Summary:

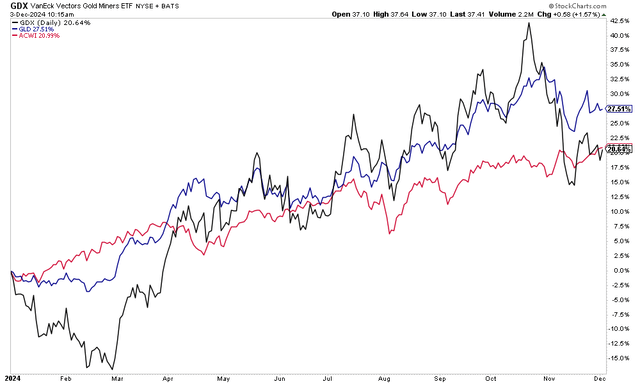

- Gold miners, represented by the GDX ETF, have gained 21% YTD in 2024, underperforming the SPDR Gold Trust ETF by 7 percentage points.

- I maintain a buy rating on Agnico Eagle Mines Limited (AEM), raising my intrinsic value estimate despite technical resistance and a valuation gap.

- AEM reported strong Q3 results with net income of $567 million, beating forecasts, but high costs and conservative guidance impacted share performance.

- Key risks for AEM include higher costs, interest rate volatility, geopolitical uncertainties, and gold price sensitivity, with technical support around $75 and a potential year-end rally.

mikulas1

Gold miners, as measured by the VanEck Vectors Gold Miners ETF (GDX), have pared their year-to-date gain. The ETF is up 21%, dividends included, so far in 2024, underperforming the SPDR Gold Trust ETF (GLD) by about 7 percentage points. Still, shares of gold-producing companies are up about on par with the global stock market this year.

One of the more popular ways to play the precious metals space is to own Agnico Eagle Mines Limited (NYSE:AEM). I first had a buy rating on the stock in April 2024 and reiterated a bullish stance at the start of the second half of this year. In July, I targeted the upper $80s due to a long-term technical target and where I viewed fair value to be.

Today, I am raising my intrinsic value estimate and keeping my buy rating, though the valuation gap is not massive and technical resistance is in play.

Gold Mining Stocks Retreat From Multi-Year Highs

Back in October, AEM reported a solid set of quarterly results. Q3 quarterly net income of $567 million, or $1.14 in per-share operating earnings, topped the Wall Street consensus forecast by $0.12 while revenue of $2.16 billion was a material $38 million beat. The Toronto-based $41 billion market cap gold industry company confirmed $1.26 billion in adjusted EBITDA, driven by gold sales just shy of 860,000 ounces, also above forecasts.

Costs were on the high side, which the market might pay close attention to – shares fell 2.2% in the session that followed the third quarter report, but AEM’s management team reiterated its FY 2024 guidance. It sees 3.35-3.55 million ounces of gold production, with capex seen in the $1.6-$1.7 billion range. I was a bit disappointed to not get an earnings outlook increase given the rally in gold, but perhaps the firm was merely being conservative.

Operationally, trends look good concerning exploration at its Odyssey, Detour, and Hope Bay mines. Financially, the company managed to reduce its net debt position to $490 million – which is a good sign considering high volatility in the interest rate space. Finally, free cash flow summed to $620 million in the quarter.

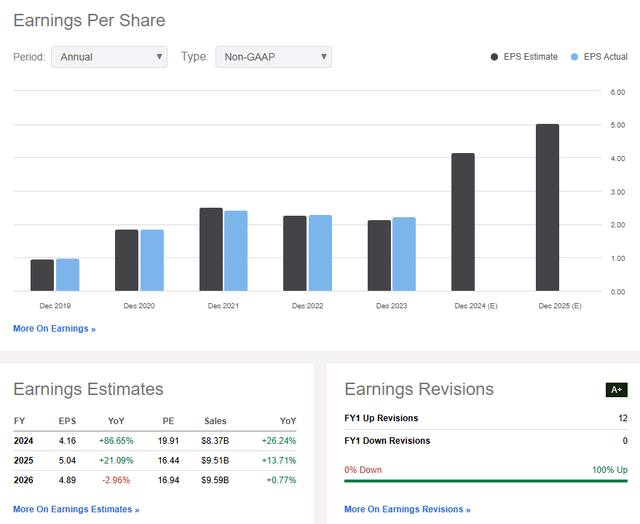

On the earnings outlook, analysts see a whopping 87% non-GAAP EPS jump this year, with a 20%+ increase in the out year. By 2026, AEM is seen having per-share earnings of around $5. Sales growth may slow from 2024’s robust level, but there has been a high of 12 sellside EPS upgrades in the past 12 months, compared with zero downgrades.

Over the past 12 months, AEM has generated $3.76 of free cash flow per share, resulting in a FCF yield of 4.4%. With solid profitability, I would not be surprised to see a dividend hike at some point in the next year.

