Summary:

- AGNC Investment Corp. has underperformed both the overall market and the mortgage REIT sector.

- Uncertainties surrounding interest rates and the possibility of Agency MBS spread widening are the key issues to blame in my view.

- Unfortunately, I don’t see these issues going away anytime soon.

- They could trigger other issues such as decline in mortgage origination and uptick in default rates.

DNY59/iStock via Getty Images

AGNC has underperformed

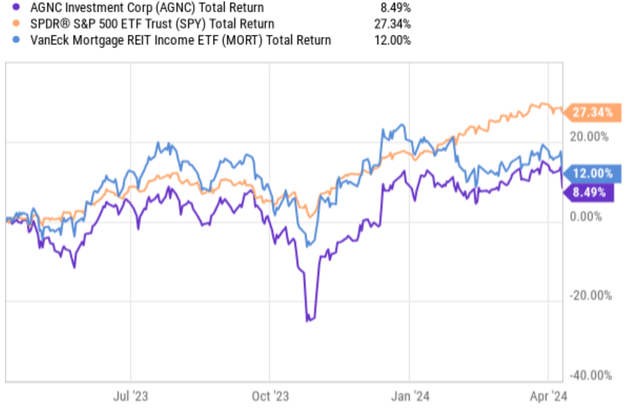

If you are a shareholder of AGNC Investment Corp. (NASDAQ:AGNC), you must be quite disappointed by its recent performance. The stock, a leader in the mREIT space, has underperformed both the overall market and the mortgage REIT sector. More specifically, the chart below shows the total return performance of AGNC compared to the SPDR S&P 500 ETF Trust (SPY) and also VanEck Mortgage REIT Income ETF (MORT) over the past year. As seen, AGNC delivered a total return of 8.5%, whereas SPY had a total return of 27.3% and MORT had a total return of 12. 0%.

An attempt to pin down the cause of such underperformance surely will involve some degree of speculation. Bearing this in mind, the top factors on my mind are twofold: the uncertainties surrounding interest rates and also the possibility of Agency MBS spread widening. If these factors make sense to you, then the remainder of this article will explain why I see these headwinds are not going away. As a matter of fact, I see good odds that could even worsen in the next 1~2 year and cause more pain for AGNC.

Mortgage origination is declining

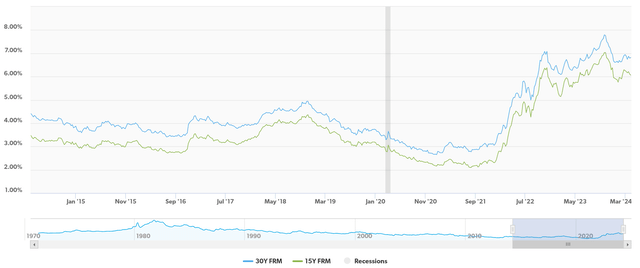

Mortgage rate currently hovers around the peak levels in at least 10 years (seen the chart below provided by Freddie Mac). Borrowers (and the market too) were hoping that the fight against inflation would come to an end soon and rates would stabilize and even start declining. However, the latest inflation data (quoted below from this Seeking Alpha news) has shattered this hope in my view.

The Consumer Price Index climbed 0.4% in March, the same increase as in February, and exceeding the 0.3% rise that economists expected. That indicates that the hot readings in January and February may be more than a “bump” on the path to inflation heading toward the Federal Reserve’s 2% goal.

Looking ahead, I see good odds for borrowing rates to stay elevated or even increase further. JPMorgan CEO Jamie Dimon recently commented that rates could be as high as 8% and I fully share his view. If borrowing rates further climb (even by a bit), I expect AGNC (together with other mREIT players) to face a strong headwind. Actually, things are already pretty ugly under the current borrowing rates as reflected in the following report regarding credit card delinquency and mortgage data. The gist was quoted below with slight edits by me. The emphases were also added by me.

Credit card delinquency rates reached their highest level on record in Q4 2023, according to a report from the Federal Reserve Bank of Philadelphia, while new mortgages appear to be riskier amid rising housing costs… Meanwhile, mortgage originations declined to a series low in Q4 as market headwinds continued to stifle demand, and the data hinted at a possible change in the risk approach of firms.

Adding all these together – high borrowing rates, high inflation, and worsening affordability, I won’t be surprised to see a continued decline in mortgage origination and also an uptick in default rates. These headwinds can negatively impact AGNC in a crucial way.

First, it could reduce AGNC’s income. Mortgage REITs earn money from the interest rate spread between the interest they pay on the funds used to buy mortgage-backed securities (“MBS”) and the interest received from those MBS. And MSB is what AGNC mainly relies on (more on this later). If there are fewer mortgages being originated, there are simply fewer MBS for ANGC to invest in.

At the same time, it could lead to decreased book value too. The value of a mortgage REIT’s holdings is directly tied to the value of the MBS they own, again, is especially relevant since MBS is AGNC’s main exposure. If fewer mortgages are being originated, the supply and demand dynamics can shift, potentially causing the value of existing MBS to decline (and also heighten the valuation risks as to be discussed in the final section).

