Summary:

- AGNC Investment Corp. reported good quarterly results, with book value rising for the second quarter in a row.

- The company has been issuing new shares, which has helped stabilize the equity/preferred coverage ratio.

- The preferred shares to focus on are AGNCN, AGNCO, and AGNCL, which offer attractive yields and coupon profiles.

Justin Paget

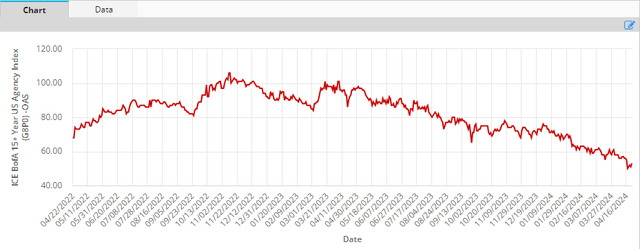

After a very difficult period for mortgage assets since 2022, asset prices have stabilized and even started to recover. In this article, we take a look at one of the bellwethers of the Agency market – AGNC Investment Corp. (NASDAQ:AGNC) from a preferreds perspective.

The company recently reported good quarterly results. Book value rose for the second quarter in a row due to the moderation of Agency spreads.

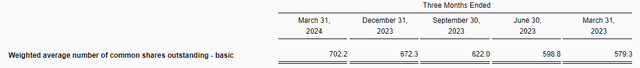

Total equity rose a little more due to continued share issuance – 25.1m of new shares were issued via the at-the-market program most recently. The company has been adding to its share count each quarter. This is an excellent result for preferred holders, as each new dollar of equity further supports preferred shares.

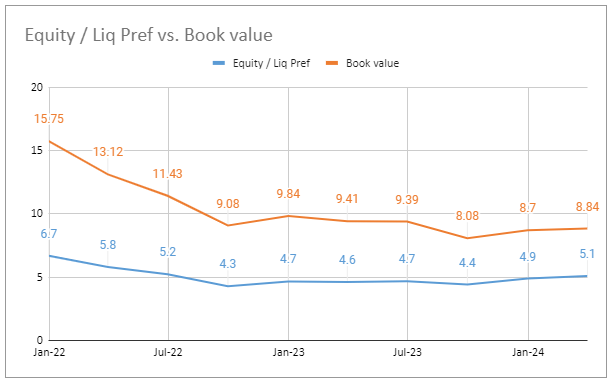

This trend of equity issuance is what has allowed equity / preferred coverage ratio (blue line) to remain much more stable than book value (orange line) since the start of 2022.

Systematic Income

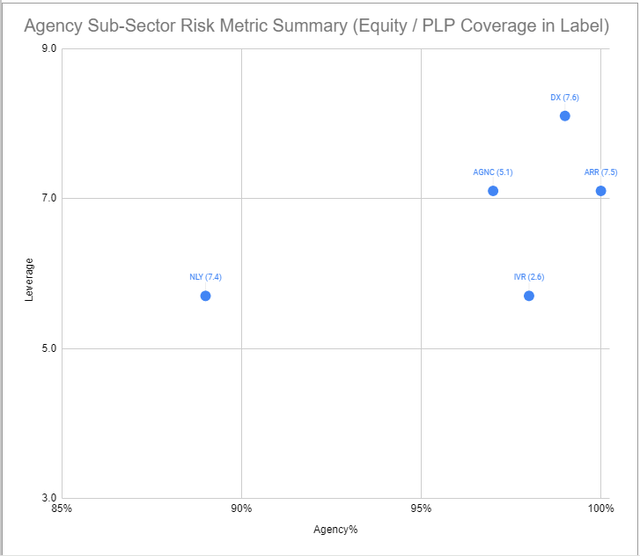

Although AGNC equity / preferred coverage of 5.1x is far from the highest in the sector — Annaly (NLY), Armour (ARR), and Dynex (DX) are all north of 7x — it is back into very respectable territory.

Systematic Income Preferreds Tool

The Suite

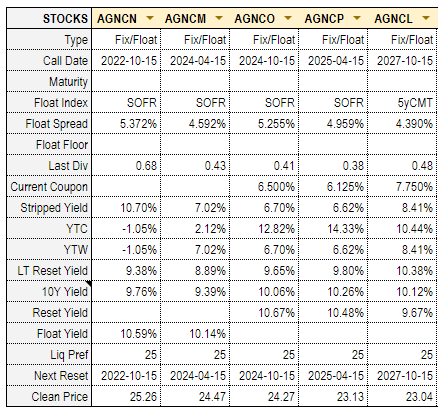

AGNC has a large suite of preferred shares. Four are SOFR-based fix/float stocks and one is a 5-year CMT (5Y Treasury Yield) reset stock.

