Summary:

- Stop viewing your house as an expense, see others’ home as an income stream.

- No need to buy and rent out, own the debt they used to buy their homes.

- Landlord or creditor? I collect marvelous income through many channels.

Tony Anderson

Co-authored by Treading Softly

“Just over 78% of borrowers have a rate below 5% while 59.5% have a rate below 4%. Those lucky enough to have an interest rate below 3% fall to 22.6% of homeowners” – Source: Fox Business

The likelihood of someone refinancing their mortgage loan or paying it off early is proportionate to their ability to refinance that debt at a cheaper rate, or the likelihood it is the cheapest debt they currently owe. You see, if they cannot refinance to a lower interest rate, they would be disinclined to pay it off early. Furthermore, if their other debts, like auto loans, credit cards, or any other type of secured or unsecured debt, bear a higher interest rate, they’ll be more inclined to pay off that debt before their mortgage.

With over 78% of borrowers having a mortgage below the 5% interest rate level, current interest rates still do not encourage homeowners to refinance, sell, or buy a new home. The interest rates will have to fall further. For many homeowners in the 4% or lower interest rate on their mortgage, the likelihood that they’ll ever be able to refinance for cheaper is very low.

What does this mean for you? What it can mean for you is that the mortgage sector, notably agency MBS (Mortgage-Backed Securities), can be highly attractive because the yields they offer will survive longer than historical levels, largely because people are discouraged by the current economic situation to pay off those debts early. You will collect interest on them for longer instead of seeing rapid repayment activity.

I’ve historically said I like to get income from sources other people have to pay without a second thought, whether that’s their cell phone bill, their power bill, or what, for most people, is their largest expense — their mortgage. Today, let’s take a look at a company that I’ve covered in the past and see how the current interest rate environment is benefitting them even further, allowing us to continue to collect wonderful income. You can look at your neighbor, and thank them for paying their mortgage because they’re paying you!

Let’s dive in!

How To Make Your Neighbor, Your Income Stream

AGNC Investment Corp. (NASDAQ:AGNC), yielding 13.8%, is a mortgage REIT that invests in agency mortgage-backed securities. Agency MBS are a unique asset class in that the “agencies” guarantee the mortgages. If a borrower defaults, the agency buys back the mortgage at par value. As a result, agency MBS has limited credit risk and gets an AAA rating.

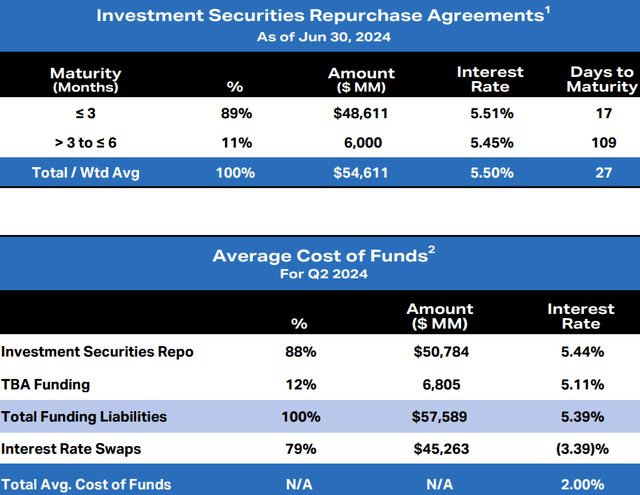

AGNC takes advantage of the low credit risk by buying agency MBS on a leveraged basis. It buys agency MBS, and will borrow using repurchase agreements aka repos. Repos are short-term lending agreements that are very common with high-quality collateral like agency MBS and U.S. Treasuries. AGNC will borrow for terms of 30-90 days, to finance the purchase of agency MBS, which has a much longer expected life. AGNC primarily profits on the difference between the yield it receives and the yield it pays.

