Summary:

- AGNC has painfully underperformed the wider market over the past few years, with the higher for longer interest rates naturally triggering headwinds to its prospects.

- For now, the management remains cautiously optimistic, with its net interest spread and leverage ratio still more than decent despite the macro headwinds.

- Even so, it is undeniable that AGNC’s profitability is likely to remain lumpy until the macroeconomy outlook is normalized by 2026, if not 2027.

- For now, with most of the pessimism already priced in, the mREIT’s discounted valuations and rich forward dividend yields appear to be rather compelling.

- The 2/10Y yield inversion has also bottomed by June 2023 with things seemingly stable over the past six months, implying that the worst may already be behind us.

3D_generator

AGNC’s Execution Remains Brilliant, Despite The Uncertain Macroeconomic Outlook

We previously covered Rithm Capital Corp. (RITM) in May 2024, discussing its uncertain mREIT prospects attributed to the higher for longer interest rate and sticky inflation, despite the rich forward dividend yields.

For this particular article, we will be looking at AGNC Investment Corp. (NASDAQ:AGNC) and sharing our findings about the stock, continuing the theme surrounding mREITs.

AGNC operates its mREIT business by “repurchasing its investment portfolio, primarily through repurchase agreements through its lending counterparties.”

Most of its funding strategy also comes from “financing long-term fixed rate assets with shorter-term variable rate borrowings,” while mitigating the rapid changes in interest rates through rate swaps (hedges) and US Treasury securities/ futures contracts.

AGNC’s Portfolio Profile

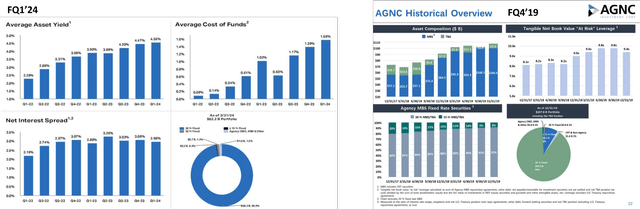

For context, AGNC’s assets are mostly tied up in 30Y fixed Agency Residential Mortgage-Backed Securities [RMBS], with it comprising 96.9% of its portfolios in FQ1’24 (-0.6 points QoQ/ +4.9 YoY/ +7.9 points from FQ4’19 levels of 89%).

Hypothetically, investing in long-term assets are thought to be more predictable and safer, with the pre-pandemic low cost of borrowings triggering a decent net interest spread of 1.33% in FQ4’19 (+0.16 points YoY).

Given the rising inflation and the Fed’s rate hikes, it is unsurprising that AGNC’s net interest spread has expanded to 3.26% at its peak in FQ2’23 (+0.52 points YoY) and remain elevated at 2.98% in FQ1’24 (+0.1 points YoY).

For now, the net result remains positive indeed, attributed to the management’s ability to access low cost borrowings at an average of 1.58% in FQ1’24 (+0.56 points YoY/ -0.18 from FQ4’19 levels of 1.76%). This is compared to the current federal fund rates of 5.25% – 5.50%.

This is on top of the drastically improved economic return on tangible common equity at 5.7% on a YoY basis (+6.4 YoY/ -3.9 from FQ4’19 levels of 9.6%) and improved leverage at 7.1x (compared to 7.2x in FQ1’23/ 9.4x in FQ4’19), building upon the management’s optimistic commentary in the FQ1’24 earnings call:

A durable and favorable investment environment for AGNC was slowly emerging. We highlighted our belief that short-term rates had peaked for this tightening cycle that interest rate volatility would decline and that Agency MBS would remain in this new, more attractive trading range.

These positive dynamics were all present to some degree in the first quarter and will ultimately drive AGNC’s performance over the remainder of the year. (Seeking Alpha)

Intermediate Term Prospects Remain Mixed – Macroeconomic Volatility Likely To Be A Bottom-Line Drag

