Summary:

- AGNC Investment’s Q3 earnings highlight a favorable investment environment with wider mortgage spreads, declining interest-rate volatility, and an accommodative Fed policy, boosting investor optimism.

- Management’s strategic shift to treasury-based hedges over interest rate swaps aims to lower future risk, despite a temporary drop in dollar roll earnings.

- AGNC’s increased cash position and stable market conditions set the stage for significant capital growth, leveraging lower Fed rates and higher MBS returns.

- The company maintains a lucrative dividend policy based on long-term economic returns, positioning AGNC for growth rather than yield in the coming years.

MoMo Productions

An Overview Of AGNC Investment’s Q3 Results

AGNC Investment (NASDAQ:AGNC) reported 3rd quarter earnings on the 22nd of September. Peter Federico, company CEO, opined with:

“For the last several quarters, we have spoken about a promising and durable investment environment that we believe was unfolding for AGNC. An environment characterized by mortgage spreads that were materially wider than historical norms, declining interest-rate volatility, and the emerging accommodative monetary policy stance by the Federal Reserve.

In the third quarter, these positive trends became increasingly apparent and as a result, investor optimism grew.”

Although not all is right in Mudville, so to speak, the marketplace turned strongly in favor of future positive financial improvement. The company reported a drop in dollar roll earnings of $0.10 per share at $0.43, part of the reason was forced and another on-purpose.

This continues our coverage of AGNC, our last, AGNC: Same Results, Same Dividend, Different Reaction, discussed the market anticipation for lower rates. In-spite, the expressman delivered a package of importance at your door. Let’s open that door, grab the package and head inside.

The Market

Our first task involves opening a portion showing the marketplace. The first tear reviews the Federal Reserve’s change in stance. Chairman, Jerome Powell, signaled, ““If the economy performs as expected, that will mean two more cuts this year,” both by a quarter-point.” The goal is to position rates at neutral, rates that neither create inflation nor restrict the economy. In his view, a neutral rate equals approximately 3%, a value reachable by 2026. The timing offered, by the Fed’s most important representative, brings into focus the timing on which a growth investment in AGNC might prove lucrative.

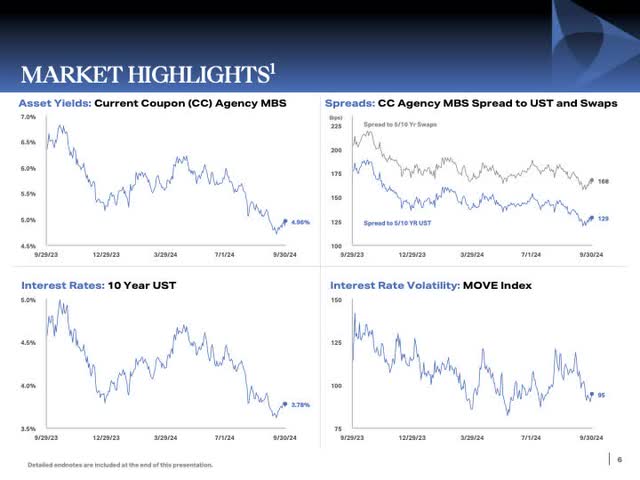

In addition, shown later, yield curves will steepen. The levered coupled with the hedging approach model AGNC uses performs “most favorable when Agency MBS spreads to swap and treasury rates are wide and stable and when interest rates and monetary policy are less volatile.” This type of market opened with the Fed changing to accommodating. Management expects Agency MBS spreads to remain in the current trading range partially from a stable supply-demand balance.

Continuing, mortgage volatility dropped from the 100-basis point range a few years back to 40 points in 2024. Again, stability decreases risk.

Another spread, coupons between five-year and ten-year notes now equals 150 basis points, right in the middle of a more normal range.

Notably, Agency MBS spread volatility has been considerably lower in 2024 with par coupon spreads between a blend of five and ten-year treasury yields trading at approximately 40 basis points. This compares favorably to 2023 and 2022 when par coupon spreads traded in a range of 75 basis points and 110 basis points, respectively. The market is settling down.

