Summary:

- Agnico Eagle has surged +78% in six months, far outperforming the S&P 500’s +12% gain, on the sharp rise in gold quotes.

- AEM’s valuation now appears stretched, suggesting a potential breather, especially with an outlook of limited production growth in the future.

- Share price losses could soon be tied to trouble in the overall U.S. equity market, assuming gold/silver do not rise markedly into early 2025.

- I am downgrading Agnico Eagle from Strong Buy to Hold as a price forecast for the next 12 months.

We Are

What a difference six months can make. I suggested Agnico Eagle Mines Limited (NYSE:AEM) as one of the smartest risk-adjusted precious metals miners to own in a bullish story on February 10th here. Since then, this low cost, the safest jurisdiction gold producer has gained +78% (as a total return) for investors vs. the equivalent-period S&P 500 index rise of +12%.

Seeking Alpha – Paul Franke, Agnico Eagle Article, February 10th, 2024

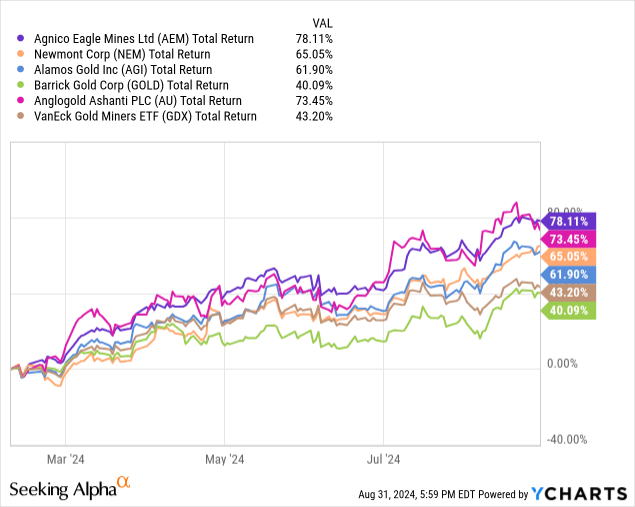

In fact, AEM has outlined the best total return for investors out of the major gold miners you could have picked, or sector average represented by the VanEck Gold Miners ETF (GDX). This list includes Newmont (NEM), Alamos Gold (AGI), Barrick Gold (GOLD), and AngloGold Ashanti plc (AU).

YCharts – AEM vs. Gold Mining Peers, Total Returns, Since February 10th, 2024

However, things change. Is Agnico suffering from operating problems? No. But, the valuation is getting somewhat stretched. My current view is a breather could be next, even if gold/silver bullion continue to drift higher the rest of the year. Do I suggest you sell your whole position? No. My thinking is avoiding this name as a buy idea, or hedging your position with covered calls, or liquidating a small portion of your shares makes sense today. Consequently, I am dropping my official 12-month rating from Strong Buy to Hold.

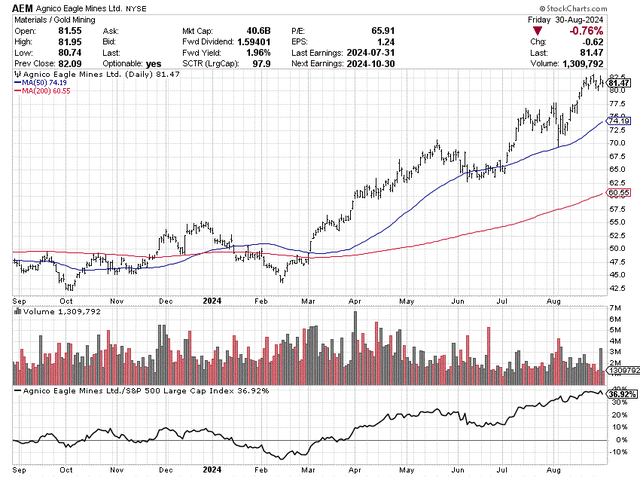

StockCharts.com – Agnico Eagle, 12 Months of Daily Price & Volume Changes

Valuation-Based Downgrade Logic

My view is the bargain setup for all gold/silver miners from six months ago or even several years ago is not the same today. Sure, rising precious metal quotes (gold +28%, silver +17%) over the last 12 months should support better operating results in the second half of 2024 and all of 2025. Yet, the oversized gold miner gains of 2024 have largely discounted this good news.

