Summary:

- Palantir’s product is industry-leading, thanks to improvements in AI.

- The current valuation, however, assumes optimistic results with no hitches.

- Uncertainty about cash flows exists, given the volatility of the technology.

- Share dilution is also occurring, which will reduce long-term returns.

AmnajKhetsamtip/iStock via Getty Images

I’ve been watching Palantir (NYSE:PLTR) for a few years now. It’s a business I like quite a bit, and it seems the market likes its stock quite a bit as well.

PLTR Stock Price Past Year (Seeking Alpha)

Folks who bought last year have almost tripled their money. A lot happened in 2023 to encourage this, namely enthusiasm among investors about AI, which has already supercharged this company’s profitability and has potential to boost it more. While I will agree about the strengths of Palantir as a company, I’ll lay out why room for caution is warranted and argue that the shares, following this rally, make for a reasonable SELL.

Financial History

Let’s review the long-term view of Palantir’s financial history, as that will better explain its current valuation and why it has shifted.

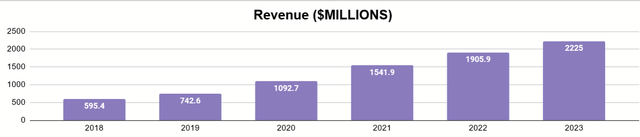

Author’s display of reported financial data

With the financial data available (IPO was in 2020), we can see that Palantir has experienced recent and consistent growth as a business, and this was occurring before the AI boom of 2023 and before the IPO. What matters to us as long-term investors is the impact to free cash flow. How does that look?

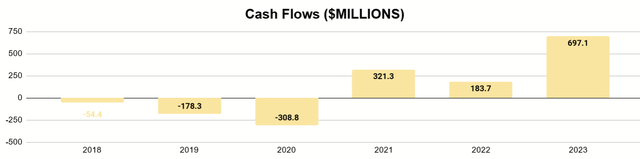

Author’s display of reported financial data

While the company did experience some cash outflow (and this explains why raising capital through an IPO became desirable), they have since delivered and generated positive results for shareholders. During this time, annual capital expenditures have never exceeded $40M, so if revenues were growing, something about the operating expenses must explain the ebb and flow of FCF.

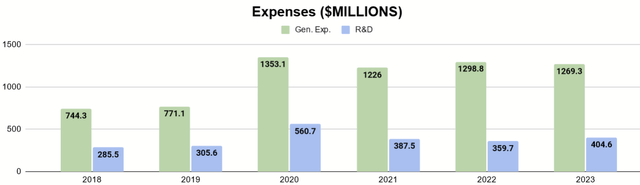

Author’s display of reported financial data

The main thing here was that expenses, namely general expenses plus research and development, increased quickly in 2020. Since then, we can see that those costs haven’t increased. As revenues almost doubled between now and 2020, this paved the way for positive cash flow, showing that Palantir has been building itself up for long-term success on a capital-light model.

To provide better clarity, though, Palantir’s sales are very seasonal, and some of this pertains to the timing of when a deal is closed and when the cash is actually received. As they note in their 2023 Form 10K (pg. 77):

Net cash provided by operating activities was $712.2 million and $223.7 million for the year ended December 31, 2023 and 2022, respectively. The increase was primarily driven by timing of payments to vendors and timing of the receipt of payments from our customers, as well as an increase in interest income.

Q4’s Change in the Winds

Management’s tone during the Q4 earnings call was more than optimistic. They sense a change in the winds, the start of a new era for the company. CEO Alex Karp noted:

Obviously, our performance in US commercial is extraordinary, some would say bombastic. The numbers that just fly off the screen are the 70% year-on-year growth in Q4. The number—numbers that I almost had to turn the page when I saw them—were the over 100 contracts over $1 million, 37 over $5 million, and 21, roughly, over $10 million. There is—it’s almost inconceivable to do that many contracts given the way our product used to be.

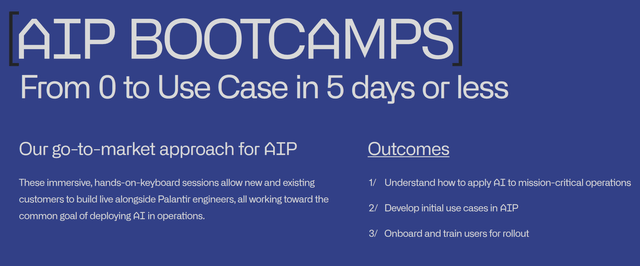

The chief reason for this was the introduction of the newest product, Palantir Artificial Intelligence Platform, or AIP.