A Key Parameter View

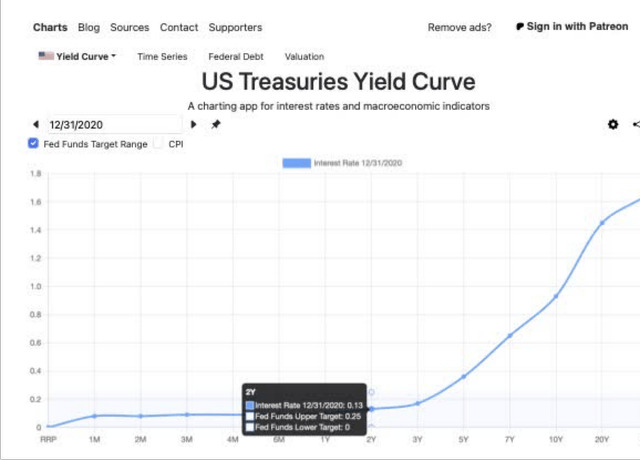

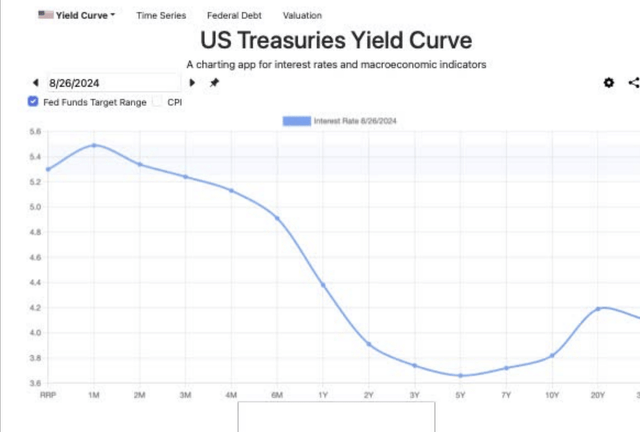

In past articles, we included statements and graphs concerning four different important parameters. The first, the yield curve, follows with three charts, one from early 2021, one from mid-September, and one from late October. The early 2021 curve shows investors the shape under stable markets.

The next plots show a curve right before the latest Fed move.

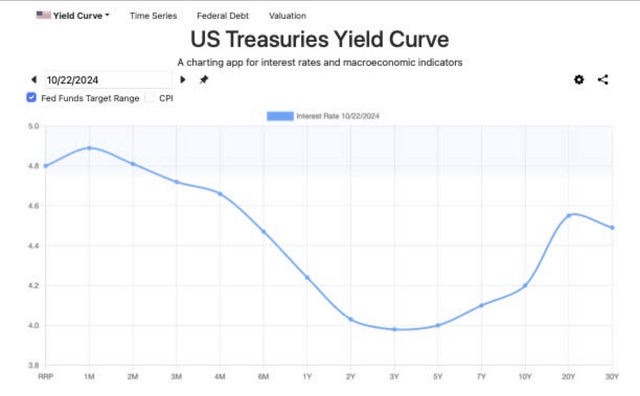

And finally, the curve generated a few days ago shows how the back and front end are starting to approach each other.

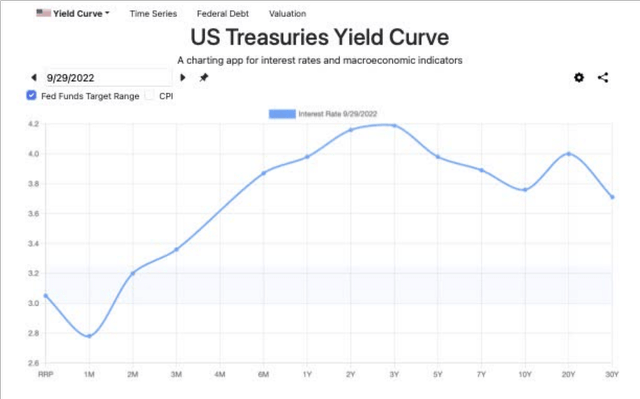

Investors might also find value in envisioning what the curve could become with short-term interest rates equaling 3%, the Fed’s two-year target. During the end of September 2022, the short end equaled 3%. For investors, notice the more normal shape, shorter durations, in general, lower than longer durations.

It is under this last curve, that models used by AGNC generate more optimal returns, borrowing at shorter durations rates while owning longer-duration higher cash generation entities.

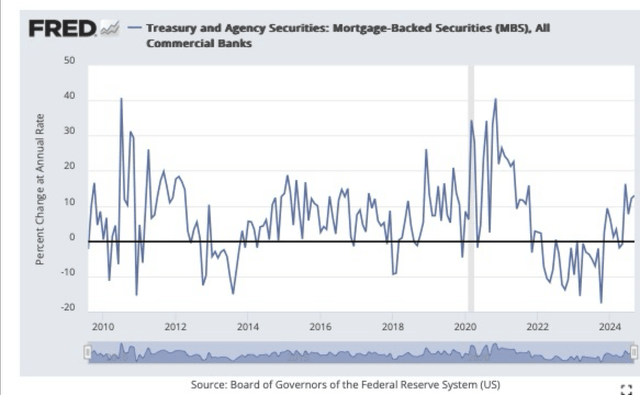

Next, we tear into the package containing a view for Agency MBS. A chart follows:

The annualized rate of change continues positive and in general still increasing, a condition bullish for long-term returns.

