Summary:

- Agnico Eagle Mines Limited is a class act and a must for most gold bugs.

- Great Q2 financial results add confidence to achieving this year’s targets for cost control and output.

- AEM remains my number one choice in the gold mining sector, which I intend to hold as part of my core position in the precious metals space.

Yelena Rodriguez Mena/iStock via Getty Images

Introduction

Approximately one year I reviewed the Q2 financial results for Agnico Eagle Mines Limited (NYSE:AEM) and gave the company a ‘Strong Buy‘ rating and commented that “If I could only hold one gold miner then Agnico Eagle would be it” The price at publication was $51.32 and recently Agnico closed on Friday 26th of July 2024 at $73.40 registering a gain of 43.02% which is not too shabby.

Today, I will take a look at the Q2 financial results for 2024 to see if they are still front-runners in the precious metals mining space.

Fundamentals

Agnico Eagle Mines is a $36.6B gold mining company headquartered in Canada with mining operations in Canada, Mexico, Finland, and Australia with interesting development projects in the United States. The Company has been in existence for 66 years and has managed to pay a cash dividend every year for the last 40 years when many in this sector were unable to do so, which is a significant achievement, especially when times were tough in this tiny sector of the market.

Second Quarter 2024 Highlights

I have previously stated that if I could only invest in one gold miner, then Agnico Eagle would be it, so it is with some excitement that I take a quick look at today’s Q2 financial results.

We will start with a statement from Ammar Al-Joundi, the President and Chief Executive Officer, as follows:

We continue to deliver strong and reliable operational results which, combined with higher gold prices, drove record operating margin and free cash flow for the third consecutive quarter. As a result of the excellent performance of our operations through the first half of 2024, we are highly confident we will achieve our full year production and cost guidance,”

One thing that gives investors confidence to invest is when a company meets its own guidelines and expresses confidence in maintaining those targets for the remainder of the year, so we are off to a good start.

Something that I look for is the cost of production and the all-in sustaining costs (“AISC”) achieved is $1,169/Oz. Going forward, the AISC in 2024 remains unchanged at $1,200/Oz to $1,250/Oz, which bodes well for future profitability.

Other standouts that interest me include:

The Payable gold production was 895,838 ounces. The Quarterly net income is $472.0 million or $0.95 per share and adjusted net income of $535.3 million or $1.07 per share. Production remains unchanged at approximately 3.35 to 3.55 million ounces for 2024. The cash position increased by $397.4 million to $922.0 allowing them to consider further M&A activities, one wonders just who could be on their shopping list?

The dividend of $0.40 per share is always nice to have as it provides a return on your capital along with the possibility of further capital growth via an increased stock price.

These results read very well for me, but I would advise you to read through these results, as you may be influenced by various metrics that I have not covered.

Financials

Agnico has a market capitalization of $36.6, a 52-week trading range of $43.22-$77.44, a P/E Ratio (TTM) of 92.91 and an EPS (TTM) of 0.79. Now, if we take a look at Seeking Alphas Quants figures, we have forward projections of PE (FWD) 20.55 and an EPS (FWD) of 3.57, and they give this stock a “Hold” rating. Taking a quick look at Seeking Alpha’s Quant Ranking, Agnico is ranked in Industry at 15 out of 44 with a score of 3.44 which places Agnico in the top half of these rankings but not exactly best in class.

The liquidity is good with an average volume of 2,188,417 shares traded per day, enabling easy access and exit points for this stock.

Agnico Eagle is traded on both the NYSE under the ticker symbol of AEM and in Canada under the symbol of AEM.TO.

On the downside, gold and its associated miners have considerable competition for investors funds such as but not limited to the USD, S&P500, Crypto currencies, real estate, energy, and a relatively new entrant to the market of Artificial Intelligence. Also note that today the price of Brent Crude is up 4.4% to trade above $80/barrel, putting upward pressure on inflation. This in turn could delay any anticipated rate cuts which would have been supportive of the USD and as it is inversely correlated to gold, could put a damper on gold’s progress.

So do consider that although gold is in a Bull Market it is not blue sky sailing all the way, there will be bumps in the road which we will have to navigate with some dexterity.

A Quick Look At The One-Year Chart

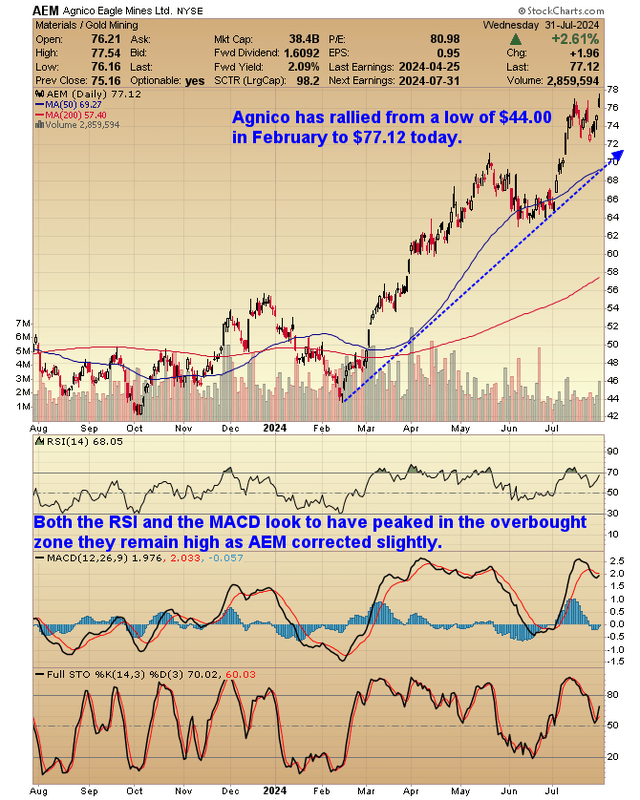

Agnico has rallied from a low of $44.00 in February to $77.00 today, much to the delight of its investors, as the chart below depicts:

Agnico Eagle Mines Ltd One Year Progress Chart (Stockcharts)

Also note that both the RSI and the MACD look to have peaked in the overbought zone as the stock price corrected a little.

