Summary:

- AGNC’s 15% dividend yield is attractive but unsustainable long-term due to expiring low-cost swaps and rising interest expenses.

- AGNC’s business model involves high leverage and hedging, making it vulnerable to interest rate volatility and declining book value.

- AGNC is not a buy-and-hold investment; it requires market timing, focusing on price-to-book value and stable interest rates for optimal returns.

- Current conditions—high price-to-book ratio, unpredictable interest rates, and expiring swaps—make AGNC a risky investment with potential dividend cuts in the next two years.

Stanislav Smoliakov

I have read a few articles on AGNC recently, and it seems to be a polarizing stock, some pointing to a well-covered 15% dividend yield and others pointing to a share price half of what it was five years ago. Two central questions appear in frequent comments: is the dividend sustainable, and how much of a benefit will lower interest rates be? Investors need to consider a few key points about AGNC.

First, AGNC is not a buy and hold investment. Their business model is to buy Agency Mortgage-Backed Securities, or MBS, which have very little credit risk and higher yield than treasuries. They then apply a very large amount of leverage (7-8x). The problem is that the duration between the assets and the liabilities is not always perfect, and the book must be hedged to avoid large losses due to changes in interest rates.

Charlie Munger’s famous quip applies: “There are only three ways a smart person can go broke: ladies, liquor, and leverage.” AGNC’s business model seems straightforward, but the result has been a steady decrease in book value per share:

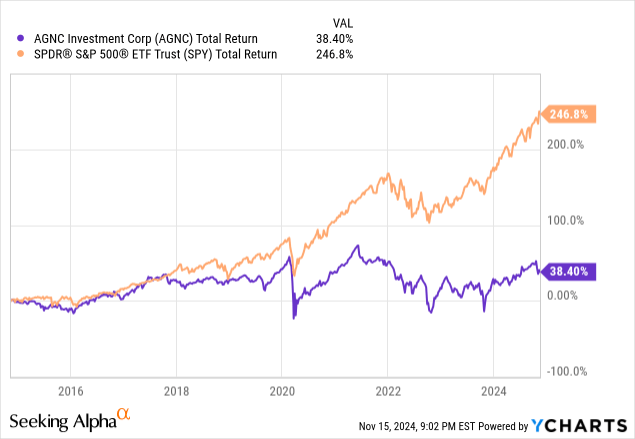

It is tempting to think of AGNC as an income vehicle, more bond-like in its behavior, but with a 50%+ drawdown during covid, the risks are decidedly equity-like. The returns have not kept up with equity investments, though, even including the 15% dividend:

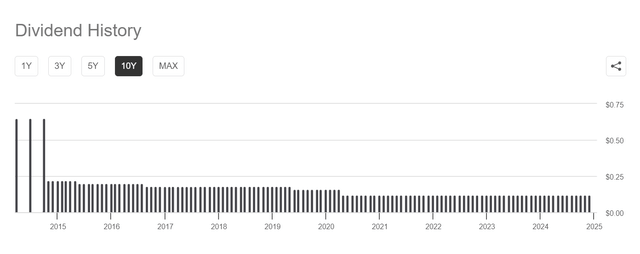

During that time, AGNC has cut the dividend five times:

Based on this history and my analysis below, I believe that the dividend will almost assuredly be cut again in the next two years. Management deserves credit for maintaining the current level for several years post-covid while navigating extreme volatility in spreads and interest rates.

Swaps and Interest Income

Interestingly, the rapid rise from 0% to over 5% interest rates has benefitted AGNC in a fairly extreme way, as it was able to lock in low-cost interest rate swaps that have been responsible for almost all of their profits in recent years. Investors need to understand this dynamic and what it means for AGNC’s future:

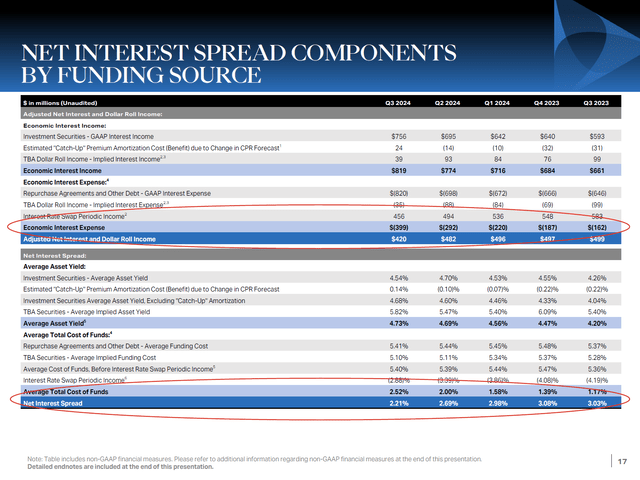

AGNC Stockholder Presentation AGNC Stockholder Presentation

The first thing to notice on this slide is that interest expenses are higher than interest income. Net interest income has not been positive since Q4, 2022. Since the business model is to earn net interest income, this should be a concern.