For the last two parameters, we offer a statement from management during the call.

“In Q3, the synthetic investment-grade index was close to unchanged, while the high-yield index tightened by about 15 basis points. On the cash bond side, the Bloomberg IG Index narrowed by 5 basis points and subsequent to quarter-end has tightened about 8 basis points. Last week, this index closed through the tightest levels seen during the COVID QE period and reaching the tightest valuations in the post-great financial crisis era.”

A graph, once again, provided in the presentation illustrates the continued lower value of the bond volatility index, MOVE, shown lower right.

Again, the market is seeking more stable footing.

Analysts sought more color driven from, in their view of October, volatility. Rick Shane of JP Morgan, asked,

“Look, you’ve laid out sort of strategically what the opportunity is, but we’re basically 22 days into the quarter, 10 years backed up 40 basis-points, spreads on the 5, 10 spread has widened 20 basis-points. The move index has gone from 95 to like 128. It’s a pretty challenging, or a pretty volatile three weeks.” How do you – what are the – first of all, how does that impact book value on an updated basis, but what opportunities and what risks should we be thinking about in the short-term given pretty dramatic moves? And again, I realize we’re within the sort of norms, but it’s a 20-day move that drives that?

Federico answered,

“[O]ur unencumbered position – cash position at the end of last quarter was $6.2 billion or 68% of our equity. That’s one of the highest prints we’ve had. But we did anticipate that as we went into the election, the interest-rate environment would become much more volatile.”

In management’s view, it’s the election and will end in a few weeks after which it appears they have plans to start investing the cash.

Markets have stabilized considerably, while election jitters have shaken stability temporarily.

AGNC Q3 Earnings Summary

A graphic provided with the conference summaries the quarterly results.

Management noted a relatively meaningful change in tangible net book of $0.42, a sign of what is to come as rates ramp lower. The change in net value also included the negative effect when paying a dividend. For the 1st nine-months, economic return equaled 13.8%.

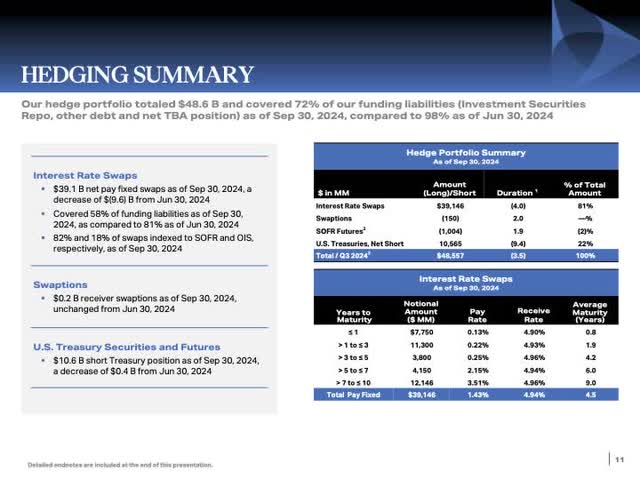

Also, the report included color for the significant drop in net spread and dollar roll at $0.10, approximately 25%. It’s blinking a like a warning beacon. One reason, a 50-basis point lower spread created from refinancing expiring low interest swaps, represented approximately half. The rest came from a purposeful switch from swap-based hedges to treasury-based. Management interestingly noted that these hedges “are not captured in our reported net interest spread.” The change into treasuries was driven in hopes of lowering risks from future deficit volatility. Finally, no other low-cost swaps are set to expire until the 2nd quarter of 2025. When more expire, the over-night interest will be at lease 1% lower. With interest rate swaps being a point of interest and sometimes contentious, we are including a presentation slide.

A quick peek into this portion shows that approximately $7.7 billion (roughly the equal to the 3rd quarter value) must be refinanced in the late portion of the 1st half of 2025. Remember, interest will also be significantly lower. We encourage readers to look at the second two bullets under interest rate swaps.

On other important parameters, management noted:

- “[A]verage projected life CPR for our portfolio at quarter-end increased 4% to 13.2%, consistent with the decline in interest rates.” (CPR represents an estimate for early retirement of a mortgage.)

- Average coupon remained unchanged at 5%. While the average coupon in our portfolio was largely unchanged at just over 5% as of 9/30.

- The actual CPRs averaged 7.3%, up slightly from 7.1% quarter over quarter.