30Y Fixed Mortgage Rates

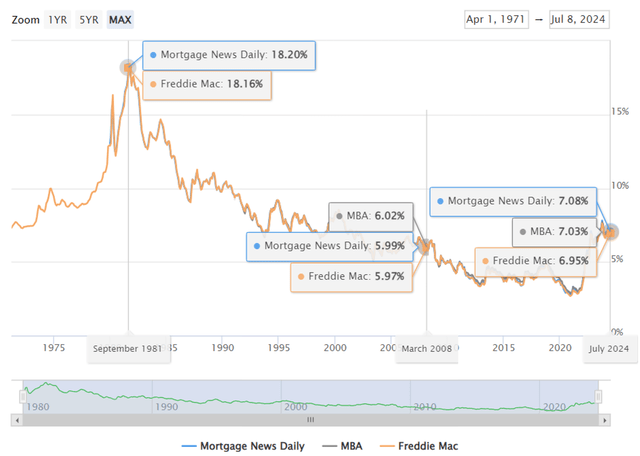

Even so, readers must note that the US 30Y Fixed Mortgage Rates at 6.95% (Freddie Mac) are higher than those reported in 2019 at ~4% and March 2008 (recession) at 5.97%, implying potential volatility once the Fed pivots.

While the AGNC management is optimistic about its intermediate-term spreads, the mREIT’s profitability is likely to remain lumpy until the macroeconomy outlook is normalized by 2026, if not 2027.

This is especially since the monetary signals are still mixed with the market pricing in a 25 basis point cut in the September 2024 FOMC meeting.

The Consensus Forward Estimates

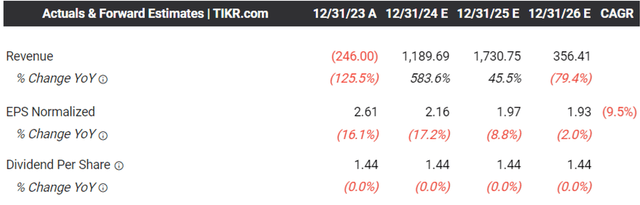

The same top/ bottom-line headwinds have also been priced in by the consensus forward estimates through FY2026, as observed in AGNC’s mREIT peer group, well reversing much of its recent financial gains during the heights of the pandemic.

The management has had a penchant of cutting dividend payouts numerous times through 2020 as well, down drastically from the annualized sum of $2.61 in 2014, $2.00 in 2019, and finally reaching $1.44 over the last twelve months.

This is worsened by the sustained share dilution to 704.2M by FQ1’24 (+30.2M QoQ/ +124.9M YoY/ +162.8M from FY2019 levels of 541.4M).

While AGNC’s dilutive capital raises have sustained its operations, bolstered its balance sheet, and grown its asset portfolio to $63.3B on a YoY basis (+11.4% YoY/ -36.9% from FY2019 levels of $100.4B), its tangible net book value per share remains underwhelming at $8.84 (-6% YoY/ -49.9% from FQ4’19 levels of $17.66).

Its payout ratio has also increased drastically to 62% on a YoY basis (+11 YoY/ -22 from FQ4’19 levels of 84.2%), based on the moderating net spread and dollar roll income per share of $0.58 (-17.1% YoY/ +1.7% from FQ4’19 levels of $0.57) and the quarterly dividends per common share of $0.36 (inline YoY/ -25% from FQ4’19 levels of $0.48).

AGNC Valuations

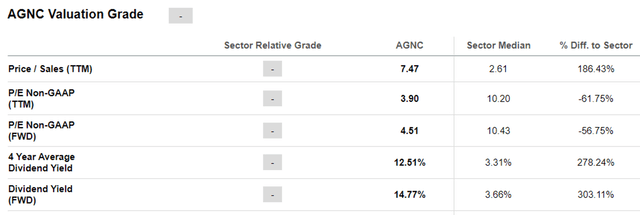

Perhaps this is why the market has downgraded AGNC to FWD P/E of 4.51x, compared to its 3Y pre-pandemic mean of 8.18x. When compared to its mREIT peers, such as Annaly (NLY) at 7.17x, Rithm Capital Corp. (RITM) at 5.99x, and Blackstone Mortgage Trust, Inc. (BXMT) at 9.70x, it is apparent that AGNC is discounted here.

This is especially when comparing AGNC’s bottom-line projections at -9.5% to NLY at -0.2%, RITM at -0.6%, and BXMT at -11% through FY2026, implying that the former remains reasonably valued despite the intermediate term headwinds.

