Summary:

- Agilent Technologies, a major player in life sciences and chemical analysis, faces cyclical and structural challenges but shows potential for growth in FY 2025.

- Despite a strong global presence and competitive advantages, Agilent’s stock offers limited upside at current prices, leading to a “hold” rating.

- Revenue decline is driven by downturns in China and reduced pharmaceutical spending, but management expects a turnaround in FY 2025.

- Valuation concerns and risks include increased competition and internal re-organization, making the stock less attractive for a “buy” rating.

Michael Vi

Agilent Technologies (NYSE:A) is one of the largest global life science test and measurement equipment and service market players. Agilent offers a broad spectrum, such as liquid chromatography (LC), mass spectrometry (MS), and other research and analytical equipment, as well as related consumables and services, which are crucial for pharmaceutics, biotech, academia, government, and various other industries. Recently, the company has been going through some challenges due to cyclical and geopolitical factors, some are cyclical, while others are structural. I believe Agilent will return to a growth trajectory in the next few years. However, at the current price, Agilent’s stock offers limited upside. Therefore, I am initiating coverage with a “hold” rating.

Agilent’s business

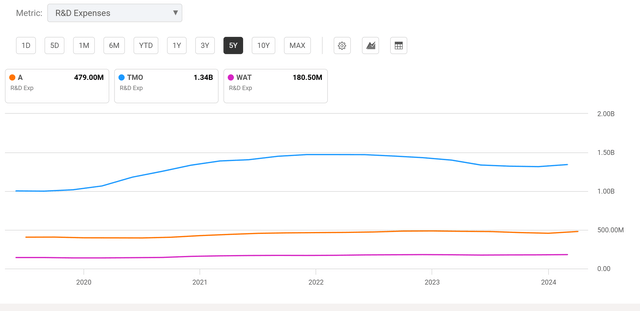

Agilent was spun off from Hewlett-Packard in 1999 as a separate entity focused on the test and measurement market. Since then, the company has grown both organically and through acquisitions. Over the years, Agilent has not only expanded its product offering but also gained market share in most of its end markets due to the company’s strong focus on R&D. Agilent spent almost 30% of its revenue on R&D expenses. In comparison, Waters Corp. (WAT) only spent about 6%, and Thermo Fisher (TMO) spent just about 3% of its revenue on R&D. In absolute dollar terms, Agilent’s R&D expense is multiple times larger than Waters Corp, but much less than Thermo Fisher.

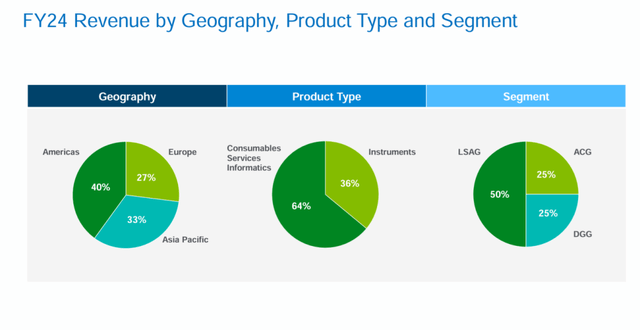

According to Agilent’s most recent earnings release, the company has three business segments: the life sciences and applied markets [LSAG] segment, the diagnostics and genomics [DGG] segment, and the Agilent CrossLab [ACG] segment. LSAG is Agilent’s most important segment and accounted for 50% of Agilent’s revenue for FY 2024. Regarding geographic exposure, Agilent’s largest market is the Americas, followed by Asia Pacific and Europe.

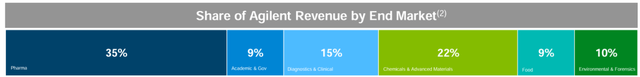

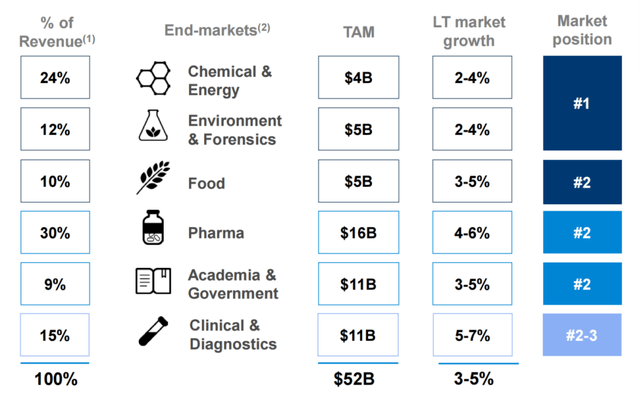

In terms of revenue by end market, the pharmaceutical end market, which accounted for more than a third of Agilent’s revenue, is the largest end market for the company. Chemicals and Materials, Diagnostic & Clinical are the next big two end market for Agilent, which account for 22% and 15% of Agilent’s revenue respectively.

While Agilent breaks down its end market into six categories, they are all related to life science, which is how I think about Agilent’s business. Prior to COVID, the global life science market was a great market with a GDP above the growth rate, according to Agilent’s 2019 Investor Day presentation.

