Summary:

- Agilysys, Inc. provides hospitality management software worldwide.

- The company’s financial trends show declining revenue growth and reduced gross margin and SG&A efficiency.

- The hotel property management software market is projected to grow, but Agilysys faces competition and potential challenges in the APAC region.

- I’m now Neutral [Hold] on Agilysys, Inc.

pick-uppath

A Quick Take On Agilysys

Agilysys, Inc. (NASDAQ:AGYS) provides a range of hospitality management software for customers worldwide.

I previously wrote about Agilysys with a Buy outlook.

Given the firm’s declining revenue growth rate and reduced gross margin & SG&A efficiency, I’m more cautious about Agilysys, Inc.’s near-term performance.

My outlook on AGYS is now Neutral [Hold].

Agilysys Overview And Market

Based in Alpharetta, Georgia, Agilysys offers a diverse range of software and hardware solutions for hospitality customers.

The company is led by CEO Ramesh Srinivasan, who has formerly held positions as Ooyala’s CEO and Innotrac Corporation’s president and CEO.

Agilysys primarily provides software for the following functions:

– Point of sale

– Hospitality management

– Inventory and procurement

– Reservations management

– Seating solutions

– Payment services.

Agilysys obtains clients through direct sales and marketing initiatives, with its customer base primarily consisting of mid to high-tier hospitality businesses.

The firm seeks customers in numerous sectors within the hospitality industry, including:

– Hotels and Resorts

– Casino Resorts

– Tribal Gaming

– Cruise Lines

– Managed Foodservice

– Sports and Entertainment

– Restaurants.

A 2022 ResearchAndMarkets report estimates that the hotel property management software market was worth around $5.9 billion in 2021 and is projected to grow to $10.9 billion by 2027.

This signifies an anticipated CAGR of 10.7% from 2022 to 2027.

Major factors contributing to this growth include the resurgence of public events following the COVID-19 pandemic and hospitality providers’ pursuit of enhanced operational efficiency.

Additionally, as hotel patrons demand more sophisticated and convenient interactions, the demand for SaaS-based solutions and mobile technology integration is expected to grow.

Major competitive and other market participants include:

-

Guesty

-

Schneider Electric

-

Lodgify

-

eZee FrontDesk

-

Protel

-

StayNTouch

-

Infor

-

NEC Corporation

-

HMS Infotech Pvt. Ltd

-

Intertec Systems

-

SABRE GLBL

-

Winhotel Solution SL

-

Siemens

-

Trawex Technologies Pvt Ltd.

-

Hostaway

-

IRIS Software Systems

-

Risk Management Solutions.

Agilysys’ Recent Financial Trends

-

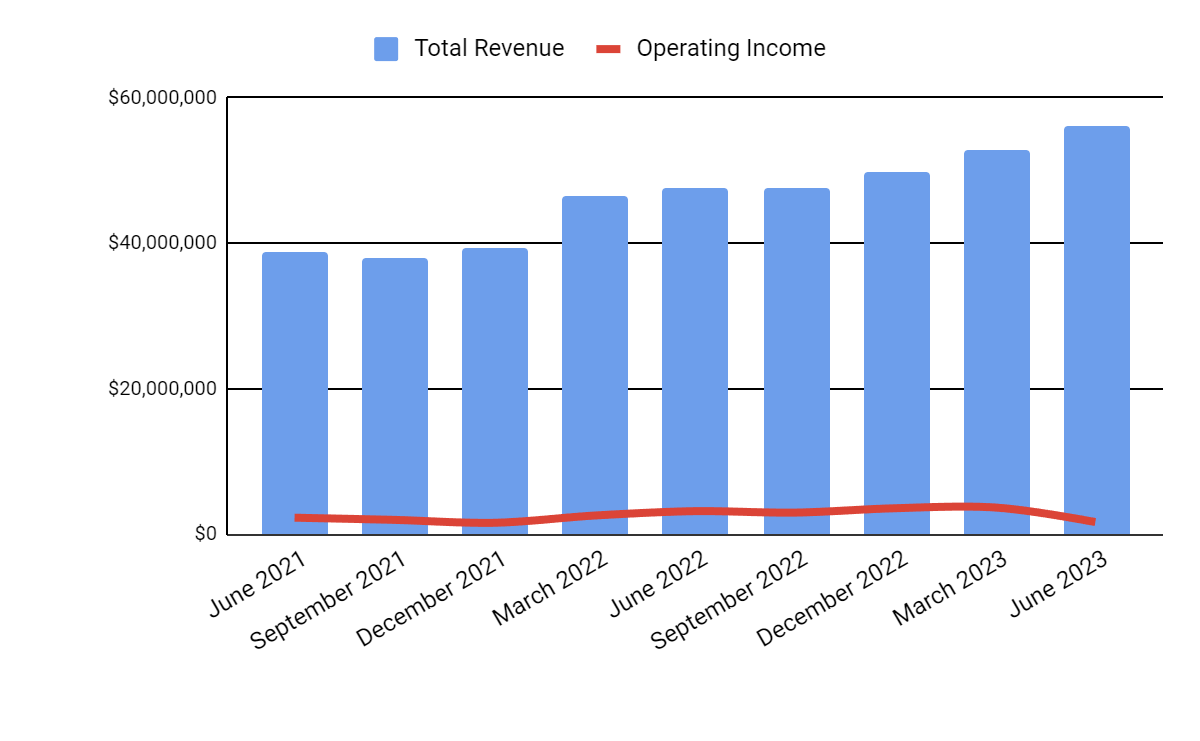

Total revenue by quarter has continued to rise; Operating income by quarter has dropped sequentially in the most recent quarter:

Total Revenue and Operating Income (Seeking Alpha)

-

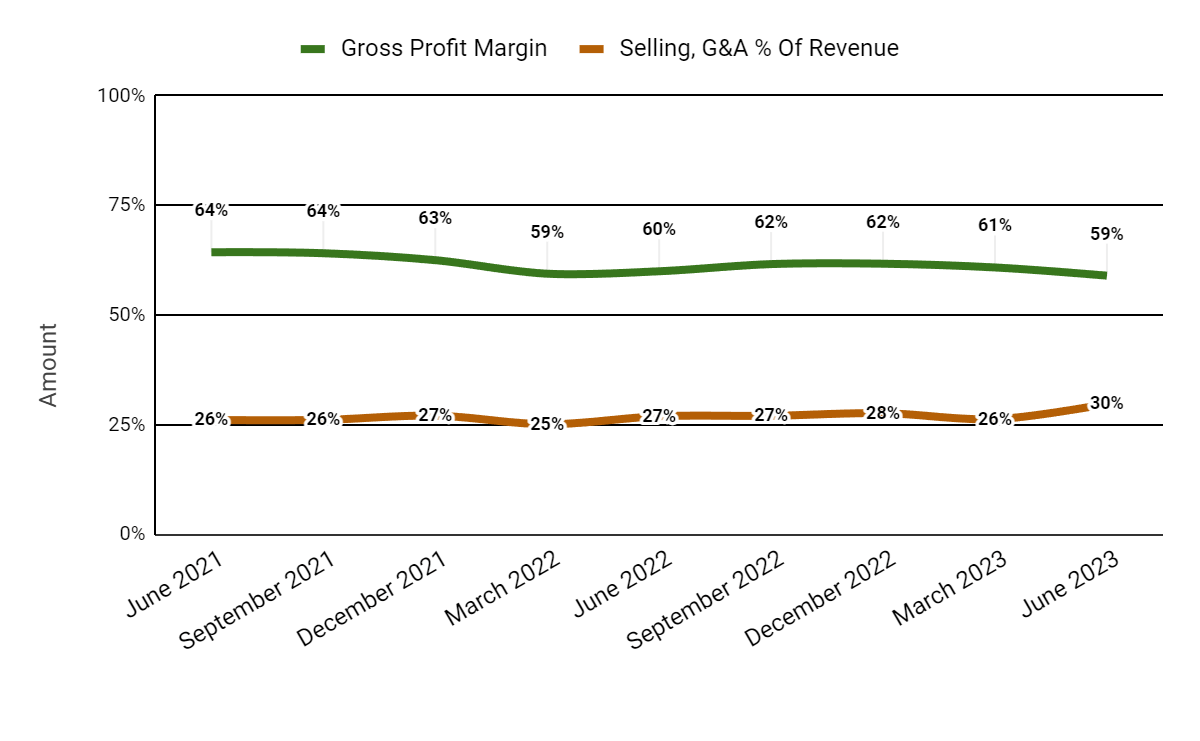

Gross profit margin by quarter has trended lower; Selling and G&A expenses as a percentage of total revenue by quarter have moved higher. Both developments are negative signals of increasing costs for each incremental dollar of revenue.

Gross Profit Margin and SG&A % Of Revenue (Seeking Alpha)

-

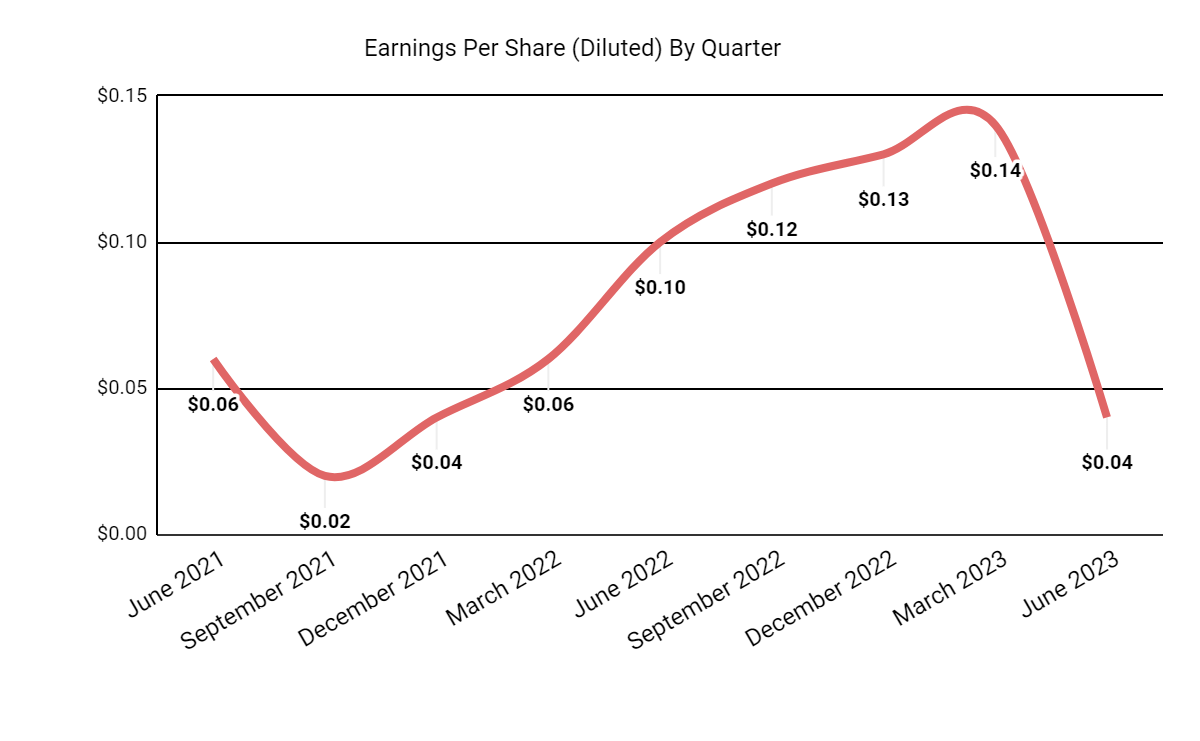

Earnings per share (Diluted) have dropped sharply in the most recent quarter:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

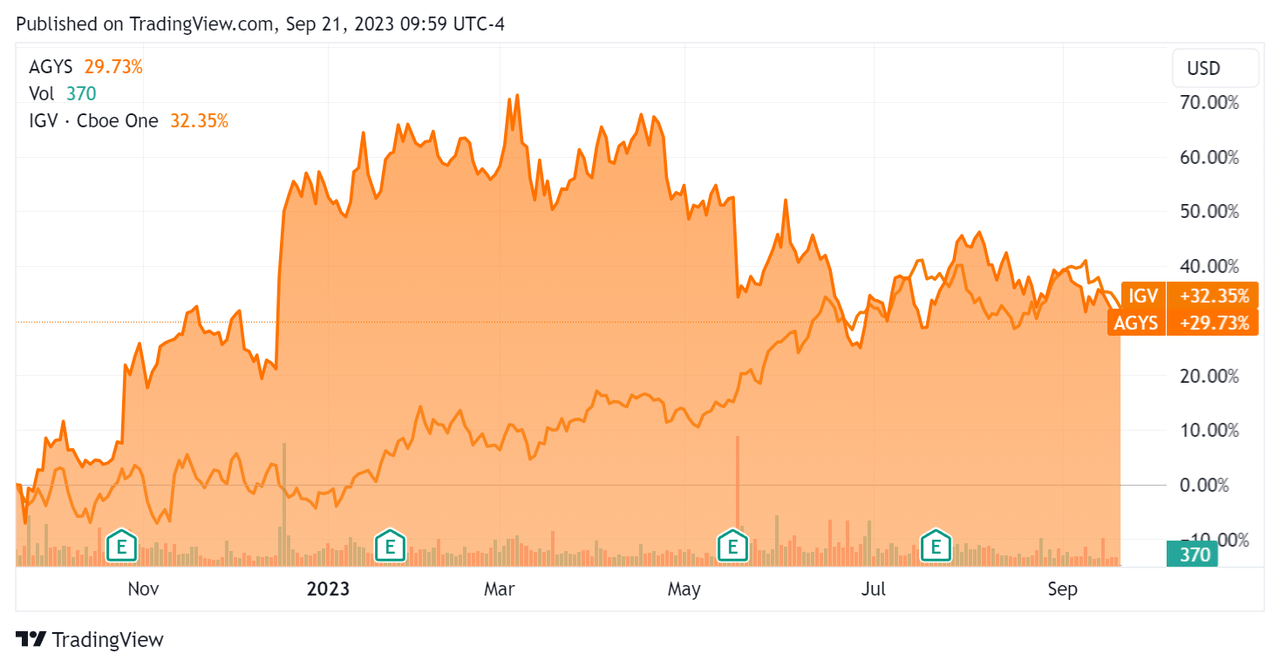

In the past 12 months, AGYS’ stock price has risen 29.73% vs. that of the iShares Expanded Tech-Software Sector ETF’s (IGV) rise of 32.35%:

52-Week Stock Price Comparison (Seeking Alpha)

For balance sheet results, the firm ended the quarter with $107.1 million in cash and equivalents and no debt.

Over the trailing twelve months, free cash flow was $24.2 million, during which capital expenditures were $10.2 million. The company paid $13.6 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Agilysys

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

8.0 |

|

Enterprise Value / EBITDA |

107.6 |

|

Price / Sales |

8.1 |

|

Revenue Growth Rate |

20.5% |

|

Net Income Margin |

6.3% |

|

EBITDA % |

7.4% |

|

Market Capitalization |

$1,690,000,000 |

|

Enterprise Value |

$1,640,000,000 |

|

Operating Cash Flow |

$34,380,000 |

|

Earnings Per Share (Fully Diluted) |

$0.43 |

(Source – Seeking Alpha.)

AGYS’ most recent unadjusted Rule of 40 calculation fell to 27.9% as of FQ1 2024’s results, so the firm’s results have deteriorated, per the table below:

|

Rule of 40 Performance (Unadjusted) |

FQ3 2023 |

FQ1 2024 |

|

Revenue Growth % |

25.8% |

20.5% |

|

EBITDA % |

8.4% |

7.4% |

|

Total |

34.2% |

27.9% |

(Source – Seeking Alpha.)