Systematic Income Preferreds Tool

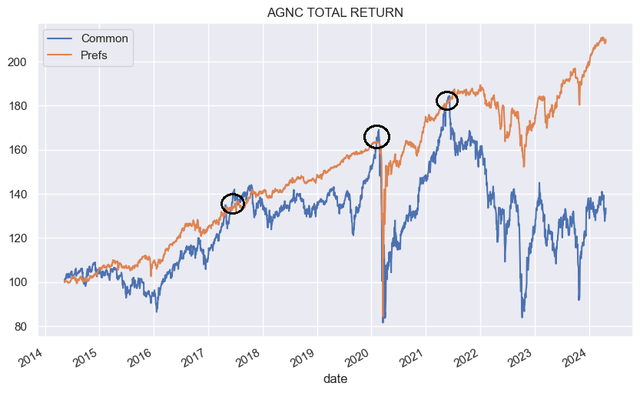

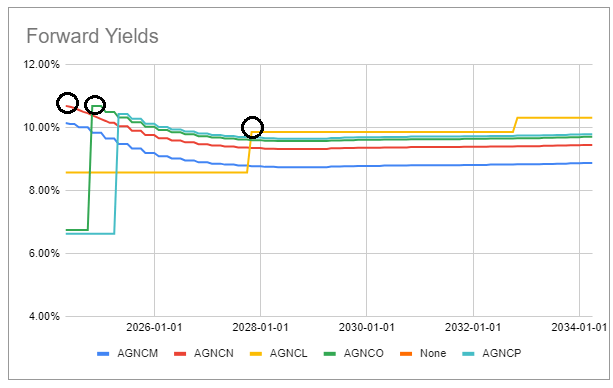

Our go-to tool for analyzing preferreds is the Forward Yield shown below. It extrapolates the yields of various stocks based on their coupon structure and forward interest rates. The idea isn’t to find the one “best” preferred – an impossible task – but rather to distill the process and make allocation more straightforward.

Systematic Income Preferreds Tool

One aspect where it is particularly helpful is in avoiding certain stocks. For example, in the chart below, we see that the yield of AGNCM is below the yield of other stocks at all periods in the future (based on today’s forward rates). This means it is unlikely to be a compelling hold.

What we also see is the typical step-wise profile of stock yields (highlighted in black circles) which have lower yields in some periods and higher in other periods. For example, AGNCN has the highest yield today but is likely to be taken over by AGNCO later this year and AGNCL in a couple of years. The yield pickup of AGNCP when it floats next year is very slim and plainly not worth the big yield give-up today. In short, the stocks to focus on in our view are AGNCN, AGNCO and AGNCL. The first two are interchangeable, while AGNCL has a different kind of coupon profile altogether. The pair of AGNCN/AGNCO and ANGCL are both attractive holds at present.

AGNCL has dipped recently due to the rise of longer-term Treasury yields. However, there is a natural self-hedging element of AGNCL due to its reset structure. Specifically, unless redeemed, in October 2027 the stock will switch to a coupon of the then 5-year Treasury yield + 4.39% from the current fixed coupon of 7.75%. The new coupon will be fixed for another 5 years.

What this means is that the higher the 5-year Treasury yield goes, the higher will be the coupon of AGNCL on its reset (unless the stock is redeemed, something which would be a terrific and immediate 8% return). In other words, the recent price dip in the stock due to the back-up in Treasury yields is a double benefit from a yield perspective. One, the lower price mechanically raises the yield of the stock (as it would for all stocks). And two, the rise in the 5-year Treasury yield raises the expected coupon of the stock on its coupon reset in 2027.

The risk to the stock is if longer-term yields drop sharply just as it approaches the Oct-2027 coupon reset date. Unlike today, the price of the stock will not benefit from the drop in longer-term interest rates at that point because unlike its duration of around 3.5 today, its duration near the coupon reset will be zeroish.

Leave The Common For Tactical Exposure

Over the last several years, we have made two points about the mREIT sector. First is that for strategic investors, preferreds are a surer bet than common shares. This is because Agency mortgage REITs carry highly leveraged portfolios that they are forced to deleverage during periodic bouts of volatility. The chart below shows how the common share price responds to these deleveraging episodes, while the preferreds remain much more resilient.

What’s interesting about the trend between the common and the preferreds is that the common has tended to catch up to the preferreds in total return terms after steep draw-downs (highlighted in black). However, the most recent drawdown since 2022 has left the common with an enormous gap to the preferreds which is unlikely to ever be erased. This highlights that, as core income holdings, the preferreds offer a much more resilient and, hence, attractive profile. AGNC is far from the only mortgage REIT with this kind of return dynamic.

Takeaways

AGNC Investment Corp. and a number of other Agency mREIT preferreds continue to be very appealing income options on their own merit and also well suited to the current environment. Overall, we continue to favor a barbel allocation of floating-rate as well as higher-quality medium-duration income securities. AGNCN is currently trading at a 10.6% yield, while AGNCL trades at an 8.4% yield.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!