Agilent’s past growth drivers

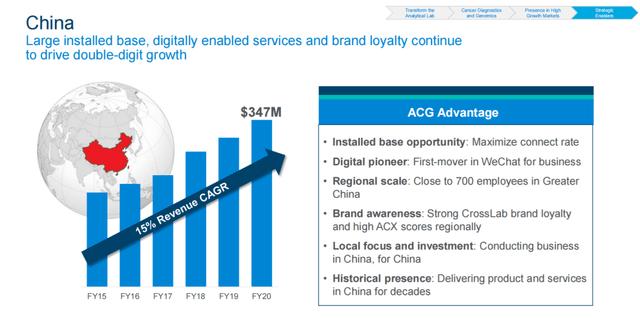

The past growth of the global life sciences market has been mostly driven by increasing R&D spending as well as the increasing outsourcing for the pharmaceutical and biotechnology companies. Additionally, the global need for test and measurement equipment has also benefited from growing demand from the government, academia, and other research institutions in areas such as food safety, environmental protection, and semiconductor self-sufficiency. Agilent has been a primary beneficiary of the strong growth in the global R&D demand, particularly in China. In fact, Agilent’s corporate website has dedicated a special report detailing Agilent’s history with China called “Agilent and China.” According to the report, Agilent can trace its operation in China all the way back to 1981, when “HP opened its Representative Office in China. From the beginning, HP and then Agilent have made it clear that they are in China for the long term, to support both China’s development and that of its own business.”

Agilent’s long history of operation in China gives the company deep local knowledge and a significant competitive advantage in China, which grew at a CAGR of 15% from 2015 to 2020 for Agilent. Coming out of COVID, Agilent’s China business initially looked like it would continue to boom. Agilent’s revenue in China grew 44% for Q4 of FY2022 and another 32% for Q2 of FY2023. However, Q2 of FY2023 was the last good quarter for Agilent in China.

Recent growth challenges

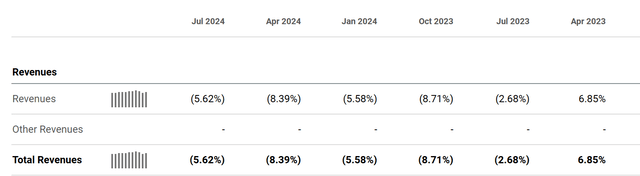

Starting from Q3 of FY2023, Agilent’s revenue has declined for 5 consecutive quarters, which is rare for Agilent.

Two factors have contributed mostly to Agilent’s revenue decline. Firstly, following years of rapid growth, Agilent’s operations in China experienced a steep downturn starting in the third quarter of FY 2023, when Agilent’s China revenue dropped 17% year-over-year. Since then, China has been a drag on Agilent’s results for 6 quarters. Secondly, the global pharmaceutical market, which accounts for roughly one-third of Agilent’s revenue, has decelerated spending. This slowdown is across the board from pharma biotech, CDMOs (Contract Development and Manufacturing Organizations), and CROs (Contract Research Organizations) following the industry’s boom during the COVID-19 pandemic.

While Agilent has suffered growth challenges during the past 6 quarters, there are positive signs of a potential turnaround for FY 2025. Management mentioned during the Q4 FY2024 call that “China was down only 3% and exceeded our expectations. We also booked our first China stimulus orders in October and anticipate much more in fiscal year 2025”. Management also expects “for the full year FY ’25, we’re expecting pharma to return to growth, so low to mid-single-digit growth there”. Looking ahead, it’s pretty clear that Agilent’s leadership has turned optimistic about returning to a growth trajectory for FY 2025 because both China and the spending by the pharmaceutical industry are on track to recover. Meanwhile, the company is committed to returning cash to shareholders through both dividends and share buybacks.

Valuation and risk discussion

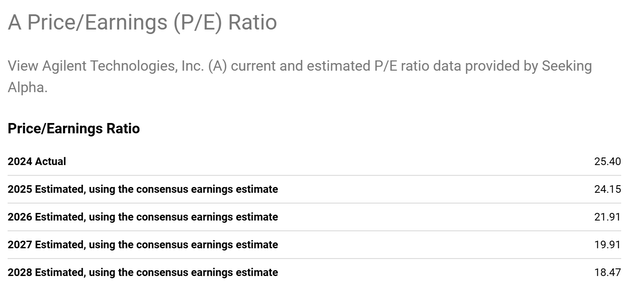

After the recent drop, Agilent is trading at more than 24 times forward earnings based on Seeking Alpha’s analyst estimates. The sector median is 20.7 times per Seeking Alpha’s valuation metrics. Agilent is trading at a 20% premium over the sector median. While Agilent possesses some competitive advantages, it is not immune to risks, which I’ll discuss next. To be conservative, I am using the sector median P/E multiple on Agilent’s FY 2025 EPS estimate of $5.56, which gives me a price target of $116-120 per share.

In terms of risks, I am mostly concerned with two long-term risks. The first risk is the potential for increased competition, particularly in the pharmaceutical market, from Waters and Thermo Fisher. Agilent’s disproportionate exposure to the pharmaceutical and biotech market increases its cyclicality due to R&D spending cycles and regulatory cycles. The second risk is the impact of cultural change. Agilent has been going through a re-organization and reconstruction process. There has been a high level of senior leadership turnover during the past 12 months. Uncertainty and new leadership style are some of the most mentioned negative reviews on Glassdoor.

Conclusion

Agilent Technologies has been a major player in the life sciences and chemical analysis market, with a strong global presence and a comprehensive portfolio of product and service offerings. The company has been a great compounding machine prior to COVID due to its competitive advantages and China exposure. However, the company has faced multiple quarters of revenue decline as well as increased competition, geopolitical uncertainties, and challenges related to its re-organization efforts. While there are early signs of business recovery, at the current market price, Agilent’s stock is not cheap enough for a “buy” rating. Therefore, I am initiating coverage for Agilent with a “hold” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.