Summary:

- Agnico Eagle Mines Limited has a better EPS outlook amid higher gold prices, strong free cash flow, and a promising chart. It has sharply outperformed GDX and S&P 500 since mid-April, with strong Q1 results and a positive earnings outlook ahead of its Q2 report.

- Key focus on the upcoming earnings report for production verification at Detour Lake gold mine and any updates to 2024 guidance.

- I see $75 as a near-term resistance point, but a longer-term target into the upper $80s is very doable, while I see the fundamental value now near $85.

- I also take a look at the options market before Wednesday night’s Q2 report as gold price spiked above $2400 per ounce amid rising geopolitical tensions today.

mikulas1

Agnico Eagle Mines Limited (NYSE:AEM) has been among the best performing Materials-sector stocks since late in the first quarter when gold took flight. Shares have moved from the mid-$40s to mid-$70s in short order, and I reiterate a buy rating amid a better earnings outlook today compared with my previous analysis back in April.

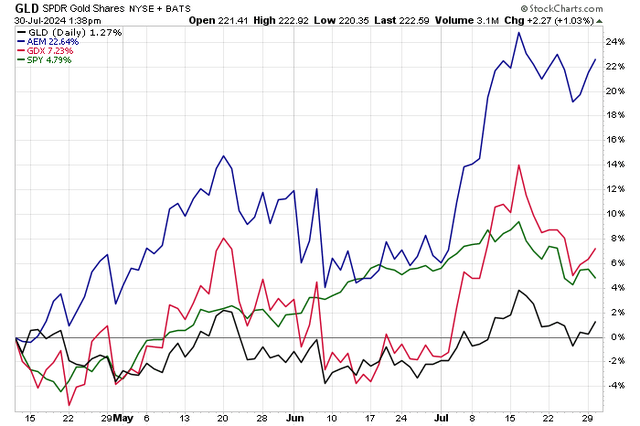

Shares are up more than 22% in total return since then, outperforming both the VanEck Gold Miners ETF (GDX) and the SPDR® Gold Shares ETF (GLD). The S&P 500 (SP500), for perspective, is up less than 5% since April 12, 2024. Ahead of AEM’s earnings report Wednesday night, both the fundamentals and technicals appear attractive, but I will note an important resistance level that could bring the bulls fits.

AEM Sharply Outperformed GDX and the S&P 500 Since Mid-April

According to Bank of America Global Research, Agnico Eagle is a senior gold mining company with multiple operating mines located in Canada, Finland, Australia, and Mexico.

Back in April, AEM reported a solid set of quarterly results. Its Q1 non-GAAP EPS of $0.76 was an impressive $0.16 beat while revenue of $1.83 billion, up more than 21% from year-ago levels, was a modest $50 million beat. Its payable gold production summed to 878,652 ounces (ca. 33 t), with an average cost of $829 per ounce. Total cash costs per ounce were recorded at $1190. Strong production was driven by record mining at its Canadian Malartic facility. The management team reiterated its gold production and expense guidance in April after it had reduced its net debt by 13%, improving the balance sheet.

What’s key to watch for in the upcoming report is how production verifies at its Detour Lake gold mine – it accounts for one-third of AEM’s net asset value and 20% of its FY 2024 revenue projection. The company plans to invest another $100 million in the Ontario mine over the next three years, according to a recent site visit from BofA. That should help de-risk the portfolio and sustain higher EPS over the years ahead.

The options market has priced in a 4.9% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the Q2 report, according to data from Option Research & Technology Services (ORATS). That’s the most expensive straddle going back to July of last year. Shares have traded higher post-earnings in the last two earnings events, with AEM topping EPS estimates in the last six instances. $0.94 of non-GAAP EPS is the consensus forecast.

Key risks include weaker gold prices, higher labor costs, financing issues should the credit markets tighten, and regulatory and operational risks as the mines it operates can be dangerous.

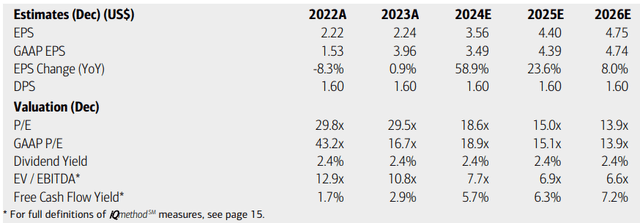

On the earnings outlook, analysts at BofA see operating EPS soaring 59% this year and jumping another 24% in the out year. By 2026, non-GAAP per-share profits could approach $5. But the consensus outlook is less sanguine. Seeking Alpha’s figures show AEM ranging from $3.57 in the current fiscal year to $3.95 in FY 2025. Dividends, meanwhile, are expected to hold at $1.60 annually, but free cash flow is seen rising markedly over the next handful of quarters.

AEM: Earnings, Valuation, Dividend, Free Cash Flow Yield Forecasts

My previous intrinsic value target was $75, and AEM hit that quickly. Today, amid sustained higher gold prices and after a slew of sell-side EPS upgrades, the profitability outlook appears better.

If we assume $3.75 of non-GAAP EPS over the next 12 months and apply a P/E of 23, below its long-term average, then shares should be near $85. Strong EPS growth and gold near $2400 per ounce – more than double its cost – warrant a premium multiple to the market in my view.

