Summary:

- I previously argued for a bullish thesis on ET stock based on the growth potential added by the acquisition of Crestwood Equity Partners.

- Here, I will add another catalyst as the power demands of AI-related technology have come into focus.

- Natural gas is the largest energy source of U.S. electricity generation.

- I will explain the connection between our power-hungry digital future and ET’s natural gas operation.

metamorworks/iStock via Getty Images

ET stock: AI tailwind expected

I last wrote on Energy Transfer LP (NYSE:ET) stock about a month ago. That article rated the stock (or unit to be exact) as a strong buy on June 25, 2024, as you can see from the chart below. The article focused on the recent acquisition of Crestwood Equity Partners as a positive catalyst for ET’s growth. More specifically, I explained why:

…. I upgraded my earlier buy rating on ET to a strong buy due to the acquisition of Crestwood Equity Partners. I expect this acquisition to catalyze a higher growth rate than my earlier projection. When adjusted by growth rate and yield, valuation metrics approach absurd levels. The P/E growth ratio is only 0.8x and PEGY (P/E to Growth and Dividend Yield) yield is only 0.5x, both far lower than the 1x ideal threshold.

In this article, I want to examine the thesis again from an entirely different angle, as the potential impact of power demand from AI-related technology has become clearer recently. In the remainder of this article, I will argue where this is a large potential for increased domestic demand tied to our smart everything future. I will explain A) why I expect energy consumption will likely rise to support the needs of artificial intelligence technology, data centers, and cloud computer servers, and B) why I expect ET to be one of the best-positioned players to capitalize on this demand.

Our digital future: Power consumption is a bottleneck

Among the many challenges and opportunities surrounding our digital future (technological, ethical, legal, etc.), a less-often mentioned, but pivotal issue in my view is how to power them. These digital technologies require a humongous amount of power to run – more than most people realize. As an example, my recent article analyzed the power need of Nvidia Corporation’s (NVDA) H100 chips and also how its new Blackwell chips could help. Quote:

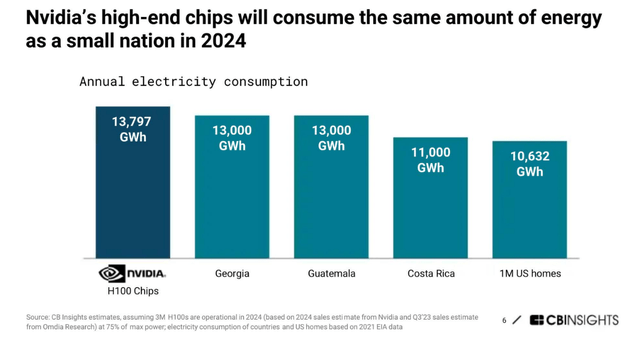

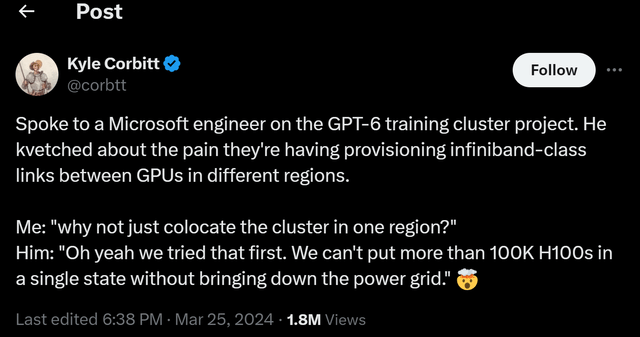

… each of Nvidia’s H100 chips consumes 700W of energy at peak operation. This is more than the power consumption of the average American household. Collectively, NVDA’s high-performance AI chips are estimated to consume more energy than many small nations as you can see from the chart below. Even for one data center, which typically employs thousands to tens of thousands of these chips, the peak power consumption can overload the power grid of a region or even a state according to the following comments from Microsoft engineers (see the second chart below).

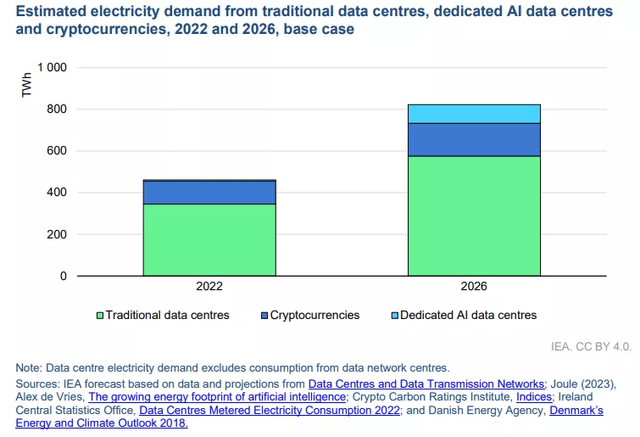

The problem is not only limited to AI, despite it being the most visible one currently. Many other technologies vital to our digital transformation are equally energy intensive, such as cryptocurrency technologies, high-end manufacturing, etc. (see the next chart below).

Next, I will explain why ET is well-positioned to help us meet such power demand in the years to come.