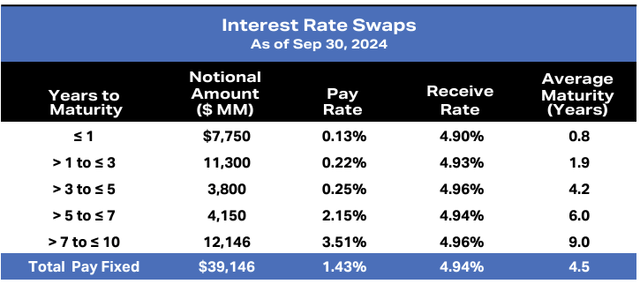

Dividends are paid from “Net Interest and Dollar Roll Income,” which is positive. So where does this income come from? Almost all of it comes from interest rate swaps, or “Interest Rate Swap Periodic Income,” which accounts for $456 million of the $420 million net interest and dollar roll income. Without the swaps, AGNC is losing money. Here is the profile of those swaps:

What we see here is that AGNC was able to lock in some extremely cheap swaps during the pandemic era, and they are now receiving much higher short-term rates in exchange. These provide essentially all of their profit. In the next two years, about half of these cash cows will expire, and AGNC will have to make due with much smaller spreads.

As these swaps expire, AGNC’s position will deteriorate further. We already see the effects of this happening:

Both “Economic Interest Expense” and “Average Total Cost of Funds” have been marching higher every quarter, and are now more than double what they were a year ago. As a reminder, short-term interest rates are lower now than they were a year ago. So the cost of funds increasing is due to swaps expiring. As a result, the “Net Interest Spread” keeps marching down.

Interest Rates

Cheap swaps coming off of the books will be an ongoing headwind. But what about lower interest rates? Will that not cause AGNC to thrive?

The short answer is that AGNC uses so much leverage that they have to hedge their interest rate risk in order to not risk bankruptcy. From 2009-2016, interest rates were near 0%, and AGNC’s book value still marched lower. Then, in 2020, rates again plunged to 0%, and again AGNC’s book value got hammered.

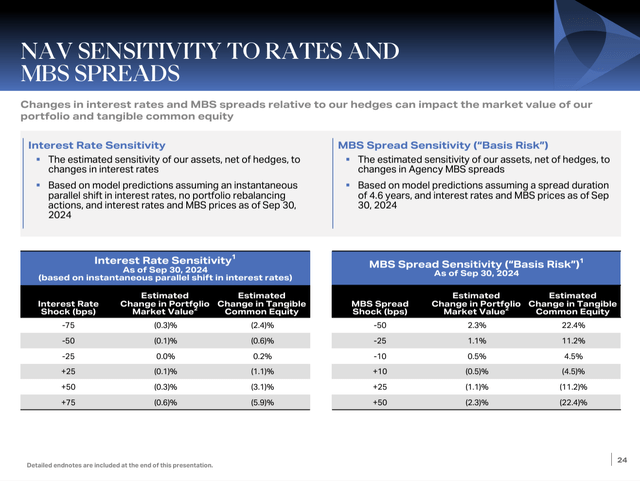

This is because lower rates will benefit the fixed income MBS that AGNC holds, but lower rates will kill their hedges, and these effects essentially balance out. The company states this explicitly on this slide:

AGNC has positioned themselves for falling rates by only partially hedging their interest rate risk. So, a 0.25% drop in rates will increase book value by about 0.2%, not a material amount. A 0.5% drop in rates will actually decrease book value, and the losses continue from there.

In reality, MBS spreads relative to treasuries have a much larger effect on book value. Because of AGNC’s hedges, any move in interest rates tends to be negative. The ideal scenario is the one where interest rates never change at all. From the most recent conference call:

As a levered and hedged investor in Agency MBS, AGNC’s return opportunities are most favorable when Agency MBS spreads to swap and treasury rates are wide and stable and when interest rates and monetary policy are less volatile.

AGNC does best when interest rates are not volatile. They do not do better in lower interest rate environments, and a drop in interest rates is not what they are looking for. Rather, they simply want stability in rates. Small moves are manageable, but large ones tend to destroy book value.

Would a 15% yield look better in a 0% interest rate environment? Yes, but recall that AGNC was yielding over 12% before covid, but when rates went to 0%, AGNC’s share price got cut in half. Interest rates at 0% would probably mean something negative for the economy has happened, and AGNC will also suffer. Rates dropping too far too fast has a negative effect on book value.