By adding a “bootcamp” phase to their sales process to familiarize customers with AIP, the process of closing new deals has sped up tremendously, particularly among their commercial (non-government) portion of revenues. These customers could now see tremendous improvement in their own operations through Palantir’s software. This is especially important because their sales process has historically been much longer, sometimes up to a year. The initial phases of sales are usually costly and loss-inducing for Palantir, and this phase is now substantially shortened.

Ryan Taylor (Chief Revenue Officer & Chief Legal Officer) explained:

The demand is off the charts for AIP, with bootcamps as the delivery mechanism for AIP, and we’re seeing AIP drive the expanding addressable market, that we’re seeing. As Alex commented, we closed 103 deals in Q4 alone over $1 million. Having been involved in many of those directly and on the ground, I can tell you that the feeling, the demand, the excitement over AIP and over Palantir is unlike anything I’ve seen in the 14 years I’ve been here, and we feel that. We feel that in a tangible way on the ground with our customers, And we’re starting to see the beginnings of that in our Q4 results.

The Market’s Valuation

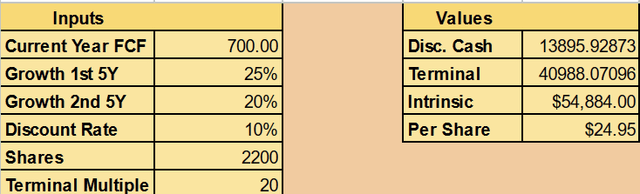

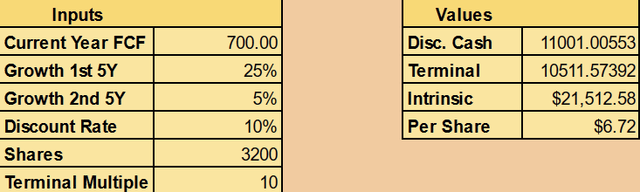

With the historical results taken in, along with a focus on Q4, we can begin to make sense of the current price of PLTR as a long-term investment. I’ll use Discounted Cash Flow model to break it down.

These inputs, seen above, get us a valuation similar to the current one on the market. They include:

- $700M for initial FCF (based on 2023’s results)

- Growth of FCF of 25% and 20% over five-year periods

- Terminal multiple of 20

These aren’t necessarily my assumptions, so I won’t try to explain them. It’s simply a way of interpreting Mr. Market’s opinion, and we can see if we agree or not. I’ll note that these are very high growth rates, ones that most companies would be grateful to have over the course of a decade.

A Look to the Future

We need to see if we should challenge or accept some of these assumptions. There are a few things that, in my opinion, could have a material impact to the long-term returns of investors if they buy in at the wrong price.

Government Versus Commercial

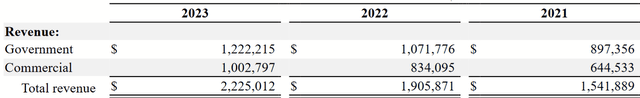

Part of the assumption on cash flow growth has to do with how we parse the growth of government customers versus commercial ones.

Seen above, revenues from government contracts have always been greater. Karp provided insight on why this has been the case:

So, I believe that everyone knows we have the best software in the world. It may not matter in a non-dangerous environment. But it did matter in Ukraine and Israel…among the most critical places in the DoD, if you — if we are forced to fight a three-pronged war, you cannot do that even from a perspective of keeping ammunitions ready without accurate software. So the more dangerous, the more real it gets, the more battle-tested and real your software has to be.

Since Palantir’s government contracts derive primarily from their work with the U.S. military, it allies, and other agencies whose priority is human safety above profits, the “premium” to get Palantir’s software was worth it. Only after the AIP bootcamps allowed potential customers to see instantaneous improvements did these new commercial sales occur, and I agree that a windfall of growth from those contracts is ahead.

Yet, I would also caution that what won over these new customers is the same thing that could lose them. That is to say, depending on how technology evolves, these companies could painlessly dump Palantir. In their 10K’s Risk Factors (pg. 14), management notes:

In addition, certain decision makers and other stakeholders within our potential customers tend to have vested interests in the continued use of internally developed or existing software, which may make it more difficult for us to sell our platforms and services.

