Summary:

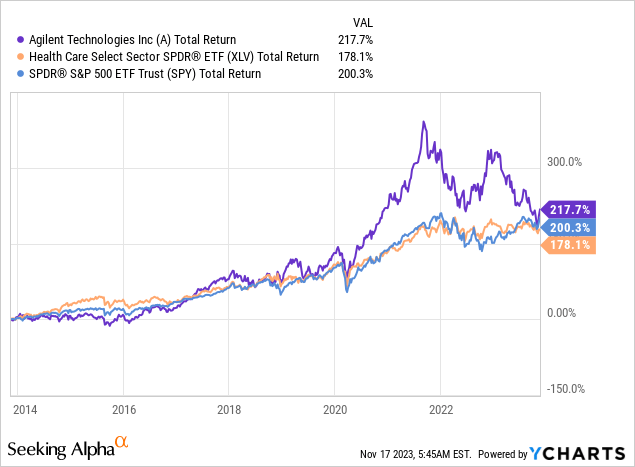

- Agilent Technologies has a fantastic track record of strong EPS growth and outperforming capital gains.

- More recently, the company has faced challenges with declining stock prices and negative headlines, including workforce cuts and declining revenue.

- Despite these challenges, Agilent remains confident in its long-term growth prospects, particularly in the pharmaceutical and life sciences markets.

Matteo Colombo

Introduction

This year, I started to focus more on healthcare. This includes biotechnology, drug manufacturers, wearable devices, and companies operating in the diagnostic & research industry, like Agilent Technologies (NYSE:A), the star of this article.

The stock, which has outperformed the healthcare sector and the S&P 500 over the past ten years, is currently trading more than 35% below its all-time high.

On July 13, I wrote my first article on this company, focusing on macro headwinds that currently offset longer-term secular benefits.

Agilent’s focus on resilient areas, such as the pharmaceutical industry, along with its emphasis on consumables and services, positions it well for future growth.

The company is benefiting from tailwinds in MedTech, biotechnology, and life science tools.

Although it faces challenges with conversion rates and macro uncertainties, Agilent’s strong financials, aggressive R&D spending, and global presence make it a compelling investment option with the potential to generate outperforming total returns.

Since then, the stock has been pretty much unchanged, as investors have been through a mix of headwinds and tailwinds, including mixed earnings and the market’s belief that we may be close to a Fed pivot, which would be very bullish for healthcare funding.

In light of these developments and the upcoming earnings on November 20, it’s time to re-assess the risk/reward, as I continue to believe that the company offers great long-term potential.

So, let’s get to the details!

Agilent’s Ongoing Struggles

In addition to its poor stock price performance, the company is creating negative headlines, suggesting that it is not out of the woods yet.

Silicon Valley Business Journal

On November 16, the Silicon Valley Business Journal reported that the company is reacting to a slump in laboratory equipment sales by cutting its workforce.

Although this is hardly a headline that keeps investors up at night, it does represent current industry struggles quite well.

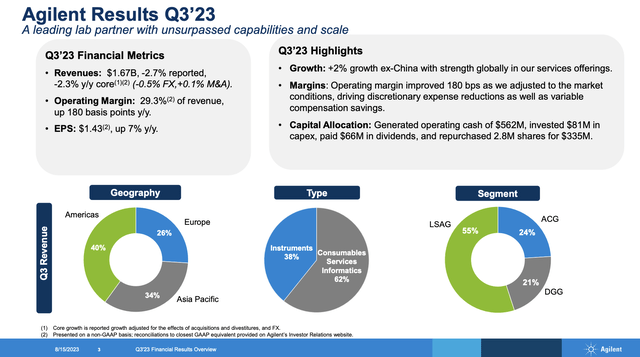

For example, in the third quarter, the company reported revenue of $1.67 billion, experiencing a core decline of 2.3% and 2.7% on a reported basis.

These numbers, which were revealed on August 15, contrast with the 13.2% core growth observed in the same period last year, which is one reason why it has had a hard time growing this year.

Factors influencing this decline include a 0.5-point currency headwind and minimal M&A contribution.

Adjusting for a revenue shift from the second quarter of the previous year, the core growth would be approximately flat compared to the prior year.

