Summary:

- Agnico Eagle is a well-managed, financially sound mining company with a bright future that deserves a place in any portfolio of precious metals stocks.

- Agnico Eagle remains my number one choice in the gold mining sector, and the Q3 results have reinforced my view that it is an essential part of my investment program.

- If you are new to this sector of the market, then in terms of acquisitions, Agnico Eagle Mines Limited is a good place to start.

kobzev3179

Introduction

On the 28th July 2023 I reviewed the Q2 financial results for Agnico Eagle Mines Limited (NYSE:AEM) and rated the company a ‘Strong Buy‘ when the price stood at $51.32. Since then, this company has registered a Total Return according to the Team at SA of 75.04%. I also commented that

“If I could only hold one gold miner then Agnico Eagle would be it”

Over many years, this company has been kind to me, however it is important not to fall in love with any stock and always do the due diligence required to satisfy yourself that it is indeed an investment that meets your own unique disposition in terms of financial objectives, aversion to risk etc., in order that you can sleep at night without worrying about the volatility that characterizes this tiny sector of the market.

Ariel View of Agnico Eagle Mine (Agnico Eagle Mines Limited)

Today I will take a quick look at Agnico’s financial results for Q3, 2024 to see if they are still my number one choice in the precious metals mining sector.

Fundamentals

Agnico Eagle Mines is a $43.45B gold mining company formed in 1957 and has the enviable record of paying a cash dividend annually since 1983. Granted, at times the dividend has been rather small, but it is an achievement when compared to many of its peers who were unable to pay a dividend at all during the hard times for this industry.

From their headquarters in Canada they oversee operations in Canada, Australia, Mexico, and Finland, with a number of development projects in the United States.

Third Quarter 2024 Highlights

The Q3 financial results have been published, so I would like to draw your attention to some points that I think are important but would also advise you to read through them as you may have a different “take” on them depending on your own investment philosophy.

The President and Chief Executive Officer, Ammar Al-Joundi, stated the following:

“We are excited to report record financial results for a fourth consecutive quarter. Our focus on operational performance, cost control and capital discipline has allowed us to deliver the leverage to record gold prices to our shareholders.”

That is a good start and helps to reassure investors that their funds are in good hands.

Something that I look for is the cost of production and the all-in sustaining costs (“AISC”) achieved is $1,286/Oz which is a tad higher than the Q2 figure of $1,169/Oz.

Other standouts that interest me include:

The Payable gold production was 863,445 ounces. The record quarterly net income is $567.1 million or $1.13 per share and adjusted net income of $572.6 million or $1.14 per share

The Company reports that it is on track to meet its gold production guidance for the full year 2024, so there are no shocks to one’s digestive system here, which is always good to know.

Operating activities generated record cash of $1,084.5 million or $2.16 per share and free cash flow of $620.4 million or $1.24 per share, increasing its cash position by $55.2 million to $977.2 million. This leads me to ponder on what they might do with this cash in terms of new acquisitions, which could further strengthen their turnover and profitability.

Debt reduction has continued at a pace with the Year-to-date net debt being reduced by $1,014.4 million, from $1,504.4 million at the beginning of the year to $490.0 million as at September 30, 2024, not far from being debt free, which again strengthens the balance sheet.

The dividend remains unchanged at $0.40 per share, which many investors appreciate along with the share price growing, adding capital growth to their investment.

These results look very good to me and I can see no reason not to have this stock in my portfolio, but we all have different views and expectations, so please do the work and satisfy yourself that any acquisition you make does indeed meet your investment criteria.

The next week or so will give us an indication of just how the market feels and reacts to these figures.

Also be aware that the downside to the precious metals sector is that a pullback is always a possibility for a myriad of reasons, including but not limited to:

Geopolitical changes, in that the election of a new government may bring with them a demand for a greater share of the profits from the mining industry.

The cost of energy, in particular the cost of oil which is sensitive to supply shocks resulting in sudden price increases.

Hard assets such as land and real estate, the new green technologies, energy, currencies the S&P500, Crypto currencies, etc.

And so we should expect a fair amount of volatility going forward as the Bull will try to throw you off it as happens in all Bull Markets.

Financials

For a forward projection, a quick look at Seeking Alpha’s Quant section has a PE (‘FWD’) of 21.98 and an EPS (‘FWD’) of 3.95, with a rating of “Hold”

Agnico is ranked in its Industry at 16 out of 43 with a score of 3.46 which places Agnico below a number of its peers including Newmont Corporation (NEM) and Barrick Gold Corporation (GOLD)

The liquidity is good with an average volume of 2,312,796 shares traded per day affording nimble traders the ability enter and exit this stock with relative ease.

Agnico Eagle is traded on both the NYSE under the ticker symbol of AEM and in Canada under the symbol of AEM.TO.

In my opinion gold is at the beginning of a Bull Market however it will be anything but plain sailing and investors will need a strong stomach in order to cope with the wild oscillations that will no doubt come our way.