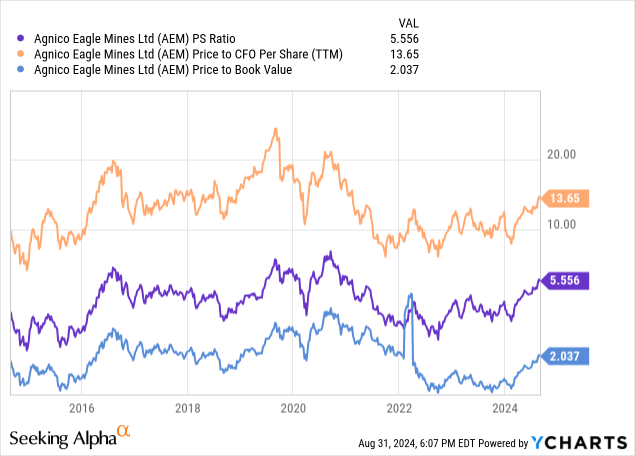

Reviewing a 10-year chart of AEM’s price to trailing sales (5.5x), cash flow (13.6x) and book value (2x), the decade-low (or nearly so) valuation setup of early 2022 to early 2024 is gone. The long-term investor advantage of buying-when-nobody-wants-them argument for gold miners that existed for years has somewhat disappeared as well. Today, I would term the share valuation zone for Agnico Eagle as closer to fair, perhaps moving to fully cooked on further price gains.

YCharts – Agnico Eagle, Price to Trailing Fundamentals, 10 Years

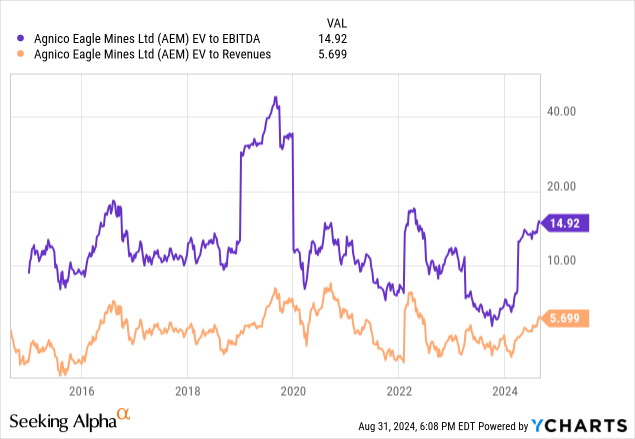

When we include changing debt and cash levels, enterprise valuation ratios explain a similar picture. With EV to EBITDA (14.9x) and Revenues (5.7x) quite a distance from six months ago, and starting to rise above 10-year averages, today might be the proper time to seriously consider when to sell AEM than to buy.

YCharts – Agnico Eagle, Enterprise Valuations, 10 Years

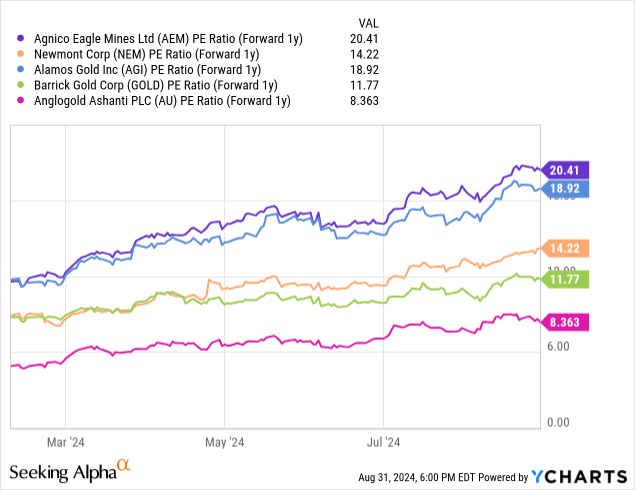

I will say a forward 20.4x P/E on 2025 analyst estimates is not exactly expensive historically. With the S&P 500 near the same number and Treasury bills available at rates in the 4.6% to 5.1% range, AEM’s forward earnings yield slightly below 5% (E/P) is far from a sell-rated level.