When taking a closer look at its business segments, we see a mixed picture as well, mainly driven by a tough comparison.

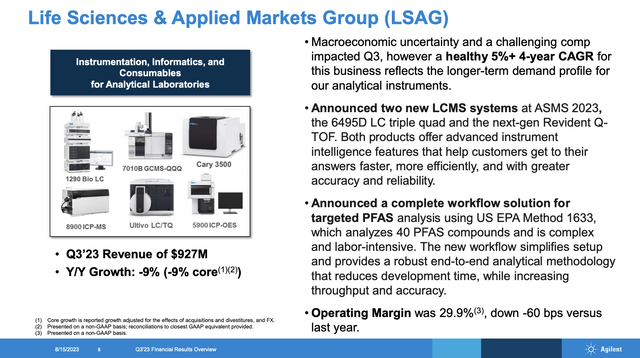

- Life Science and Applied Markets (LSAG): This segment reported revenues of $927 million, a 9% decline against a tough comparison of 18% growth. Market challenges in China impact LSAG’s performance across all end markets and global pharma.

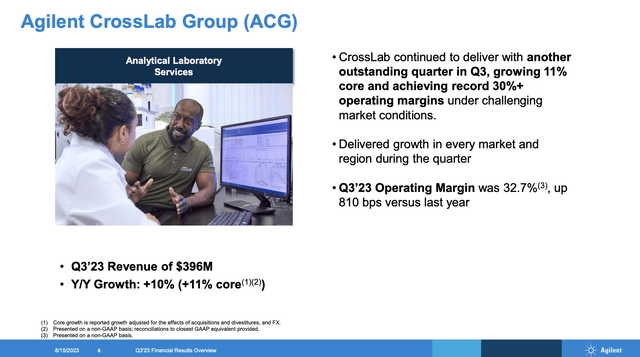

- Agilent CrossLab Group: No weakness to be seen here, with revenues of $396 million, up an impressive 11% core, with growth in all regions and end markets. Strong demand for services as customers embrace Agilent’s value proposition.

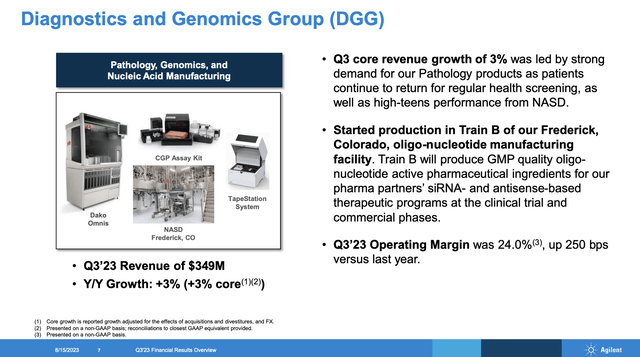

- Diagnostics and Genomics Group: Revenues of $349 million, with core revenues up 3%. Pathology grew high single digits, while NASD business grew high teens. Resolution Bioscience is shut down due to market weakness, but investments in future growth continue.

To somewhat summarize the numbers and comments above, the total pharma business was down 8%, primarily due to a 30% decline in the pharma market in China.

Biopharma business grew by 5%, while small molecule was down 16%. The Chemical Advanced Materials market declined by 3%, influenced by macro concerns and a difficult comparison.

China did a number on the company’s earnings.

Excluding China, the rest of Agilent grew by 2%, surpassing expectations.

- The Chemicals and Advanced Materials market decreased by 3%, facing a challenging 22% comparison but remaining flat sequentially in dollar terms.

- The academia and government market grew by 5%, with growth in all regions except the Americas.

- The diagnostics and clinical market grew by 3%, driven by high single-digit growth in pathology.

- The environmental and forensics business grew by 2%, propelled by water infrastructure projects and increased funding for PFAS-related activities.

- The food market saw a 1% growth, primarily in Asia and Europe.

With all of this in mind, the future is far less depressing than one might assume.

The developments Agilent is facing aren’t unique. The common theme in its industry is tough comparison headwinds and ongoing weakness in China.

Looking beyond these issues, we continue to see favorable demand.

Agilent’s Future Look Strong

Despite near-term challenges, Agilent remains confident in long-term growth prospects.

