Summary:

- Apple’s management has been quiet about its AI strategy, and as a result, the company has been perceived as falling behind the competition.

- Apple’s AI capabilities, however, place it near the front of the pack in our view.

- Growing demand for edge processing could portend faster refresh cycles for Apple’s hardware products.

Nikada/iStock Unreleased via Getty Images

A Tall Ask

Management teams of publicly traded companies are under immense pressure: every three months, they must jump on a call and explain their successes or failures (though oftentimes failures may be spun as successes) to investors and analysts. These calls can result in wild fluctuations of the company’s stock price which, presumably, the executive teams cares about quite a lot.

This is part of the impetus that compels management teams to highlight a company’s efforts in whatever field or subject happens to have the eye of market scrutiny upon it, whether that subject be artificial intelligence, decentralized finance and the blockchain, or Web3 (remember that?).

There also exists a perverse risk of not mentioning the subject of the market’s focus: you become vulnerable to being perceived as behind the competition.

This is where we begin with Apple (NASDAQ:AAPL), which has been conspicuously quiet in its aims for the market’s current obsession, artificial intelligence. Take, for example, the company’s latest earnings call where artificial intelligence was mentioned zero times in management’s remarks. The first mention of the technology came in the form of an analyst question near the end of the call which could reasonably be paraphrased as “Do you guys have an AI strategy? Because you don’t seem to talk about it much.”

Of course, when you’re Apple you can afford to do things that other companies can’t (like refrain from gratuitously mentioning AI). But that also doesn’t mean that investors should be in the dark.

Hardware & AI

Over the last several years it has become fashionable to discount Apple’s hardware business (with the exception of the iPhone), and to treat the company as largely a services-based enterprise.

This makes sense. Apple’s computers are quite expensive compared to PCs of comparable quality and tend to last longer. This longer refresh cycle is a natural drag on sales. Slumping PC demand and an oversaturated environment for smart phones has further propelled the narrative that, while hardware is a crucial component of Apple’s business, the software and services side of the house is ultimately more important.

AI, however, threatens to upend this thinking.

AI requires far more computing power to run that non-AI functions, and so the energy and processing demands on hardware are likely set to see a steep upward curve as the technology progresses.

The computational ability presented by Apple’s A17 bionic chip is tough to overstate–while it is not the smallest nanometer chip (it clocks in at 3 nanometers, which is the measurement of each individual transistor on the chip), its power is not far behind that of a chip capable of powering a desktop PC.

The S9 chip, which powers the Apple Watch, is also quite a leap forward. Its capabilities allow for many functions (including the Siri function) to be handled on-device (known as edge processing) rather than being passed off to a network. Edge processing is a key bit of technological capability that is likely to grow in importance as data centers continue to experience rising costs associated with ever greater computing and energy demands. Therefore, the thinking goes, as demands on the cloud grow greater, the ability to perform AI and other high-demand tasks on-device rather than having them be sent to the cloud will be critical.

It can be difficult, however, to explain the opportunity in front of Apple when management refuses to entertain it. As evidence for this, take CEO Tim Cook’s response to the AI question from the conference call:

If you take a step back, we view AI and machine learning as core fundamental technologies that are integral to virtually every product that we build. And so if you think about WWDC in June, we announced some features that will be coming in iOS 17 this fall, like Personal Voice and Live Voicemail. Previously, we had announced lifesaving features like fall detection and crash detection and ECG. None of these features that I just mentioned and many, many more would be possible without AI and machine learning. And so it’s absolutely critical to us.

And of course, we’ve been doing research across a wide range of AI technologies, including generative AI for years. We’re going to continue investing and innovating and responsibly advancing our products with these technologies with the goal of enriching people’s lives. And so that’s what it’s all about for us. And as you know, we tend to announce things as they come to market, and that’s our MO, and I’d like to stick to that.

Enough said. While it might be great for Apple to just drop new products and innovations on the market, it is decidedly unhelpful for investors.

And so, in order to grasp the magnitude of the greenfield in front of Apple, we must turn to a competitor for context.

In July of this year Dell (DELL) hosted a special Q&A call in which senior executives discussed a wide range of topics. One of the more interesting nuggets to come out of the conversation came from Jeffrey Clarke, Dell’s Co-COO and Vice Chairman when asked about whether AI for edge processing functions will drive PC refreshes. Here is his full answer, with emphasis added:

Look, any time that we can get a new technology that drives productivity into the best general purpose productivity device on the planet, it’s — we’re better off. And when we look at what Microsoft’s plans are with AI and future versions of Windows, it’s doing just that. It’s going to make the workforce more productive. And any time we’ve seen that with previous versions of Windows, it’s driven a substantial refresh cycle. We think that’s the opportunity here.

And what’s equally important about this refresh cycle, you’re going to ask your PC to do more with some form of assistant, some form of, I’d say, do some language modeling or language processing, it’s going to do some machine learning with the capabilities that we’ll put on our PCs in the future. And that’s going to drive a higher ASP. You’re going to need a more capable PC to ask it to do more. Then that’s good for business. We’ve seen ASPs increase over the past 3 years. The likelihood that continues, asking more of it is highly likely.