- Issuing $780 million in common equity.

- Materially helped drive higher book-value.

- Holding leverage constant at 7.2.

- Lowering hedging from 98% to 72%.

- Adding $5 billion in Agency MBS and $6 billion in pools.

- Leaving Ginnie Mae TBA largely unchanged.

- That the asset Value increased to $72 billion.

- Ending the quarter with slightly more than $6 billon cash up from $5 billion in the previous quarter.

- Ending the quarter with a duration gap of 0.4 years, a positive postering with lower interest rates expected.

AGNC Dividend

The Q&A always includes questions concerning the high dividend. Bose George, of KBW, asked about swap roll-off and convergence between core earnings and economic returns. Federico answered,

“Because we did favor treasury-based hedges, they actually were a better-performing hedge, really for the last several quarters given the tightening in swap spreads. So we wanted to have more treasury-based hedges, and that has a direct impact on our net spread and dollar roll income, because it doesn’t include those hedges. . . In fact, for example, if you included the carry on our treasury position, it would probably be somewhere in the neighborhood of about $0.08 of carry on our treasury position right now, that is not captured in that net spread and dollar roll income. So from that perspective, it’s not a significant driver. In fact, it’s not a driver at all of our dividend policy.

He continued noting that the dollar roll generated significantly more income than the dividend for a few years and didn’t, on purpose, influence the dividend.

“If you think about our net spread and dollar roll income, it has been well over our dividend now for a couple of years, and it hasn’t impacted our dividend policy. It’s a reflection of the current period earnings. When you take that net spread and dollar roll income and even express that on our equity, it translates to a return on equity of somewhere between 19% and 20%. He closed with this summary, “We’re looking at the long run economics of our portfolio, and we think it still remains very well-aligned.”

The summary suggests that management pays it dividend on long-term model results not dips and crests. With this in mind, our future view with respect to the dividend changed. We no longer expect increases long-term. This investment seems poised for creating growth rather than yield. Longer-term charts suggest that two regions of support and resistance exist, one near $12 and the other in the $15 region. Over the next few years, in our new view, the opportunity equals capital growth while collecting a lucrative but diminishing yield.

Company Direction

AGNC has several levers in which management maneuverers results including interest rate swaps vs. treasury hedges, leverage and cash invested at levered values.

With confidence in a curve steepening and remaining stable afterward, management offers in-sight into its investment direction. With MBS hedged with treasuries generating greater returns vs. interest rate swaps, increases in the treasury hedges sets a change. Adding reasoning, they included this, “Consistent with this shift towards longer-term hedges, our overall hedge ratio declined to 72%.” This doesn’t completely preclude continuing with a mix of swaps and treasuries.

On leverage, Eric Hagen from BTIG, asked about room for increasing. The CEO simply answered, a lot of room with this thought, increased leverage requires more stable markets. Election volatility likely delays changes possibly until early next year.

A last discussion about where in the cycle AGNC now sits seems prudent. Management has raised its cash to $6+ billion significantly higher than normal thus opening a door into $6 billion times the leverage factor of investment. It also must hedge increased purchases, but, still, this can end up being enormous growth. Of note, asset size increased $6 billion alone between the two quarters.

Management, also, noted that 80% of the hedges are greater than seven years. With these longer-term hedges, it makes sense for the company to lower hedging allowing debt repricing at new, lower Fed fund’s rates to increase values.

Also, when asked about plans for putting new capital to work, the company added, “we’re likely to maintain and add higher coupons relative to the index, which we think offer the best – the best long-run returns.”

AGNC Stock Chart

Now it is time to open the chart side of the package. This day chart, created from TradeStation Secuities, shows the markets mild negative reaction.

We view this reaction, once settled, as a buying opportunity. Using the three-day rule is always wise. In this case, we would wait until after the election.

Risks

Investment risk always exists. With AGNC, a major risk for growth resides with the Fed pausing interest rate cuts. The equity value would be stuck. But lower rates of an additional 1.75% over the next two years game changes the company’s performance. Approximately, $7 billion in low-cost interest rate swaps must be refinanced within the next six months. Lower cost hedges must be replaced with higher cost entities. Management addressed and planned a resolution a long ago. At this point, it is again important to remember that the basic model defines the dividend. We, also, see growth through expending capital with this more stable marketplace in place.

The package contained a gift of stability that if proven going forward creates a lucrative investment environment. In our view, the major risk will be unsettled environments from internal or global events: i.e. wars, energy disruptions etc. The company, today, is still positioned for managing volatility, a position that could change. We continue our buy rating after the dust settles. The Postman delivered a pretty nice package, wouldn’t you say.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.