Summary:

- AGNC Investment Corp. exceeds expectations in its latest earnings report, but there is no upside advantage to investing in common shares.

- The company’s use of derivatives, such as interest rate swaps, has helped mitigate the negative impact of higher interest rates.

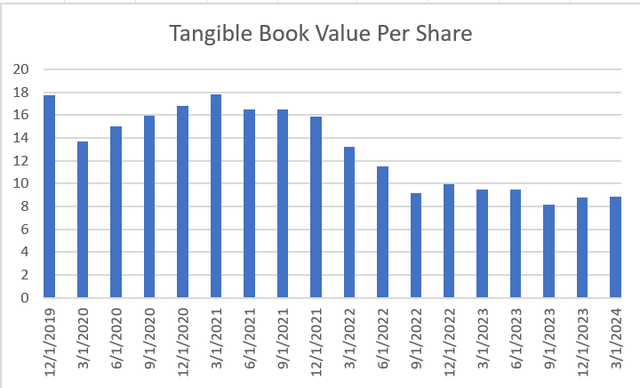

- AGNC’s tangible book value per share has dropped significantly in the past four years, and the agency securities market has declined.

filo

AGNC Investment Q1 Earnings

After Monday’s market close, AGNC Investment Corp. (NASDAQ:AGNC) reported first quarter earnings that slightly exceeded expectations. The REIT continues to navigate the higher interest rate environment. While hedges continue to support keeping the company stable, I’m not seeing an upside advantage to investing in the common shares.

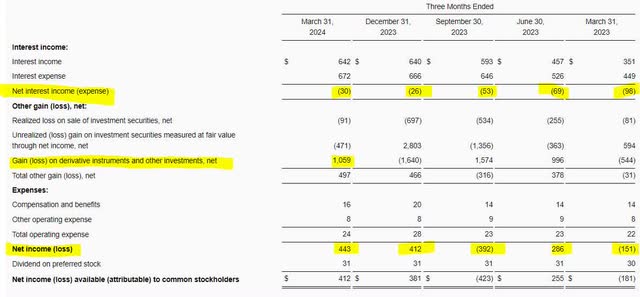

The core of AGNC Investment’s business is investing in agency insured mortgage-backed securities. While investors look at agency insured assets as nearly risk free because of their government insured backing, the financing of those investments through short-term leverage has made things more complicated. For AGNC, the company invested heavily in mortgage-backed securities when the pandemic stimulus hit in 2020 and 2021. But, when interest rates rose, AGNC saw its debt servicing costs skyrocket and its interest income stall. The result has been several consecutive quarters of negative net interest income.

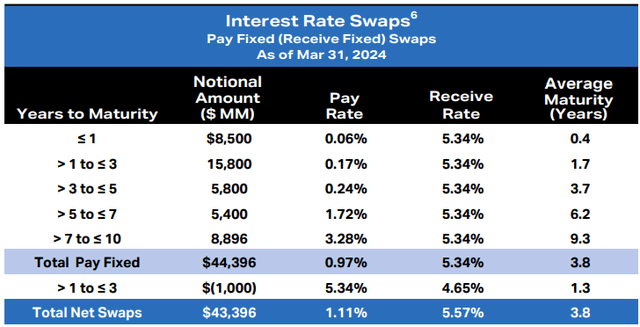

AGNC uses derivatives to hedge against higher rates and keep the company’s capital from being eroded by negative net interest income. One derivative used by AGNC is interest rate swaps where the company agrees to pay a fixed rate based on the market conditions at underwriting and in exchange, they receive a variable rate. Since interest rates have gone up since AGNC underwrote the swaps, they are receiving greater income than they are paying out.

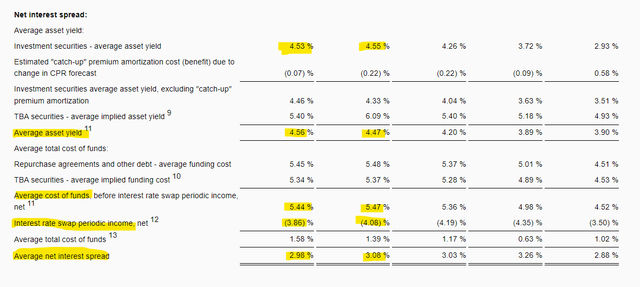

AGNC incorporates the net income from interest rate swaps into its cost of funds calculation. The interest rate swaps drive the average cost of funds down to well below market levels, and the result is a positive net interest spread. While AGNC has several years of these interest rate swaps leftover, their positive effects on earnings and net interest spread are going to begin to wear away as more of them expire.