Further, AGNC currently holds high-yielding MBS. If interest rates plunge, then many of those mortgages will either be refinanced to a lower rate, or the home sold and mortgage paid off early. So as rates drop, prepayment risk rises. As AGNC themselves state, rate stability benefits their earnings, not lower rates.

Book Value Decay

One reason for the steadily declining book value is the volatility whipsaw effect, leading to decay. Interest rates go up and down in cycles. Whenever they do, AGNC loses part of their book. If rates drop 0.5%, and then rise 0.5%, then book value decreases permanently for each of those temporary moves.

The effect is more pronounced with spreads. Spreads widen, and they tighten, but they stay within a range. When it comes to book value, though, a 0.5% widening followed by a 0.5% tightening will have the effect of (1 – 0.224)*(1 + 0.224) = 0.95, meaning that 5% of book value will be permanently erased. So as spreads widen and tighten over the years and throughout the cycle, book value is constantly, if slowly, eroding.

When to Buy AGNC

All of this paints a fairly bleak picture for AGNC, as book value, interest income, and ultimately dividend per share, are all highly likely to decline over time. However, this does not mean that AGNC should never be held as an investment. Long term, it is not likely to outperform equities. In the short term, however, AGNC gives very strong signals as to when it is undervalued and when it is overvalued.

Spreads are a good indication of the future performance of the portfolio, as wide spreads mean that AGNC can make more interest income in the future, as well as receive a benefit to its book value as spreads tighten. Spreads have tightened meaningfully in recent quarters, but remain elevated above historical norms.

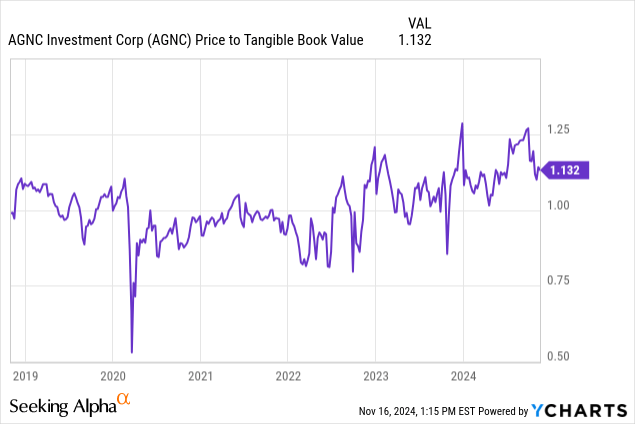

More meaningful, however, and easier to follow, is AGNC’s price to book value. Obviously, 2020 was an outlier, but generally speaking, the price to book value tends to trade in a range between 0.8x and 1.2x. If you buy closer to 0.8x, then you are getting a good deal, and can expect positive returns as the price to book value increases. If you pay closer to 1.2x book value, then you are paying too much, and will likely underperform as the ratio falls. As a rule, I do not pay over book value for AGNC.

It takes some time and patience in order to time the entries and exits, but AGNC is one stock where market timing can be used very effectively. In order to invest successfully, a few ingredients must be present: a low price to book value ratio, reasonably wide spreads, and an expectation of stable interest rates.

Today, the price to book ratio is too high, interest rates are difficult to predict, and elevated income from swaps will be rolling off. I see the dividend as stable for the next two quarters, but highly at risk over the next two years when a large portion of cheap swaps expire. I do not wish to be holding AGNC when the dividend is cut, so I am not investing at the moment.

AGNC does have a fairly liquid options market, which makes investing even easier. I like to sell puts at 0.8x book value, and sell calls at 1.2x book value. Lately, that means I have been selling more calls, as prices reached extremely high valuations close to 1.25x book value. I do not currently hold any position after the recent drop in share price.

Risks

My bearish outlook stems from the fact that AGNC carries equity-like risk without equity-like returns. It is currently expensive, and is likely to see declining earnings for the next several years. That is not an investment that fits my criteria.

However, spreads remain wide, high-yield MBS are available, and AGNC has reduced their hedges to only 72% of book value, instead of closer to 100%. They also benefit from low-cost swaps for several more quarters and years. If interest rates remain steady, AGNC could retain the dividend for longer than expected and provide a meaningful total return, especially if an investor believes stock indices to be overvalued and not likely to continue their impressive recent performance.

AGNC’s performance also hinges on management’s decisions regarding hedging, asset selection, and capital management. For example, issuing new shares at above book value, which AGNC does often, is usually a good idea. A series of correct decisions can lead to increasing book value and earnings power.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.