Summary:

- Agilent Technologies’ Q4 revenue was $1.69 billion, reflecting a 9.7% YoY decline, but the company achieved a healthy operating margin of 27.8%.

- Most regions showed sequential growth except for China, which saw a 31% decline.

- Agilent anticipates a slow but steady recovery in fiscal year 2024 with cost-saving measures and expects revenue in the range of $6.71 to $6.81 billion.

Matteo Colombo

Introduction

As we slowly (or rapidly?) head toward 2024, it’s time to discuss one of the most fascinating stocks of 2023.

This year, I started covering Agilent Technologies (NYSE:A) as part of a bigger focus on the healthcare sector.

My most recent coverage was published on November 17, when I wrote an article titled “Agilent Technologies: Looking Undervalued Heading Into Earnings.”

As the title may suggest, it was an earnings preview in light of the stock’s poor performance.

Here’s a part of my takeaway (emphasis added):

While short-term uncertainties have led to a stock price decline and workforce cuts, Agilent’s strong financials, commitment to innovation, and global presence make it a compelling long-term investment that benefits from significant secular growth.

The upcoming earnings report provides an opportunity to re-assess the risk/reward scenario, with the potential for rebounding growth in China and a positive outlook beyond current challenges.

Last month, the company announced its earnings, which were better than expected. The company also presented at the Evercore ISI HealthCONx Conference, which means we have a lot to discuss!

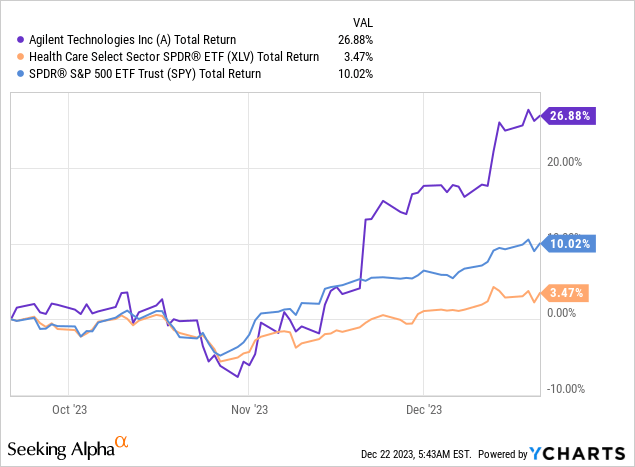

Since my November article, the stock has returned more than 20%, making it one of the best performers in healthcare – and in the S&P 500, in general.

Over the past three months, the A ticker has returned close to 30%!

Hence, the aim of this article isn’t just to dive into 3Q23 earnings but to assess the new long-term risk/reward as we head into what is set to be yet another exciting calendar year.

So, let’s get to it!

The Company Is Back On Track

Let’s start with the raw numbers.

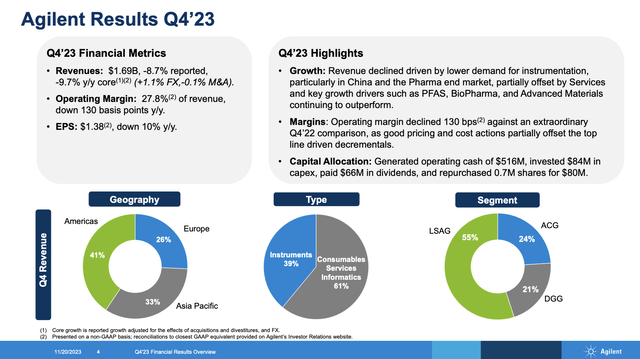

Agilent’s Q4 revenue was $1.69 billion, reflecting a 9.7% year-over-year decline.

Despite the challenging market conditions, the company achieved a healthy operating margin of 27.8%. Earnings per share came in at $1.38, surpassing guidance, even with a 10% decline.

Analysts were looking for $1.34 in EPS.

Agilent Technologies

Although experiencing a year-on-year decline, most regions showed sequential growth, except for China, which saw a 31% decline.

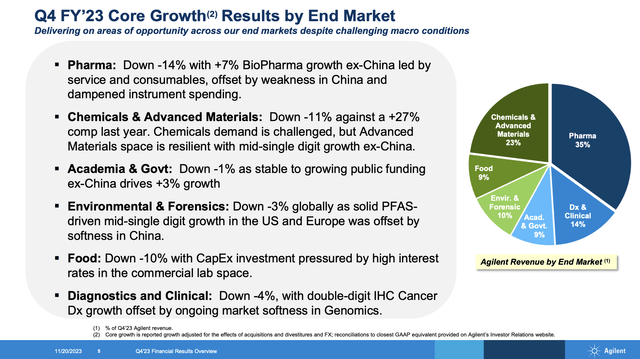

Moreover, as expected, the pharma sector witnessed a 14% decline due to cautious capital expenditures, which is something almost every single one of Agilent’s peers is struggling with.

