Summary:

- AGNC Investment Corp.’s net interest income trend is positive, supported by cooling inflation and potential interest rate cuts.

- The stock is selling at a small premium to book value, with potential for multiple compression and a long-run valuation target of $10.60 per share.

- Risks include high leverage and fluctuating profit, but overall, AGNC Investment shows promise for positive net interest income and strong total returns.

filo

AGNC Investment Corp. (NASDAQ:AGNC) report has just been released, and it points to a positive trend in net interest income.

With the backdrop of cooling inflation, as demonstrated by June’s CPI report, I think that investments in mortgage trusts that primarily hold mortgage-backed securities in their portfolios have upside potential and could potentially achieve double-digit returns moving forward.

AGNC Investment’s stock is selling only at a small premium to book value and I think the risk/reward relationship is supportive of an upgrade in the stock classification to ‘Strong Buy’.

The central bank also appears poised to finally slash short-term interest rates, which should benefit AGNC Investment’s mortgage-backed securities investments.

My Rating History

I raised my stock classification for AGNC Investment from ‘Hold’ to Buy three months ago due to a stronger outlook for the mortgage trust sector in general.

With June’s CPI report strongly indicating that the central bank will slash interest rates this year, at least once, I think that mortgage could deliver strong total returns moving forward.

AGNC Investment also profited from narrowing losses in terms of its net interest income, which helps round out the case for a ‘Strong Buy’ stock classification.

Agency Portfolio, Cooling Inflation, Improving NII

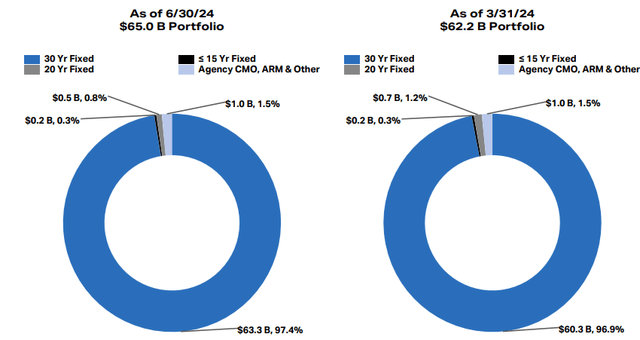

AGNC Investment’s portfolio continued to consist primarily of 30-year fixed rate mortgages which, as of June 30, 2024, had a total value of $65.0 billion, reflecting an increase of $2.8 billion QoQ.

Agency-guaranteed residential mortgage-backed securities are AGNC Investment’s bread and butter, though the mortgage trust also owns mortgage credit investments as well as Treasury securities.

Portfolio Overview (AGNC Investment Corp.)

Mortgage-backed securities, as opposed to mortgage servicing rights, are good assets to own in case the central bank lowers interest rates. This is due to the unique relationship that exists between interest rates and the prices of mortgage investments which tend to move in opposite directions. In short, residential mortgage-backed investments are preferable mortgage investment instruments during falling-rate periods.

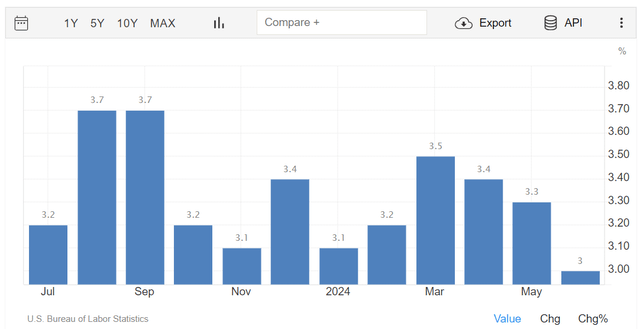

AGNC Investment is poised to profit from cooling inflation and lower short-term funding rates. According to the latest CPI report, inflation cooled to 3.0% in June, down from 3.5% in March. What this cooling trend does is increase the odds of a near-term rate cut which should help mortgage real estate investment trusts like AGNC Investment and lead to lower interest expenses.

Inflation (U.S. Bureau Of Statistics)

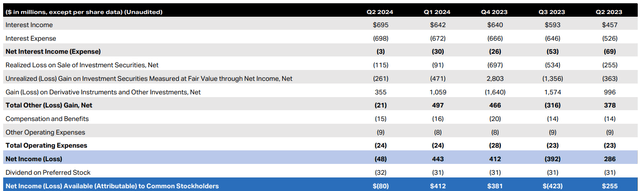

AGNC Investment’s trajectory in net interest income has been negative since the central bank started to hike interest rates in 2022, which resulted in sharply higher short-term interest expenses.

