Summary:

- AGNC suffered volatility this week as the mREIT encountered resurgent bond yields.

- AGNC’s book value has continued to improve, underscoring its bullish thesis.

- The company is well-positioned for a yield curve steepening phase, as mortgage spreads are also expected to remain wide.

- The stock’s dirt-cheap valuations suggest the market remains too pessimistic about its recovery.

- I argue why this week’s pullback has afforded income investors another solid buying opportunity to load up.

cagkansayin

AGNC: Don’t Fear The Post-Earnings Volatility

AGNC Investment Corp. (NASDAQ:AGNC) investors suffered a pullback this week as the leading mREIT posted its earnings scorecard. In AGNC’s Q3 earnings release, the company missed Wall Street’s estimates despite posting a solid improvement in its economic return.

As a result, buyers have gotten it spot on, as AGNC has emerged from its battering since its lows in October 2023. However, bond yields rose this week, likely contributing to the volatility observed in AGNC as the market reassessed potential interest rate risks. Management expects the Fed to remain constructive in its more dovish posture through 2025.

In my previous bullish AGNC article, I highlighted that buying sentiments on it have remained resilient. I also indicated that the stock’s undervaluation should bolster its bullish proposition as the Fed moves into a more dovish posture. Therefore, I’m not surprised with AGNC’s relative outperformance on a total return basis against the S&P 500 (SPX) (SPY) since then.

Notwithstanding my optimism, this week’s pullback suggests the market has likely baked in the optimism of potentially lower interest rates through 2025. As a result, the focus has justifiably turned to AGNC’s execution risks if interest rates fall much slower than anticipated. Notably, a resilient economy and uncertainties in the upcoming US presidential election have likely worried investors as they bake a revival in long-term inflation rates. Despite that, consumers are becoming increasingly confident about a more stable macroeconomic environment. In addition, wider mortgage spreads remain constructive for AGNC, bolstering its earnings capability.

The mREIT has turned toward increasing its hedges toward longer-dated treasury securities, underscoring its conviction in the yield curve steepening thesis. Therefore, AGNC has telegraphed its conviction about potentially lower interest rates moving ahead as it reconfigured its hedging portfolio.

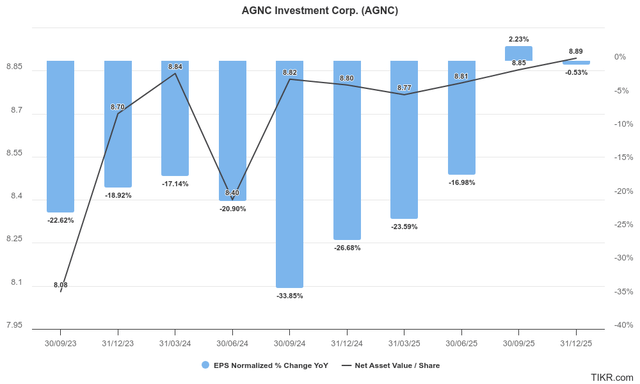

AGNC’s Stable Book Value Helps Sustain Bullish Sentiments

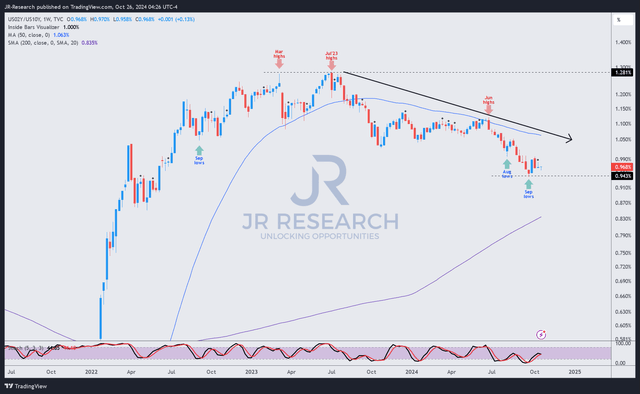

US2Y/US10Y price chart (weekly, medium-term) (TradingView)

As seen above, the yield steepening thesis has gained traction since the US2Y/US10Y peaked in July 2023. It has moved into a decisive downtrend, as the 2Y (US2Y) remains below the 10Y (US10Y) as we ended the week. However, the surge in yields has coincided with downward volatility in AGNC as the market baked in uncertainties linked to possible interest rate risks. As a result, I believe that AGNC’s execution through 2025 will be critical to a further valuation re-rating.