Agilent Technologies

Biopharma outside China, however, saw high single-digit growth.

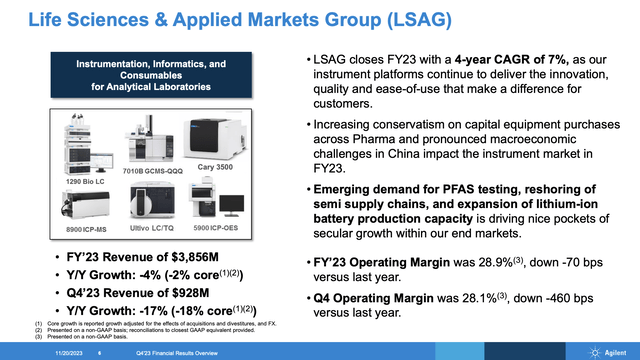

- Life Science and Applied Markets Group (“LSAG”): This segment achieved revenue of $928 million, reflecting an 18% core decline. This decline was attributed to customer caution in Pharma, partially offset by growth in PFAS solutions and Advanced Materials.

Agilent Technologies

- Agilent CrossLab Group (“ACG”): This segment saw revenue of $404 million, marking a 4% core increase and 6% reported. Growth was observed across all regions except China, with the Contract Services business showing double-digit growth.

-

Diagnostic and Genomics Group (“DGG”): DGG generated revenue of $356 million, remaining flat on a core basis and up 1% on a reported basis. In this segment, strong growth in Pathology NASD businesses was offset by challenges in genomics.

Taking a closer look at the company’s operating environment during the fourth quarter, Agilent faced a dynamic landscape marked by challenging macroeconomic conditions.

Despite these hurdles, the company showed resilience and adaptability in its end-market performance.

The pharma sector, Agilent’s largest market, experienced a substantial 14% decline, contrasting sharply with the 20% growth rate observed in the same quarter of the previous year (tough comparisons).

While biopharma and small molecule segments faced challenges, there was a noteworthy 7% growth in biopharma, excluding China, mitigating some of the overall market impact.

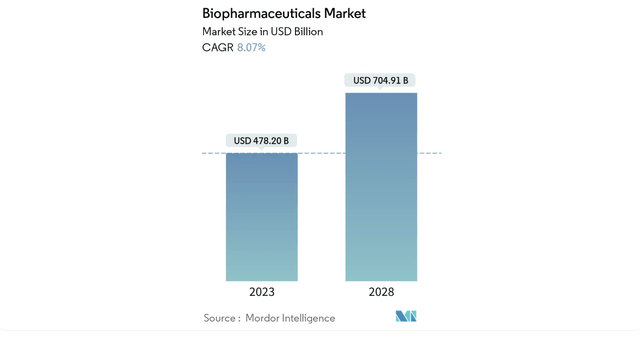

Mordor Intelligence expects the biopharma industry to grow by at least 8% per year through 2028.

Mordor Intelligence

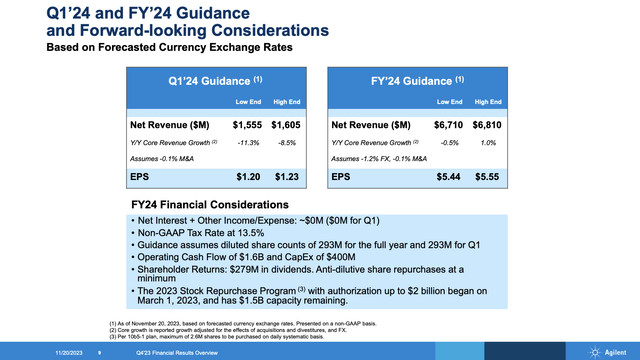

Going forward, Agilent anticipates a slow but steady recovery in fiscal year 2024, considering market uncertainties and challenges.

Cost-saving measures of approximately $175 million are incorporated into the guidance below.

This outlook also includes revenue in the range of $6.71 to $6.81 billion, with core growth ranging from a slight decline of 0.5 to 1 point of growth.

Fiscal 2024 non-GAAP EPS is expected to be in the range of $5.44 to $5.55.

Agilent Technologies

Another thing I want to highlight with regard to shareholder distributions is that the company generated an impressive operating cash flow of $516 million, which exceeds 100% of adjusted net income.

On November 16, the company hiked its dividend by 4.9%. The dividend has been hiked by 8.6% per year over the past five years. Unfortunately, the yield is just 0.7%, which makes Agilent a poor choice for investors dependent on income.

Long-Term Growth Potential

During the recent Evercore ISI healthcare conference, the company discussed longer-term growth trends.

In light of what we discussed in this article so far, the company is very upbeat about its opportunities in China – despite challenges.

