Summary:

- I reiterate a “Buy” rating on Agilent Technologies, Inc. with a one-year target price of $150 per share, driven by strategic growth and market recovery.

- Agilent’s acquisition of BIOVECTRA will enhance its CDMO business, focusing on oligonucleotides and CRISPR therapeutics, and expand service offerings in peptide synthesis.

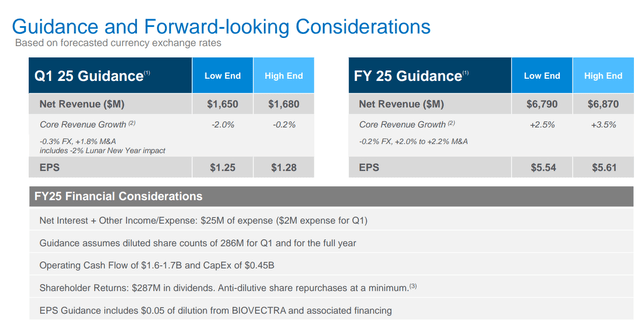

- Agilent’s FY25 guidance includes 2.5%-3.5% core revenue growth and 5.8% adjusted EPS growth, aligned with market expectations and supported by segment-specific growth strategies.

- Key risks include the sluggish economy and geopolitical tensions in China, which represents a significant portion of Agilent’s revenue.

Michael Vi

In my previous “Buy” thesis on Agilent Technologies, Inc. (NYSE:A) from August 2024, I highlighted their business transformation towards growth areas. Agilent delivered -0.3% core revenue growth in its fiscal Q4 and guides for 2.5%-3.5% core revenue growth for FY25, in line with the market expectations. I reiterate a “Buy” rating with a one-year target price of $150 per share.

Completed Acquisition Of BIOVECTRA

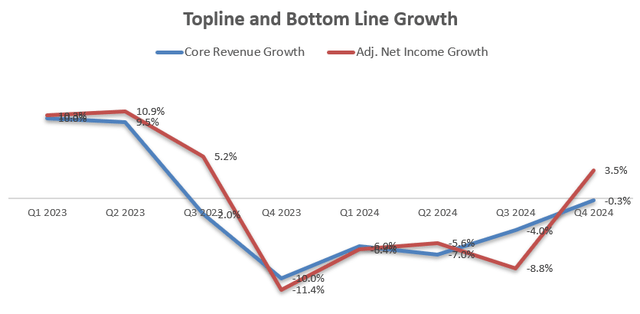

Agilent released its Q4 FY24 result on November 25th after the market close, reporting 0.3% decline in core revenue and 3.5% growth in adjusted net income, as depicted in the chart below.

During Q4, Agilent completed the previously announced acquisition of BIOVECTRA for $925 million, a leading specialized contract development and manufacturing organization (CDMO). I believe the acquisition will help Agilent build their CMDO business in oligonucleotides and CRISPR therapeutics end-markets. During the earnings call, the management noted that the company will add additional high-growth therapeutic modalities like peptide synthesis to extend their service offerings.

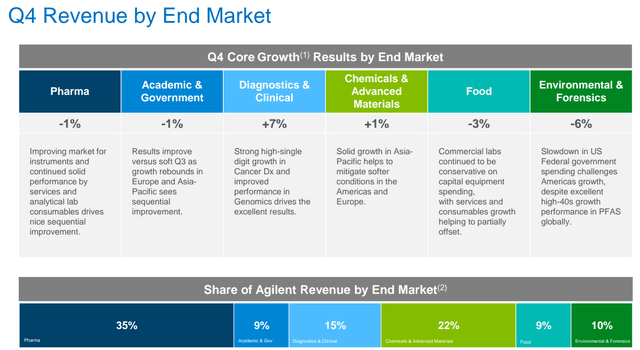

My key takeaway from the quarter is the early signs of recovery in the pharmaceutical market. Agilent’s pharma end-market declined by 1% during the quarter, with biopharma declining by mid-single-digit and small molecule growing by low-single-digit. During the earnings call, the management expressed strong confidence in a broader market recovery throughout 2025.

Outlook and Valuation

Agilent is guiding for 2.5%-3.5% core revenue growth and around 5.8% adjusted EPS growth for FY25, as detailed in the side below. The outlook is largely aligned with the market expectations.

I am considering the following factors for their future growth:

- Life Sciences and Applied Markets Group: The segment represents almost half of Agilent’s total revenue. During the earnings call, the management indicated that the segment will be a strategic focus in the near future. As the Fed has begun to cut interest rates, I anticipate the economic will start to normalize and the funding environment in the biopharma industry will gradually improve. As such, I anticipate the segment will grow by 5.5%, aligned with the overall growth in pharma and applied market. In the near term, I anticipate strong growth momentum in their analytical lab consumables, which grew at a mid-single-digit rate.

- Agilent CrossLab Group: The segment has exhibited consistent growth across major geographies except China, as noted during the earnings call. I believe Agilent has a strong CrossLab services team. I anticipate the segment will grow by 4% annually, comprising 5% growth in developed countries and 1% headwind from China.

- Diagnostics and Genomics Group: I anticipate the segment will grow by 5%, aligned with their recent performance.

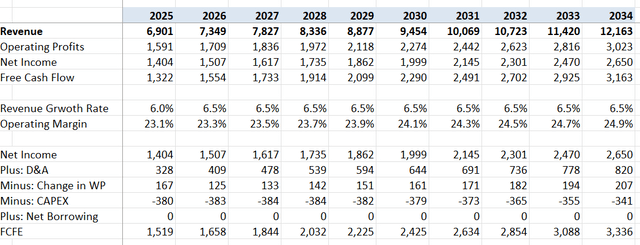

- Adding the three segments together, I calculate Agilent will deliver 5% organic normalized revenue growth. In addition, I assume the company will allocate 6% of revenue toward M&A, contributing 1.5% growth to the topline.

- I continue to forecast 20bps annual margin expansion, driven by 10bps from gross profits and 10bps from reduction in SG&A expenses. I estimate the total operating expenses will grow by 6.2% annually, resulting in 20bps operating margin expansion.

- The cost of equity is calculated to be 11.9% assuming: risk-free rate 3.8%; beta 1.17; equity risk premium 7%.

I calculate the free cash flow from equity (FCFE) as follows:

Discounting all the future FCFE to the year-end of FY25, the one-year target price is calculated to be $150 per share, as per my estimates.

Key Risks

The Asia Pacific region represents more than 34% of Agilent’s total revenue, with China representing a significant portion of this market. In Q4, their China business declined by 3% year-over-year. During the earnings call, the management noted an increase in funnel sales activities in China. However, they decided to take a conservative approach on the timing of the market recovery. I think China will remain a key risk for Agilent in the near future due to the sluggish economy and escalating geopolitical tensions between the US and China.

End Note

I am encouraged by the signs of end-market recovery in 2025, which could potentially accelerate Agilent’s growth in the near future. I reiterate a “Buy” rating with a one-year target price of $150 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.