ET stock will help us meet the energy demand

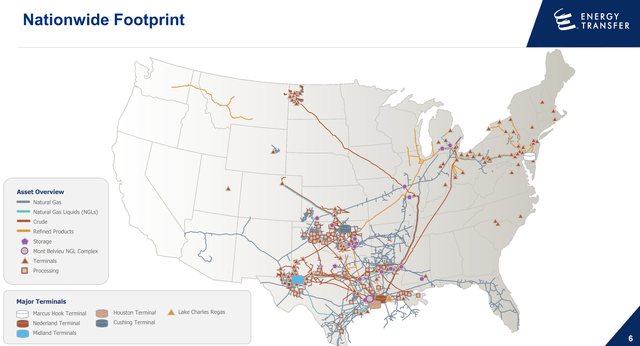

ET owns a diversified portfolio of energy assets in the U.S. Its core asset is a vast network of natural gas midstream facilities, intrastate and interstate transportation facilitates, storage facilities, etc. A key connection (among others) between the boom in digital technologies and ET’s operation is that natural gas is the largest source of U.S. electricity generation. Currently, about 43% of electricity is generated by burning natural gas. To further pinpoint the issue, it is with natural gas production but with storage and transportation in my view. As the following report from Wells Fargo Investment Institute (WFII) analyzed:

We believe that U.S. natural gas production capacity and reserves are sufficient to meet growing demand, with infrastructure being the key constraint in balancing supply with this demand growth over time. We expect this to provide midstream companies with incremental growth opportunities and higher utilization of existing assets, ultimately extending the terminal value of natural gas infrastructure.

This is exactly where ET’s core strength lies, and it has been reinforcing this strength with continuous capital investments. As a notable example, ET has been investing (very wisely from hindsight) over the past few years to connect its network to power plants located within a 10-mile reach of its intra-state pipelines. Fast-forward to now, the company believes it has connected to more than ~55% of the power plants in Texas, particularly in the Dallas area, where the city is emerging as a data center hub (see the next chart below).

ET June 2024 Investor Presentation

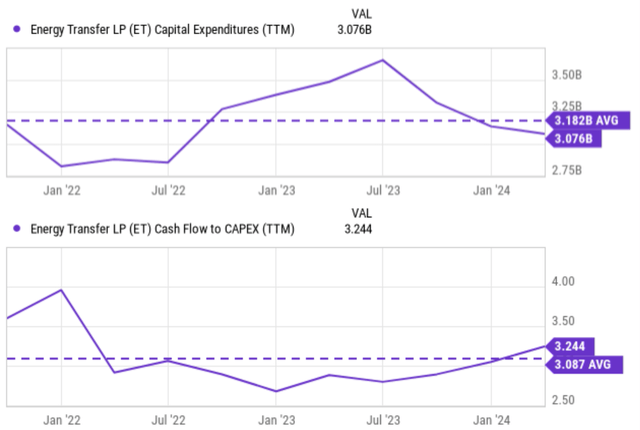

In the meantime, ET keeps investing in its core assets, both via capital expansion projects and M&A deals. The company has budgeted a growth capital of about $2.9 billion in 2024. Energy Transfer has been spending on average $3.18 billion on CAPEX in recent years, as you can see from the chart below (top panel). I won’t be surprised if the company further cranks up the investment in the years to come. Thanks to strong organic cash generation, the company currently enjoys good capital allocation flexibility despite the sizable CAPEX budgets. As seen from the chart below (bottom panel), ET’s cash flow to CAPEX ratio currently hovers around 3.244x, notably higher than its 3-year average of 3.087x. A high ratio cash flow to CAPEX ratio is better and means more capital allocation flexibility.

The company is also active on the M&A front. Besides the Crestwood Equity Partners acquisition detailed in my last article, Energy Transfer recently also completed the acquisition of WTG Midstream. This acquisition

…adds approximately 6,000 miles of complementary gas-gathering pipelines that extend Energy Transfer’s network in the Midland Basin. Also, as part of the transaction, the Partnership added eight gas processing plants with a total capacity of approximately 1.3 Bcf/d, and two additional processing plants which are under construction… ET expects the WTG assets to add approximately $0.04 of Distributable Cash Flow (DCF) per common unit in 2025, increasing to approximately $0.07 per common unit in 2027.

Other risks and final thoughts

In terms of downside risks, like other midstream companies, ET faces risks from changes in commodity prices (especially oil and natural gas), regulations, and the legal battle surrounding its environmental impacts. Commodity prices (especially natural gas prices) are highly volatile and can impact the profitability of transporting and storing these materials substantially. The long-running legal battle surrounding its Dakota Access pipeline serves as an example of the substantial legal and regulatory risk ET entails. To wit, the Dakota Access Pipeline (DAPL), part of ET’s vast network, has been involved in a long-running legal battle with the Standing Rock Sioux Tribe. The legal disputes could potentially halt ET’s operations of the DAPL.

However, there are also some risks more specific to ET, and the company’s relatively large debt load is at the top of my list here. The company’s leveraging has been stabilizing in recent years and the cash-to-CAPEX ratio has been improving as aforementioned. ET’s credit ratings have been improving in tandem (see the next chart below) with a stable outlook. However, its debt loads are still relatively high, not only in comparison to the overall economy (midstream companies on average have a higher debt load than the overall economy) but also in comparison to other close peers such as Enterprise Products (EPD). The debt load, combined with the current elevated borrowing rates, could limit its financial flexibility during downturns.

All told, my conclusion is that ET offers a very skewed return/risk profile under current conditions, and thus reiterated my strong buy rating. My rating is based on a few considerations. First, I expect strong EPS growth after the integration of the Crestwood assets (the focus of my last article). Second, I expect a secular tailwind thanks to the surging power demand from digital technologies and ET’s strategic position to help meet such demand. And finally, despite all these growth catalysts, the valuation is quite reasonable as reflected in its ~11x FWD P/E ratio and an ~8% dividend yield.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If you share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.