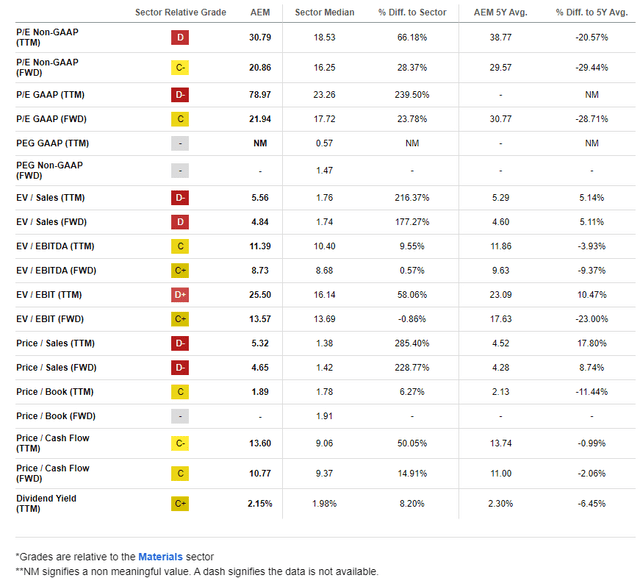

AEM: Mixed Valuation Metrics, But Historically Cheap on Earnings

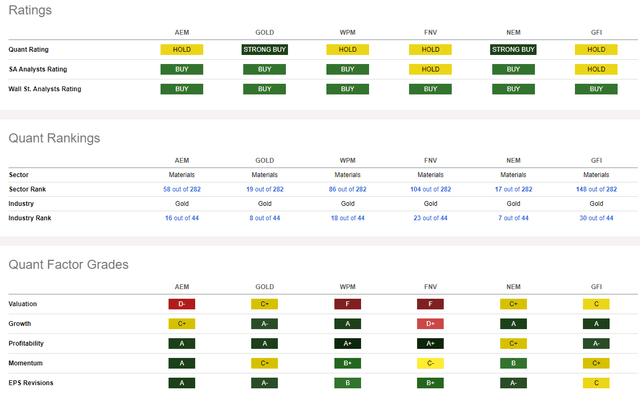

Compared to its peers, AEM sports a soft valuation rating, but the forward trajectory appears much better. Earnings growth is expected to slow next year, but with the positive trend in sell-side estimates, I would not be surprised to see 2026 EPS estimates ratcheted higher following this week’s Q2 release and as the price of an ounce of gold has sustained above $2400 per ounce. Backing up that assertion is the reality that AEM’s profitability trends are strong while share-price momentum is healthy.

Competitor Analysis

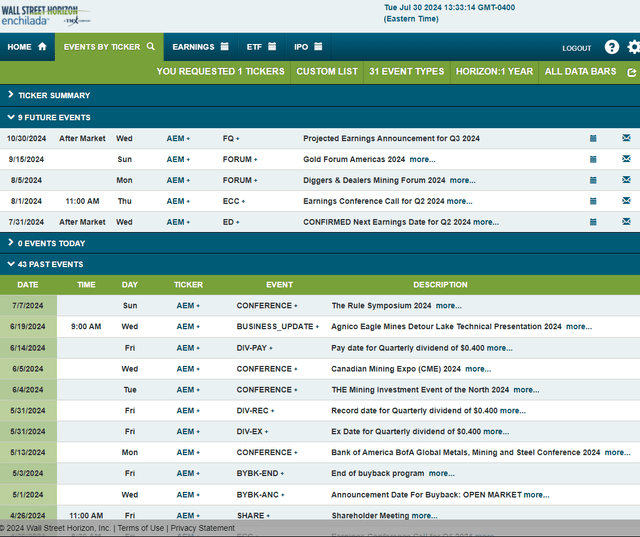

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2024 earnings date of Wednesday, July 31 AMC, with a conference call the following morning. You can listen live here.

Thereafter, the company’s management team is slated to present at a pair of conferences – one next Monday and the other toward the end of the third quarter.

Corporate Event Risk Calendar

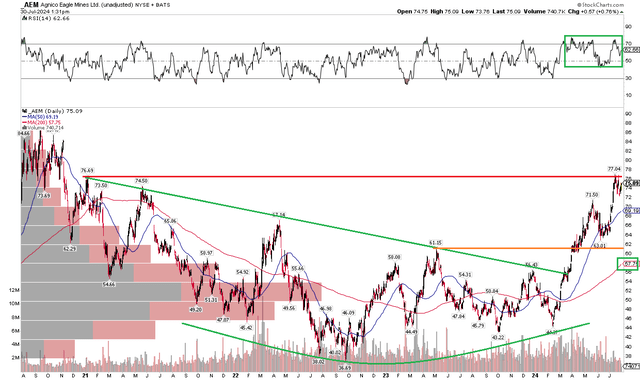

The Technical Take

My technical target was likewise $75 or so on a longer-term basis at the start of Q2. Notice in the chart below that shares have rallied right to that level – the high from May 2021 and late 2020. The next upside target of interest would be the $88 to $90 zone – that’s AEM’s all-time high from several years ago and the previous gold up-cycle.

Today, with a rising long-term 200-day moving average and an RSI momentum oscillator that is ranging in a bullish zone, the bulls control the primary trend. What’s more, AEM broke out from a downtrend resistance line earlier this year, followed by a test of key support in the low $60s. That’s where I see current support.

Overall, with resistance near the current price, I expect a modest pause in the uptrend, but long-term, investors should eye the upper $80s while the low $60s is support heading into earnings.

AEM: Bullish Breakout, Shares Hit the $75 Target, Rising 200dma

The Bottom Line

I have a buy rating on Agnico Eagle Mines Limited. I see the stock as still undervalued amid higher gold prices today and solid execution by the management team. The firm’s high free cash flow is a bright spot in a cyclical industry.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GDX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.