the World Economic Forum, I have followed their work on supply chains for many years and believe this recognition is meaningful.

Adding to that, Agilent is highly diversified.

As the charts above show, it has significant exposure in Europe and APAC nations. It is also far less dependent on healthcare than one might expect due to its focus on laboratories.

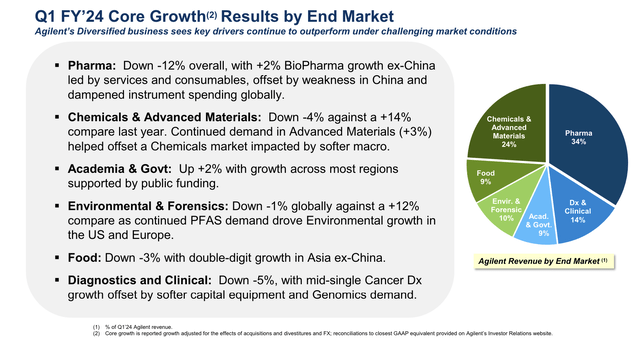

Using the data below, we see a big part of the company’s customers operate in non-healthcare sectors that require advanced laboratories, including chemicals and food-related customers.

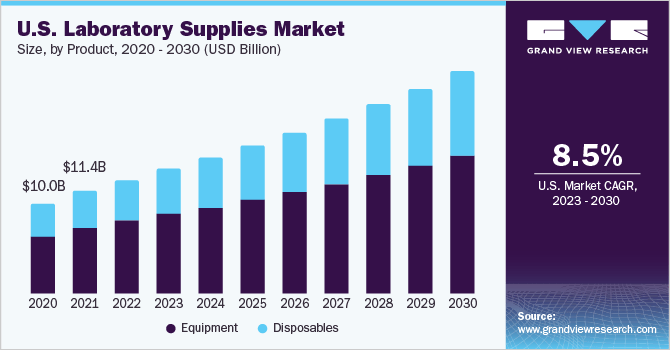

Moreover, according to Grand View Research, the market for laboratory supplies is expected to rise by 8.5% annually through 2030, with roughly a third of it consisting of consumables.

Grand View Research

Even better, Agilent is in a great spot to benefit from outperforming growth in key markets, including Asia.

The market is expected to grow steadily in the coming years owing to the continuous and stable supply of laboratory equipment. The Asia Pacific region accounted for the majority of growth during this period, owing to increased clinical diagnostic testing adoption, increased disposable income, a surge in research, development, and innovation activities, and increased disease prevention and early detection awareness. – Grand View Research

Improving Growth & What To Expect Going Into Earnings

You may already have seen it in the charts I used to show the company’s sector/industry breakdowns, but the company is still stuck in a volatile business environment.

In the first quarter, the company noted that the chemical and advanced materials market decreased by 4% after a 14% growth rate in the previous year.

Advanced materials, however, showed resilience with a low single-digit year-on-year improvement and positive quarter-over-quarter growth despite challenging comparisons.

Meanwhile, the academia and government market grew by 2%, which indicates stable academic funding and lab activity. In general, I have heard similar comments from the company’s peers, who indicate that this market segment remains extremely strong – likely due to less impact from elevated rates on funding.

Moving over to the diagnostics and clinical market, this segment saw a 5% decline, with pathology growth offset by challenges in various areas, including genomics, cell analysis, and liquid chromatography.

The environmental and forensics market saw a 1% decline, driven by new global regulations for PFAS testing, with China and the U.S. offsetting growth in Europe.

Going into its second-quarter earnings, the company hasn’t set the bar very high, as it expects revenue to come in between $1.56 and $1.59 billion. That’s a decline between 9.1% and 7.4% on a reported basis.

