Summary:

- AGNC reported slightly weaker than expected Q2’24 results, but the REIT’s spread profile is improving, mainly due to growing interest income.

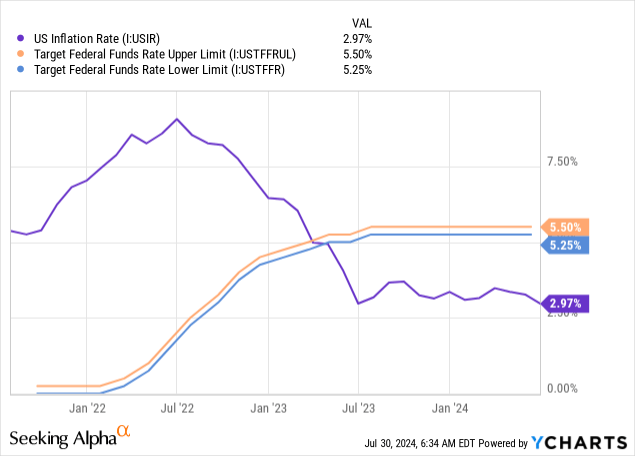

- Inflation is moderating, and the Fed is nearing its ‘pivot point.’

- Shares now trade at a 17% premium to the REIT’s longer term (3-year) price-to-book ratio.

ryasick

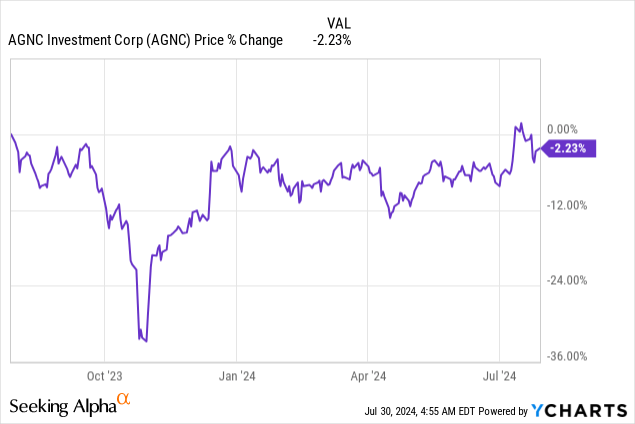

Inflation continued to moderate in the month of June and the Fed is moving closer to its ‘pivot point’… the point at which it will reduce the federal fund rate and provide relief to those investment companies that rely on a lot of debt to buy mortgage securities. AGNC Investment (NASDAQ:AGNC) is set to be one beneficiary of this changing federal fund rate trajectory, which could be a catalyst for the company’s large mortgage-backed securities portfolio. AGNC reported slightly weaker than expected second-quarter results on July 22, 2024, but the mortgage REIT is seeing strong growth in its interest income. Shares are leaning a little bit on the expensive side here for me, and a hold rating makes the most sense to me right now.

Previous rating

An unfavorable outlook for near term federal fund rate cuts amid re-accelerating inflation in Q1’24 was why I down-graded shares of AGNC from buy to hold in April: Inflation Is Back. With inflation moderating again in Q2, the Federal Reserve is now moving closer to its ‘pivot point’ which may start to support the earnings of mortgage REITs. However, shares of AGNC are now trading at a comparatively high price-to-book ratio, which is why I am staying with my hold rating for now.

Slowing inflation and MBS tailwinds

Consumer prices increased 3.0% in June which marked the third consecutive month of falling inflation. While inflation reaccelerated at the beginning of the year, the new down-trend in inflation strongly suggests that the Federal Reserve will soon lower the federal fund rate. The Federal Reserve is widely expected to hold the federal fund rate steady this week, but may prepare the market for a first rate cut in September.

AGNC is set to benefit from this changing outlook in the federal fund rate because the mortgage REIT’s portfolio still mainly consists of mortgage-backed securities, of the agency-kind. An agency-security is one that has been issued by a government-sponsored enterprise or by an entity of the federal government. These agency securities provide recurring interest income for investors who can choose their specific mortgage-backed security investments based on metrics such as duration or credit quality.

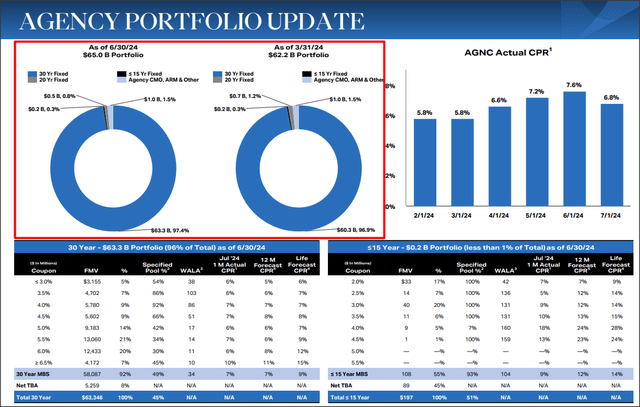

AGNC’s agency investments in this specific kind of mortgage-backed securities amounted to $65.0B at the end of the June quarter, showing $2.8B quarter over quarter growth. Mortgage-backed securities are set to respond positively to changes in interest rates, as typically all fixed-income instruments do.