During its 3Q23 earnings call, the company emphasized investing in innovation and achieving cost efficiencies to support future profitable growth.

The company is on track to achieve targeted cost savings and is positioned well for the future.

Although the company acknowledges a challenging macro environment for new instrument purchases, it is confident in the long-term growth prospects of its industry.

The Pharma market remains a focus, with innovation and advances in medicines continuing.

In the applied markets, growth opportunities are expected in PFAS testing and the electrical vehicle transition.

Statista data reveals that the market for PFAS analytical instruments alone is expected to rise to $350 million by 2028:

California’s forecasted $888 million of spending (highest of all states in the U.S.) is driven by the state’s high number of confirmed contamination sites, the state Water Board’s proactive testing for PFAS contamination, and a more rigid regulatory environment. At the same time, New Hampshire, despite its small size, falls into the top 20 spot for remediation spending at $59 million, driven mostly by its more advanced regulatory landscape.

[…] “Public water systems, including investor-owned, will need to make significant investments to meet existing and impending standards,” says Balsamo. “Our team is keen to see if looming water quality standards will accelerate utility acquisitions, especially as smaller systems face additional financial pressures to address PFAS.” – WaterWorld

The company’s biggest segment, life sciences, is also expected to see fast growth. According to a recent report:

Compound Annual Growth Rate (CAGR): The estimated Compound Annual Growth Rate (CAGR) for the Life Sciences market during the period from 2022 to 2028 is 11.75%. CAGR reflects the average annual growth rate over the specified timeframe.

Furthermore, it is making tremendous progress in developing diagnostics for, i.e., cancer treatments.

The U.S. FDA has approved Agilent’s PD-L1 IHC 22C3 pharmDx as a companion diagnostic for identifying patients with gastric or gastroesophageal junction (“GEJ”) adenocarcinoma who may be eligible for Merck’s Keytruda (pembrolizumab) treatment.

Patients with gastric or GEJ cancer whose tumors express PD-L1 pathway can now be identified for potential treatment with Keytruda using PD-L1 IHC 22C3 pharmDx.

Agilent developed this assay in partnership with Merck as a companion diagnostic for Keytruda. This marks the sixth cancer type for which PD-L1 IHC 22C3 pharmDx has gained FDA approval.

Lou Welebob, vice president and general manager of Agilent’s Pathology Division, stated, “PD-L1 expression is a critical biomarker for response to anti-PD-1 therapies such as Keytruda. This endorsement underscores Agilent’s leadership in the development of companion diagnostics for groundbreaking anti-PD-1 therapies.” – Via Seeking Alpha

Nonetheless, for the time being, headwinds prevail, causing the company to adjust its outlook (in an unfavorable direction).

The revised outlook for the full year anticipates a more challenging macroeconomic environment, particularly in China.

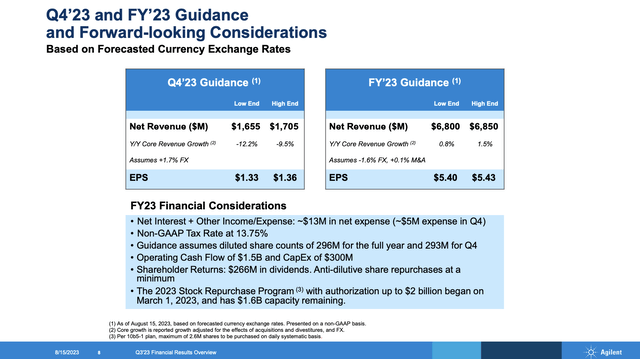

Hence, full-year revenue is expected to be in the range of $6.80-$6.85 billion, representing a decline of 0.7% to flat on a reported basis and core growth of 0.8% to 1.5%.

Non-GAAP earnings per share for the full year are forecasted to be between $5.40 and $5.43.

So, now what?

Fourth Quarter & Valuation

As we’re very close to the company’s fourth-quarter earnings, let’s see how high the bar is.

According to the company, fourth-quarter revenue is estimated to be in the range of $1.655-$1.705 billion, reflecting an 8% to 10.5% decline on a reported basis and a decline of 9.5% to 12% on a core basis.

Non-GAAP earnings per share for Q4 are expected to be between $1.33 and $1.36.

These numbers are visible in the chart above.

