Summary:

- AGNC Investment Corp. has enjoyed a drastic boost in sentiment in the past few months due to recent rate cuts.

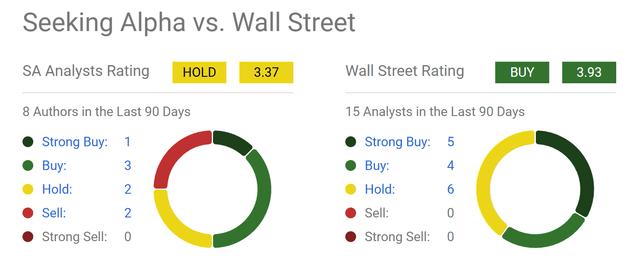

- Wall Street analysts now rate it as a solid “BUY”.

- Its 13% dividend yield is attractive, but I have concerns about the sustainability of AGNC’s payouts given the trend of its net interest income.

- Additionally, AGNC’s P/TBV ratio current hovers around the highest level in a decade, suggesting considerable valuation risks.

BobHemphill

AGNC stock is now loved by Wall Street

My last work on AGNC Investment Corp. (NASDAQ:AGNC) was published back in April 2024. The article was entitled “AGNC Investment: I Expect Headwinds Ahead”. Since it has been more than 6 months, it would be helpful to quote the background at that time, so I can better contextualize the thesis in this article. At that time,

AGNC Investment Corp. has underperformed both the overall market and the mortgage REIT sector. Uncertainties surrounding interest rates and the possibility of Agency MBS spread widening are the key issues to blame in my view.

Since then, there have been some substantial changes in the macroeconomic parameters. Most importantly, the Fed rates have been lowered by 50 basis points since then. The mREIT sector responds sensitively to interest rates (for reasons to be elaborated on later). As such, the prevailing sentiment surrounding the stock has changed drastically since my last writing. As an example, Wall Street analysts have given the stock a consensus rating of “BUY” with a solid overall score of 3.93. Out of the 15 analysts who have covered the stock, five of them have rated the stock as a “Strong Buy”, four have rated it as a “Buy,” and none have rated it as a “Sell” or “Strong Sell”.

Against this backdrop, in the remainder of this article, I will explain why I disagree with such bullish sentiment. I totally see the positives in the stock (such as the high current yield and the potential for continued rate cuts). But I don’t see a clear skewness in its return/risk ratio due to the negatives (such as dividend safety and valuation concerns). Thus, I consider the stock a HOLD under current conditions.

Seeking Alpha

AGNC Stock yields 13%

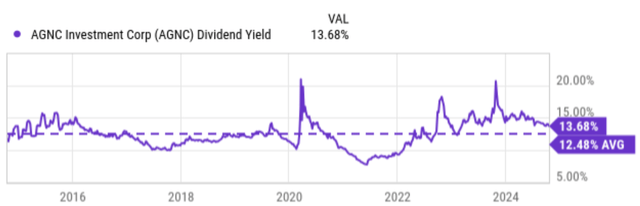

Let me start with the positives. The top positive most AGNC bulls emphasize, of course, is its mouthwatering dividend yield. As seen in the chart below, the stock is currently yielding 13.7%, an extremely appealing yield in both absolute terms and relative terms. As seen, in the past decade from 2014 to 2024, its dividend yield has been hovering in a range of 10-15% the majority of the time. The average dividend yield for AGNC over this period is about 12.48%. The current yield is noticeably above historical levels, and such an above-average yield serves both as an indication of attractive valuation and also provides sizable downside protection.

However, as discussed next, I am uncertain if the current level of payouts can be sustained.

Seeking Alpha

AGNC stock: a closer look at dividends

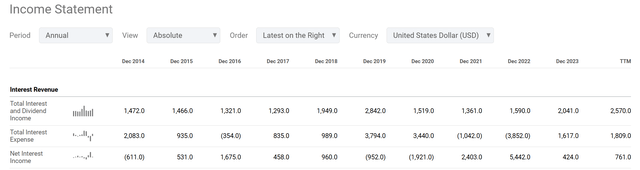

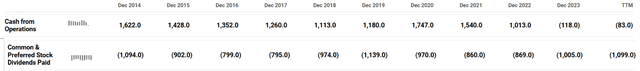

AGNC’s net interest income, the difference between its interest revenue and interest expense, has been on a rollercoaster in recent years as you can see from its income statement below. The company experienced a large negative net interest income of $1,921 million amid the pandemic in 2020. The trend completely reversed in 2021 when its net interest income turned into a positive $2,403 and further surged to $5,442 million in 2022. The underlying reason is that the Fed cut interest rates to essentially zero to fight the pandemic during this period. This positive trend was short-lived. In 2023 and 2024, AGNC’s net interest income decreased drastically as the borrowing rate climbed up. Its net interest income was $424 million for 2023 and currently stands at $761 million only as of TTM 2024.

