Summary:

- Agilent is a wonderful business with a strong competitive moat, decent growth, and excellent profitability.

- The company benefits from customer “stickiness” and growth in the biopharmaceutical sector.

- Agilent’s recurring revenue and cost reductions contribute to its financial strength and potential for higher valuation.

- The company is still facing growth headwinds, but it appears it will soon return to growth, and the valuation is currently reasonable.

AzmanJaka

It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price – Warren Buffett

We believe Agilent (NYSE:A) is one of the rare companies that can be called a “wonderful business”. It is likely that, for this reason, it has historically tended to be quite overpriced, and only rarely do investors get a chance to purchase shares at close to fair value.

The company has a very strong competitive moat, decent growth, and excellent profitability. In general, it operates in an attractive industry, where intellectual property and high switching costs give companies strong pricing power. One of the reasons for this customer “stickiness” derives from the fact that regulation of the drug manufacturing process disincentivizes customers from changing to a different tool provider, as they might have to repeat validation processes. The other reason is that once customers familiarize themselves with how to operate a given piece of equipment, they don’t want to spend the time learning how to operate a different one.

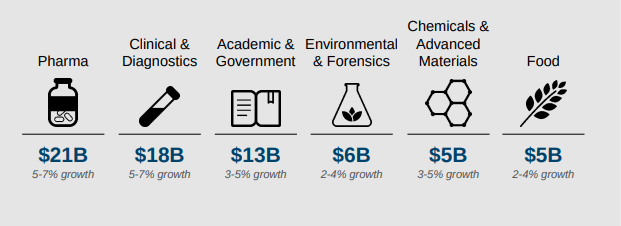

Companies like Agilent also benefit from significant growth in the biopharmaceutical sector by selling an increasing number of tools, consumables, and services. Long-term, the company believes it can grow revenues at a 5% to 7% rate, which along with some margin improvement and share count reduction could result in double-digit EPS growth.

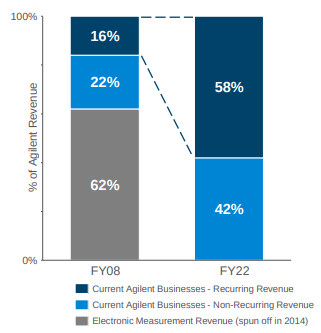

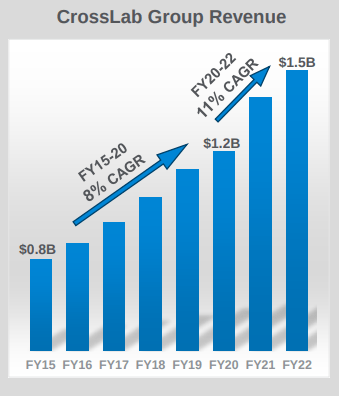

We believe the general quality of the business has been improving since the divestiture of Keysight Technologies (KEYS) in 2014. This electronic measurements business was highly-cyclical, and allowed Agilent to focus on more advanced equipment like chromatography and mass spectrometry tools. Another improvement in the business was the implementation of the CrossLab strategy, which aims to expand services and consumables. This has resulted in the majority of Agilent’s revenue being recurrent, providing much better financial visibility and reducing customer churn risk.

Agilent Investor Presentation

Company Overview

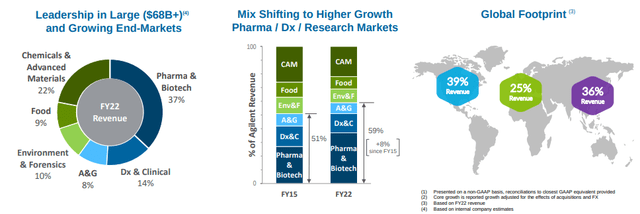

Agilent tools have applications in a variety of end markets such as pharma & biotech, clinical and diagnostics, chemical, energy, food, and environmental applications. At the same time, the company has a nice geographical diversification.

The company estimates most of its end markets will grow between 2% and 7% long-term, with opportunities to increase market share as well as increased revenue from add-on services such as equipment maintenance.