Nevertheless, Agnico Eagle’s valuation on earnings estimates is the highest of the mega-cap gold miners. Of course, you can argue better resource assets (locations and costs) should be priced at a premium, and I agree. Yet, the forward 2025 P/E forecast has risen from 12x in February to 20x today.

YCharts – AEM vs. Gold Mining Peers, Price to Estimated 2025 Earnings, Since February 10th, 2024

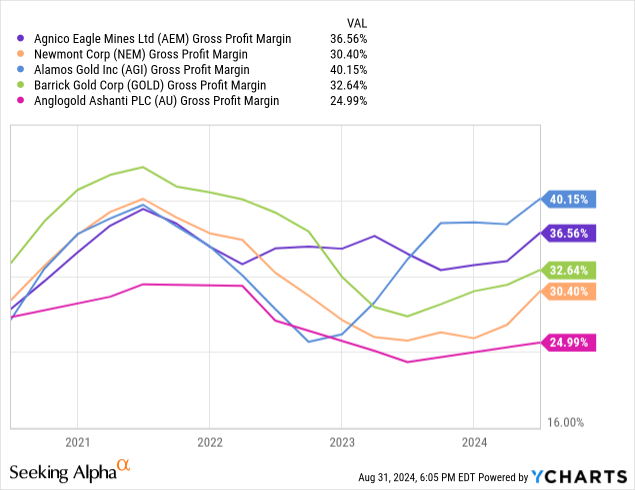

Gross margins are also some of the strongest out of the peer group, which is a huge plus if you want to own a miner. But, margins are not dramatically better than the other major miners, with Newmont and Barrick possibly catching AEM on further gold price gains into 2025.

YCharts – AEM vs. Gold Mining Peers, Gross Profit Margins, 4 Years

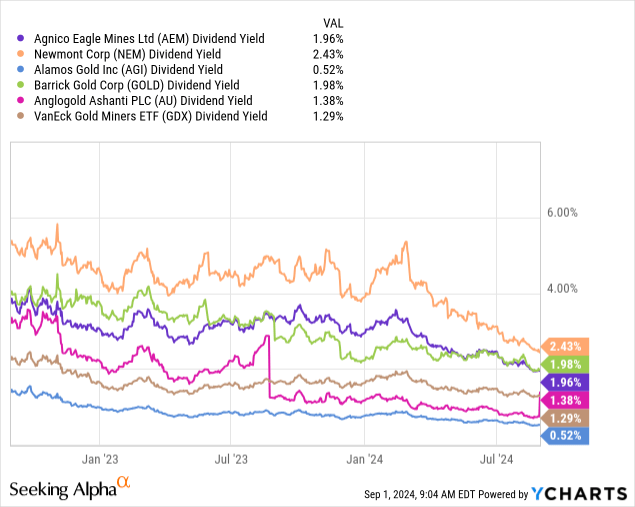

Lastly, dividend yields in the sector (including AEM) are roughly half the level of two years ago. One of the easiest to argue excuses to own the major gold miners in late 2022 revolved to dividend yields being superior to the overall U.S. equity market and those available from T-bills. Agnico Eagle’s annual cash distribution of almost 4% two years ago and 3.5% rate from February has declined to less than 2% in late summer 2024.