Internal systems have long been one of Palantir’s cited concerns. While their lead in the AI game gives them a dominant position right now, we have to consider how much that is subject to change over time.

Consider how far AI has come in the last decade. In the first five years, not quite as much happened. The release of AlphaZero (the chess player) in 2017 was impressive by those standards. The last five years (and 2023 in particular) saw a lot more progress get made. Where will we be in five years?

I think this is an important question to ask because this means that competition (even that by the customer itself) could steal the lead just as easily as Palantir got it. Even if it keeps the lead, the company may have to set less attractive prices, and that alone can weaken the value for owners of PLTR.

For that reason, I think the government contracts (with their different priorities) are the only source of revenue we could reasonably expect to grow consistently over a decade.

Effects of Share Dilution

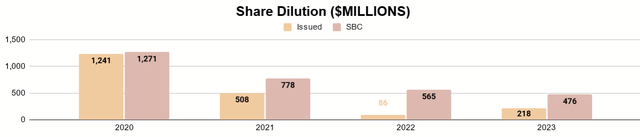

Throughout its public life, Palantir has diluted its common shares. This naturally occurs during an IPO, but the company has continued to do so in the years that followed.

During its IPO, the company had 1.6 billion shares outstanding. That amount is 2.2B after the dilution that followed. From 2021 – 2023, all share issuance was through the exercise of stock options, as they haven’t needed to raise capital. We can see that SBC has been the main source of dilution as well, consistent with the founders’ belief that employees should have an incentive to make the stock more valuable.

The amount of dilution has rivaled the value of free cash flow in those years, but the good news is that it’s been a declining trend. Nevertheless, dilution means that any shares you buy today will come with a smaller stake later in the future and hurt long-term returns, and it’s something that’s easy to miss.

Since the IPO, it’s been roughly a 10% rate of dilution, which reduces a single share’s equity by about 9%. 9% can impact long-term returns quite a bit.

A More Conservative Valuation

Let’s present an alternative future for PLTR with these assumptions. For one, we’ll keep the $700M estimate as a baseline and the 25% growth rate for the first five years because Palantir’s near-term position with AI seems hard to dispute. What we’ll change is:

- 5% growth in the latter five years

- Terminal Multiple of 10

- 3.2B shares

I think it’s reasonable to assume Palantir will likely preserve their government contracts and continue to make inroads with those customers. Government revenue could still enjoy modest, double-digit growth in the latter half of the decade because having the top product isn’t as much a financial decision for government agencies as it is a strategic one.

As AI flowers and improves in unexpected ways, this can create opportunities for commercial customers to utilize their internal software better. They may rethink their relationship with Palantir. In such an event, commercial revenue may cease to grow at all.

Given their somewhat balanced split of the revenues between government and commercial, I think this means growth of FCF could end up as low as 5%. (Remember that revenue grew 17% in 2023.)

Because Palantir is a quality company, though, both in terms of its product and strong balance sheet, I don’t imagine its shares would trade below a multiple of 10. Yet, it still reflects those diminished prospects beyond the decade, and more shares allow for the effects of further dilution. (I’ll note that 3.2B requires less than 4% annual dilution.)

Lastly, I use a discount rate of 10% as a standard, to compare it to the typical returns of broad market indexes over such a time period.

That gives us a fair value of $6.72. Even if we add the cash balance to the Treasury Bills to derive a current net cash per share of $1.64, that still leaves us with overvaluation.

Conclusion

I spent much of this time explaining why Palantir is a great company. It produces free cash flow at a fat margin, and at least half its revenue comes from various government agencies that will buy their software because they aren’t in it for the profits. Normally, Sell articles explain why a company is bad, but that isn’t the case here.

My case is that when we allow for perfectly plausible downsides to be reflected in the valuation, we see that PLTR is at best fairly valued and at worst very overvalued. Investors make money by allowing a margin of safety and the possibility for less optimal outcomes in their entry price. That is not what Mr. Market offers today.

Given that the company does not pay a dividend and isn’t even doing buybacks (again, dilution is occurring), I don’t see the benefit to the long-term investor by holding. To me, the sensible thing is to sell and to wait for a more realistic price again.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.