Summary:

- AGNC Investment Corp. faces significant challenges due to high-interest rates, resulting in negative net interest income and high leverage.

- The company’s strategy of investing in higher-yield mortgage securities is hindered by limited availability and call risk, complicating its financial recovery.

- AGNC may need to issue more shares to fund future investments, further diluting common share value.

- Preferred shares like AGNCO offer better yields, but overall, AGNC’s risks make it an unappealing investment at this time.

stanciuc

Introduction

AGNC Investment Corp. (NASDAQ:AGNC) is a real estate investment trust that primarily invests in agency backed mortgages (also known as an mREIT). Agency backed mortgages are securities backed by mortgaged assets that are insured by the federal government. Back in April, I discussed the challenges facing AGNC relating to higher interest rates. I’ve been harsh in the past about investing in the company’s preferred shares. Today, I’m neutral on AGNC’s preferred stock, but still short on its common shares as I’ve discovered more risks than just higher interest rates to its financial model.

AGNC and the Negative Net Interest Income

AGNC invests in mortgage-backed securities utilizing leverage. The company borrows money over a short-term duration and uses the proceeds to buy interest-bearing securities. In a normal world, the spread between the securities income and debt interest would be AGNC’s profit for carrying those securities, but the world has been far from normal over the last few years.

Following the pandemic, interest rates on borrowing dropped to near zero and mortgage demand skyrocketed. AGNC borrowed at near zero rates and began buying mortgage-backed securities with coupons ranging from 2.5 to 3.5%, making solid net interest income from the spread. Then, the Federal Reserve raised rates aggressively to combat inflation, which caused AGNC’s debt costs to soar from 25 basis points to nearly 550 basis points. Unable to offload its low coupon mortgages, AGNC faced skyrocketing interest payments against the low coupon mortgage securities.

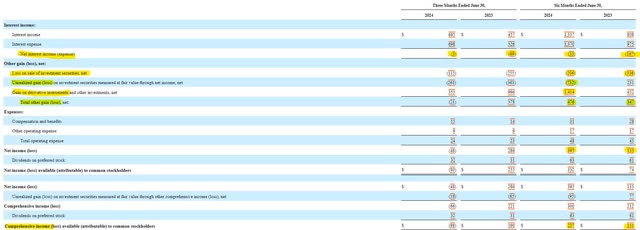

As rates have remained high, AGNC has offset some of its losses by investing in higher coupon mortgage securities. In the first half of 2024, net interest income (interest income less interest expense) improved to a loss of $33 million, which was better than the $167 million loss in the same period from a year ago. AGNC has turned to derivatives to also offset losses and saw $1.4 billion in gains during the first half of the year. Derivatives helped AGNC swing to a net income of $395 million.

SEC 10-Q

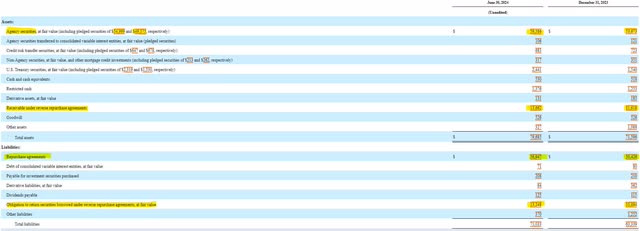

AGNC’s balance sheet shows the extent of its leverage. The company owns $59.6 billion worth of agency backed securities against $57 billion of repurchase agreement debt. The $2.5 billion gap between the two is notably lower than it was at the end of last year ($3.2 billion). This means that AGNC has decided to take on more leverage and invest in more mortgage-backed securities while rates are high. The hope is that the investment in higher yielding coupons will speed up the transformation to positive net interest income as interest rates come down.

SEC 10-Q

How Long Will Interest Income Drag?

For AGNC to free itself from this situation, the low-income securities must go. Selling them now would create enormous realized losses, as they are worth far less than when they were underwritten. The only other option is to hold them to maturity, but how long is that? According to the company’s SEC filing, more than 80% of the company’s securities are invested with maturities ranging from five to ten years.

SEC 10-Q

Buying Higher Yield Securities Leads to New Problems

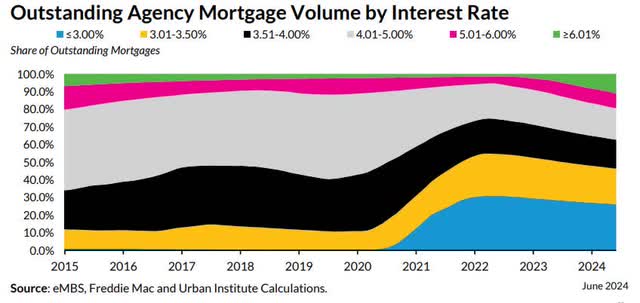

AGNC’s purchase of higher interest securities is a logical step to stabilizing its net interest income, but two major challenges present themselves with this strategy. First, the rise in interest rates greatly reduced the demand for new mortgages, especially since homebuyers did not want to move and give up their under 4% mortgage rates. The lack of availability in higher interest securities remains to this day with only 20% of agency debt yielding over 5% and nearly two thirds yielding under 4%.