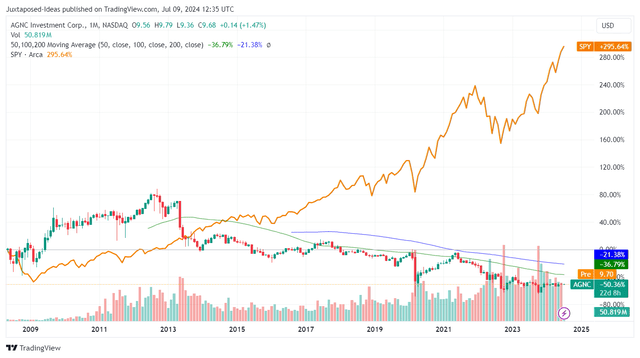

AGNC 15Y Stock Price

Despite so, while AGNC may seemingly offer a rich dividend yield of 14.88%, compared to the sector median of 3.62% and the US Treasury Yields of between 4.26% and 5.35%, it is only attributed to the stock’s drastic decline by -50% over the past 15 years compared to the wider market at +295%.

Otherwise, by +0.05% on a YTD basis, compared to the wider market at +17.6%.

While AGNC’s dividend yields may appear to be very tempting, we believe that its investment thesis is on the speculative side. This is especially since there may be potential stock market volatility from the ongoing US election and geopolitical issues.

So, Is AGNC Stock A Buy, Sell, or Hold?

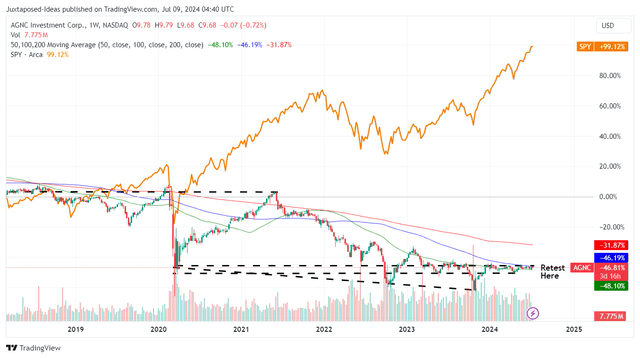

AGNC 5Y Stock Price

So, is AGNC a Buy?

This is a very hard question to answer indeed.

Based on the recent stock price movement, AGNC continues to chart new lows over the past few years, with things only seemingly to stabilize in 2024.

Assuming that the management continues to deliver QoQ/ YoY improvements in its economic return on tangible common equity and tangible net book value per common share in the upcoming FQ2’24 earnings call on July 22, 2024, we may see sentiments improve from these bottom levels indeed, supporting its recovery momentum ahead.

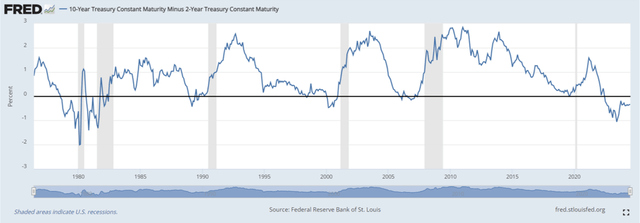

10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity

Federal Reserve Bank of St. Louis

The 2/10Y yield inversion has also bottomed by June 2023 with things seemingly stable over the past six months, implying that the worst may already be behind us. The eventual reversion may allow AGNC to similarly report improved performance, once its rate swap hedges are more predictable and spreads more profitable over the next few quarters.

Combined with the potentially improved market sentiments then, we may see the market upgrade the mREIT’s valuations and stock prices nearer to its historical trading levels, lending strength to its capital appreciation prospects.

Combined with the rich and relatively well covered dividend payouts (compared to pre-pandemic levels), we are cautiously initiating a Buy rating for AGNC, though with certain caveats.

One, investors should always monitor the management’s execution closely, since they have been shifting the composition of their hedge portfolio to swap-based hedges over the past few quarters, with its spreads likely to be volatile for so long that the fed has yet to pivot.

While the management has been consistently paying out dividends (albeit with the much-needed cuts), readers need to monitor its payout ratio, since a further decline in its spreads and book value may potentially trigger another payout cut ahead.

Two, the potential stock price appreciation will naturally come at the expense of its currently rich forward dividend yields, assuming that its dividends per share remain stagnant. As a result, dividend oriented investors also need to temper their expectations, while calibrating their goals towards total returns instead.

Three, it goes without saying that AGNC is only suitable for those with higher risk tolerance, attributed to the numerous risks and potential volatility in the near term. It may be appropriate for interested investors to size their portfolios accordingly, prior to the mREIT’s eventual normalization over the next few years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.