Summary:

- Agilysys reported its FQ1 2023 financial results in late July.

- The firm provides a range of hospitality software technologies to customers worldwide, via on-premises or delivered from the cloud.

- AGYS has produced revenue growth and improving earnings, but a looming macroeconomic slowdown amid higher interest rates leaves me on Hold for the stock.

Marko Geber/DigitalVision via Getty Images

A Quick Take On Agilysys

Agilysys (NASDAQ:NASDAQ:AGYS) reported its FQ1 2023 financial results on July 26, 2022, beating expected revenue and EPS estimates.

The company provides a range of hospitality management software for customers worldwide.

Until we get closer to the end of the interest rate hiking cycle, I’m on Hold for AGYS at its current level.

Agilysys Overview

Alpharetta, Georgia-based Agilysys provides software and hardware solutions for a wide variety of industries.

The firm is headed by Chief Executive Officer Ramesh Srinivasan, who was previously CEO of Ooyala and president and CEO of Innotrac Corporation.

The company’s primary offerings include:

-

Point of sale

-

Hospitality management

-

Inventory & procurement

-

Reservations management

-

Seat solutions

-

Payment services

The firm acquires customers via its direct sales and marketing efforts.

AGYS’ customer base tends to skew toward the middle to upper level of the hospitality market.

Agilysys’ Market & Competition

According to a 2022 market research report by Research and Markets, the market for hotel property management software was an estimated $5.9 billion in 2021 and is forecast to reach $10.9 billion by 2027.

This represents a forecast CAGR of 10.7% from 2022 to 2027.

The main drivers for this expected growth are a return to public events as the effects of the COVID-19 pandemic wane and a desire by hospitality providers for more efficient operations.

Also, hotels will likely increase their demand for SaaS-based solutions as well as for mobile technology integrations as their customer base requires more advanced and convenient interactions.

Major competitive or other industry participants include:

-

Guesty

-

Schneider Electric (OTCPK:SBGSF) (OTCPK:SBGSY)

-

Lodgify

-

eZee FrontDesk

-

Protel

-

StayNTouch

-

Infor

-

NEC Corporation (OTCPK:NIPNF)

-

HMS Infotech Pvt. Ltd

-

Intertec Systems

-

SABRE GLBL

-

Winhotel Solution SL

-

Siemens (OTCPK:SIEGY)

-

Trawex Technologies Pvt Ltd.