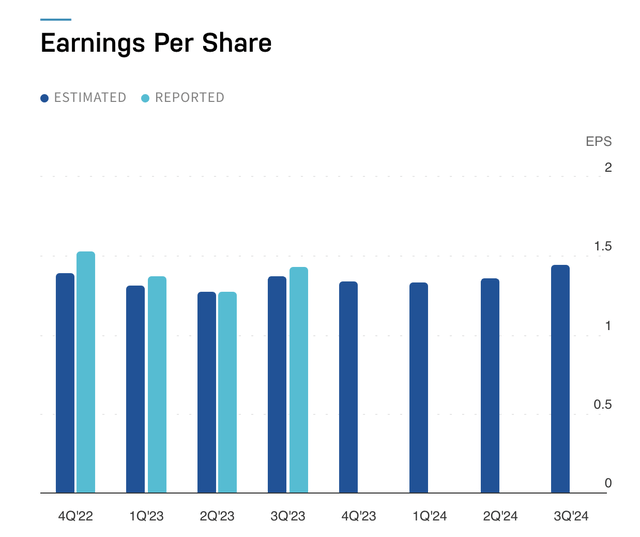

In 4Q23, analysts expect the company to generate $1.34 in EPS, which is based on eight estimates. Over the past four weeks, four analysts have downgraded their EPS expectations, which shows that a lot of negativity has been priced in.

This EPS target indicates a 12.4% decline in EPS. It’s also in the middle of the company’s own guidance range.

Although this needs to be taken with a grain of salt, I believe the company could beat estimates, as I believe that funding fears in the life science industry may be a bit overblown. I also expect that China’s healthcare industry is rebounding at a faster pace despite ongoing economic challenges overseas.

Regardless of that, I’m looking forward to the company’s comments on growth in China, healthcare inventories, and overall funding conditions in light of elevated rates.

I believe if the company hints at rebounding growth in China, we could see a stock price upswing. Comments that hint at prolonged weakness will almost certainly achieve the opposite.

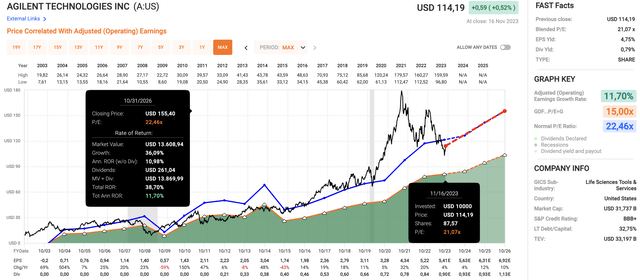

Valuation-wise, we’re dealing with an attractive stock.

Using the data in the chart below:

- Agilent is trading at a blended P/E ratio of 21.7x.

- Going back 20 years, the normalized valuation multiple is 22.5x.

- This year is expected to see 4% EPS growth, followed by 4% growth in 2025. Based on these numbers, its 21.7x multiple is justified.

- However, after 2024, EPS is expected to pick up and return to double-digits. This trend is confirmed by many other healthcare companies as well, as lower inventories, stronger overseas growth, and more favorable funding conditions are expected to bring back “normal” selling conditions.

Hence, I do expect that Agilent will continue its long-term uptrend, which could result in 10-11% annual returns – even if 2024 turns out to be another slow year.

The only reason why I do not own Agilent is my investment in Danaher (DHR). This healthcare supplier is highly correlated to it.

Having that said, I look forward to 4Q23 earnings. I’m positive and expect the company to hint at rebounding demand in key areas.

Nonetheless, please be aware that this is in no way an encouragement to start short-term trading and betting on post-earnings stock price developments.

The main goal of this article was to discuss the risk/reward, which I believe is very favorable for long-term investors.

Takeaway

Despite challenges and negative headlines, Agilent Technologies remains resilient.

The company’s strategic focus on the pharmaceutical industry, consumables, and services, positions it well for long-term growth.

While short-term uncertainties have led to a stock price decline and workforce cuts, Agilent’s strong financials, commitment to innovation, and global presence make it a compelling long-term investment that benefits from significant secular growth.

The upcoming earnings report provides an opportunity to re-assess the risk/reward scenario, with the potential for rebounding growth in China and a positive outlook beyond current challenges.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.