The company’s recent trip to Shanghai highlighted the company’s dedication to aligning with China’s initiatives, such as the 14th 5-year plan and “Made in China 2025.”

Furthermore, the company believes that its strategic investments and adaptations to in-country sourcing lay the groundwork for future growth in one of the world’s most significant markets.

Simultaneously, Agilent is strategically positioning itself to tap into emerging opportunities globally. The company aims to capitalize on untapped potential in regions with nascent life sciences and MedTech landscapes.

Agilent believes that this dual focus on thriving in established U.S. markets and strategically entering emerging territories positions the business for sustained global growth.

Speaking of faster growth, Agilent also highlighted ongoing opportunities in the replacement cycle of small molecule instrumentation, particularly in the QA/QC labs of the pharma industry.

As customers strive to keep their fleets updated, there is a consistent demand for new instruments, creating a cyclical growth pattern every 18 to 24 months. The company sees potential for sustained growth as they believe they are approximately nine months into the current replacement cycle.

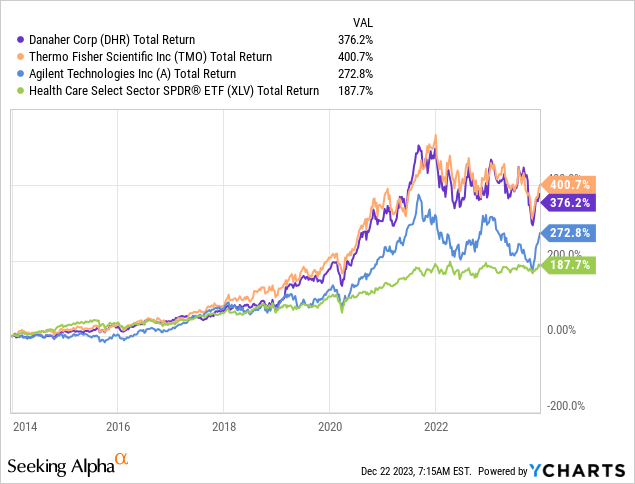

This also applies to two of my other favorite stocks, Thermo Fisher (TMO) and Danaher (DHR), which have done very well in the past.

As a matter of fact, A, TMO, and DHR have all outperformed the healthcare sector over the past ten years.

Based on these benefits, Agilent is upbeat about the growth potential in its service business, represented by Agilent CrossLab (“ACG”).

With double-digit growth in the ACG business, the company is actively working to improve connect rates, aiming to provide comprehensive services to entire labs.

This includes not only supporting their install base but also offering services beyond Agilent’s own instruments, making it a meaningful and expanding business.

On top of that, while expecting more moderate growth in the chemicals and advanced materials market, Agilent remains optimistic about long-term secular trends.

Despite potential challenges in the market, the company believes in the continued drive towards battery-powered vehicles and advancements in chemical and advanced materials, providing opportunities for growth.

Valuation

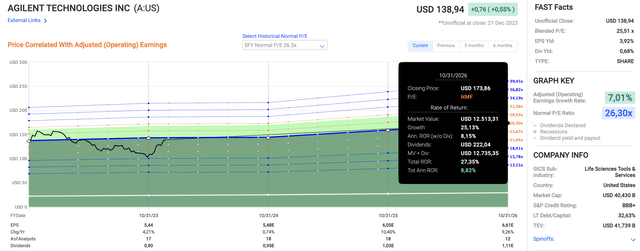

Using the data in the chart below:

- Agilent is currently trading at a blended P/E ratio of 25.5x.

- The five-year normalized valuation multiple is 26.3x.

- I believe the slightly higher normalized valuation is a fair target, as the company is expected to average 10% annual EPS growth after 2024.

- In general, it looks like Agilent and its peers will be out of the woods in the second half of 2024.

- A return to its normalized valuation would indicate a potential of 8% to 11% annual returns over the next few years, which is decent.

FAST Graphs

However, if I were to add another stock to my healthcare exposure, I would wait for a correction. Although it may come with risks of missing even more upside, I am not a big fan of the general risk/reward after the recent stock market rally.

Nonetheless, I’m sticking to a Bullish rating, as I have little doubt that the company is in a good spot to accelerate EPS growth and maintain elevated growth rates in the future.

The only reason why I do not own Agilent is my significant Danaher exposure. I do not want too many highly correlated stocks in my portfolio.

Takeaway

After a tough start to the year, Agilent Technologies emerges as a standout performer in the healthcare sector.

Despite short-term setbacks reflected in a stock decline and workforce cuts, Agilent’s recent earnings report exceeded expectations, fueling a remarkable 20% stock return.

The company’s resilience in a challenging market, strategic dividend hikes, and an optimistic outlook for 2024 and beyond underscore its long-term potential.

While I’m cautious about market risks after the recent rally, the prospect of sustained growth, especially in the service business, makes Agilent a stock worth watching for future opportunities.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.