Summary:

- Notwithstanding the market’s pessimism, AGNC Investment Corp. stock has performed reasonably well recently.

- Fed Chair Jerome Powell didn’t send “negative” signals in his congressional testimony.

- The market has priced in the first cut in September 2024, and Powell has not rejected the market’s prognostications outright.

- AGNC’s upcoming earnings call on July 23 will be scrutinized for clues on the adjustment of AGNC’s hedging strategies.

- I argue why AGNC’s relative undervaluation is well-poised to benefit as the Fed moves into cutting interest rates. Read on.

Bonnie Cash/Getty Images News

AGNC: Powell’s Testimony Is Well-Received

AGNC Investment Corp. (NASDAQ:AGNC) investors have performed reasonably well since my previous bullish AGNC update in early April 2024. I urged investors to focus on the mREIT’s highly appealing dividend yield, which should provide robust valuation support. In addition, a more normalized macro environment as the Fed rate hikes reach their peak should also help maintain buying sentiments. Consequently, AGNC has not disappointed, as it has delivered a total return of more than 4% since then.

Fed Chair Jerome Powell delivered his congressional testimony at Capitol Hill yesterday. Powell did not deliver “negative” surprises to the market in his keenly watched update. Powell has also refrained from telegraphing the timing of the Fed’s potential interest rate cuts by the end of 2024. However, the market had already priced in two interest rate cuts starting from September before his testimony. It has not been adjusted materially, as the market priced in a 70% probability of the first cut in September 2024.

Furthermore, Powell highlighted the need to maintain stability on its balance sheet runoff. Accordingly, the Fed has reduced the “pace of balance sheet runoff starting in June.” As a result, I have assessed that the macro headwinds that engulfed AGNC over the past two years could abate further.

AGNC: Assess The Adjustment Of Hedges

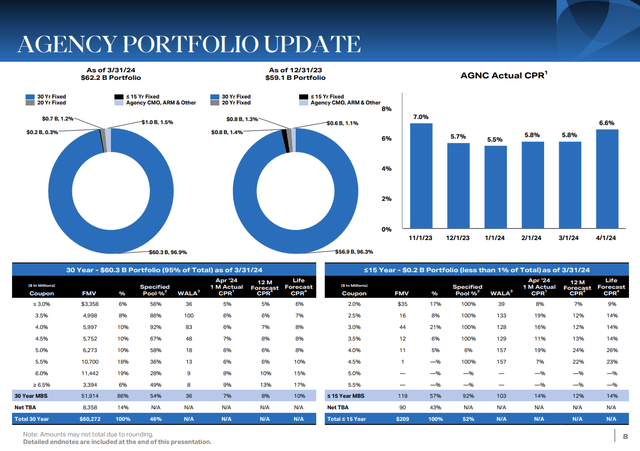

AGNC Agency portfolio (AGNC filings)

AGNC Investment Corp.’s Q2 earnings call will be delivered on July 23. Investors will scrutinize how the company adjusts its leverage and risk management in response to anticipated rate cuts in the second half. As a reminder, AGNC borrows short (through repos) and invests its long-term portfolio mainly through Agency MBS.

Accordingly, AGNC’s Agency portfolio value rose to $62.2B in Q1. Nearly 97% of the portfolio is dedicated to the 30Y-fixed segment. As a result, AGNC must manage its duration risks very carefully through appropriate hedging strategies. Coupled with leverage, it could compound unanticipated impact attributed to market volatility and spread adjustments.

Notwithstanding my caution, AGNC provided constructive commentary in Q1. I assess that AGNC’s optimism has been bolstered by Powell’s less hawkish testimony, supported by recent unemployment and inflation statistics. Hence, the market has likely reflected lower execution risks related to unanticipated surprises that could affect AGNC markedly in the second half. As a result, it should position AGNC better as it recalibrates its hedges and duration gap in anticipation of the expected interest rate cuts.

AGNC: Valuations Still Undemanding

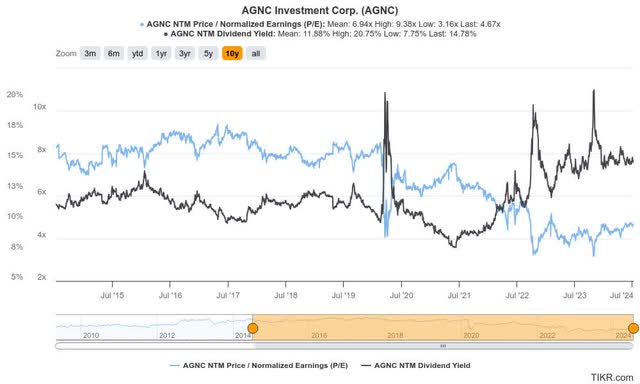

Despite that, the market still seems overly pessimistic about AGNC’s valuation. As seen above, AGNC’s net spread and dollar roll income multiple is still valued well below its 10Y average. Therefore, the market appears to remain concerned about the execution risks as we transition from rate hikes to rate cuts over the next five months.

Given AGNC’s leveraged portfolio, some pessimism is justified. Furthermore, over the past ten years, the market has accorded AGNC relatively low multiples (and correspondingly relatively high dividend yields).

Consequently, AGNC must demonstrate how it can capitalize on the anticipated Fed regime changes to deliver accretion on its net spread and dollar roll income over the next two years. Income investors must be confident in AGNC’s forward dividend yield of almost 15% before considering returning with greater conviction.

Is AGNC Stock A Buy, Sell, Or Hold?

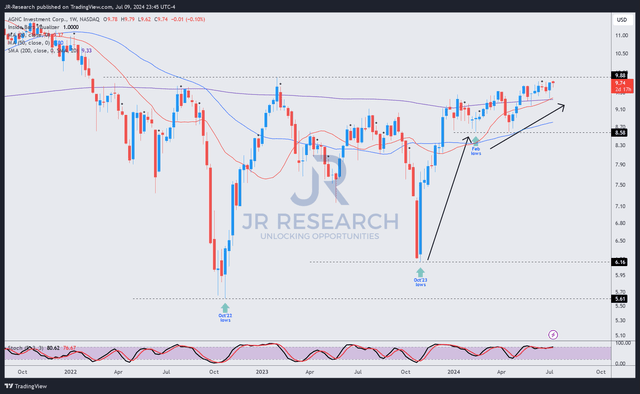

AGNC price chart (weekly, medium-term, adjusted for dividends) (TradingView)

AGNC’s price action (adjusted for dividends) suggests a pretty stiff resistance zone under the $9.9 level. That has resisted buyers’ attempts to break out of that level since July 2022.

Despite that, AGNC’s uptrend bias hasn’t been disrupted, even though volatility was assessed in mid-April. Since then, AGNC has progressed well along its recovery toward the $9.9 zone.

Given AGNC’s relative undervaluation and more constructive macro environment in the second half, income investors will likely find the opportunity appealing.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.