Agilent Investor Presentation

Growth

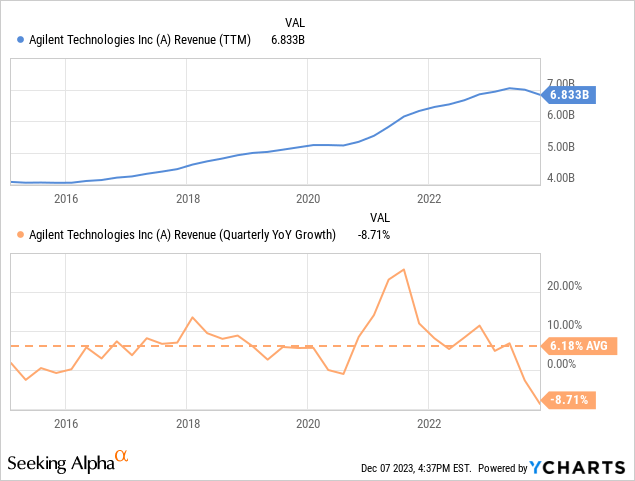

We believe the company’s revenue growth target to be credible, given that since the Keysight Technologies divestiture, the company has averaged a quarterly y/y growth rate of ~6%. Close to the middle of its 5% to 7% target, even if recent quarters have experienced negative growth.

We believe this is largely the result of a period of over expansion by many of its customers during the post pandemic period, and it will take some time to go through the excess.

It does seem a turning point might be near, with CEO Mike McMullen recently commenting at the Evercore ISI HealthCONx conference that saw signs of stabilization in the fourth quarter.

[…] in the fourth quarter, we actually saw what we saw encouraging signs of potential stabilization because we had more instrument orders than we had shipments. So we built backlog and we had a book-to-bill over one for the first time. What, Bob in several quarters, I think.

Other reasons for optimism include Agilent’s plan to further expand its Nucleic Acid Solutions Division (NASD), which it believes is on the road to delivering more than $1 billion in revenue.

The company is also optimistic on the growth of semiconductors and lithium-ion batteries. Agilent’s portfolio addresses the entire battery value chain, from mining and materials processing to cell components and recycling. The company is also to benefit from a number of new therapeutics on the market that have a large patient population size. It believes some of this growth will start to be seen in 2024.

Financials

Agilent reported a small decline in revenue of -0.2% to $6.83 billion, mostly the result of negative foreign exchange impacts. Still, thanks in part to a 30 bps improvement in the operating margin, the company was able to deliver 4% y/y growth in EPS. The fourth quarter saw a significant year-over-year revenue decline of -8.7% and an EPS of $1.38, down 10% compared to the previous year. A big reason for the revenue decline was lower demand for instrumentation, particularly in China and the pharma end market. One bright spot was CrossLab, which delivered another solid quarter, growing +4%.

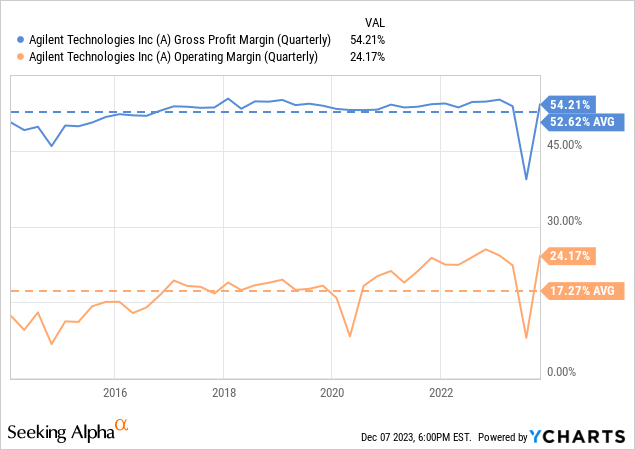

The company has been working hard, lowering its cost structure to be able to grow earnings faster than revenue. It has assured investors that some of the things it is doing right now are permanent changes where the cost won’t come back. One example is rationalization of its real estate footprint. Some of these cost reductions will have an impact in 2024 and are not expected to come back in future years. Looking at the operating margin over the past decade, it is clear that it has been trending higher.

Recurring Revenue

One of the most attractive characteristics of Agilent is the large percentage of recurring revenue it produces. This part of the business has been growing faster than the rest of the company, which makes it increasingly important when valuing the business. As recurring revenue increases, we believe a higher valuation multiple can be justified.

Agilent Investor Presentation

This is something that clearly excites CEO Mike McMullen, who said during the Evercore ISI conference that he is very bullish on this part of the business.

So the whole construct of ACG, Agilent and CrossLab was we take care of the entire lab. We’ve been doing very, very well on the enterprise service as well. So we’ve been winning a lot of multi-year large engagements where we’re going to take care of the entire fleet of the lab.

We’re also going to provide a lot of other services in addition to that asset management and other services that our customers increasingly are looking to companies like Agilent to provide. So I’m very bullish, I agree with I’m not sure who you spoke to, but I’m very bullish along with this person that there’s a lot of opportunities for service and for us, it’s become quite a meaningful business for us.

Balance Sheet

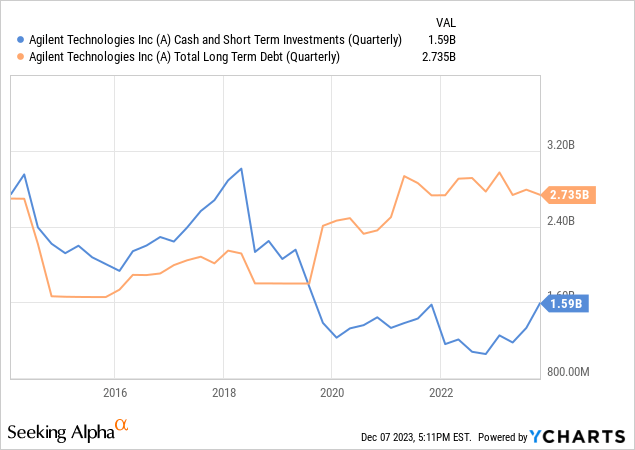

While the company does carry some long-term debt, it could pay more than half using cash and short term investments. With a net debt to EBITDA ratio of less than 1x, we are very comfortable with the strength of the balance sheet.

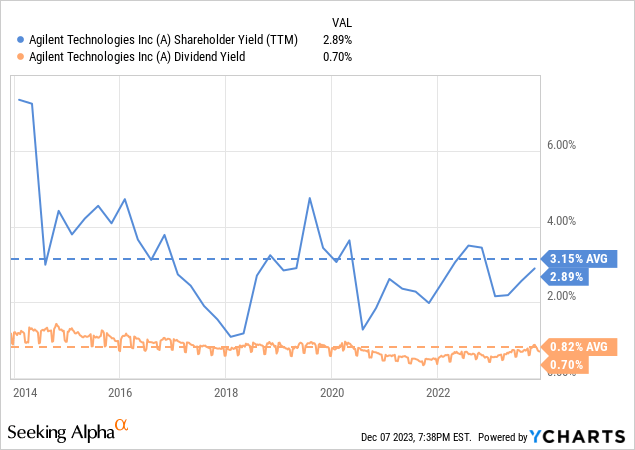

Shareholder Returns

Agilent pays a small percentage of its earnings as dividends, which results in a very modest dividend yield. However, the company returns significant amounts to shareholders through stock buybacks, which is reflected in a shareholder yield of close to 3%.