Part of the problem is that mortgage real estate investment trusts tend to borrow short-term in order to invest long-term. This in turn means that mortgage trusts like AGNC Investment take the full brunt of rate increases which narrows the difference between interest income and expenses.

In 2Q24, AGNC Investment’s net interest income was still negative ($3 million), but the trend here is positive. In the year-ago period, AGNC Investment lost $69 million in net interest income from its mortgage investments and with the central bank now poised to change the tune, AGNC Investment might be just at the brink of turning around its net interest income trajectory for good.

Net Interest Income (AGNC Investment Corp.)

Book Value Drop QoQ And Multiple

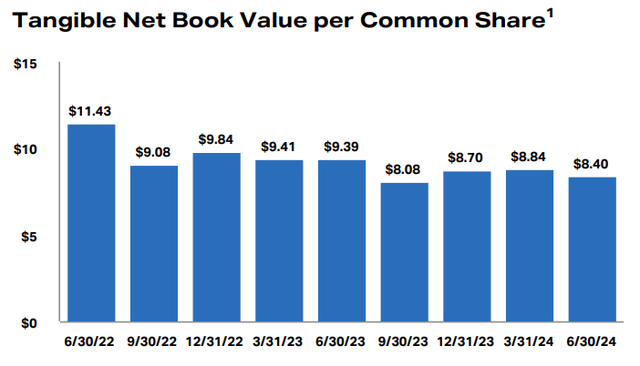

AGNC Investment’s net book value as of June 30, 2024 was $8.40 which reflected a QoQ drop of 5%. This was the largest such decline since 3Q23 which is when the mortgage real estate investment trust’s book value fell 14% QoQ. The long-run trend in book value for AGNC Investment is negative as well: in the last two years, the trust’s book value suffered a stunning decline of 27%.

Tangible Net Book Value Per Common Share (AGNC Investment Corp.)

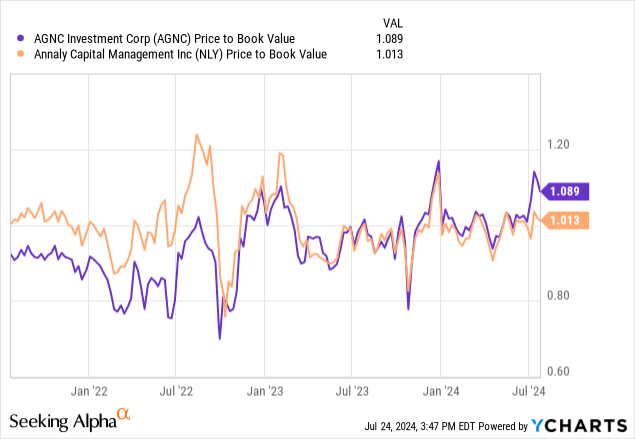

Generally speaking, big mortgage trusts sell for book value multiples that I consider to be moderate. AGNC Investment is selling at a 9% premium to book value as I am writing this piece, compared to a 1% premium for Annaly Capital Management, Inc. (NLY).

AGNC Investment, in my view, could go through a multiple decompression process, led by the central bank’s rate cuts that are poised to lead to higher net interest income in 2H24.

With a multiple compression underway, I view a 1.10x BV as a realistic long-run valuation target for both Annaly Capital Management and AGNC Investment in a rising-rate environment. The implied valuation target for AGNC at a 1.10x BV multiple is $10.60 per share.

What Could Go Wrong?

There are some intrinsic risks with mortgage trusts as they tend to be highly leveraged. Mortgage real estate investment trusts also have a widely fluctuating profit picture which makes short-term as well as long-term profit predictions extremely difficult.

A major drawback of the mortgage trust model is that companies like AGNC Investment or Annaly Capital Management borrow money short-term and invest it into mortgage securities for the long term. This mismatch in duration creates risks for shareholders and can result in situations of severe book value declines (as we have seen in 2022 and 2023).

My Conclusion

Though AGNC Investment’s book value slid again in 2Q24, the net interest income situation is looking better, and the outlook does, too, in my view.

AGNC Investment is very close to returning to positive net interest income and the central bank is poised to help the trust out here: With inflation cooling substantially in the last three months, AGNC Investment is poised for an inflection point when it comes to its net interest margin. Lower borrowing and interest costs should have a substantial and positive impact on the mortgage trust’s net interest margin in the future.

As the outlook for profit (NII) growth improves and mortgage-backed securities benefit, valuation-wise, from lower interest rates as well, I think a change in the stock classification to ‘Strong Buy’ is in order.

AGNC Investment’s stock presently pays a 14% yield, and I am adding to my long position incrementally.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.