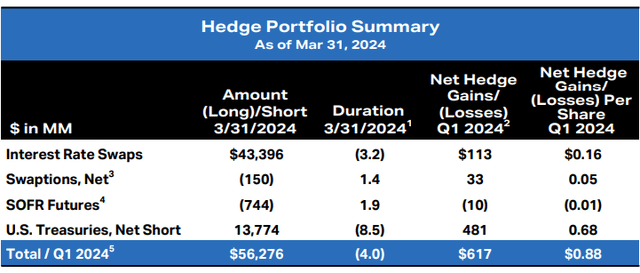

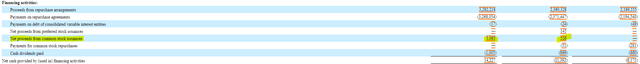

While interest rate swaps have helped earnings, they have not been as helpful as the company’s shorting of US Treasuries. Selling US Treasuries with an agreement to buy them back later has helped generate most of the earnings created by the hedges and in fact, they account for the company’s entire positive earnings quarter.

Despite hedging, the higher interest rate environment has taken its toll on AGNC’s value. The company’s tangible book value per share, a key metric for valuation of mREITs, has dropped from just under $18 per share to under $9 per share in just over four years. This plunge is caused in part by the $1.5 billion in common shares issued over the last two years that has led to returns under the company’s dividend yield.

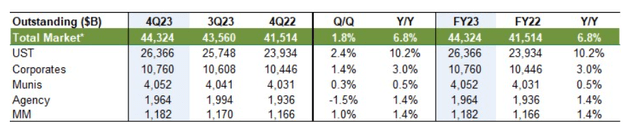

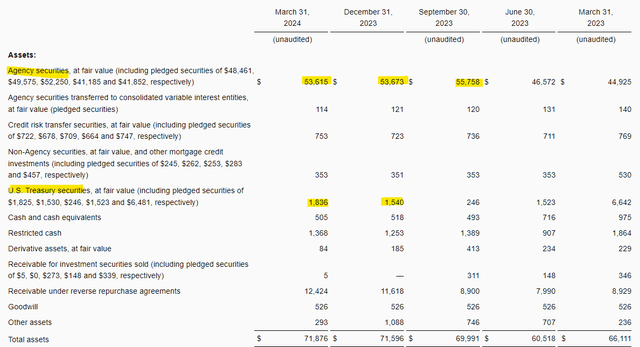

While the company believes it can capitalize over changes in the interest rate environment, I’m a bit more skeptical. While mREITs were able to buy agency securities hand over fist during the pandemic, times have changed. The total number of agency securities is not growing near where it was during the pandemic. In fact, the total number of agency securities declined in the fourth quarter.

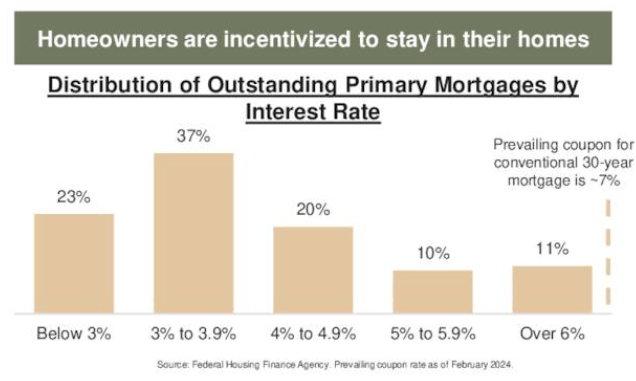

In addition to this, investment companies holding agency securities are much like their mortgagor counterparts. They are locked into lower interest rate loans and will need to take massive realized losses to sell them. A supermajority of agency backed securities can’t be unloaded without taking these losses. The agency market is very different compared to what it was three years ago, and this is also indicative of the fact that AGNC’s agency investments have declined for two consecutive quarters.

Conclusion

While I don’t believe the company can maintain shareholder value, I am a bit more optimistic about their preferred shares compared to when I wrote about them in October. I believe it is alright to hold the preferred shares with the interest rate swaps and Treasury shorts propping up the company, but I believe the weight of lower interest mortgages will continue to weigh the company down as interest rates stay higher for longer.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.