-

Hostaway

-

IRIS Software Systems

-

Risk Management Solutions

Agilysys’ Recent Financial Performance

-

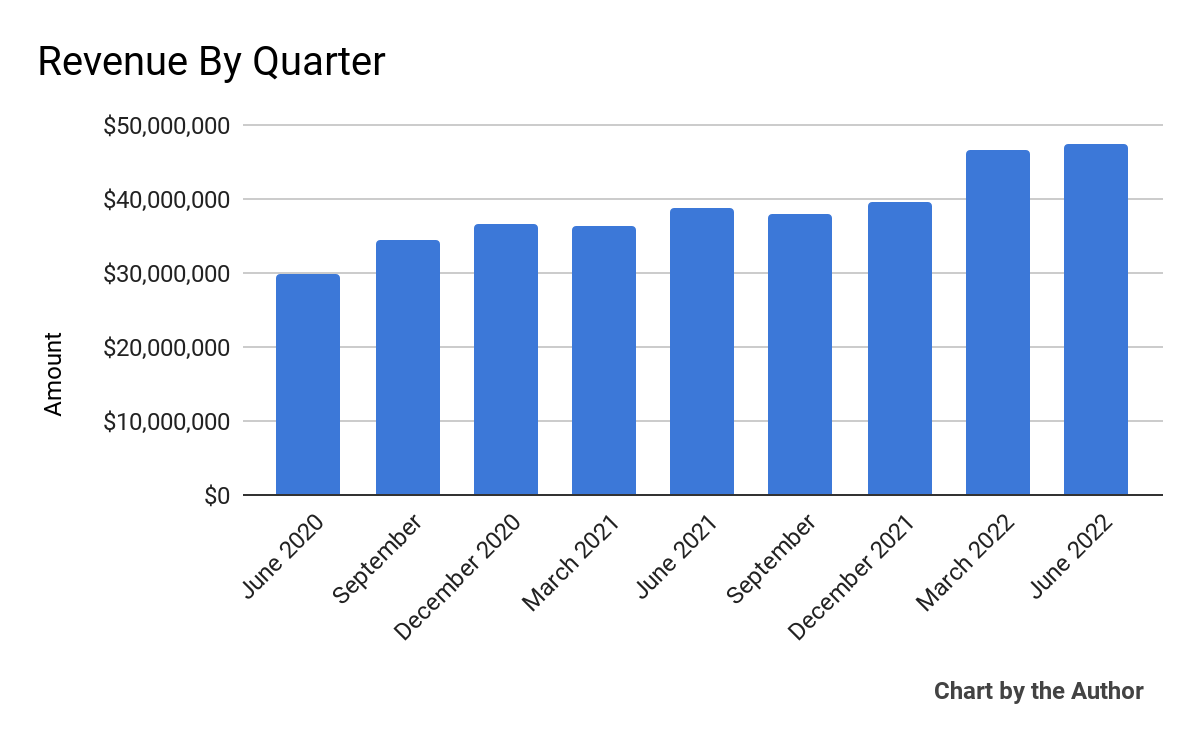

Total revenue by quarter has increased further in recent quarters, as shown below:

9 Quarter Total Revenue (Seeking Alpha)

-

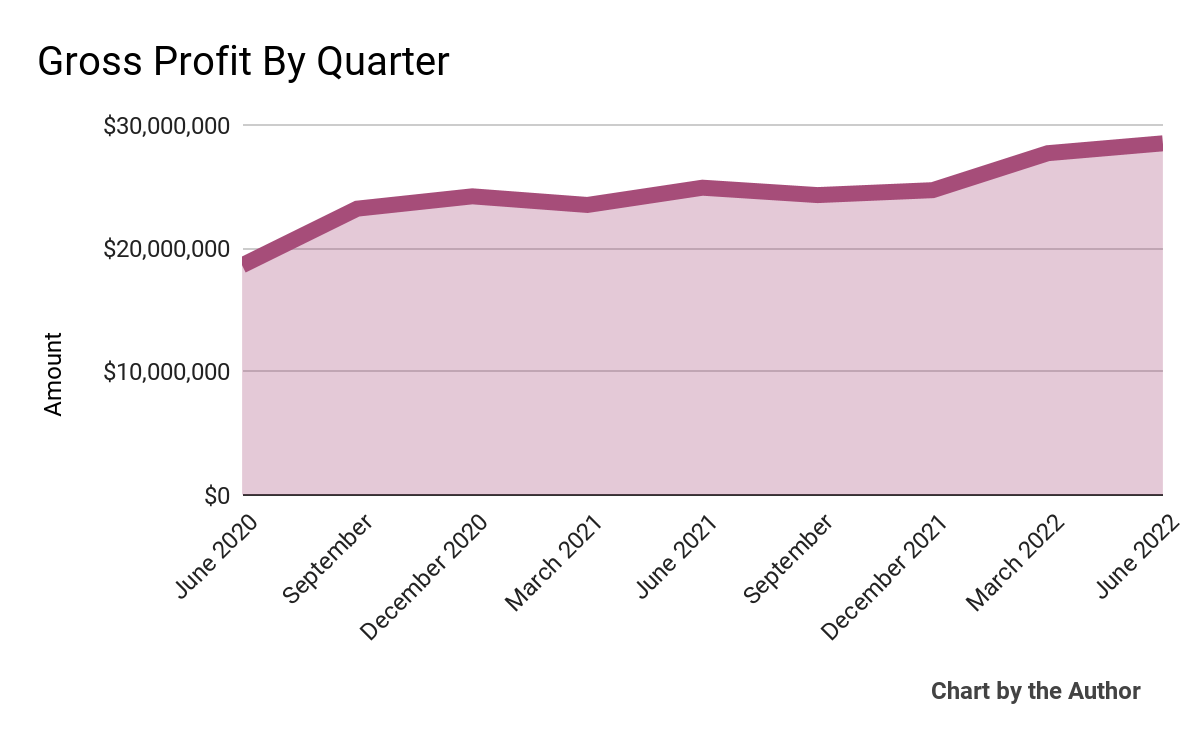

Gross profit by quarter has followed a similar trajectory as total revenue:

9 Quarter Gross Profit (Seeking Alpha)

-

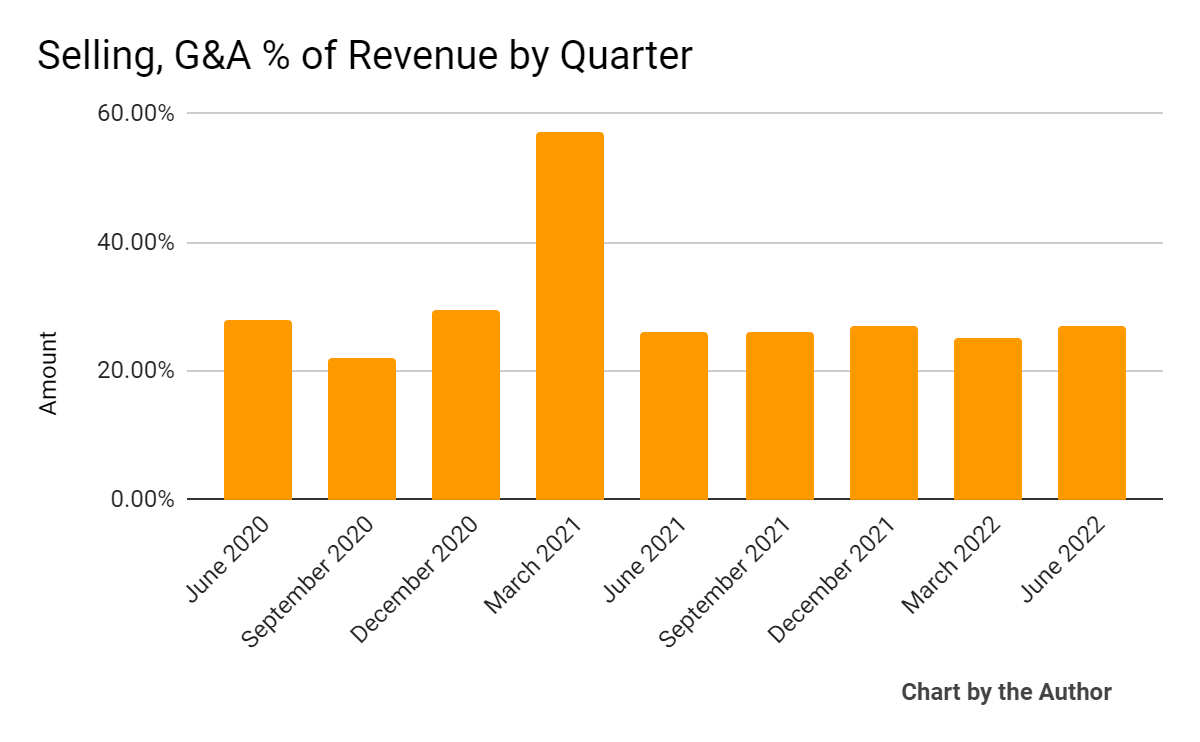

Selling, G&A expenses as a percentage of total revenue by quarter have generally remained within a narrow range:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

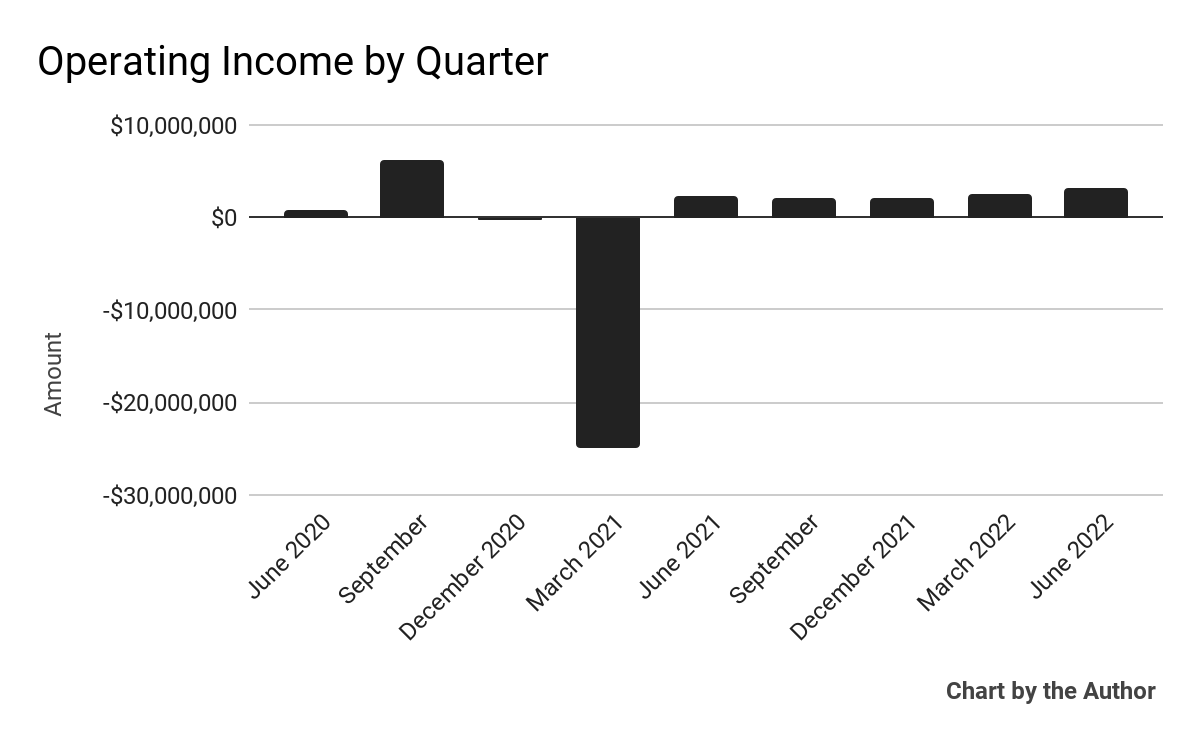

Operating income by quarter has remained positive in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

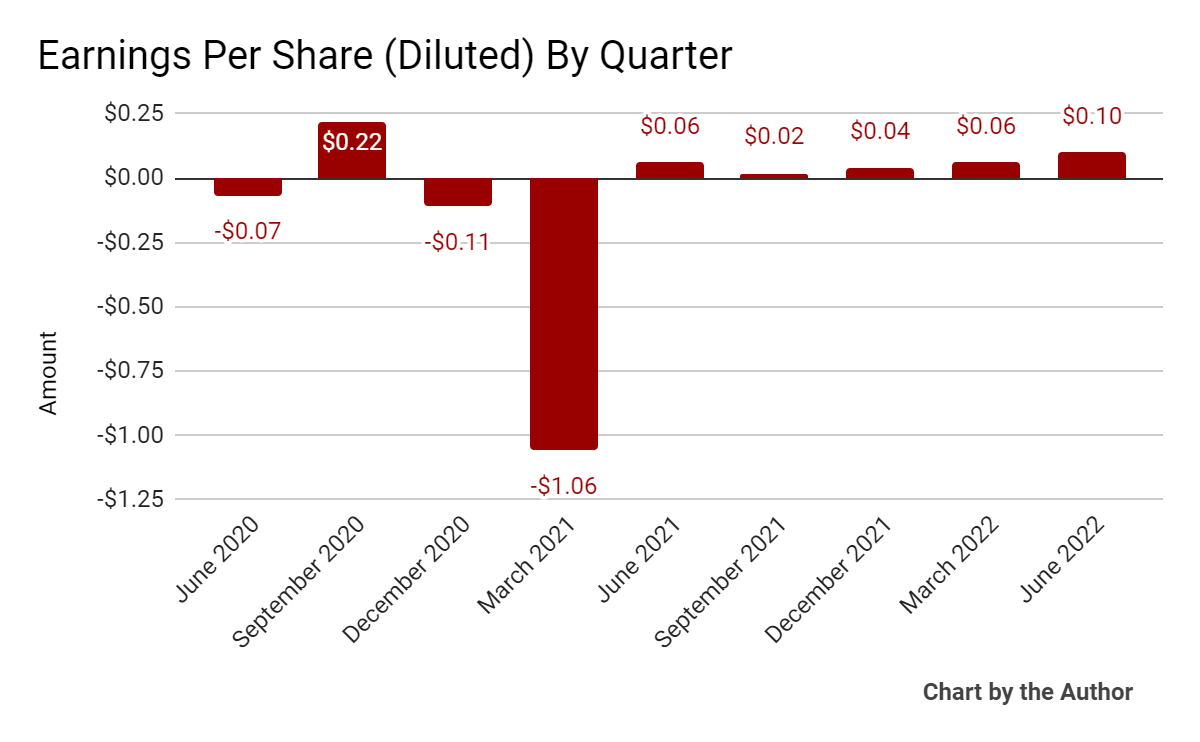

Earnings per share (Diluted) have grown in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

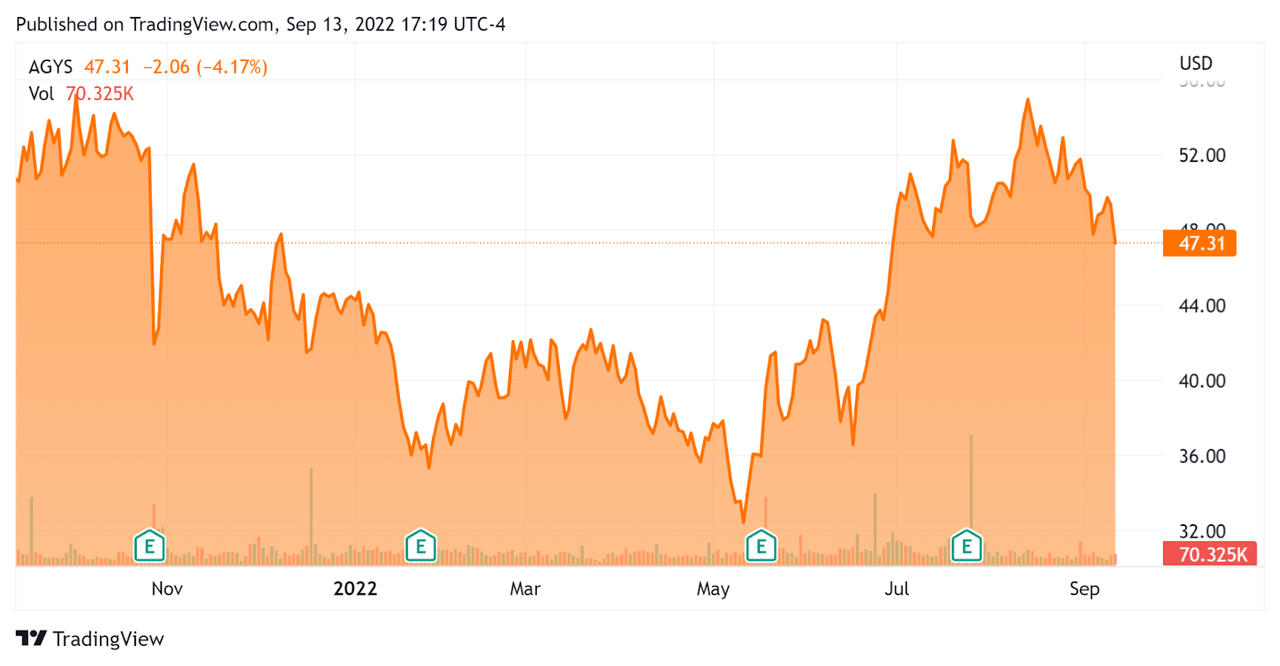

In the past 12 months, AGYS’ stock price has fallen 6.8% vs. the U.S. S&P 500 index’ drop of around 12%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Agilysys