However there is always the possibility that some of those investors will take their profits and sit on the sidelines hoping for a cheaper entry point a little further down the line. If you are a sophisticated, experienced, and nimble investor, this may be something for you to consider. My position, for what it is worth, is to sit tight and ride out the ups and downs of this Bull Market as I believe that we are in the early stages of this sector’s development and I do not want to miss out on possible future gains by trying to time exit and entry points.

Stock Comparison Chart

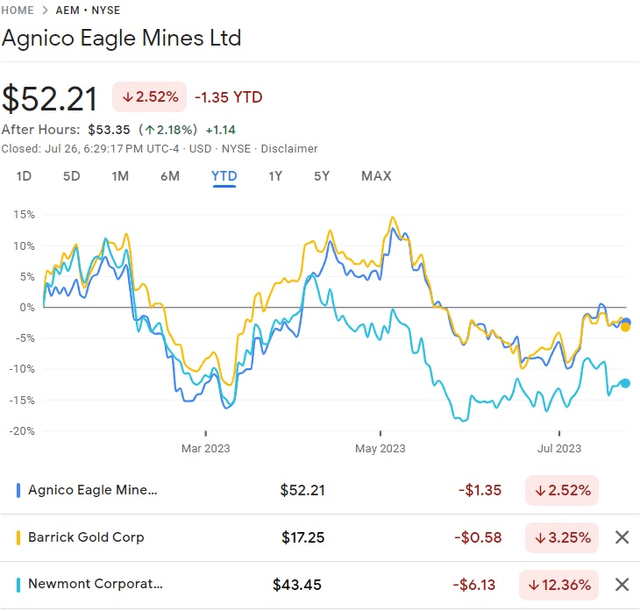

A year ago, we compared Agnico Eagle compared with Barrick Gold (GOLD) and Newmont Corporation (NEM) on a YTD basis when all three companies were mired in negative territory, as the chart below shows:

Agnico Eagle Mines Ltd Compared With Barrick and Newmont Q2 2023 (Google Finance)

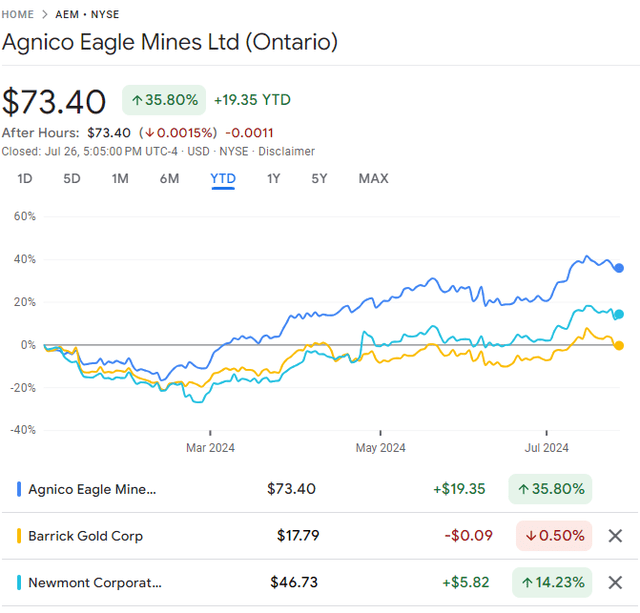

If we now fast-forward to today and compare these three stocks on a YTD basis, we can see that Agnico has outperformed the other two stocks with some gusto on the chart below:

Agnico Eagle Mines Ltd Compared With Barrick and Newmont Q2 2024 (Google Finance)

Conclusion

Agnico Eagle is a class act and my number one choice in the gold mining sector. And remember that “Class” is permanent and “Form” is temporary.

Gold is currently trading around $2447/Oz which should be supportive of gold mining share prices going forward, so Agnico could experience some new money coming their way from investors who previously shunned this tiny sector of the market.

Agnico’s results have been published on a day when gold is trading some $40.00/Oz higher than yesterday, and will therefore attract the attention of investors to the precious metals sector at a time when this stock sparkles brightly.

My readers are aware that I am Long both physical silver and gold and that I own a portfolio of gold, silver and uranium mining stocks in the precious metals space, including but not limited:

Mega Uranium Limited (MGA)

Laramide Resources (LAM)

Wheaton Precious Metals Corp. (WPM)

Agnico Eagle Mines Limited (AEM)

Fortuna Mining Corp. (FSM)

First Majestic Silver Corp. (AG)

IMPACT Silver Corp. (IPT:CA)

Pan American Silver Corp. (PAAS)

Due diligence on your part is vital to ensure that you are making the right trades for your own unique criteria, financial objectives, aversion to risk etc.

If you can spare the time, your opinion and comments are very much appreciated by our readers and me as they add some semblance of balance to these publications, thanks, Bob K

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EXK, IPT:CA, SVM, AG, AEM, SAND, WPM, SSRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.