Summary:

- Investing in AGNC Investment offers a high dividend yield of 14%, but this comes with significant risks, including interest rate, default, pre-payment, and liquidity risks.

- AGNC’s elevated yield is largely a return of investor capital.

- Investors should be cautious of high-yield investments, as they often result in lower risk-adjusted returns and significant principal losses during market downturns.

Kirpal Kooner

Using the “Rule of 72”, you should be able to double your money over the next five years, by investing in a dividend payer like AGNC Investment Corp. (NASDAQ:AGNC) that currently sports a dividend yield of 14.0%. If one reinvests those dividends that I receive, mathematically you could do even better than that, but then what would you live on? Why would you not take this deal all day long and sleep well at night too?

Risk

We currently live in a 4.0-5.0% world as it relates to yields on CD’s, US Treasuries, and most investment-grade corporate bonds. When looking at the 30-year mortgage market, you can expect roughly 6.0-7.0% right now. The initial red flag is that AGNC’s current yield is much higher than the average income producing investment and the current 30-year mortgage rate.

My only explanation for this is that the average investor is taking on a lot more risk by investing in this mREIT and opting for a high-dividend payer versus the average sustainable dividend payer. In addition, there is a sizeable chunk of the investor’s own money included in AGNC’s stated dividend yield. In reality, a large portion of the current yield should be viewed as “return of capital”. The investment is self-liquidating itself over time, hence the downward slope of AGNC’s stock chart since inception.

Interest Rate Risk

We prefer to own high-quality corporate bonds for our clients that prefer income-oriented strategies. In the current yield environment, our focus is on the three-to-five-year maturity range, and we are willing to hold them until maturity. Along the way, price volatility tends to be mild and for income investors coupons are paid semi-annually.

While prices of individual corporate bonds do fluctuate with interest rates movements over an investor’s holding period, if the notes are held to maturity, these price movements are a non-issue. The trade-off for low volatility and more predictable outcomes is that you give up the chance for larger yields. After all, there is no such thing as a free lunch.

With a bond mutual fund, REIT, or BDC, you have no such assurances. You are at the mercy of interest rates along and will be subjected to more relative volatility along the way. You have much greater interest rate risk because there is no set term for the investment, resulting in lengthy duration. You also have no assurance of getting your principal back at the end of your term, whenever that may be. By opting for a higher yield, investors take on significantly more interest rate risk in hopes for higher return. You may see your principal go down a lot along the way. This is a big trade-off for opting for that seemingly juicy yield.

Default, Pre-Payment, and Liquidity Risks

There also tends to be a higher degree of credit risk with most mREITs, via defaults. If a significant number of borrowers default, the value of the mortgage-backed security pool held by the mREIT will materially decline. AGNC experienced this issue, shortly after it began trading, in 2008.

There is also significant pre-payment risk when one invests in mortgage-backed REITs. When borrowers pre-pay their mortgages, the REIT is forced to reinvest the pre-paid loan proceeds at current market rates, which could be much lower than the average rate of the existing mortgage pool.

There can also be liquidity risk with a mREIT. If the real estate/ mortgage market goes south, the mREIT may have difficulty selling their holdings if there is a lack of buyers. They could be forced to sell at significant discounts, in order to meet investor redemption requests.

The Importance of Total Returns

I have heard and/or seen countless comments centered around not caring about invested principal, as long as the investor is receiving their dividend. That is foolish thinking. Bernie Madoff was paying investors 1.0% a month, but the money was coming out of their (or someone else’s) principal. Give me $100,000, and I will pay you $10,000 in income per year for the next ten years, but at the end your principal will be $0. This should be viewed as “return of principal”, not a 10% yield.

High dividend payers are obviously not as bad as Ponzi schemes, but your total return over time can be much less than an investment’s stated current yield. The only explanation for this is that while you were receiving your annual distribution of 14%, your principal was going down along the way, via price decline of the underlying investment’s net asset value (NAV).

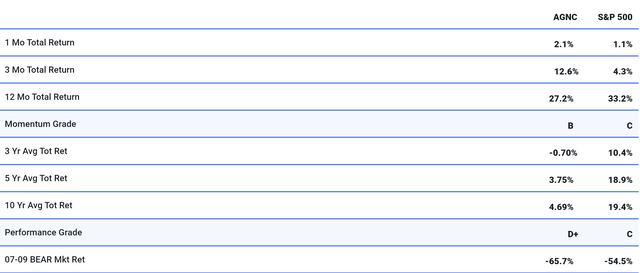

Below is a chart of the average annual total returns over the last one-year, three-years, five-years, and ten-years for AGNC. This number includes the gain or loss of your principal and the dividends that you received.

Despite a big double-digit yield over the last ten years, the average total return has been just 4.69% per year. Not only did you not have any capital appreciation, but your principal also went down much more than the dividend income you received. Investors took a lot of extra risk chasing juicy yields, while ending up with a below-market return. Keep in mind that this ten-year return does not include the devastating 2008-2009 time period for REITs.

But wait, the last ten years get even worse when you break it down. Over the last five years, AGNC has delivered an annual total return of just 3.75% per year. Hindsight shows that an investor would have been better off buying individual investment-grade corporate bonds and would have slept much better at night by sidestepping the inherent volatility of AGNC. You would have received a better risk-adjusted return.

The last 3-year period has been even worse. You would have lost an average of -0.70% per year during that holding period. You have nothing to show for yourself and you took on a big amount of risk chasing yield. Adding inflation into the mix makes the losses even worse for income investors.

We then look at how well investors did over the last twelve months with their holding in AGNC. Not only did they receive their fat dividend check of 14%, but also received an additional 13.1% in capital appreciation. Well, hallelujah, you finally got back to even after all those years!

Here is the reason why investors in AGNC and many other high-yield investments have garnered outsized returns over the last twelve months. The market started piling into high yielders on the rumor that the Fed was going to eventually pivot and start lowering rates.

The rumor is now news. The Fed has lowered interest rates by 50 basis points, and is planning on more rate cuts. Unfortunately, for the REIT investor, this is already baked into the cake. The market has already looked out over the next 18 to 24 months, and these expectations are now reflected in the price of AGNC. Hence, the outsized total return in AGNC over the last twelve months.

Unfortunately, it seems income investors expect this kind of total performance to keep on keeping on. And why not, greed is now the dominant emotion in income investing, with risk and past performance out the window. I have seen this wash/rinse cycle repeat itself numerous times along the way. I have seen high-yield portfolios lose 60-70% of their principal, only to have the owners of those portfolios tell me, “Why should I care about my principal, I am still receiving my dividends.”

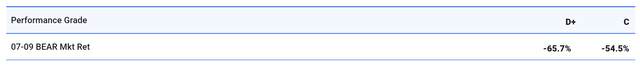

How did AGNC fare during the 2008-2009 great recession? Those investors who are now holding a truckload of high-yield investments don’t want to hear this, but it was down 67.9% during that turbulent period. Your $10,000 became $3,210.

If you think REITs are any safer. The REIT index (RWR) did even worse than that. It was down a gut-wrenching 71.5% during that same timeframe.

Congratulations if you caught the outsized mREIT gains observed over the last twelve months. History has shown that the worst performing sector one year after a Fed pivot is REITs, with an average loss of -10.4%.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Best Stocks Now Premium gives you access to Bill Gunderson, professional money manager & analyst with over 24 years of experience.

You get Bill’s daily "live" buys and sells in his four portfolios: Emerging Growth, Ultra-Growth, Premier Growth, and Dividend & Growth.

JOIN NOW to get daily "live" buys and sells, weekly in-depth market-timing newsletter, access to Bill’s proprietary database with daily rankings on over 4,800 securities, and a daily live radio show!