And then you have the subcategory in PCs, one of my personal favorites workstations, engineers, developers, creators, designers, data scientists, working at the Edge using those high-performance PCs with GPUs in them to do more complex AI tests. You’ll see next generation PCs with NPUs in them, neural processors. And those are going to allow us to do some of the basic neural processing that John referenced earlier, that will be in every PC going forward.

John Roese, Dell’s Chief Technology Officer, was a bit more succinct when he chimed in with the following:

[W]e don’t see any other path other than more and more processing on the PC, more of it dedicated to AI-type tasks and a richer user experience, which you can imagine all of those things are pretty good for us.

Granted, the discussion about Microsoft’s (MSFT) future versions of Windows may not present an apples-to-apples (no pun intended) comparison, but what is good for the goose is good for the gander and any move that Microsoft makes to enable its system to be AI friendly is almost certainly going to be matched by Apple.

Bears might counter this line of reasoning by pointing out that Dell’s business, which centers largely around enterprise-level computing, is very different from Apple’s. That may be true, but it does not logically follow that the AI demands from Apple’s customer base are likely to be any less significant. Indeed, the generative AI demands set forth by Apple’s more ‘creative type’ user base could prove to be even more significant than those brought by an enterprise-level customer who may be more concerned with squeezing a few extra bits of efficiency out of their latest hardware refresh.

Refresh Ahead?

What would a refresh cycle for Apple’s hardware–namely its Mac and iPad products, the sales trajectory of which has been the subject of much derision for the past few quarters.

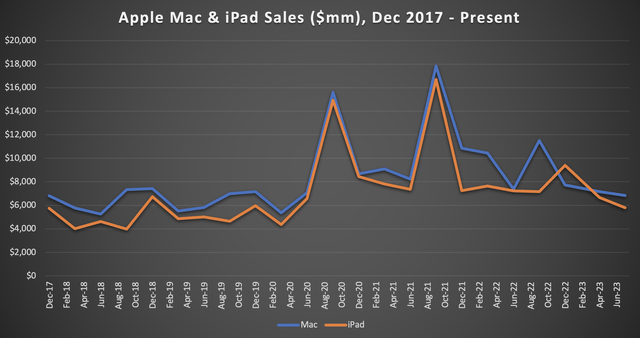

Well, let’s take a look. We assembled Apple’s quarterly Mac and iPad sales going back to December, 2017, and the results paint an interesting picture.

Apple Filings, Author’s Chart

In the above time frame, the average quarter clocked in $8.3 billion in Mac sales, and $7 billion in iPad sales. The latest quarter ending July 2023 was a disappointment for Apple investors, with $6.8 billion in Mac sales and $5.7 billion in iPad sales.

The chart, we think, reveals the reason for the current hardware malaise: the quarters ending September 2020 and 2021 saw an enormous pull-forward of sales in these categories. September 2022 was far more disappointing. We think the pull-forward of sales to be the most likely explanation because there is very little in the way of evidence to show that Apple is losing popularity among consumers.

Bears will say that it is unlikely that customers who bought in 2020 and 2021 will buy again anytime soon, but we think otherwise.

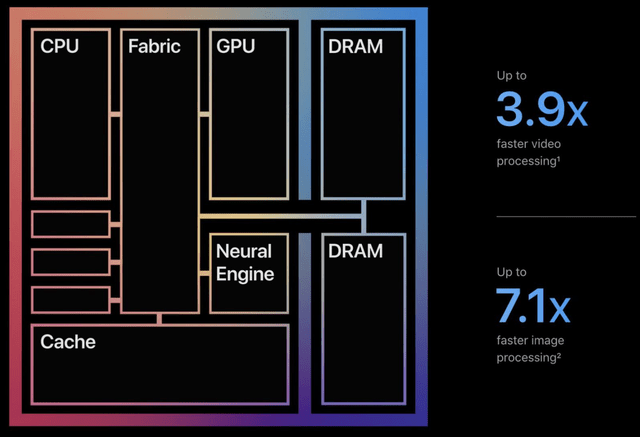

Apple Presentation

First, the introduction of the M2 and M2 Pro chip for the company’s Mac offerings was a game changer, able to handle highly demanding machine learning and AI tasks with ease (even, according to one blogger, beating out Nvidia’s (NVDA) comparable offering). The M2 can support up to 10 GPU cores, and its Geekbench score (a measure of computing power) was similarly impressive.

No Macs made prior to 2021 have the M2, and therefore run an accelerated risk of obsolescence as computational demands and the need for edge processing (which is, again, vitally important) continue to grow over time.

The Bottom Line

Apple has had its fair share of naysayers of late, arguing that the stock is too expensive, or that the company may be losing its edge against the competition when it comes to AI. We think this is far from the truth–Apple’s current lineup of products and hardware are more than capable of handling the load that AI promises to bring to individual machines.

Further, we think that AI is likely to drive faster refresh cycles in Apple’s hardware products, which has been perceived as a drag on the company’s results for the past year or so. We think this could materialize within the next 12-18 months as AI applications continue to grow and gain popular footholds.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist, and while they will be corrected if identified the author is under no obligation to do so. Author Is also under to obligation to update changes of view. The opinion of the author may change at any time and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.