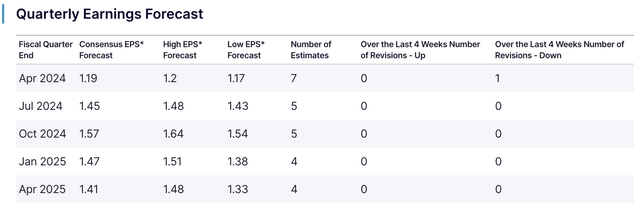

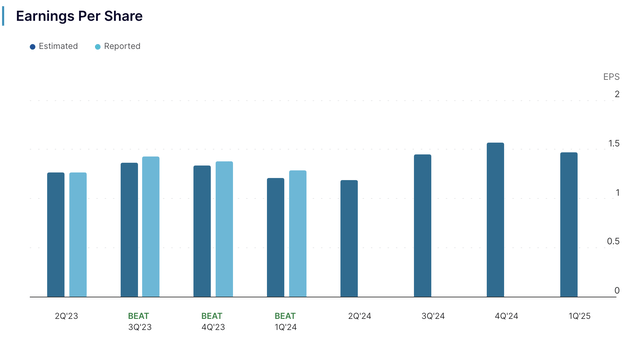

Analysts expect 2Q24 EPS to come in at $1.19. This is based on seven estimates, with one down revision over the past four weeks.

The company has beaten EPS expectations for three consecutive quarters.

Going into earnings, I care a lot about what the company has to say about its future. As obvious as that may sound, Agilent and its peers are in a very volatile post-pandemic environment.

The market needs visibility, as we want to know how much longer demand will be sluggish. Using the chart above, analysts expect stronger earnings momentum going into the end of this fiscal year.

This is expected to last.

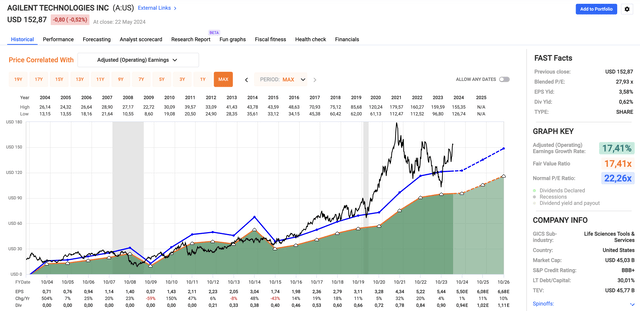

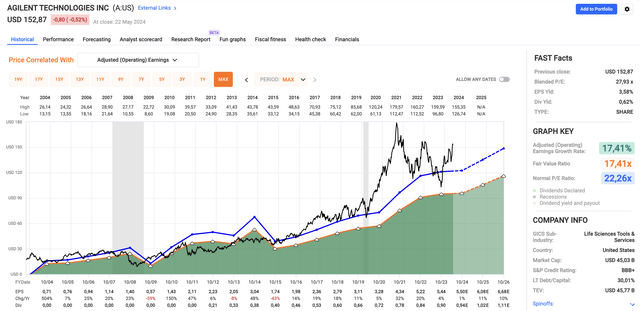

Using FactSet data from the chart below, analysts expect 1% EPS growth in 2024, potentially followed by 11% and 10% EPS growth in 2025 and 2026, respectively. Please note that I’ll show this chart again in the valuation part of this article.

This makes sense, as the company added some color to its longer-term growth expectations during the recent TD Cowen Annual Health Care Conference.

During this conference, the company started by mentioning the CEO transition from Mike McMullen, who was with Agilent for 40 years, to Padraig McDonnell, who has been with the company for 26 years.

He has a very customer-centric approach and growth mindset, having successfully grown the CrossLab business’ operating profit margin from 25% to 30%.

Speaking of growth, the company used the conference to explain that it keeps a very positive long-term outlook, expecting between 5% and 7% annual organic growth and between 50 and 100 basis points of margin improvements.

Unsurprisingly (given what we discussed so far), the company sees opportunities in biotech and wants to increasingly focus on recurring revenue, which is something all of its peers are doing as well.

Moreover, and this is something to keep in mind as we await the 2Q24 earnings call, China is turning out to be stronger than expected. In 1Q24, it saw 9% contraction. It expected a revenue contraction in the mid-20s.