Sentiment Analysis

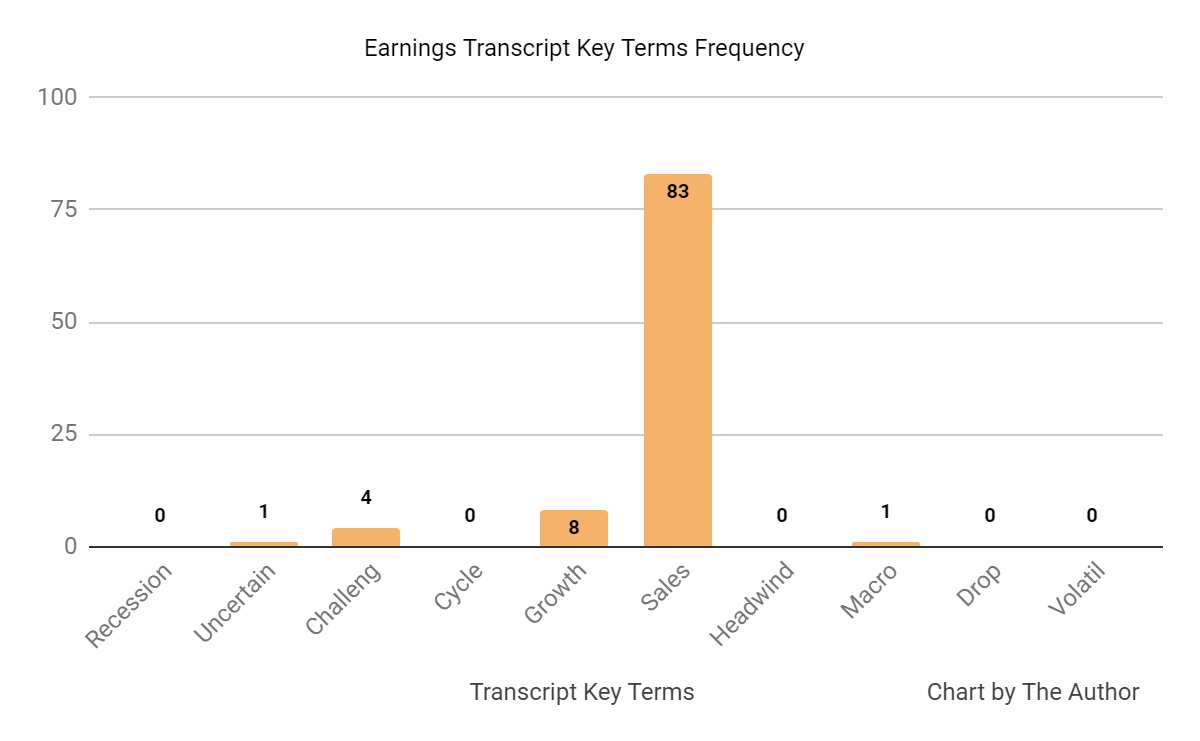

The chart below shows the frequency of various words in management’s most recent earnings conference call:

Earnings Transcript Key Terms Frequency (Seeking Alpha)

The word frequency in the chart indicates the firm continues to see challenging competitive conditions in its Asia region efforts.

Analysts questioned management about its large-deal pipeline, its APAC region deals and reasons for the strong sales quarter.

Leadership indicated that it is seeing strong demand for larger RFPs from hotel chains and from other hospitality organizations.

Also, the APAC region’s performance was strong due to certain deals that reached their decision point.

The strong sales quarter was due to a variety of factors coming together, including an expanded sales team, more trade show participation and increasing maturity in its product offerings.

Commentary On Agilysys

In its last earnings call (Source – Seeking Alpha), covering FQ1 2024’s results, management’s prepared remarks highlighted the above-mentioned very strong sales results.

Notably, services implementation efficiency rose to match the increasing sales success, resulting in a decrease in backlog.

Leadership highlighted the increasing sales team productivity as well, stating that sales reps that have been with the firm less than 2.5 years have already closed 72% of the deals they closed in the entire previous fiscal year.

Management didn’t disclose any customer or revenue retention rate metrics.

Total revenue for FQ1 2023 rose by 18.1% year-over-year, but gross profit margin fell by 1.0%.