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

6.86 |

|

Revenue Growth Rate |

17.3% |

|

Net Income Margin |

4.4% |

|

GAAP EBITDA % |

7.2% |

|

Market Capitalization |

$1,230,000,000 |

|

Enterprise Value |

$1,180,000,000 |

|

Operating Cash Flow |

$20,580,000 |

|

Earnings Per Share (Fully Diluted) |

$0.22 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

AGYS’ most recent GAAP Rule of 40 calculation was 24.5% as of FQ1 2023, so the firm needs some improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

17.3% |

|

GAAP EBITDA % |

7.2% |

|

Total |

24.5% |

(Source – Seeking Alpha)

Commentary On Agilysys

In its last earnings call, covering FQ1 2023’s results, management highlighted ‘recovering’ sales in its managed food services segments, while the hospitality industry in Asia ‘continues to struggle with various levels of lockdowns and travel restrictions across several countries.’

The company produced gains with new properties where the parent company was already a customer, with more than 80% choosing to utilize subscription models.

Agilysys has been able to turn its on-premises codebase into cloud versions as a subscription, offering customers the option of their choice.

As to its financial results, total revenue was up 22.7% year-over-year, with subscription revenue accounting for 47.4% of all recurring revenue.

Management does not provide net dollar retention rate, so investors have no visibility into its customer churn, product/market fit or sales & marketing efficiency.

However, management did say that ‘fiscal 2022 was our best customer retention year ever, well north of 95%.’

Gross profit margin decreased year-over-year, from 64.2% in 2021 to 60%, while the company’s Rule of 40 results have been in need of improvement.

For the balance sheet, the firm finished the quarter with cash and marketable securities of $94.9 million, while the company generated $19.6 million in free cash flow over the trailing twelve months.

Looking ahead, management expects fiscal 2023 full year revenue to be $192.5 million at the midpoint of the range, with subscription revenue growth of around 30% and EBITDA to be ‘better than 15% of revenue.’

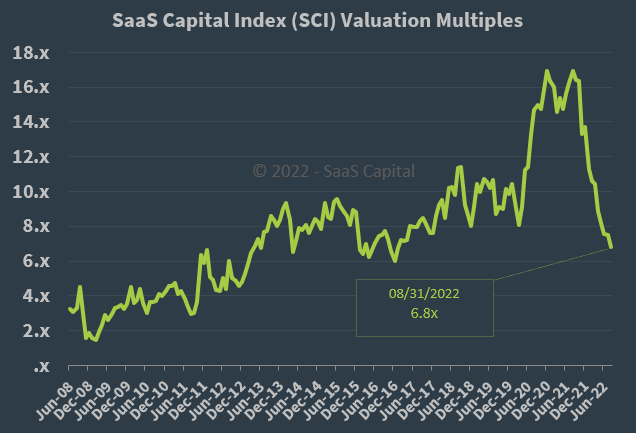

Regarding valuation, the market is valuing AGYS at an EV/Sales multiple of around 6.9x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x at August 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, AGYG is currently valued by the market at the same level as the broader SaaS Capital Index, at least as of August 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth trajectory.

Agilysys is seeking to make a turn toward a cloud-centric approach and appears to be making good progress in that regard, although its hospitality customers usually require customizations that slow down implementation progress.

In recent months, as technology stocks have caught a bid in the market, AGYS has risen. However, with the most recent inflation print remaining high, the stock sold off as did the broader technology market.

While management is not hearing of customer slowdowns, at least with their mid-level to high-level hospitality chain customer base, with higher interest rates putting a damper on business spending, I believe it isn’t long before those concerns start delaying buying decisions.

Until we get closer to the end of the interest rate hiking cycle, I’m on Hold for AGYS at its current level.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This report is for educational purposes only and is not financial, legal or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or removed at any time without notice. You should perform your own research for your particular financial situation before making any decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!