Urban Institute

The problem of availability further complicates itself with the second major challenge – call risk. Many agency-backed securities that were issued a year ago are currently getting called in and being replaced with lower coupon securities as these securities have only one year of call protection, and new securities are being offered at lower interest rates. This becomes problematic as rates fall because AGNC could find itself losing securities with coupons greater than 5% by call risk only to end up settling with lower coupon notes combined with the large share of low-rate mortgages from the pandemic era.

To examine the market size of callable to non-callable agency debt, I conducted a search through my Fidelity brokerage account. Of 1,064 agency securities available at the time of my search, only 258 had call protection. Of those 258, only 38 offered coupons of greater than 5%. Of those 38, only 11 were issued in the last couple of years with virtually none of them being issued between 2009 and 2022.

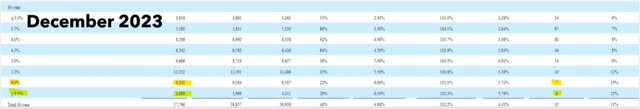

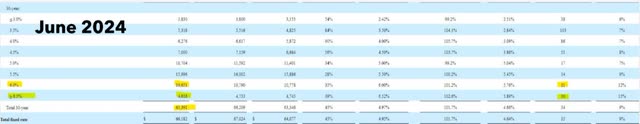

Does AGNC offer investors the ability to see whether the securities being held are callable or non-callable? It kind of does. In its SEC filing, the company details its holdings by coupon with the average duration of its holdings. To highlight the difficulty in holding high-yield notes, AGNC’s 6% and above coupon notes went from 7 to 11 months average duration from December 2023 to June 2024. If the average duration goes over 12 months in its Q3 filing, then we will know that the company has some high coupon securities locked up for a long time, but I believe we are going to see that duration stall, hinting that many of the high-yield securities have been called.

SEC 10-Q

SEC 10-Q

The Dilution Problem

As if these issues aren’t enough, I believe that AGNC will need to issue more shares to fund future investments. This theory is derived by the combination of increased leverage during the first half of 2024 and the headwinds of high-yield securities being callable throughout the next several months. AGNC does hold the authorization to issue up to $1 billion in shares and this will be a wet blanket on the common share price.

SEC 10-Q

The Preferred Shares

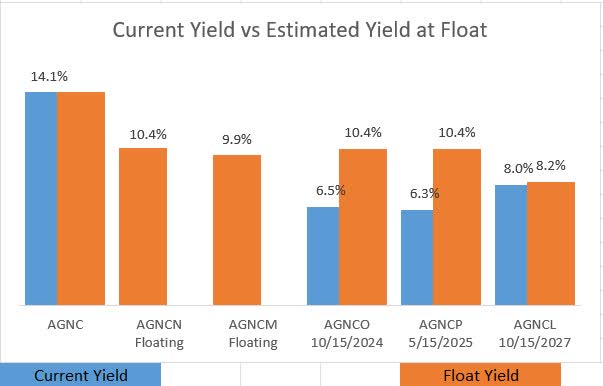

AGNC has a plethora of preferred share options, and while I rate all of them a hold, I do want to highlight which security I think would be the best for an investor seeking to put new money in here. AGNCO is a preferred security whose dividend is set to float next month. While it will likely pay one more dividend at the fixed rate, a yield of 6.5%, subsequent dividends will be paid at a rate of three-month SOFR plus 4.993%. This would imply an estimated floating yield of 10.4%. While AGNCN pays at the same yield, it is trading at 3.5% over par, while AGNCO is trading at par.

Microsoft Excel API

Put Options, A Better Short Strategy

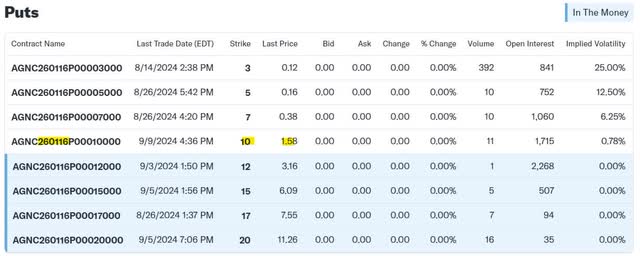

Going short on AGNC common shares can be expensive, especially since the company’s dividend of $1.44 per share per year would need to be funded by the short seller. Buying put options presents a more pragmatic approach, as the $10 strike for January 2026 is trading below the projected accumulated dividend obligation at $1.58 per share. It should be noted that volume is thin on these options, so they may be harder to close at a later date.

Yahoo Finance

Conclusion

The addition of call risk to high-yield agency mortgage-backed securities is one more layer of risk that makes AGNC unappealing to me. Combined with the fact that the company is stuck holding below-market rate mortgage securities for at least five years, I think AGNC will need to continue hedging with derivatives and issuing shares to stay relevant. Some preferred holders are getting great yield to cost, and those shares should not be sold, but at these prices with declining rates I’m not compelled to buy preferred shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.