Summary:

- AGNC Investment Corp., a mortgage REIT, focuses on government-backed residential mortgages, offering a high dividend yield of 13.78% with monthly payouts.

- AGNC provides liquid options that present opportunity for increasing income through collection of premiums.

- AGNC’s dividends are stable and outperform peers, supported by dynamic portfolio rebalancing and hedging, ensuring sustainability despite interest rate fluctuations.

- With potential Fed rate cuts and global uncertainties, AGNC presents a strong buy opportunity for income-focused investors, though reinvestment is limited by REIT payout requirements.

Paper Boat Creative

AGNC Business Model

AGNC Investment Corp. (NASDAQ:AGNC) is a mortgage real estate investment trust (mREIT) that invests primarily in mortgage-backed securities, specifically government-backed residential mortgages. The company focuses on paying out a minimum of 90% of its taxable income to maintain its REIT tax status and thus exhibits a high dividend yield of 13.78%, as of October 16, 2024. Notably, these dividends are paid out monthly and the trust operates under a constant dividend per share policy. As shown in recent 10-Q and 10-K filings, the company boasts a relatively low book value that is bound to increase as interest rates drop, as the company is valued according to the MBS on its books. The company is highly liquid (14.7M ADTV) and readily offers options with tight bid-ask spreads that can be sold to synthetically increase income and essentially generate extra dividends, all while maintaining price stability. Structurally, the REIT hosts a healthy level of leverage that is central to increasing returns on equity.

Uniqueness Among mREITs

AGNC’s main idiosyncrasy comes from its business model. Similar to other mREITs, it primarily holds mortgage-backed securities but stands out in the aspect that it strategically focuses on securities issued by Government-Sponsored Enterprises (GSEs), such as household names like Freddie Mac, Ginnie Mae and Fannie Mae. Distinguishably, these entities hold implicit government guarantees, which virtually eliminate credit risk.

As shown in periods of market stress, such as the 2008 Great Financial Crisis, AGNC outperforms its peers. The company conducted its initial public offering on its common stock on May 13, 2008, and investors sought out the safety of government-backed holdings, leading the company’s stock to outperform and substantially appreciate throughout the remainder of the crisis.

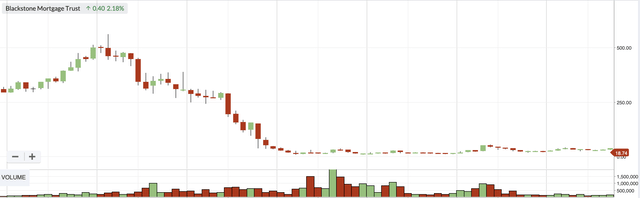

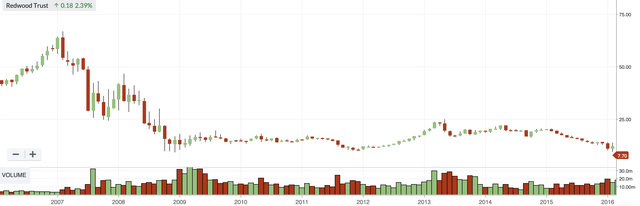

Here is the split-adjusted visual performance of AGNC, ABR, BXMT, and RWT, respectively:

AGNC Price Chart (Stockopedia) ABR Price Chart (Stockopedia) BXMT Price Chart (Stockopedia) BXMT Price Chart (Stockopedia)

While other mREITs diversify risk exposures between credit risk and interest rate risk, specifically by investing in higher-risk assets such as distressed loans, AGNC can focus on optimizing interest rate risk. The company does so by employing a host of hedging strategies that mitigate earnings sensitivity to changes in the yield curve, such as through interest rate swaps and swaption holdings.

Key to this hyper-income strategy is the abundance of liquid options that offer attractive premiums, an aspect that stands out among mREITS. This attribute differentiates AGNC in that it allows investors to gain supplemental income beyond those offered by dividends.

Regarding dividends, the general frequency of payouts is quarterly, which aligns with reporting standards. While rare, but not exclusive, monthly dividend payouts provide cash flow that offers liquidity at moments when potential investing opportunities arise and allows for earlier and more frequent reinvestment, increasing the compounding effect. A comparison of dividends among peers appears in the Dividend Summary section.

Macroeconomic Environment

Interest rates have empirically proven to be cyclical, and the Fed is exceptionally skilled at telegraphing its intentions, so we can reasonably expect further rate cut continuation, especially after the October 11 PPI report suggested that producer-based inflation is exhibiting material signs of cooling. This recent pivot toward rate cuts, or at the very least an end to quantitative tightening, would benefit AGNC by evoking an increase in MBS prices, thus increasing book value. Not to forget, mortgage spread expansion could significantly improve the company’s Net Interest Margin (NIM) as reinvestments at more attractive yields start to appear possible.

Tactically, both this unprecedented presidential election in the United States and potential escalations in the Middle East surrounding Israel, Asia, and Eastern Europe may lead to a spike in volatility, thus, increasing option premiums and allowing for a more fruitful income yield between dividends, cash-covered puts, covered calls, and potentially short straddles and strangles.

Fundamental Analysis

AGNC held its monthly dividend of $0.12 per share held constant through the entirety of the post-COVID regime thus far (since May 2020), (13.79% yield), which outpaces industry averages. Strikingly, while AGNC’s Q2 2024 return on tangible equity was negative (primarily driven by book value losses presumably adversely impacted by interest rates), the company adamantly maintained its dividends, attracting income-driven investors. Together, the high yield, stability and frequency of payments provide both forecastable cash flows and lower reinvestment risk.

The company widely uses interest swaps ($48.7B in notional value) which help to mitigate the interest rate risks that apply to its MBS portfolio and manage funding costs, which increased by 2% in 2024. Plus, spread compression (decreasing from 2.98% to 2.69% primarily due to restrictive monetary policy) has been harmful to profitability but the effects were dampened by the dynamic hedging policy. This downside mitigation is complemented by a robust leverage strategy (7.4x leverage ratio) that aims to enhance upside return and overall add convexity to the portfolio.

Juxtaposing AGNC and its peers, AGNC, as the name suggests, maintains an agency-backed strategy, as its portfolio composition of $59.7B of a total of $66B of mortgage-backed securities is allocated to Agency-MBS. This gross reduction of credit risk makes AGNC more defensive in times of market volatility.

Additionally, the company maintains institutional ownership of 18.06%, and I highlight that the stock is held by funds with enormous amounts in AUM, such as Vanguard’s Total Market Stock Index Fund and Blackrock’s Institutional Trust Company, N.A. Inclusion in these funds provides a stable backdrop of capital to AGNC, abating future going concerns.

Qualitatively, the company runs through 5 stringent tests each quarter that are more rigorous than necessary to maintain its REIT tax status, including justifying the nature of assets, adequate diversification of asset ownership across various issuers, and position limits within its own portfolio.

Data according to both the company’s latest 10-Q and 10-K filings.

Dividend Summary

Notably, the company operates under a constant dividend payout strategy, which attempts to stabilize the value of dividends, converse to a constant dividend ratio that remains in proportion to a company attribute, often earnings or stock price. This allows the monthly dividend per share to be confidently modeled and forecasted. Empirical data from Stockopedia shows that throughout the entirety of the post-COVID era, AGNC has been paying monthly dividends of $0.12 per month, despite headwinds from adverse interest rate volatility. To address sustainability in this highly leveraged structure, AGNC’s portfolio is often dynamically rebalanced and holds hedging securities, which ensures a strong position to maintain payouts through all kinds of rate environments. Thus, while earnings and stock price have fluctuated, dividends have proven stable.

Comparatively, among mREITs, AGNC’s dividend yield outperforms its peers, as is suggested by data from Stockopedia, MarketWatch and Yahoo Finance as of October 16, 2024:

| Stock | Dividend Yield |

| AGNC | 13.78% |

| ABR (Arbor) | 11.34% |

| ARI (Apollo)* | 11.16% |

| BXMT (Blackstone)** | 10.16% |

| FRST (Franklin) | 11.01% |

| KREF (KKR) | 11.46% |

| NLY (Annaly) | 13.0% |

| PMT (PennyMac) | 11.43% |

| STWD (Starwood) | 9.59% |

*ARI announced dividend cuts from $0.35 to $0.25 on September 11, 2024, so yield calculation is forward-looking

**BXMT announced dividend cuts from $0.62 to $0.47 on August 13, 2024, so yield calculation is forward-looking

This data exhibits the attractiveness of AGNC’s dividends among its peers.

Risk Analysis

- Interest rate risk: A supporting argument for this “long” recommendation is the evidence provided by historical data that the initiation of rate cuts tends to lead to various others, thus we can reasonably expect subsequent cuts to come. As a cushion for the unexpected, the company holds give or take $50B in notional value of Interest Rate Swaps that are specifically purchased to protect book value from sudden market shocks. Pertaining to options, short puts are long rho (the Greek that signifies sensitivity to changes in interest rates) and short calls (covered calls reduce risk) are short rho, so the two cancel out interest rate effects.

- Credit risk: this risk is essentially abated, as the vast majority of AGNC’s MBS holdings are government-backed. Thanks to support from government-sponsored entities, exposure to credit risk is directly reduced.

- Regulatory risk: regulations that dictate funding markets could unexpectedly tighten, thus reducing AGNC’s ability to utilize margin to grow or refinance existing debt. As risk mitigation, AGNC runs simulated scenarios and rigorous stress testing to assess the potential impact of regulation changes, especially with the proverbial passing of the presidential baton.

- Liquidity risk: This risk is minimal, as AGNC is the most actively traded REIT of all kinds, exhibiting a rolling 3-month average daily trading volume of 14.7M shares.

Strategy Implementation

This is a pure income factory.

Mechanically, the investor can short cash-secured puts to enter the stock at a desirable price and generate premium income doing so. The distance from the money where the put strikes are located is directly determined by the optimization of the degree to which investors want to get assigned and their desire for lower-risk income. Upon assignment, the investor will benefit from the juicy 13.9% dividend yield, which is remarkably distributed monthly. Should the investor wish to exit the position, they can sell covered calls, which will simultaneously generate income while providing the opportunity to experience a capital gain, should the investor sell calls that have a strike price above their cost basis and get called. As a bonus, an investor can concurrently sell both puts and calls (either in a short strangle or short straddle fashion), if not minding potentially increasing position size should assignment occur while also not minding closing out the position and having generated dividend income, put premium income, call premium income, and, potentially, a capital gain.

Conclusion

AGNC Investment Corp. presents an attractive income-based opportunity to long-term investors While equity markets face headwinds from global uncertainty and changing American presidential regime, investors seek stable income with potential upside that high-yielding assets like AGNC can provide. Ultimately, the Fed’s possible shift toward expansionary monetary policy through rate cuts provides an opportunity for book value appreciation. Combined with the stability of constant monthly dividends and income-generating option strategies, this opportunity is attractive. These aspects alone merit a “Strong Buy” rating.

However, I must acknowledge the unfortunate truth that REITs of all kinds must distribute 90% of earnings to maintain their tax status. History has shown that mREITs are affected in such a way that this massive payout requirement limits reinvestment in the company, thus capital growth is softly capped. This attribute stands alone as a “hold” recommendation. I foresee the stock appearing around $14.00 per share by the end of 2025. This is considering implied market expectations for Fed Funds Effective Rate of 3.33 (six 25 bp cuts) according to probabilities implied by FFE futures and a historical midcycle P-B ratio of 1.1 for all mREITs and AGNC itself.

Therefore, I overall recommend a “Buy” with a mid- to long-term outlook, suggesting that portfolio managers everywhere can use this strategy as part of a tactical asset allocation strategy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.