Outlook

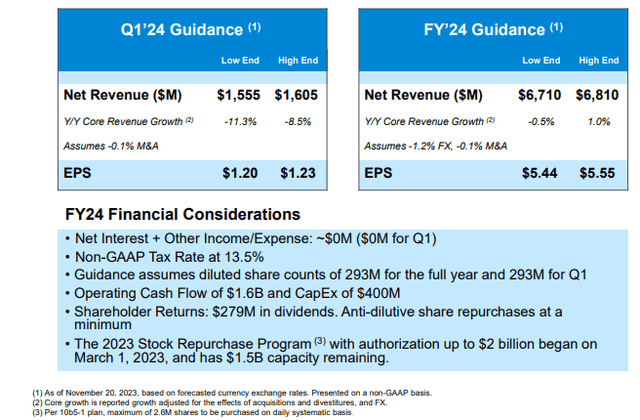

Agilent is guiding for revenue growth to deteriorate even more in the first quarter of FY24, expecting year over year core revenue growth to be between -11.3% and -8.5%. Despite the tough start to the fiscal year, the company expects FY24 to deliver core revenue growth in the range of between -0.5% and 1.0%. Seen differently, the company expects to return to positive growth in the next three quarters. This appears to have been confirmed by CEO Mike McMullen at the Evercore ISI HealthCONx conference that they have “a view that we can get back to growth in 2024”.

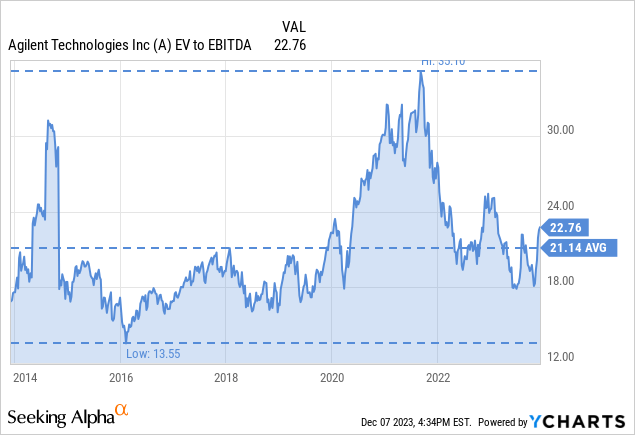

Valuation

Agilent is trading very close to its ten-year average EV/EBITDA multiple, however, we believe the company to be much higher quality today than it has ten year ago. It has improved profit margins, and the percentage of revenue that is recurring.

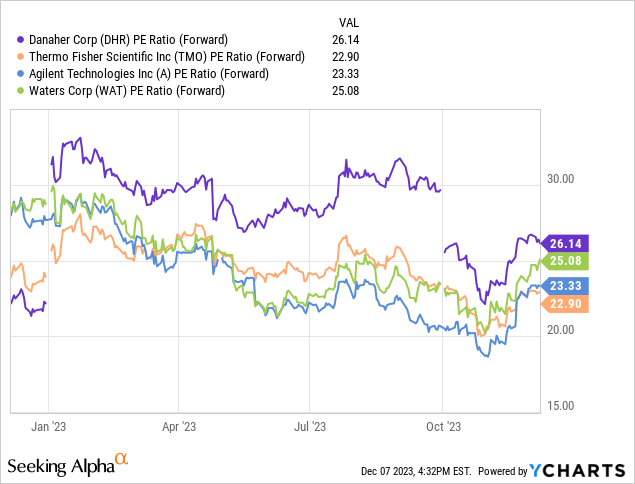

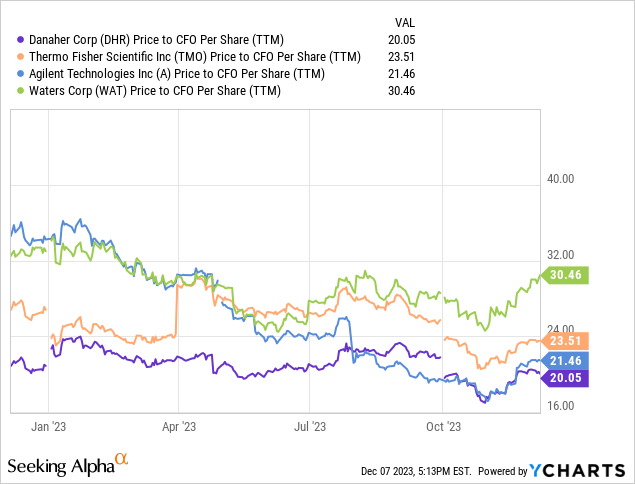

It also looks reasonably valued when compared to some of its peers like Thermo Fisher Scientific (TMO), Danaher (DHR), and Waters Corp (WAT). In that group, only Thermo Fisher Scientific has a slightly lower forward P/E ratio, but the difference is minimal.