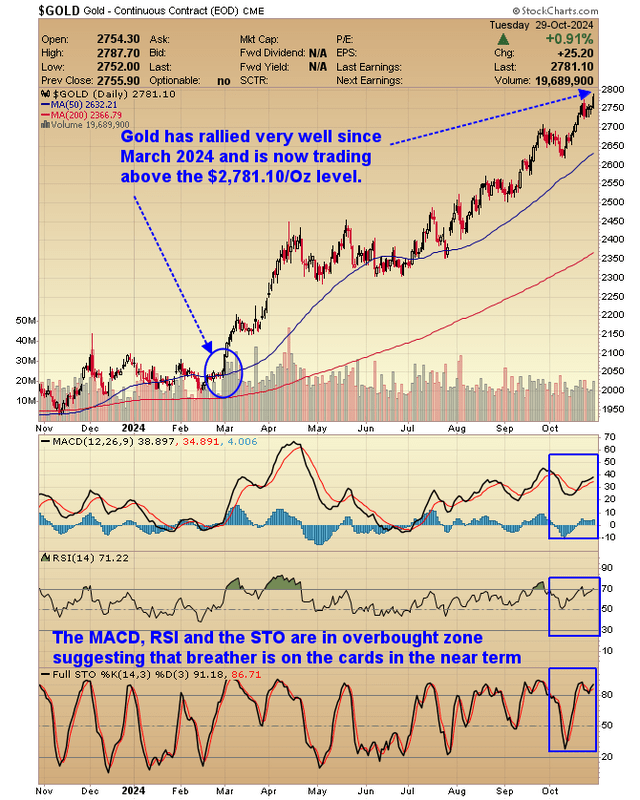

A quick look at the chart of gold’s progress shows that gold has rallied very well since March 2024 and is now trading above the $2,781.10/Oz level.

Progress Chart For One Year Of The Gold Price (StockCharts)

The MACD, RSI and the STO are in overbought zone suggesting that breather is on the cards in the near term.

A Quick Look At The One Year Chart Of Agnico Eagle

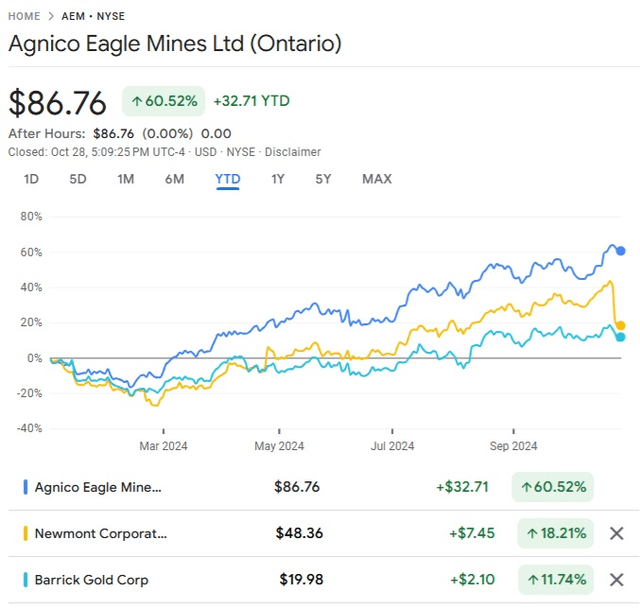

Agnico has rallied from a low of $44.00 in February to $86.76 today much to the delight of those gold bugs who invested in this stock some time ago as the chart below indicates.

A One Year Progress Chart of Agnico Eagle Mines Limited (StockCharts)

Please note that the technical indicators especially the RSI which popped up above the ‘70’ mark and the MACD had peaked in the overbought zone and so Agnico is taking a short breather.

For those of you who want to ‘buy the dips’ note that the dips are fairly shallow and short-lived, so the risk exists that you may have to pay more to repurchase your position if your timing is a tad off.

My tendency for now is to hold tight and ride out the ups and downs of this Bull Market as I believe the possibility of missing out on a sudden leap forward in the price of some of these gold mining stocks is significant.

Stock Comparison Chart

If we now compare Agnico Eagle with similar sized gold mining companies such as Barrick Gold Corp (GOLD) and Newmont Corporation (NEM) on a YTD basis it is clear that Agnico has outperformed both of them by a considerable margin as the chart below shows:

A One Year Chart Of Agnico Eagle Compared With Newmont and Barrick Gold Mines (Google Finance)

As the old adage goes “The cream rises to the top” and this top performer is doing just that. As for the future, well there are myriad of considerations that can change the picture almost overnight, so we do need to stay on our toes and be alert to re-position ourselves from time to time in order to maximize our profits. However, I have no reason to replace Agnico as my number one choice in the gold mining sector.

Conclusion

Agnico Eagle is a well-managed, financially sound mining company with a bright future that deserves a place in any portfolio of precious metals stocks.

Agnico Eagle remains my number one choice in the gold mining sector and the Q3 results have reinforced my view that it is an essential part of my investment program.

My readers are aware that I am Long both physical silver and gold and that I own a portfolio of gold, silver and uranium mining stocks in the precious metals space.

If you can spare the time your opinion and comments are very much appreciated by our readers and me as they add some semblance of balance to these publications,

Thanks, Bob K

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EXK, IPT:CA, SVM, AG, AEM, SAND, WPM, SSRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.