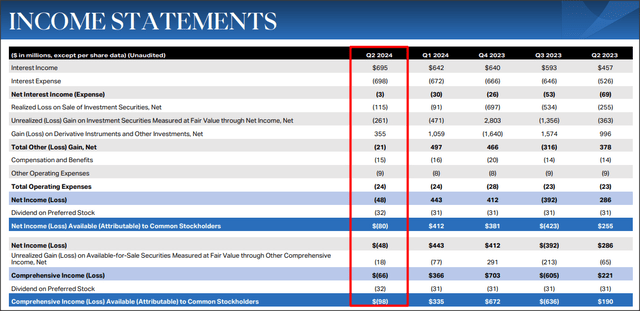

AGNC saw significant growth in its net interest income in second-quarter which came in at $695M, 52% higher than in the year-earlier period. While interest expenses also rose to $698M (+33% Y/Y), expenses grew much more slowly than the mortgage REIT’s income, resulting in an uplift in AGNC’s interest spread. The outlook, in my opinion, is set to become more favorable once the Federal Reserve cuts the federal fund rate as it would indicate lower interest expenses for the mortgage REIT going forward.

AGNC’s valuation compared against biggest mREIT rival

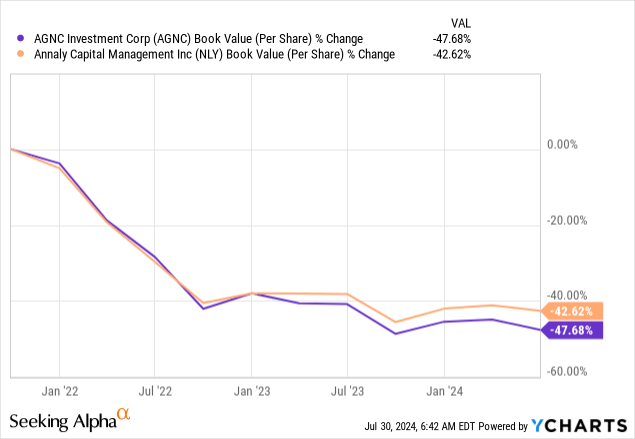

AGNC’s book value has been in a down-trend ever since the Federal Reserve decided to jack up interest rates at an extremely fast pace in 2022. In the last three years, AGNC’s GAAP book value — which was $9.16 per-share as of the end of the June quarter — declined a massive 48%. Annaly Capital Management (NLY)’s GAAP book value declined at a slightly lower rate of 43%. I recommended Annaly in April due to the mortgage REIT’s attractive valuation, good dividend coverage and upcoming Fed catalyst.

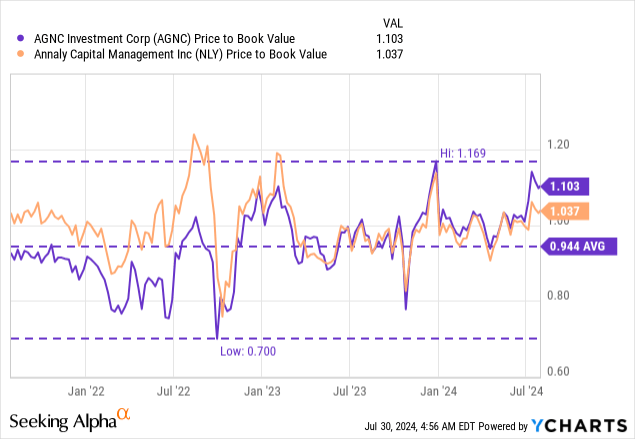

AGNC is currently priced at a 10% premium to book value which creates a valuation advantage for Annaly… whose shares reflect a 4% premium to book value. Since both mortgage REITs own large portfolios of mortgage-backed securities (of the agency category), which are set to re-price higher once the Fed initiates a down-cycle in interest rates, my preference here would be for Annaly, mainly for valuation reasons.

AGNC is also relatively expensive from a historical valuation point of view as shares have historically traded at a price-to-book ratio of 0.94X… meaning income investors are currently paying a 17% premium to book value. I would consider AGNC as a buy only if shares sold around ~1.0X book value (~$9.16 per-share) which implies a more moderate valuation and a higher safety margin for income investors.

Risks with AGNC

The biggest risk with AGNC relates to the Federal Reserve continuing to tip-toe around federal fund rate cuts. If the Fed doesn’t pivot in the next couple of months, and therefore finally create confidence for investors that the rate-cutting cycle has begun, shares of AGNC may continue to languish. If the Fed postpones its pivot point, AGNC may not benefit from an expected re-pricing of its mortgage-backed securities portfolio.

Final thoughts

AGNC’s interest income surged 52% year over year in the second-quarter and the mortgage REIT missed earnings expectations by only $0.01 per-share. With interest income growing much faster than interest expenses, the economics for AGNC have greatly improved in Q2’24. The inflation trend is also showing a lot of promise which implies that the Fed’s highly expected ‘pivot point’ may be just around the corner. This could further help improve AGNC’s spread economics and present a catalyst for a re-pricing of its underlying mortgage-backed securities.

I believe the risk profile for AGNC is overall favorable from a business/investment/spread perspective, but I do have reservations with respect to AGNC’s high valuation based off of book value. Annaly, which also offers a large MBS portfolio is selling for a lower price-to-book ratio and AGNC is now trading at a 17% premium to its 3-year average P/B ratio. As a result, AGNC’s 14.3% yield is still risky and dividend investors may only want to allocate a small portion of their portfolio assets to such a high-yielding investment choice!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC, NLY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.