YCharts – AEM vs. Gold Mining Peers, Dividend Yields, 2 Years

Final Thoughts

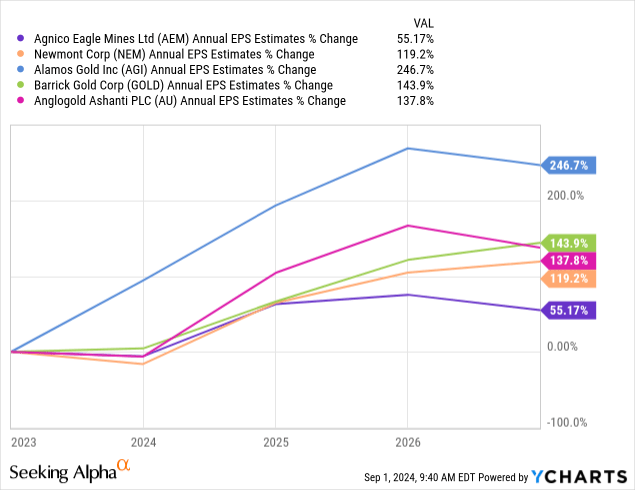

I suppose the primary negative data point working against Angico Eagle shares during 2025 will be the realization that production growth and operating margin improvement have become quite subpar vs. the major mining groups. Why not own a lower valuation setup upfront with above-average growth prospects?

YCharts – AEM vs. Gold Mining Peers, Analyst Estimates for EPS Growth 2024-26, Made August 30th, 2024

At this stage of the gold/silver rise, I much prefer Newmont’s position for new investment. The benefits of the Newcrest Mining merger should really shine through 2025 operating performance. And, a larger, more diversified gold reserve base is available to buy at a far lower valuation than Agnico Eagle.

My research is still placing gold’s long-term underlying worth around US$3000 per ounce and silver above $40 (using relative valuation analysis to other commodities, money supply, debt creation in the U.S. since the 1960s). So, the precious metals bull run should continue, albeit at a slower percentage gain pace over the next 6-12 months, than we’ve experienced since the end of 2023.

If China does something crazy, or Russia expands its war with Ukraine by attacking neighboring nations, or the Middle East situation becomes more unstable with Iran getting directly involved with Israel, an overshoot of my metals price targets will become increasingly likely. Depending on the economic and political circumstances, $4000 to $5000 gold and $80 to $100 silver could arrive sooner than most investors or citizens of the world believe possible. Given this is our future, Agnico Eagle should continue to outperform the S&P 500 by a wide margin.

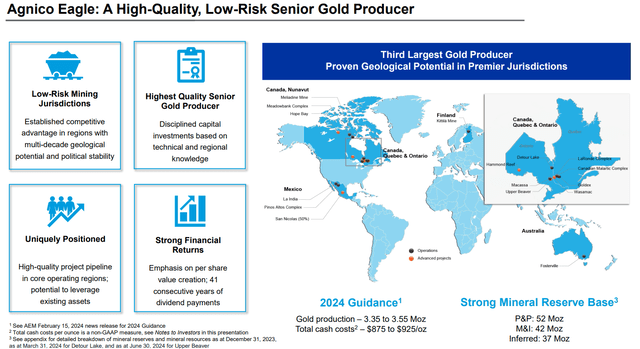

Agnico Eagle – August 2024 Investor Presentation

Eventual AEM targets of $120 to $160 per share are very realistic a few years out. However, the easiest part of the precious metal mining advance could be over, especially if global equity markets take a hit soon.

The most reasonable trading scenarios I am modeling with a slower economy and sizable U.S. stock market decline could mean Agnico Eagle’s stock price will trade between $70-$90 over the next 12 months. This forecast conclusion is forcing me to downgrade shares from Strong Buy to Hold, using a 1-year outlook as my yardstick.

Owning Agnico Eagle as part of a diversified portfolio of gold/silver assets remains a bright idea. I am just not as excited to buy shares at this stage of fluctuations in the various financial markets. I personally no longer hold a stake, as I prefer to focus my gold trading/investing on the cheapest alternatives, such as Newmont. Yet, for long-term investors not trading the gold sector daily, I believe maintaining an AEM position is still appropriate.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.