This was driven by growth in applied markets, including chemicals and advanced materials, supported by semiconductors and lithium-ion batteries – two major growth markets in Asia.

In general, while China is suffering more from post-pandemic weakness than other major nations, the South China Morning Post reports that underlying strength remains solid:

Despite its slump from a baseline kept high by the pandemic, China’s diagnostics market is still expected to beat the global industry in growth, as it plays an important role in disease prevention and treatment for a large and rapidly ageing population.

“In 2023, the industry gradually returned to normal development, and the demand for conventional tests that had been previously affected is set to grow rapidly,” said Zhu Yaoyi, a professor and secretary general of the association’s medical laboratory sciences branch, at an event commemorating the report’s release. – South China Morning Post

That said, one thing to keep in mind is the Biosecure Act and rising geopolitical tensions that could turn into risks for Agilent.

The bill, introduced in January, seeks to stop firms that receive federal funds from using select Chinese service companies: the genomics firms BGI, MGI, and Complete Genomics; and WuXi AppTec, a contract drug manufacturer with clients such as Eli Lilly and Company. The bill’s latest iteration also adds WuXi AppTec’s sister company, WuXi Biologics. – C&EN

The good news is that Agilent is investing in local capabilities, including new facilities to meet “country-of-origin” requirements to deal with new laws of nations protecting their own markets.

Valuation

Using the chart below again, the company is trading at a blended P/E ratio of 27.9x, which is well above its normalized P/E ratio of 22.3x.

The obvious question is if this is warranted.

Personally, I have become a bit more careful, yet far from bearish.

The biggest mistake investors in this space have made in recent years is focusing too much on the short-term. Because of a strong performance during the pandemic and slowing growth after the pandemic, a lot of stocks in this industry appeared to be expensive.

While Agilent is far from cheap, the market is expecting the company to return to its old habit of reporting double-digit annual EPS growth.

If the company is able to grow organic revenue by up to 7% per year on a consistent basis, I doubt investors will shy away from a 28x multiple.

A potential correction could be triggered if the company hints at more weakness in China or any of its major end markets. Given how fragile the recovery is, any signs of weakness could cause some selling.

That said, I do not anticipate corrections to last, as I expect Agilent to gradually work its way to new all-time highs, potentially returning to its old “habit” of returning north of 10% per year, which is likely if it combines 5-7% annual organic revenue growth with up to 100 basis points of margin improvements.

Takeaway

As discussed in prior articles, Agilent Technologies has proven itself as a resilient and innovative leader in the diagnostics and research industry, with a solid recovery after challenging post-pandemic years.

With a strong focus on strategic growth, diversified market exposure, and innovation in manufacturing, the company is well-positioned for sustained growth.

Moreover, despite the volatile business environment the company is facing, Agilent’s organic growth outlook and expected margin improvements highlight its long-term potential.

While the stock may face short-term fluctuations, especially with the upcoming earnings report, its historical performance and growth markets make it a compelling investment, which is why I stick to a Buy rating.

Pros & Cons

Pros:

- Strong Market Position: Agilent is a leader in life sciences, diagnostics, and applied chemical markets.

- Resilient Performance: The company has shown an impressive recovery last year – despite a challenging environment.

- Innovative Operations: Agilent’s use of AI, robotics, and data analytics sets it apart and provides opportunities for long-term growth.

- Growth Potential: Expected organic growth of 5-7% annually and margin improvements are great news for long-term shareholder returns.

- Global Reach: The company has significant exposure in Europe and APAC, with growth opportunities in non-healthcare sectors.

Cons:

- Valuation Concerns: The company is trading at a P/E ratio of 27.9x, which is well above its normalized P/E ratio of 22.3x. This means there’s little “room for error” when it reports its earnings.

- Market Volatility: The post-pandemic business environment remains unpredictable, with ongoing uncertainties.

- Geopolitical Risks: Rising tensions and new regulations, like the Biosecure Act, could impact Agilent’s operations in China.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.