Selling and G&A expenses as a percentage of revenue increased by 2.8% YoY, indicating reduced efficiency in this regard and operating income decreased by 46.9%.

The company’s financial position is strong, with plenty of liquidity, no debt and positive free cash flow generation.

AGYS’ Rule of 40 performance has been only moderate and has deteriorated somewhat since FQ3 2023.

Looking ahead, consensus revenue for fiscal 2024 is expected to grow by 17.4% over the previous fiscal year.

If achieved, this would represent a modest in revenue growth rate versus fiscal 2023’s growth rate of 21.7% over fiscal 2022.

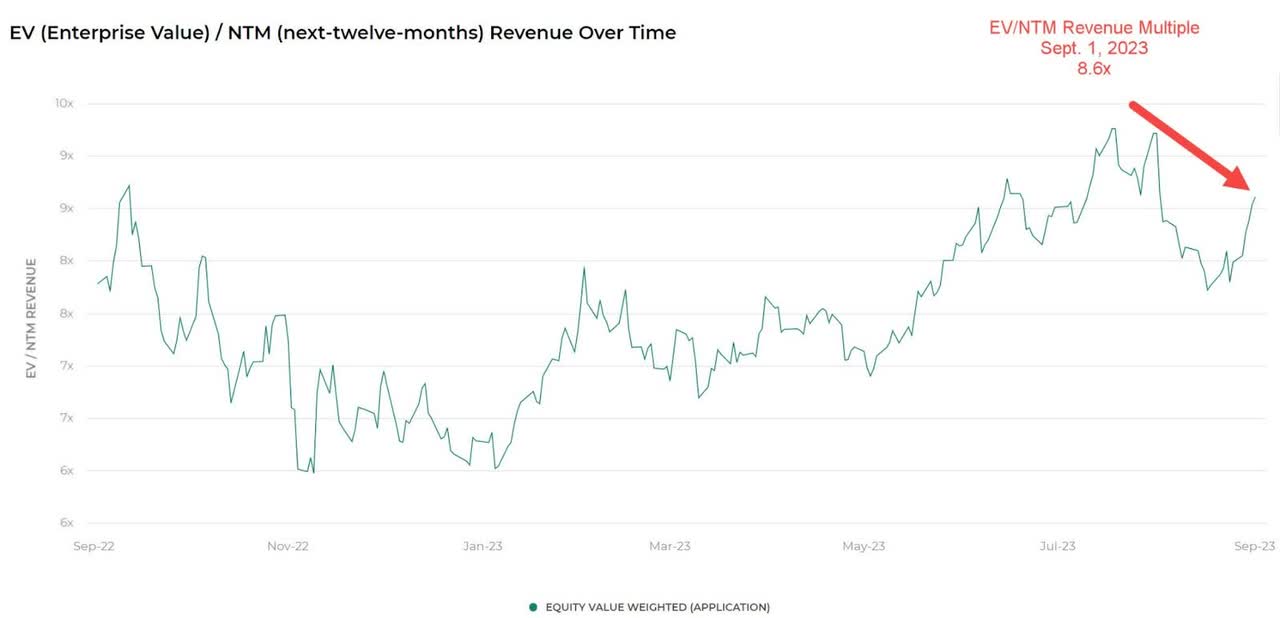

Regarding valuation, the market is valuing AGYS at an EV/Sales multiple of around 8.0x on TTM revenue growth rate of 20.5% against a median Meritech SaaS Index implied ARR growth rate of around 19% (Source).

The Meritech Capital Index of publicly held SaaS application software companies showed an average forward EV/Revenue multiple of around 8.6x on September 1, 2023, as the chart shows here:

EV/Next 12 Months Revenue Multiple Index (Meritech Capital)

So, by comparison, AGYS is currently valued by the market at a slight discount to the broader Meritech Capital SaaS Index, at least as of September 1, 2023.

Risks to the company’s outlook include continued competitive pressure in the APAC region and lengthening sales cycles, which may reduce its revenue growth potential in the near term.

Given the firm’s declining revenue growth rate and reduced gross margin & SG&A efficiency, I’m more cautious about its near-term performance.

My outlook on AGYS is now Neutral [Hold].

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!