Yield spread is likely to become more inverted

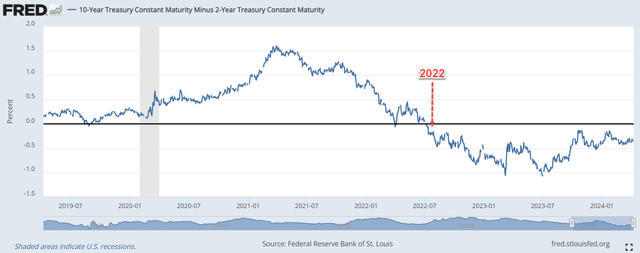

As mentioned earlier, Mortgage REITs like AGNC earn money from the rate spread between the funds they borrow (which are close to the short-term rates) and the yield they charge (which are closer to the long-term rates). As a result, AGNC’s profit is sensitive to the yield curve. As seen in the chart below, the yield curve has become inverted in 2022 and remains so thus far – a leading factor in my mind causing AGNC’s (and mREIT in general) underperformance relative to the overall market during this period.

Since reaching the worst level of more than negative 1% in mid-2023, the yield spread has narrowed quite a bit. Currently, the yield spread is close to zero with 10-year treasury rates around 4.6% and 2-year treasury rates around 4.9%. It is totally possible that the spread continues its current trend and turns positive, which would provide a major tail for AGNC.

However, I view this scenario as highly unlikely given the current macroeconomic parameters. My thought process involves only basic economic principles and is detailed here. The gist is:

The Fed only controls the short end of the rates and the market controls the long-term rates. As inflation persists, the Fed would have to either maintain the current short-term rates or even further increase it. While the market’s demand for safe-haven assets increases during economic uncertainties – such as persisting high inflation. And long-term government bonds are the primary safe-haven assets. This increased demand for longer-term bonds serves as a counterforce that tends to push their prices up and drive their yields down. As such, the long-term rates often rise slower than the short rates (this current rate hike cycle serves as the most recent example), leading to a more negative yield spread.

Other risks and final thoughts

Besides the above risks, there are a few additional risks that are more peculiar to AGNC that I’d like to point out before closing.

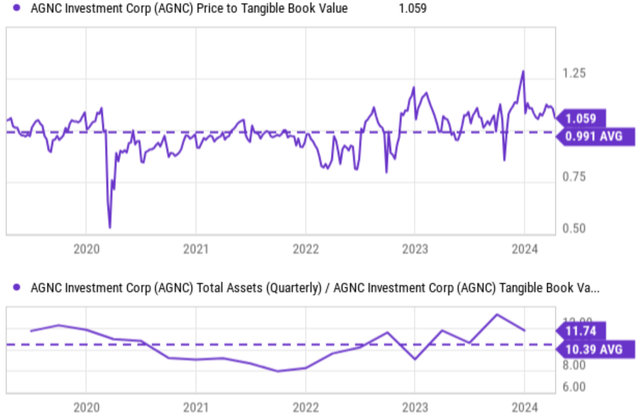

On the downside, I am also concerned about some valuation risks. As seen in the top panel of the chart below, AGNC is trading at about 1.06x tangible book value, about 7% above its historical average of 0.99x. A 7% premium is not too much by itself, however, the issue is compounded by the relatively high leverage as seen in the bottom panel of the chart. Its current asset/TBV ratio of 11.74x is not only above its historical average, but also close to the peak levels in at least 1 decade, quite concerning to me given my outlook for borrow rates and yield spread ahead. As aforementioned, these uncertainties could cause AGNC to suffer dramatic book value losses (which have happened many times in the past). Thus, I think the valuation risks are higher than the 7% on the surface.

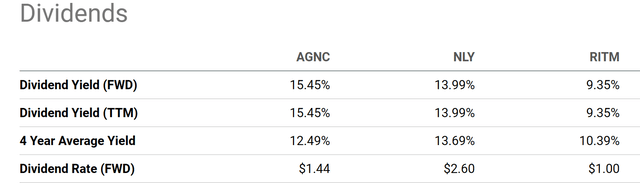

On the upside, its dividend is a major draw. The chart below summarizes AGNC’s dividend yields compared to its peers and its 4-year average. As seen, AGNC is currently yielding a whopping 15.45%, truly incredible both in absolute terms and relative terms even by mREIT standard. As seen, it is substantially higher than close peers like NLY (13.99%) and RITM (9.35%). It is also higher than its own 4-year average yield (12.49%) by a good margin. Such a dividend yield provides a sizable current income for investors who need it and also a good amount of downside protection.

To wrap up, I am rating AGNC as HOLD because of the uncertainties discussed above. For existing investors (especially income-oriented investors), the stock offers good appeals like high yield and it’s trading at a reasonable valuation. After all, I do not see anything horrible wrong with holding a sector leader at ~1x TBV. However, as a potential investor, I am concerned that the conditions (mainly the yield spread and mortgage origination issues as discussed) can remain tough for AGNC for longer.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.