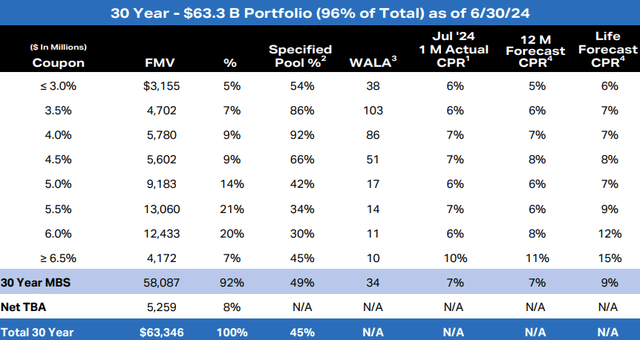

As you probably know, the yield curve has been inverted, meaning that short-term interest rates have been higher than long-term interest rates. AGNC has been rotating into MBS with coupons of 5%+, which makes up approximately 60% of its portfolio now. Source

AGNC reported its weighted average coupon at 4.95%. However, with interest rates high, the rate that AGNC has been paying on its repos has been 5.5%. They have been paying more to borrow than they receive from their assets – which has been a headwind to cash flow. However, that isn’t the whole story, AGNC has $45 billion in interest rate swaps which reduced their effective cost of funds to just 2.00%.

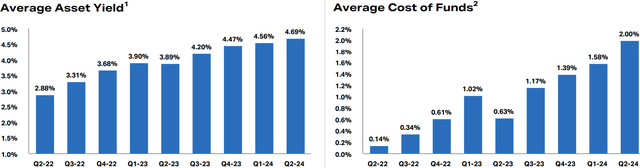

Interest rate swaps mature, so while AGNC has managed to maintain positive cash flow, their cost of funds has been steadily increasing as swaps mature. AGNC’s swaps go out an average of 4.4 years, so they have a long runway before their costs would actually climb to 5.5%. However, some swaps are maturing every quarter, so their cost of funds has been stepping up each quarter. Sometimes faster than their average asset yield could catch up:

The Fed’s 50 bps rate cut helps AGNC in a few ways.

First, AGNC had $54.6 billion in repo outstanding as of the end of the Q2, but it only has $45.2 billion in interest rate swaps. So about $9.4 billion in repos are unhedged. This unhedged portion will benefit directly and quickly, as a 50 bps cut can be expected to lead to a 50 bps reduction in interest expense. That is approximately $47 million in lower interest expense ($0.06/share). Another way of looking at it, is AGNC’s portfolio yielded 4.95%, and they paid 5.5% on their debt. Their portfolio yield has likely continued climbing as lower coupon MBS repay, and they are reinvesting at higher yields, so it is likely over 5%, and their unhedged cost of funds is now 5%. It went from cash flow negative unhedged to cash flow positive unhedged.

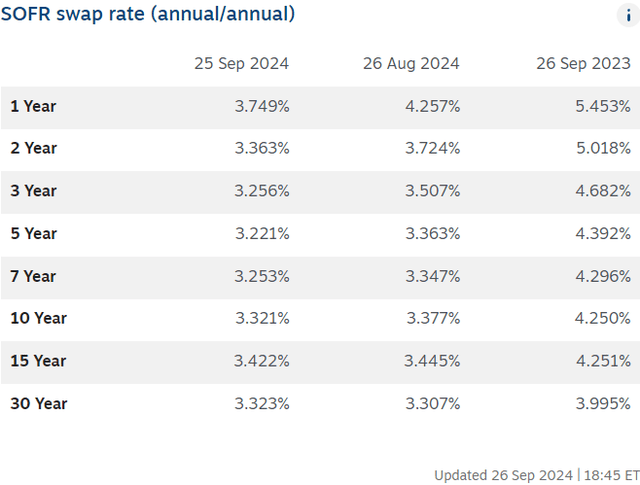

Second, swap rates have declined materially as well. While AGNC might choose to let its hedging portfolio shrink, it is not going to stop hedging entirely. As their interest rate swaps roll off, AGNC will replace them with new swaps. With the Fed’s rate cut, we have seen the fixed rate that swaps have to pay has decreased: Source

So, if AGNC wanted to take out a new 5-year swap last month, they would pay 3.363%. Today, they would pay 3.221%.

Third, it allows AGNC to get more aggressive. In the Q2 earnings call, CEO Federico noted:

“Since quarter end, economic data has continued to be supportive of the Fed moving toward a more accommodative monetary policy stance. That shift will likely occur over the next several months and should be viewed as the beginning of a new more favorable monetary policy cycle.

To this point, in its most recent summary of economic projections, the Fed’s short-term rate forecast showed a total of 9 rate cuts over the next two years. As at least some of these rate cuts become a reality, the risk of meaningfully higher rates will decline, interest rate volatility will decline and the yield curve will steepen. These will all be positive developments for the agency MBS market specifically and for fixed income more broadly.”

