Summary:

- Agilent’s may be an underappreciated winner with Alnylam’s recent clinical success, as manufacturing Amvuttra could generate more than $500M in revenue in the coming 5-7 years that isn’t in models.

- Sharp cutbacks in capex spending across academic labs, biopharma, chemical, food/beverage, and material science companies has hit Agilent’s revenue hard this year, but the capex cycle will recover.

- Despite current challenges, Agilent’s long-term leverage to growth in areas like advanced materials, biopharma, and genomics makes it worth consideration.

- Life sciences tools companies almost never get conventionally cheap without a disaster, but there’s still a GARP argument for Agilent shares toward $150.

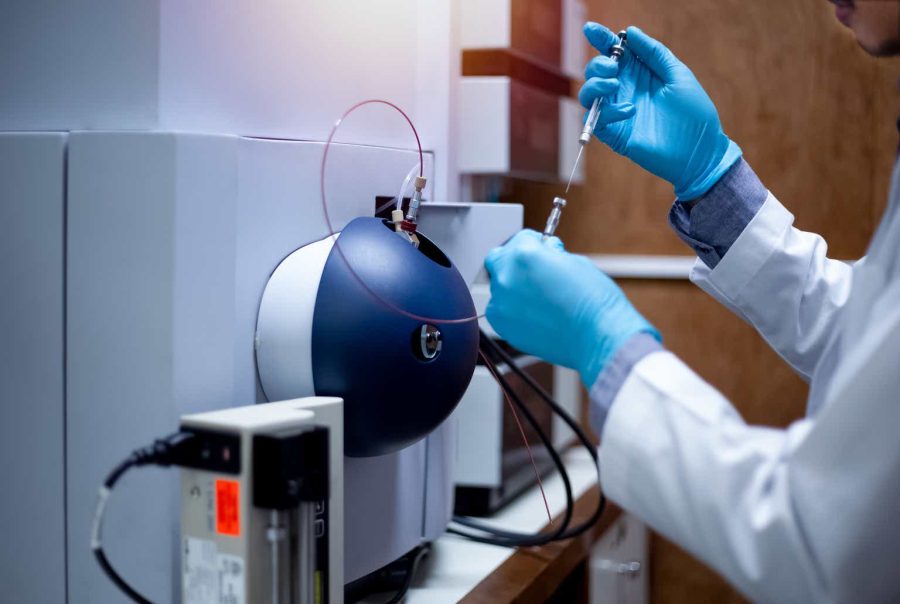

Suriphon Singha/iStock via Getty Images

If you follow enough stocks long enough, your brain starts to resemble a “crazy wall” (or, more nicely, an “investigation board”; imagine the TV trope of pictures, notes, and so on connected by strings), but sometimes that be helpful.

Writing about Alnylam (ALNY) and its very successful HELIOS-B study the other day, my mind turned to other companies that could be impacted, and that brings me to Agilent (NYSE:A). Not only is a piece of Alnylam’s blockbuster-to-be Amvuttra potentially worth well over $500M/year in the not-so-distant future, it’s been a while since I’ve updated my thoughts on this life sciences and material sciences company.

Up more than 20% since my last article (though down more than 10% from its highs), my “different is better” thesis on Agilent seems to be working out, as the company’s shares have outperformed comparables like Bruker (BRKR), Danaher (DHR), Thermo (TMO), and Waters (WAT) and may be in a relatively better position to navigate a very challenging period in the life sciences tools space. Not exactly a bargain, I do think there is still a credible argument to make in Agilent’s favor.

Let The Sun Shine

As I said in the open, my thoughts turned to Agilent when I saw the HELIOS-B results, as Agilent has long been Alnylam’s manufacturing partner for its oligonucleotides. Based on trial results that were effectively as good as anybody good reasonably expect (and better than base-case expectations), Amvuttra looks positioned to become a major player in the ATTR-CM amyloidosis market, and that will provide a boost to Agilent’s Nucleic Acid Solutions business.

Agilent’s Nucleic Acid Solutions business is still a relatively small one for Agilent (around 4% to 5% of revenue), but it has benefitted from not only Alnylam’s success (including five commercialized compounds), but also growing clinical interest in similar approaches (RNAi, antisense, and so on) and next-gen sequencing for indications like oncology.

I have never seen Agilent or Alnylam discuss their manufacturing relationship, but based on knowing a little bit about the business, I would estimate that Agilent sees about 7.5% to 10% of the revenue that Alnylam’s compounds produce. With approval in ATTR-CM Amvuttra’s revenue is likely to scale up quickly to over $5B and a peak in the $8B to $10B area is not ludicrous to consider. With that, Agilent may be looking at an incremental $500M in revenue over the next few years that I don’t believe was in many analyst models.

Based on management discussions, they can handle about $450M in revenue today, with new capacity coming online in FY’26 and FY’27 that will double that. Given what could be a fast ramp for Amvuttra, Agilent may have to accelerate those plans, and I’d note that Alnylam has other promising products in its pipeline, including a drug for hypertension (zilebesiran) that could generate multiple billions of dollars in revenue (or multiple hundreds of millions of dollars for Agilent) if later-stage studies are successful.

Meanwhile, It’s Still Raining …

As enthusiastic as I may be about the Amvuttra revenue opportunity, the reality is that present conditions remain challenging for Agilent.

Revenue was down more than 7% in the last quarter, with 13% contraction in Life Sciences and Applied Markets Group (or LSAG) on weak spending on instruments (liquid chromatography, mass spec, and cell analysis, with the latter down “mid-20’s”). Applied CrossLab Group revenue was better, up 5% on double-digit growth in service contracts, but not surprisingly new instrument installation revenue was weak. Diagnostics and Genomics Group revenue was down 8% on broad weakness, including a low-teens contraction in NAS as clinical programs were pushed out, but there was some growth in pathology and cancer diagnostics, and PFAS testing remains a growth opportunity.

Management did note that orders turned positive for the first time in seven quarters, but conditions remain tough and they also cut revenue guidance by about 5% at the midpoint, with much of the damage coming from ongoing weakness in the pharma and China end-markets.

Looking at other life sciences tools companies, Danaher reported a 17% decline in Biotechnology revenue for calendar Q1’24 and a 3% decline in Life Sciences, while Thermo saw a 3% decline in sales, and Waters saw a 9% decline. Bruker managed 2% organic growth, but does admittedly have a different set of drivers in play. Said differently, even with Agilent’s more cyclical business mix (chemical, material sciences, and food/beverage companies account for almost as much revenue as biopharma customers), the company isn’t doing that much worse than its peers.

… But It Won’t Rain All The Time

I’m also still bullish on the longer-term opportunity at Agilent. Based on company commentaries during the last earnings cycle, it seems like biopharma capex budget corrections are bottoming out and should start growing again in 2025. Likewise, while I don’t think academic/government research budgets are going to come roaring back, I don’t see them getting much worse. I expect chemical company capex will likely be softer over the next year or so, and probably so too for food/beverage, but semiconductor and electronics markets are rebounding, and there’s still strong demand in areas like battery technology.

Thinking about this thematically, Agilent is still leveraged to strong trends like the “greening” of the chemical industry – harnessing R&D to find compounds that have a better overall environmental footprint and/or replace key performance materials that are for whatever reason problematic (like removing rare earth elements from magnets). I also see opportunities for Agilent to leverage its capabilities in areas like mass spec into the growing market for MS-driven clinical diagnostics (though I think Bruker is the better play on that theme).

I’m also still bullish on the long-term leverage Agilent has to genomics, sequencing, and structural chemistry. Cell analysis and structural chemistry are still in their infancy insofar as driving drug development, and there is a long runway for growth in areas like next-gen sequencing (for research and diagnostics) and new therapies like RNA interference (Alnylam’s core technology), messenger RNA (the core technology at BioNTech (BNTX), antisense (Ionis (IONS), gene therapies, and other newer approaches like gene and exon editing. To that end, I’d point out that Roche (OTCQX:RHHBY) has signed six partnership deals over the last four years with biotechs targeting RNA in one form or another, and they’re not the only Big Pharma pursuing this area.

The Outlook

Although Agilent did about as I expected in FY’23, that hasn’t been the case in FY’24 as the sharp downturn in biopharma capex, not to mention weaker trends in the chemical industry, government/academic labs, and food/beverage have hit the company harder than I expected.

I’m expecting revenue to decline 5% or 6% this year, but rebound about 7% next year and grow around 8% for a few years after that. Not surprisingly, I DO have Amvuttra-driven revenue in my Agilent model, though there are certainly uncertainties as to the timing and magnitude of the ramp here (the drug isn’t even approved yet for ATTR-CM and won’t be launched until 2025). Long term, I’m still looking for around 5% to 6% revenue growth from Agilent and that’s without considering any meaningful M&A.

Margins seem to be holding up okay for now, and I think Agilent will get by with a slight decline in EBITDA margin from FY’23 and a point or so decline in operating margin before rebounding in FY’25 and climbing toward 30% (operating margin) and the low/mid-30%’s (EBITDA). I still expect free cash flow production to scale up with revenue growth, reaching the mid-20%’s over the next three to five years and then slowly climbing toward the high-20%’s over time, driving high single-digit (around 8%) annualized FCF growth.

The bad news regarding Agilent’s relative outperformance is that a stock that wasn’t all that cheap to begin with really isn’t meaningfully cheaper now. I do still see a decent long-term return on a discounted cash flow basis (mid-to-high single-digits), and I can still argue for a slightly higher share price on the basis of growth, margin, and return-driven EV/revenue and EV/EBITDA (including an 20x forward EBITDA multiple).

The Bottom Line

Agilent isn’t a classic bargain and there are plenty of valuation-oriented investors who still won’t touch it at this level. If you’re more of the “growth at a reasonable price” type, though, I do think this recent pullback could be an okay opportunity ahead of what should be a better operating environment in calendar 2025.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of alny, RHHBY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.