AEM: Revenue & Earnings Forecasts, EPS Revision Trends

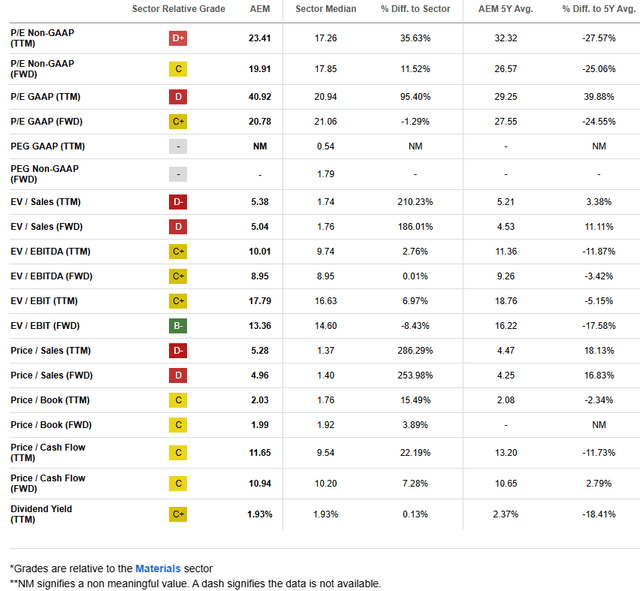

On valuation, I had previously increased my fundamental target from $75 to $85. Now, using a normalized EPS level of $5 and applying a below-market multiple of 19, then shares should trade near $95. My earnings assumption is up materially from the last outlook, but given that AEM operates in a highly cyclical industry, the P/E multiple should be brought down, hence my more conservative multiple of 19 today compared to 23 earlier this year.

Big picture, the fundamental value is still significantly above the market price.

AEM: Shares Attractive on Earnings, But A Tempered P/E Warranted

Key risks for this gold producer include higher labor and operating costs, a spike in interest rates given the debt position, geopolitical uncertainties as it is an international company, and, of course, high sensitivity to gold prices.

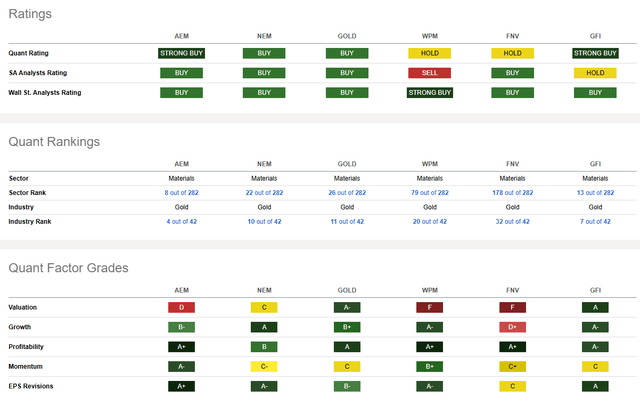

Competitor Analysis

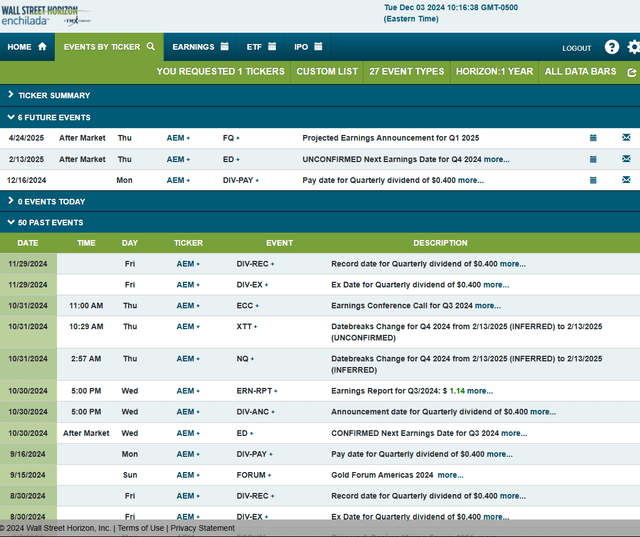

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2024 earnings date of Thursday, February 13 AMC. Before that, the company pays a $0.40 per-share dividend on Monday, December 16.

Corporate Event Risk Calendar

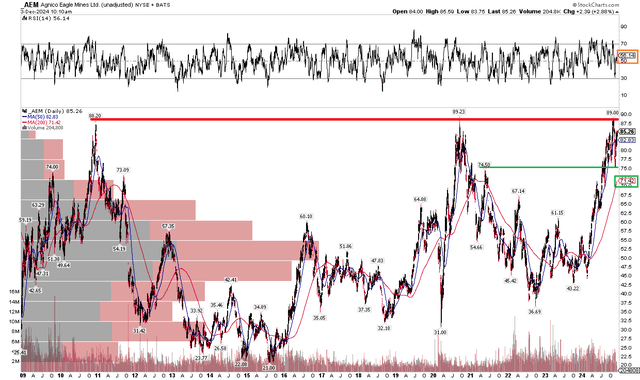

The Technical Take

With shares still undervalued, AEM’s technical situation is more precarious than earlier in 2024. Notice in the chart below that shares approached that all-time high spot I discussed in the middle of the year. Indeed, $89 has proved to be a tough price for the bulls to carry AEM through. The stock pulled back to $75 in November, and I see that as near-term support.

Also take a look at the long-term 200-day moving average – it’s rising and comes into play in the low $70s. I expect that to rise toward $75, making the mid-$70s important support for AEM. Moreover, the RSI momentum gauge at the top of the graph has eased from strong readings earlier in the year.

Keep in mind, though, that AEM has historically performed well in December and January when assessing 10-year seasonal trends, so we could see a year-end rally with strength into early 2025.

AEM: Shares Touch Long-Term Resistance, $75 Support

The Bottom Line

AEM has performed well since July, with shares rising to both my fundamental target and technical resistance I pointed out a handful of months ago. Today, I reiterate a buy rating and raise my intrinsic value objective, but point out key resistance just below the $90 mark on the chart with $75 acting as support.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GDX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.