Despite that, Wall Street expects AGNC’s net spread and dollar roll income to continue declining through 2025, impacted by the reduction in its net interest rate spread. AGNC posted a net spread and dollar roll income of $0.43 in Q3, down markedly from the $0.53 metric the mREIT posted last year.

Notwithstanding the caution, AGNC posted an increase in its net tangible book value per share of about 5% in Q3, underscoring the solid economic return from its portfolio. Hence, I assess that the market will likely focus on the volatility in the underlying mortgage spreads moving ahead, while the demand for Agency MBS is expected to remain stable. In addition, the reduction in the mREIT’s leverage ratio (down to 7.2x tangible equity) should afford AGNC potential opportunities to lever up based on its assessment of more favorable market conditions.

Hence, I determine that this week’s caution isn’t expected to torpedo the yield curve steepening thesis that management is likely banking on. Investors must assess whether its valuation still supports the stock’s bullish thesis, even as it navigates the changes in its hedging strategies and recent uncertainties.

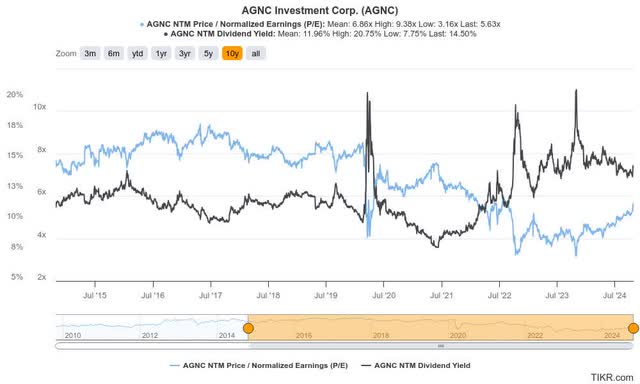

AGNC Stock: Still Dirt Cheap

AGNC’s forward net spread and dollar roll income multiple of 5.6x is still below its 10Y average. It’s also markedly below its peers’ median of 8.2x, underscoring its relative undervaluation. Moreover, the stock’s robust 14.5% forward dividend yield should provide significant valuation support for AGNC as income investors aim to reallocate from cash.

I assess that buying sentiments on AGNC should remain robust, given its improving fundamental thesis, more constructive macroeconomic conditions, and relatively attractive valuations. In addition, it has also delivered its balance sheet. Also, its primarily fixed-rate securities portfolio should be supported by potentially lower interest rates through 2026, bolstering its portfolio value.

However, investors mustn’t understate interest rate risks linked to increased refinancing or prepayments. However, the high mortgage rates should help mitigate a surge in the near term, providing more clarity in AGNC’s earnings profile. In addition, investors must also consider the potential for heightened inflation risks, given the change in administration in January 2025. The market seems to be betting on a second Trump administration, potentially lifting interest rate risks. Hence, the recent resurgence in yields suggests the market is likely pricing in such uncertainties. However, investors should note that the race between Kamala Harris and Donald Trump is too close to call, as betting odds are still expected to remain in the margin for error ranges.

Is AGNC Stock A Buy, Sell, Or Hold?

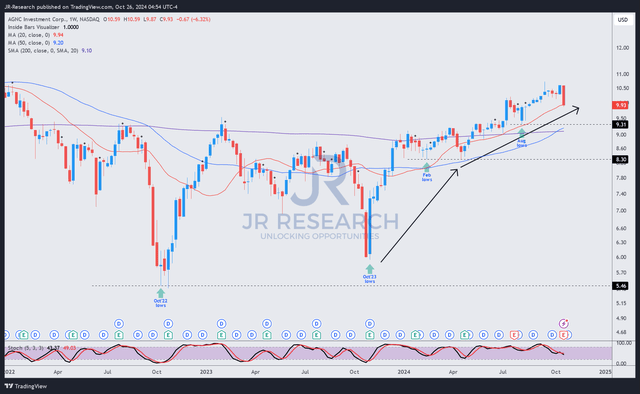

AGNC price chart (weekly, medium-term, adjusted for dividends) (TradingView)

AGNC’s price action (adjusted for dividends) indicates an increasingly solid uptrend bias, notwithstanding this week’s volatility. Hence, I’ve not assessed red flags requiring me to be more cautious about its bullish thesis.

Given an increasingly dovish Fed, AGNC seems well-poised to ride its uptrend continuation. Near-term uncertainties linked to the recent surge in yields are not expected to be structural. Therefore, we should get more clarity after the presidential election, offering investors an attractive dip-buying opportunity.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!