Such a net interest income is insufficient to cover its current dividend payouts. As you can see from its cash flow statement (the second chart below). The company paid out a total of $1,005 million in dividends in 2023 and $1,009 million as of TTM.

Seeking Alpha

Seeking Alpha

Looking ahead, I expect its net interest income to remain pressured. As mentioned in my earlier article:

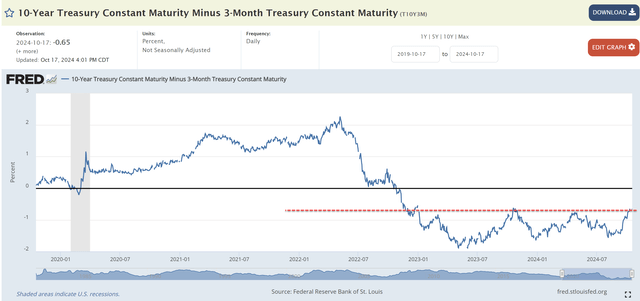

Mortgage REITs like AGNC earn money from the rate spread between the funds they borrow (which are close to the short-term rates) and the yield they charge (which are closer to the long-term rates). As a result, AGNC’s profit is sensitive to the yield curve. As seen in the chart below, the yield curve has become inverted in 2022 and remains so thus far – a leading factor in my mind causing AGNC’s (and mREIT in general) underperformance relative to the overall market during this period.

The current spread between the 10-year and 3-month treasury rates, as shown below, remains inverted. The current degree of inversion is very similar to that at the time of my last writing. Next, I will explain why I expect the inversion to persist longer.

FRED

Other risks and final thoughts

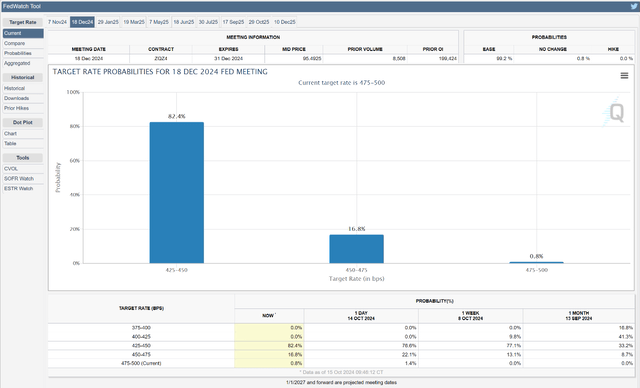

The top reason in my mind that can cause the inverted yield curve to persist longer is the odds of further rate cuts. The probability curve for interest rate cuts has shifted (i.e., diminished) considerably since April. Even in the past month alone, the probability has diminished materially with the lease of the September CPI data. To wit, the following CME Group FedWatch Tool compares the current probability of rate cuts implied by market expectation vs. that a month ago. As seen, the implied probability was 41.3% for the Fed to cut rates further to the 4%~4.25% range in Dec 2024. As of now, the implied possibility is zero.

CME Group

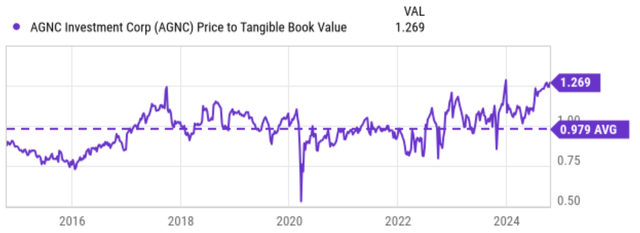

Another downside risk is valuation. The chart below illustrates the price-to-tangible book value (P/TBV) ratio of AGNC. As seen, AGNC’s P/TBV ratio has experienced significant volatility. The P/TBV ratio has dropped to as low as ~0.55 in 2020 and climbed to as high as 1.25. The average P/TBV ratio for AGNC over the past 10 years is about 0.979. The current level of 1.27 is not only above its historical average but also among the top levels in at least 10 years.

All told, I rate the stock as a HOLD given the above consideration of its positives and negatives. To recap, AGNC’s high dividend yield is very attractive, although I am concerned about the sustainability of its current payouts. The high P/TBV ratio suggests that the stock may be overvalued. However, its position as a sector leader can justify its valuation premium to a degree. For these reasons, I don’t see a clear skewness in its return/risk profile under its current conditions.

Seeking Alpha

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.