Similarly, when looking at price to cash flow from operations per share, only Danaher appears slightly cheaper, and by a modest margin. We believe overall the whole group looks reasonably valued.

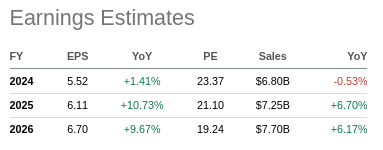

Analysts on average expect FY24 to look very similar to FY23 in terms of sales and EPS, with a noticeable recovery until 2025. We believe they are being too conservative, and based on comments and guidance from management, there are reasons to be cautiously optimistic about the second half of FY24. However, a potential derailment to the return to growth could occur if a recession materializes next year in the US.

Seeking Alpha

Based on our future earnings estimates, we calculate a net present value of $124 per share, which is close to the current price. We therefore believe shares are priced to deliver a reasonable return, and are upgrading our rating to ‘Buy’ as a result.

| EPS | Discounted @ 10% | |

| FY 24E | 5.52 | 5.02 |

| FY 25E | 6.11 | 5.05 |

| FY 26E | 6.70 | 5.03 |

| FY 27E | 7.37 | 5.03 |

| FY 28E | 8.11 | 5.03 |

| FY 29E | 8.92 | 5.03 |

| FY 30E | 9.81 | 5.03 |

| FY 31E | 10.79 | 5.03 |

| FY 32E | 11.87 | 5.03 |

| FY 33E | 13.06 | 5.03 |

| FY 34E | 14.36 | 5.03 |

| Terminal Value @ 4% terminal growth | 217.61 | 69.34 |

| NPV | $124.71 |

Risks

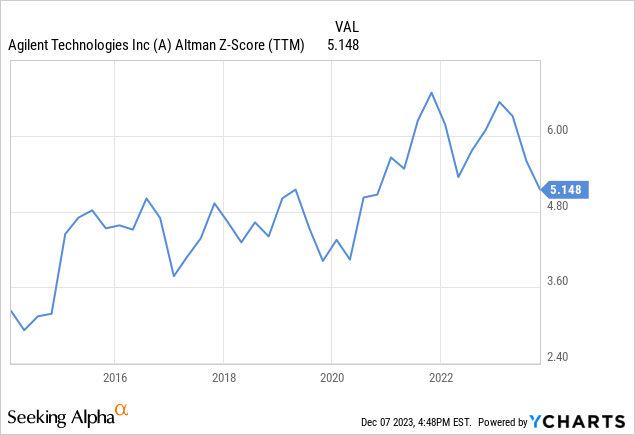

The biggest risk we see is that there is no significant margin of safety between our estimate for the intrinsic value of the shares, and where they are trading right now. Other than that, we believe Agilent to be a much lower risk compared to the average stock in the S&P 500 index (SPY) or the Russell 2000 (IWM). This is reflected in its very high Altman Z score, which is comfortably above the 3.0 threshold.

Conclusion

Agilent has experienced some headwinds in recent quarters, and is expected to see significant negative growth next quarter as well. Still, we believe headwinds will eventually dissipate, and the company will return to growth. Agilent has several attractive qualities that make the company attractive to investors, including a strong competitive moat, customer and geographic diversification, and a significant percentage of its revenue being recurrent. We believe the temporary headwinds have created an opportunity for investors to purchase shares at a reasonable valuation. Shares are trading close to our estimated fair value, and we believe they offer an attractive risk/reward to investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling shares, you should do your own research and reach your own conclusion, or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.