AGNC’s leverage is at 7.4x, which is very low compared to its history. The reason AGNC has kept leverage low is the volatility risk as the markets have attempted to predict when the Fed would cut rates. Coming into 2024, the market was very optimistic that rates would be cut as early as March. They weren’t, and the result was volatility in rates and in MBS prices. AGNC remained cautious to avoid being leveraged in those downswings.

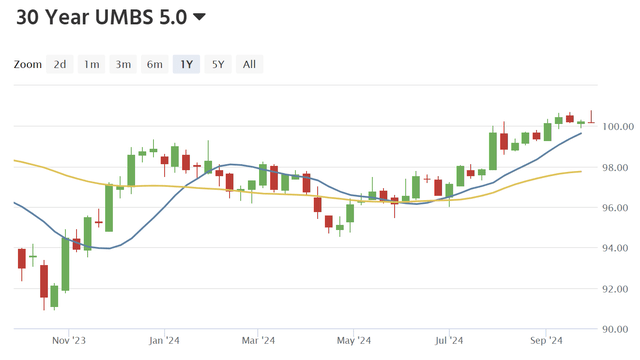

Throughout 2024, we saw MBS prices dip and rally a few times as the market’s predictions of when the Fed would cut were dashed. Source

Avoiding being overly leveraged with downswings like that makes sense. However, now that the Fed has cut, the likelihood of several more cuts is much higher. The downside risk is lower, and the upside potential is higher. This is an environment where AGNC is likely comfortable taking leverage higher.

It is worth noting that AGNC likely is trading at a premium to book value right now. For some, that might be a reason to sit out. However, it is worth noting that in the best periods to own agency mortgage REITs in the past like the GFC and during the Dot-com bust, agency mortgage REITs traded at large premiums to book value. Since mREITs grow by issuing shares, trading at a premium to book value is an unmitigated competitive advantage if MBS prices are going up.

Why?

A REIT trading at a premium can issue more shares, which increases book value per share, and more importantly, allows them to buy more MBS. If MBS prices are going up, then owning more MBS is a good thing. Investors readily accept this with equity REITs like Realty Income (O) or BDCs like Main Street Capital (MAIN). These companies owe at least some of their success to chronically trading at premiums to book value, allowing them to raise capital and invest in opportunities when peers can’t. In this respect, mortgage REITs aren’t different, trading at a premium to book value is a strength that provides a competitive advantage.

AGNC is trading at a premium, and it should be issuing shares and selling them in the open market as fast as they can. We expect that it is, and that will be a big benefit for all existing shareholders. If MBS is going to continue its rally, AGNC should want to be buying as fast as it can.

Conclusion

With AGNC, we can pick up a REIT that is trading at a premium to book value in a situation where they should be minting as many shares as possible because their assets are highly discounted and likely to see strong price changes in the future. CEFs, BDCs, and REITs grow the same way, primarily through issuing new shares to ink additional investments that benefit all shareholders. When they’re sold at a premium to book value, it raises the book value for every single shareholder, new and existing. MBS prices are always the first to be impacted by the economy and interest rates. If the economy starts to stumble, investors and institutions take a risk-off approach and start buying up treasury notes, Agency MBS, and triple-A-rated CLO debt. This is because they’re considered to be very low-risk assets. When you take an mREIT wrapper and add in their leverage, it does increase the risk of the investment because now you’re holding not just the safer asset but the safer asset plus all of the additional leverage. With AGNC, we see reasonable levels of leverage being deployed to own these assets and to amp up the income they generate.

When it comes to retirement, you need to have income pouring into your account, and owning double-digit yields from your neighborhood’s mortgages is a beautiful way to collect income while admiring the homes around you. Those homeowners diligently make payments towards their mortgage by working hard to earn a living. Millions of American homeowners working towards covering one of their largest expenses every month without hiccups can be one of the greatest sources of income. Support those homeowners and let them support you.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, Philip Mause, and Hidden Opportunities, all are supporting contributors for High Dividend Opportunities. Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

High Dividend Opportunities, #1 On Seeking Alpha

HDO is the largest and most exciting community of income investors and retirees with over +8000 members. We are looking for more members to join our lively group! Our Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get access to our Model Portfolio targeting 9-10% yield. Don’t miss out on the Power of Dividends!

We’re offering a limited-time 17% discount on our annual price of $599.99 plus a 14-day free trial via this link only: